Author: Lin, Trader

Compiled by: Felix, PANews

Trader Lin recently shared his trading insights, including technical analysis, risk management, psychological factors, etc., which are suitable for novice traders or those who often suffer losses. The details are as follows.

Go with the Trend

Strong upward trends often bring substantial profits. You should always trade with the trend. As the old saying goes: "The trend is your friend." This is absolutely true. Investing is a game of probability. Therefore, you need to maximize your odds of success.

Buying stocks in an uptrend is like sailing with the wind; everything feels easier. The market rises faster, lasts longer, and progress becomes smoother. When going with the wind, even a small push can lead to huge gains. This is why everyone feels like a genius in a bull market.

So, how do you identify a trend?

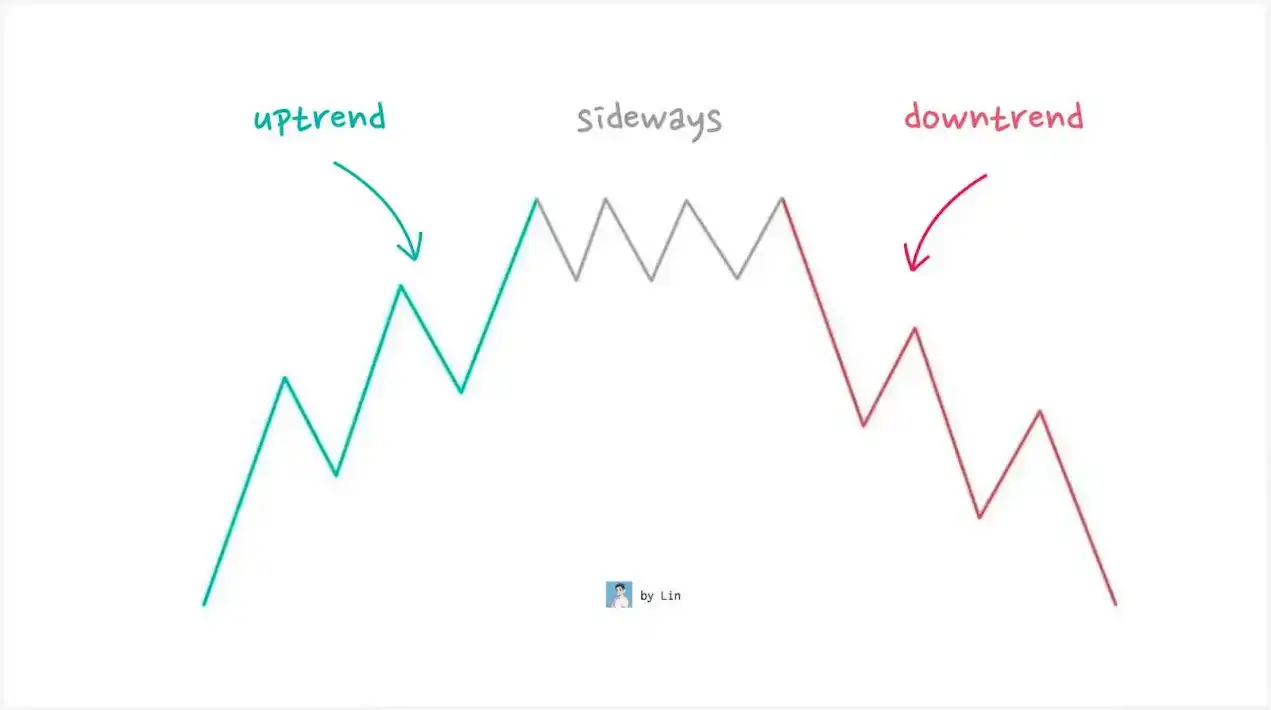

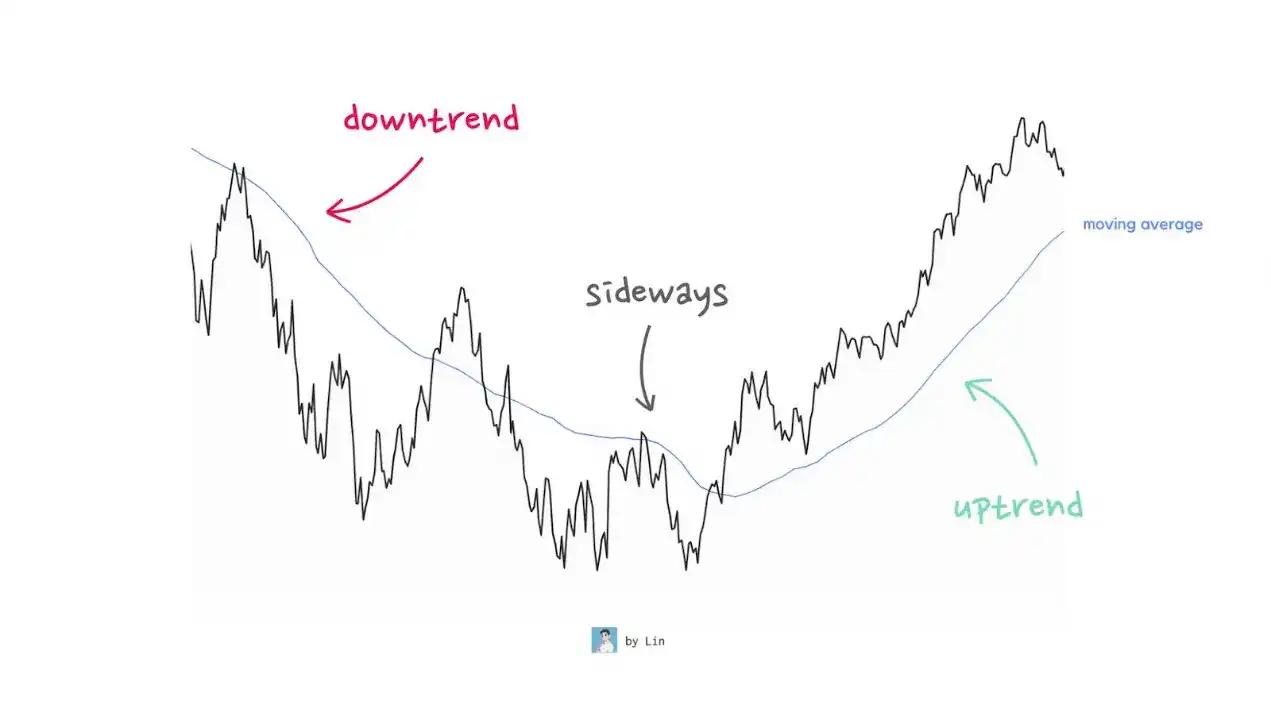

Identifying the direction of a trend generally only takes a few seconds. A trend is simply the overall direction of data points in a time series. Let's look at an uptrend:

- First, the chart extends upward from the bottom left corner.

- Second, there is a series of higher highs and higher lows.

Of course, the same applies to a downtrend.

To identify these trends, you can also use simple tools like trend lines or moving averages to help determine the overall direction.

Importantly, the market has different time frames.

The market may decline in the short term but still be in an uptrend in the long term. Or, the market may be strong in the short term, but the long-term trend may be weak. You need to choose a time frame that suits your strategy.

Day traders focus on hours and days, swing traders look at weeks, and long-term investors focus on years. Your chances of profit are greatest when all time frames (short, medium, and long term) are aligned.

Most of the time, the market has no clear trend. Only a small portion of the time does a clear, strong trend emerge. The rest of the time, the market moves sideways.

Sideways markets are the most dangerous for active investors. Because there is no clear direction, extreme volatility, failed breakouts, and failed pullbacks. You will be whipsawed repeatedly. Just when you think the market is about to move in your favor, it hits a wall and reverses.

Of course, if your trading cycle is short, you can also profit from these fluctuations. But for most people, doing nothing is often the best choice in such situations.

But overall, big money is made in strong uptrends. There are two main reasons:

- First, stocks in an uptrend tend to continue rising: When a stock is already rising, it is more likely to continue rising than to suddenly stop. Market sentiment is optimistic. Everyone is only focused on the rise.

- Second, there is usually little or no overhead selling pressure: This means most people holding the stock are already profitable. They are not in a hurry to sell. With fewer sellers, the price rises more easily.

However, not all trends are the same. Some are slow and steady. Others are fast and steep. The steeper the trend, the stronger it appears. But there are pros and cons to everything.

Stocks that rise too quickly are more fragile. When the price rises too fast, it becomes overbought. This makes it more prone to sharp corrections or sudden reversals. So strong trends are powerful, but they also require caution.

The goal is to go with the trend while it lasts, but nothing lasts forever.

Focus on Leading Sectors

After determining the overall market trend, you need to look for leading sectors. Its importance is obvious.

Investing is a game of probability; you want as many factors as possible in your favor.

Ask yourself, would you buy a newspaper company's stock today? Probably not. Few people read physical newspapers anymore. Everything is online. The market isn't expanding; it's shrinking. Demand naturally declines. Finding and retaining customers becomes harder. Retaining good employees is harder. Employees are less willing to join an old, stagnant industry. These are natural disadvantages.

Now look at the opposite situation.

Artificial intelligence is currently one of the strongest industries. Everyone wants to work in AI. It has a natural appeal. Talent, capital, and attention are all flowing in the same direction. Development becomes much easier.

A leading industry is like a rising tide that lifts all boats. Not everyone benefits equally, but the overall trend is important.

Ideally, the entire industry should be doing well. If all but one company are performing poorly, it often means the industry has peaked or is about to decline.

Of course, no trend lasts forever. Some industry trends last for decades, others only for days. The key is to catch the big trends.

- Megatrends are long-term changes that reshape industries. For example, railroads, the internet, mobile technology, and now AI.

- Boom and bust trends are short-lived peaks followed by sharp declines. For example, SPACs and meme stocks.

- Cyclical trends rise and fall with economic fluctuations. Oil and gas are a good example, with prices fluctuating with demand and economic growth.

Buy the "Leader" at Market Bottoms

Once you identify the overall trend and the leading industry, you can buy the leading company. The reason is simple. Most people want the best; it's human nature.

Look at the sports world. Everyone talks about the World Cup champion or Olympic gold medalist. News headlines, interviews, sponsors, and history books focus on the first place. Few remember who came second. The winner gets all the attention, money, and status.

A simple example:

Who is the fastest runner on earth? Usain Bolt. Who is the second fastest? Most people don't know. In fact, Bolt isn't much faster than the second place. But no one really cares about second place. It's all about the best, the fastest, the winner.

The same is true in business and investing. Winners get the most attention. They attract more customers, talent, and capital. Success reinforces itself, making it easier to stay on top.

For companies, this means your product is compared to others. Employees want to work for the best companies. Investors want to invest in the best companies, not the second best. This advantage may seem微不足道 at first glance, but over time, these small advantages accumulate and eventually have a huge impact. This is why winners keep winning.

Every industry has a market leader:

- Apple in smartphones

- Google in search engines

- OpenAI in large language models

- NVIDIA in GPUs

These industry leaders are far ahead of their competitors.

What makes a market leader? Large and growing market share, rapid revenue and profit growth, strong brand, continuous innovation, and top founders (team).

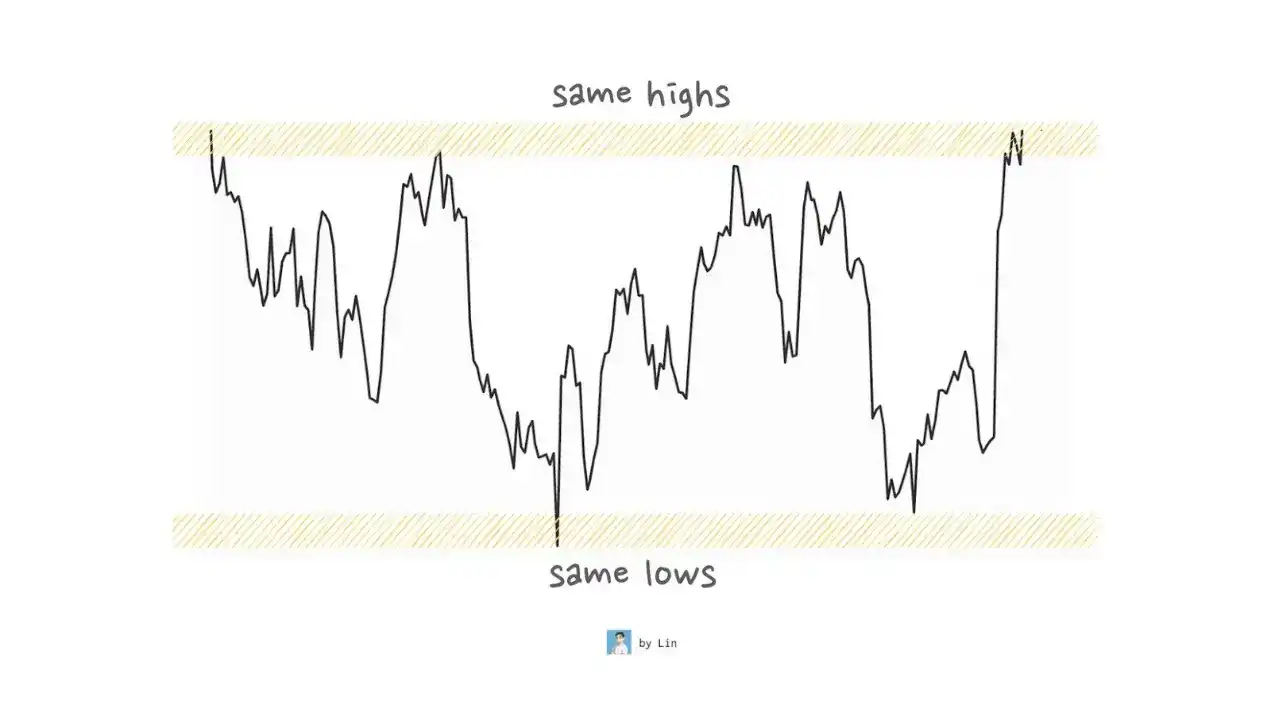

When to buy leading stocks? Buy when the market is in an uptrend and the stock breaks out of a base. The reason is simple. Investing is risky; many things can go wrong. You can't eliminate risk, but you can reduce it.

There are several ways to do this: do your research, catch the market uptrend, focus on strong companies, and buy at the right time.

Timing is more important than most people think. Buying at the right time reduces risk at entry. It also gives you a clear idea of when things go wrong. If the stock price falls below your purchase price or a key support level, that's a signal that you should retreat or stop loss. A good purchase price helps clarify your selling price. And having a clear selling price is crucial for managing risk.

Buying when a stock breaks out of a base pattern is usually less risky. A base pattern is simply a period when the stock moves sideways and consolidates. It is building up energy. When it breaks out, the trend is in your favor. Momentum increases. There is less selling pressure above, making it easier for the stock to rise.

You are not guessing; you are reacting to market strength. This is how you improve your odds.

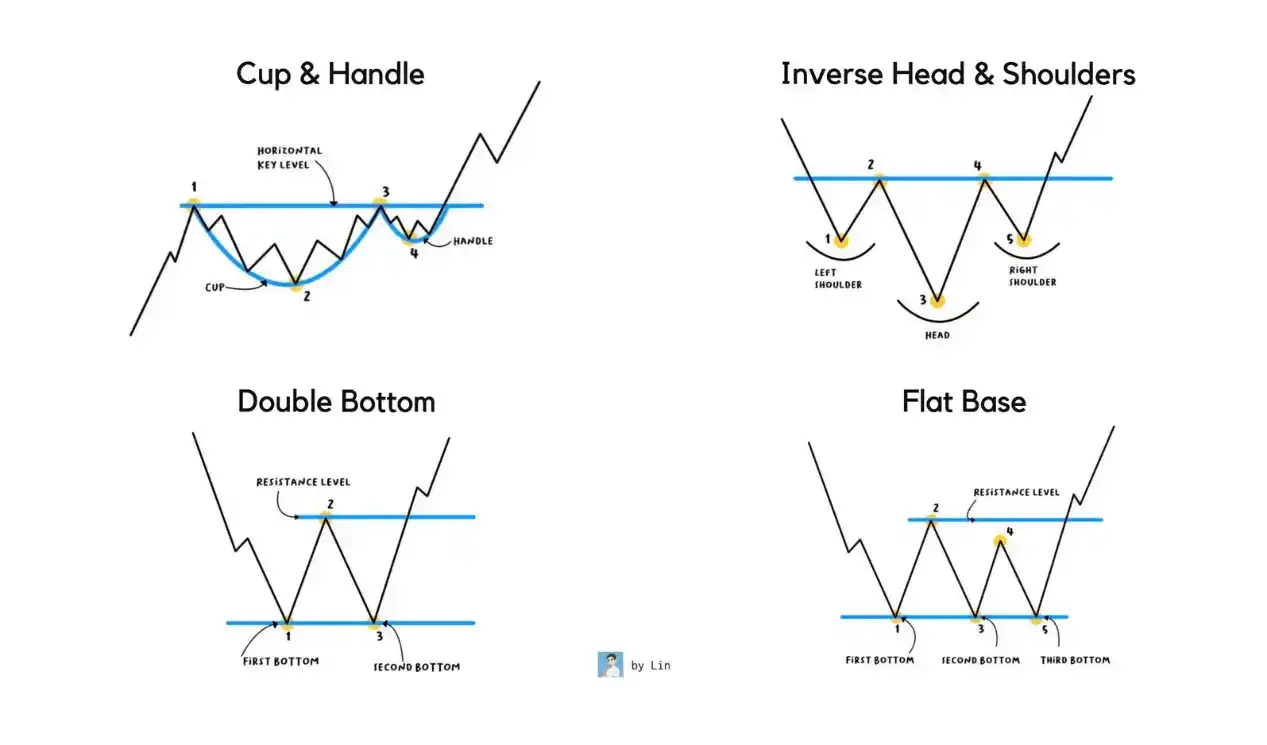

There are several different types of base patterns. Some of the most common include:

- Cup with handle

- Flat base

- Double bottom

- Inverse head and shoulders

These patterns typically appear early in a new wave or trend.

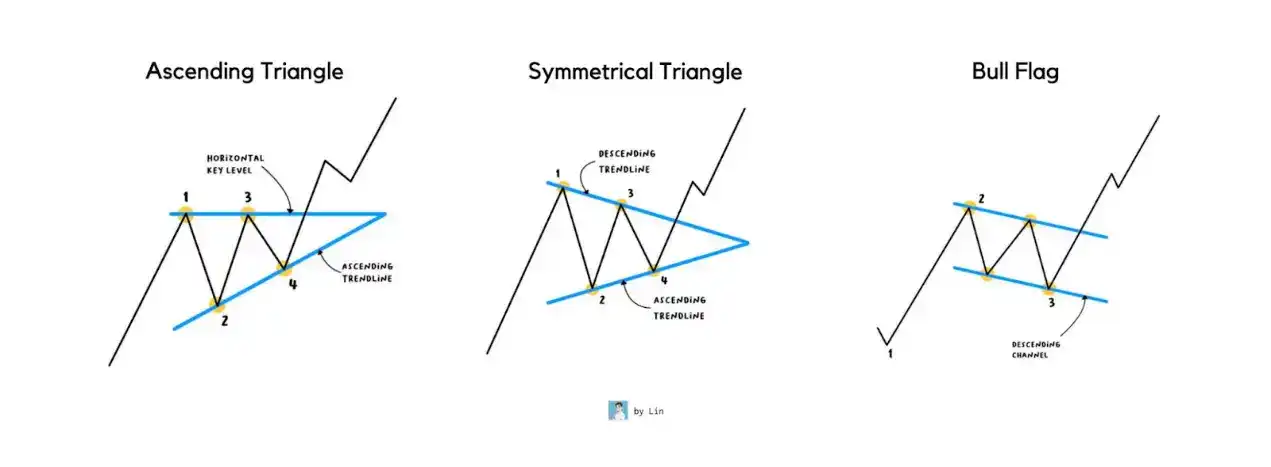

When a stock's price rises and then stalls, these base patterns are called continuation patterns. The most common continuation patterns are flags and triangles.

Additionally, you can control risk. When a stock breaks out, one of three things can happen:

- The stock continues to rise

- The stock pulls back and retests the breakout area

- The breakout fails, trapping early buyers

Breakouts are not always effective. The failure rate can be high. You need to be mentally prepared to be wrong often.

Most breakouts fail due to weak markets, the stock not being a true leader, or large institutions selling. This is why risk management is so important.

You must always be prepared for the worst. You must limit downside risk; you must set a clear stop-loss point.

Accepting losses is difficult; no one likes to admit they are wrong. But refusing to take a small loss is precisely what turns small problems into big ones. Most big losses start as small losses. They become big because people hesitate, hoping to break even when they exit.

Remember this: you can always buy back if the stock rebounds.

Protecting your downside risk keeps you in the game. This is why it's so important to keep the odds in your favor.

One more small tip: pay attention to volume.

Breakouts on high volume are stronger and less likely to fail. High volume means large investors are buying. And large investors leave traces.

Big players find it hard to hide their moves. They can't buy all their positions at once. They need to accumulate gradually.

Let Your Profitable Stocks Run

Fundamentally, the essence of investing is to have profits greater than losses. Nothing else matters. This is what many investors overlook.

They think success comes from finding cheap stocks or chasing the hottest stocks. P/E ratios, moving averages, moats, and business models are only part of the puzzle. All of these help. But none of them alone guarantee success.

What really matters is:

- How much can you make when you are right?

- How much will you lose when you are wrong?

This applies to both day traders and long-term investors. The only real difference between them is the time horizon. The principles are the same.

The most important lesson here is: you will be wrong, and you will be wrong a lot.

Investing is a game of probability. Even if you think it can't fall anymore because it's cheap; or you think it must rise because all the fundamentals are rising, you can still be wrong.

A good rule of thumb is to assume you are correct at most 50% of the time.

Think about Michael Jordan missing about half of his shots. Yet he is considered the greatest player of all time. You don't need to be right every time to get a great return.

This happens even when the market is good.

When the market is bad, it's worse. Sometimes your accuracy is only 30%. This is normal.

Mistakes are not failures. They are part of the process. Once you accept this, everything changes. Your focus will shift from being right to managing outcomes.

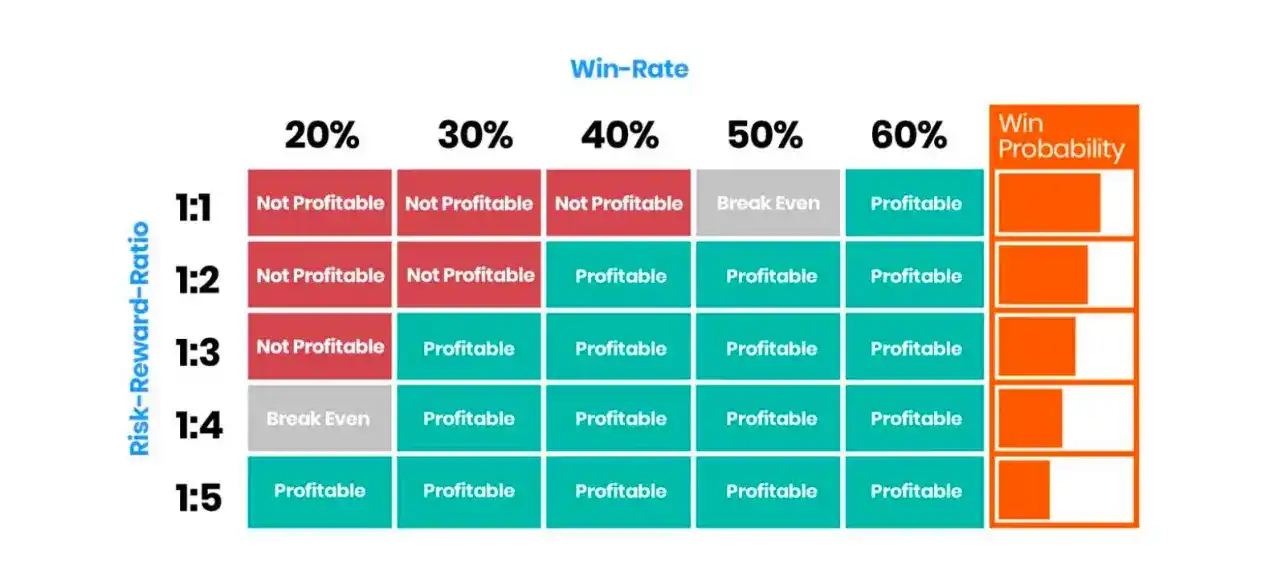

This simple table illustrates this clearly.

It shows the relationship between win rate and risk-reward ratio. Suppose your win rate is only 30%. In this case, your profits must be more than twice your losses to break even. To actually make money, your profits should be about three times your losses. This is when your strategy starts to work.

The goal is to incorporate failure into your strategy.

A 50% win rate sounds good, but it's not realistic in the long run. Markets change, conditions deteriorate. This is why your strategy needs to work even in unfavorable environments.

Starting with a 30% win rate and a 3:1 risk-reward ratio is a good starting point. You can adjust later. But if you don't know where to start, start here.

So what does this mean in practice?

Many investors think buy and hold means never selling. This is only half true. You should buy and hold profitable stocks, not losing ones.

You can never predict how much a profitable stock can rise. Sometimes it's 10%, sometimes 20%, and in very rare cases, it can even reach 100% or higher. Of course, if your investment logic fails, or the fundamentals or technicals deteriorate, you definitely want to stop loss in time. But let profitable stocks run as long as possible.

To know when to stop loss, you need to calculate the average profit. Suppose your average profit is about 30%. Then, to maintain a 3:1 risk-reward ratio, your average loss should be around 10%.

There are many ways to do this. You can adjust position sizes, or sell in stages, for example, selling one-third at -5%, -10%, and -15% respectively. On average, if you sell one-third each time, your loss will still be around 10%.

The specific method is not important; the principle is. Big profits come at the cost of many small losses. Small losses protect you from disasters.

Cut Losses Quickly

After buying a stock, the only thing you can really control is when to exit.

You cannot control how much it can rise, when it will rise, or even if it will rise. The only real choice you can make is how much loss you are willing to bear.

Sometimes bad things happen: the company reports bad earnings, bad news comes, and the stock gaps down overnight. Even if you do everything right, you can still get hit hard. This is part of the game. You can't completely avoid it.

But holding losing stocks is dangerous. The longer you hold, the greater the potential loss. The goal is to exit early while still giving the stock enough room for normal fluctuations. Stocks go up and down every day. You can't sell just because of a small drop.

Yes, sometimes the stock price gaps down, triggers your stop loss, and then rebounds. This does happen. But the last situation you want is: the stock price falls, you wait for it to rebound before exiting, but it continues to fall.

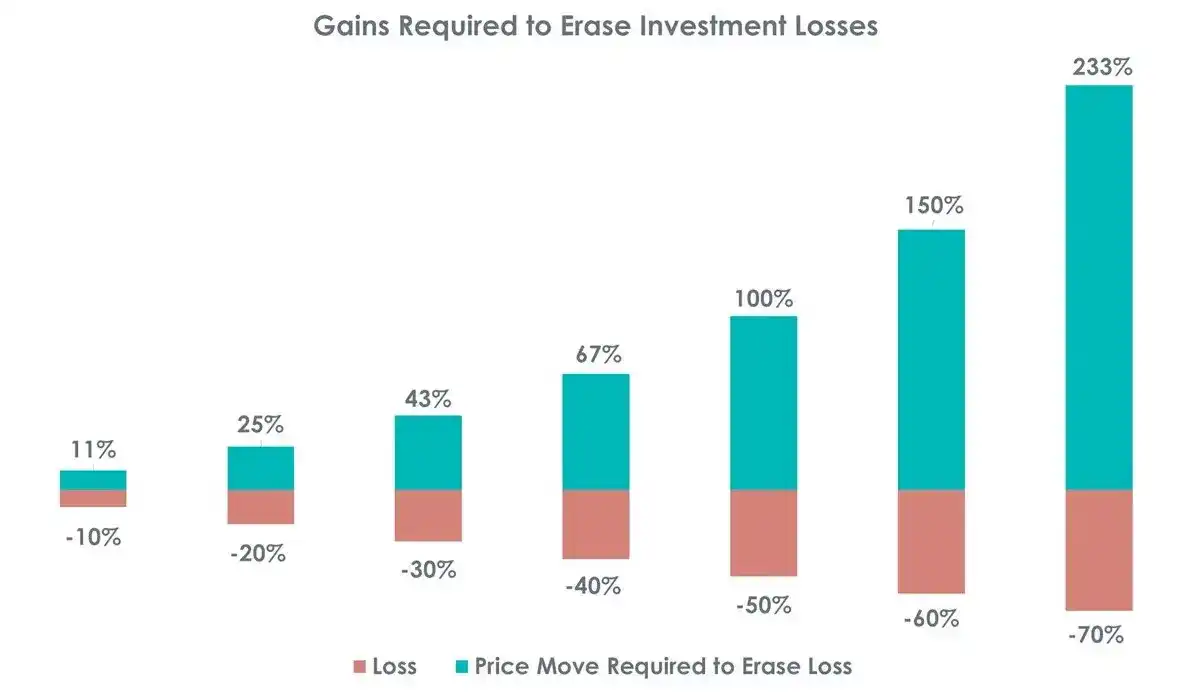

Every huge loss starts with a small loss. And the larger the loss, the harder it is to recover.

- A 10% loss requires an 11% gain to break even.

- A 20% loss requires a 25% gain.

- A 50% loss requires a 100% gain.

This is why protecting downside risk is so important.

Stopping loss is difficult. As long as you still hold the position, there is hope. Hope that it will recover. Hope that you will eventually be right. Hope that you won't look stupid.

Taking a loss is painful. Admitting a mistake is painful.

Research shows that people need twice the gain to make up for a loss. In other words, the pain of loss is twice that of gain.

Because as long as the position is not closed, the loss is not finalized. There is a chance to rebound. There is a chance to prove you are right. But once you sell, the loss becomes real, and the mistake becomes permanent. But you need to accept losses; it's part of the process.

No one is always right. Investing is always full of uncertainty. Investing is not about perfection; it's about making more than you lose over a period of time.

The sooner you stop loss, the better. Holding a losing position usually means something is wrong, perhaps your timing is off, your stock selection is wrong, or the current market environment is unfavorable.

Additionally, there is opportunity cost. Money tied up in losses cannot be used for other investments. This money could be used more effectively elsewhere. Learning to cut losses quickly is one of the most important skills in investing.

Related reading: Crypto Trader's Handbook: A Quick Look at 25 Brutal Truths