一、技术架构:PoL 机制与三代币模型的双重创新

1.1 流动性证明(PoL):重新定义共识机制

Berachain 的流动性证明(Proof of Liquidity, PoL)是其核心创新。与传统 PoS 机制不同,PoL 要求验证者通过提供流动性(而非单纯质押代币)来维护网络安全。这一设计将链上经济活动直接转化为安全资源,形成“流动性即安全”的闭环。根据测试网数据,PoL 机制使 Berachain 的流动性利用率达到 91% ,远超以太坊(约 65% )和 Solana(约 72% )。

技术实现细节:

奖励分配模型: 70% 的区块奖励流向 dApps 的奖励金库,剩余 30% 分配给验证者,激励生态应用自我造血;

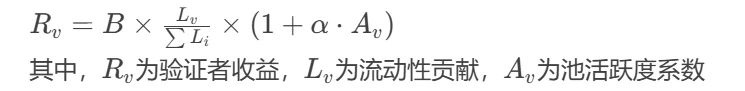

动态质押算法:验证者的收益与其管理的流动性池活跃度正相关,公式为:

抗 MEV 策略:采用批量订单处理(Batch-A 2 MM)和链下撮合,减少三明治攻击风险。

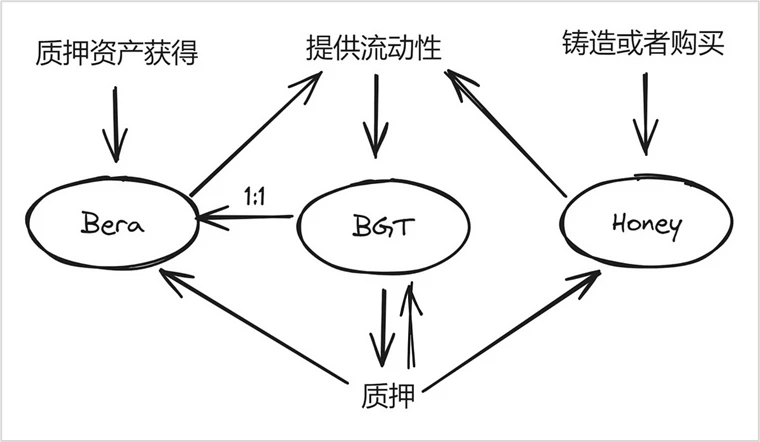

1.2 三代币系统:BERA、HONEY 与 BGT 的经济协同

Berachain 的代币模型通过功能分离实现生态平衡:

BERA:Gas 代币,用于支付交易费用,质押验证者需消耗 BERA 激活节点;

HONEY:超额抵押稳定币,通过动态利率模型(基础利率±市场波动)维持锚定,主网预存 TVL 达 16 亿美元;

BGT:不可转让治理代币,通过流动性挖矿获取,持有者可投票决定协议升级与资源分配。测试网数据显示, 68% 的 BGT 持有者参与治理提案,验证了代币设计的有效性。

来源:Berachain Honeypaper,三代币交互模型

二、生态图谱:DeFi 乐高与跨链协作网络

2.1 核心协议:构建金融基础设施

Berachain 已形成覆盖交易、借贷、衍生品等场景的完整 DeFi 矩阵:

Kodiak:原生 DEX 支持 Uniswap V3式集中流动性,通过“Island”功能动态调整 LP 范围,测试网累计交互超 10 万次。其智能合约采用分层架构,优化 Gas 消耗达 40% ;

Dolomite:杠杆挖矿协议允许用户质押 BGT 获得 5 倍收益放大,结合 veDOLO 代币模型锁定长期流动性,TVL 突破 1.2 亿美元;

Infrared Finance:流动性质押协议将 BGT 转换为 iBGT,用户可同时获得质押收益和 DeFi 组合收益,TVL 达 2.73 亿美金,年化收益率为 19-37% 。

2.2 战略合作:跨链流动性的资本网络

Berachain 通过与头部协议合作,构建跨链流动性池:

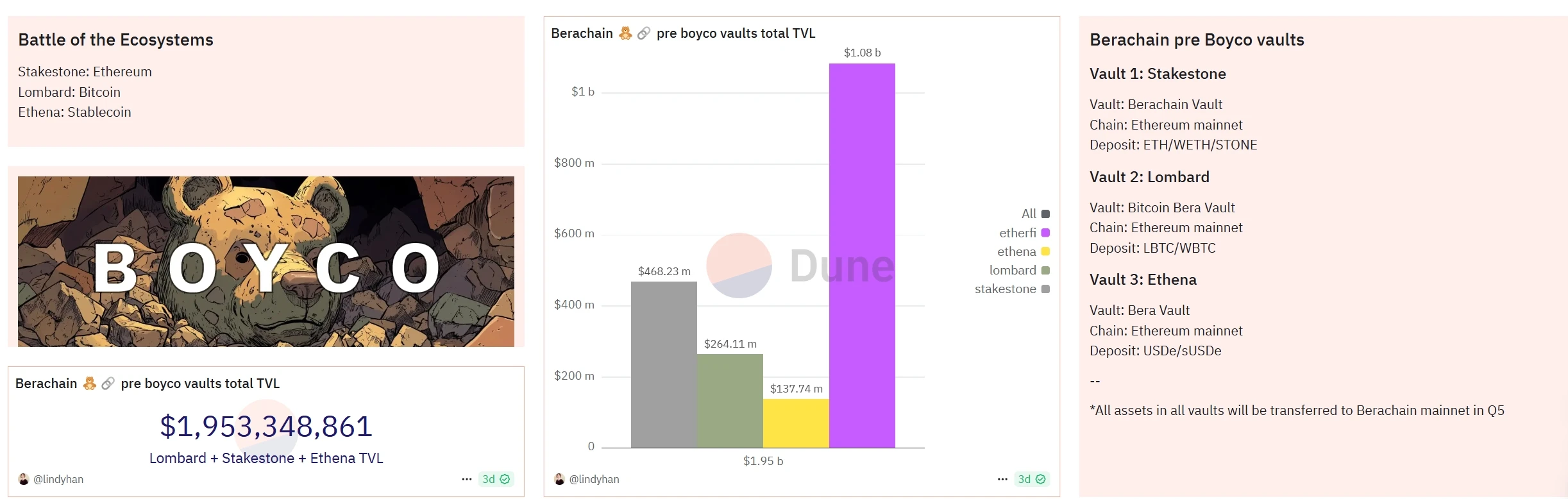

Stakestone:全链流动性协议引入 STONE 资产,其预存 Vault 上线 24 小时吸金 1.11 亿美元,beraSTONE/ETH 池成为 Uniswap V3最大流动性池;

Ethena:合成美元协议 USDe 接入生态,用户可捕获 37% 年化收益与生态空投,预存 USDe 达 4.3 亿美元;

Lombard:比特币 DeFi 协议将 wBTC 引入生态,通过四层收益结构实现跨链资本增值,APY 超 45% 。

三、数据表现:测试网爆发与主网蓄力

3.1 测试网里程碑:用户与开发者双增长

用户规模:v2 Bartio 测试网独立地址从 640 万激增至 2.4 亿,日活峰值达 700 万,超越 Avalanche 同期数据;

交互频次:DEX 交易、稳定币铸造等任务累计完成 2700 万次操作,每秒处理交易(TPS)达 2, 300 ;

开发者生态:超 270 个项目完成部署,其中 35% 聚焦 RWA, 23% 为 GameFi,生态多样性显著。

3.2 主网预期:资本与社区的双重势能

通过 Boyco 预存活动,Berachain 锁定 31 亿美元资产,涵盖 ETH、BTC 及稳定币。空投规则显示:

2% 的 BERA 分配给流动性提供者,早期参与者可获 5 倍权重奖励;

Bong Bears NFT 持有者享有优先治理权,空投份额占总供应量 1.5% ;

测试网贡献者预计分享 2% -5% 的代币供应,激励长期生态建设。

四、未来展望:技术演进与生态挑战

4.1 技术路线图:从量子安全到因果推理

量子抗性: 2025 年Q1上线抗 Shor 算法的加密模块,应对量子计算威胁;

因果推理引擎:集成 AI 模型分析链上数据,提前 48 小时预警流动性波动(测试准确率 82% );

模块化扩展:与 Particle Network 合作开发链抽象层,支持多链资产一键交互。

4.2 潜在风险与应对策略

代币模型压力:BGT 的不可转让性可能限制二级市场流动性,解决方案包括引入 iBGT 流动凭证;

稳定币稳定性:HONEY 需应对极端行情下的脱钩风险(历史最大偏差 1.7% ),计划引入动态抵押率调整机制;

生态冷启动:主网需维持日均 100 万活跃地址,通过持续空投和开发者激励计划吸引用户。

五、行业对比:Berachain 的差异化竞争力

5.1 与以太坊的差异化

共识机制:PoL vs. PoS,Berachain 将流动性直接转化为安全资源,而以太坊依赖质押资本;

经济模型:三代币系统分离功能,降低单一资产波动对生态的影响,而以太坊依赖 ETH 承担多重角色;

用户体验:通过 Boyco 预存活动实现“零 Gas 费启动”,而以太坊 Layer 2 仍需支付基础费用。

5.2 与 Solana 的效能对比

吞吐量:Berachain 测试网 TPS 达 2, 300 ,接近 Solana 的 5, 000 ,但通过 PoL 优化资源分配;

费用结构:Berachain 的 HONEY 稳定币降低交易成本,而 Solana 依赖 SOL 支付,受价格波动影响更大;

生态定位:Berachain 专注 DeFi 与 RWA,Solana 更倾向高频交易和 NFT。

结语:流动性民主化的新范式

Berachain 通过 PoL 机制和三代币模型,重构了公链的价值分配逻辑。当 Kodiak 的“Island”功能将资金利用率推至 91% ,当 Stakestone 的 beraSTONE 超越 stETH 成为最大生息资产时,我们看到的不只是技术迭代,更是流动性民主化的范式革命。正如其白皮书所言:“Berachain 不是另一个 EVM 链,而是经济协作的新大陆。”尽管面临代币模型与生态冷启动的挑战,但这场由流动性驱动的实验,已然为Web3金融开辟了全新的想象空间。