Author: Ma He, Foresight News

Original Title: Earning $80,000 in One Day, This Top Player Treats Polymarket as an ATM

The crypto market is unpredictable, even top traders sometimes step back due to its hellish difficulty.

Predicting weekly or monthly trends might not be too hard, but what if the timeframe shrinks to minutes? The difficulty skyrockets.

However, smart people always find their own ways to make money.

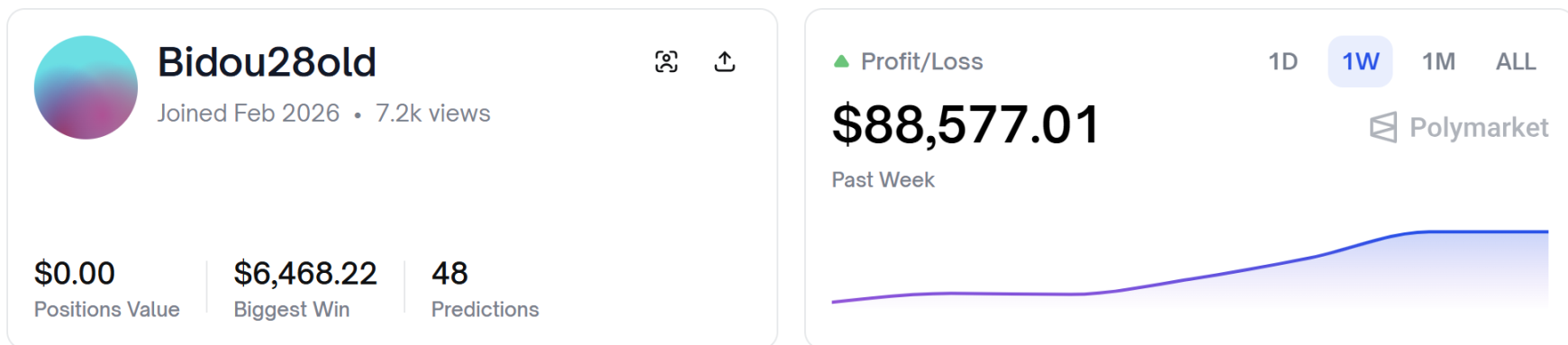

A player nicknamed Bidou28old (0x4460bf2c0aa59db412a6493c2c08970797b62970) on Polymarket, who just joined in February this year, netted $80,000 in less than a day.

This player is no ordinary speculator; they were among the first top players on Polymarket's newly launched "5-minute / 15-minute ultra-short-term prediction markets" in February 2026.

They made only 48 predictions in all, but the win rate and profit-loss ratio are astonishing. They aren't "predicting" the future; they are "hunting" volatility. They are most likely a quantitative trader or an arbitrageur with extremely low-latency market data, specifically targeting Polymarket's pricing delays for a dimensional strike.

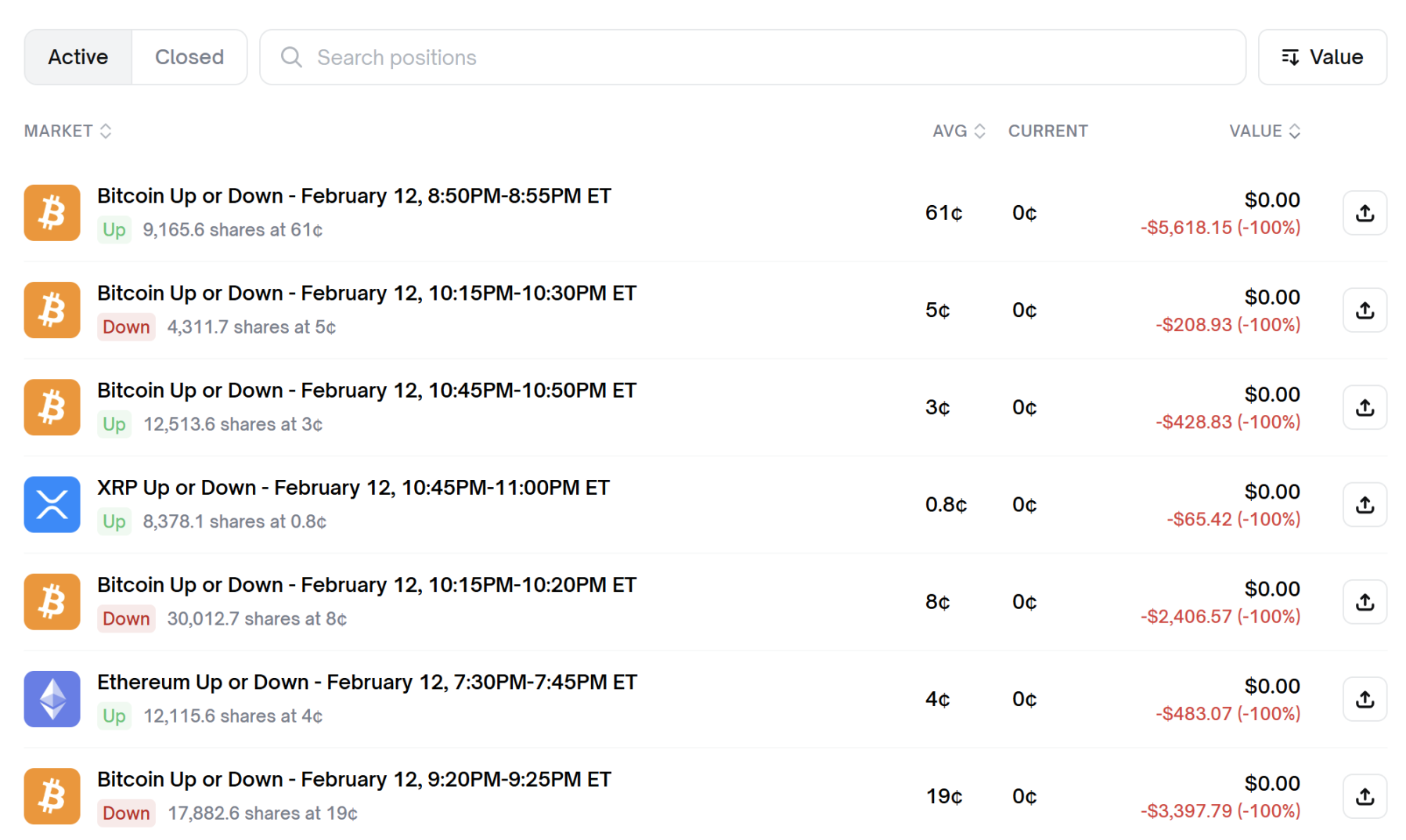

If you scroll down on this trader's Polymarket address homepage, you will be stunned by their "losses" – just these 7 losses amount to over $10,000.

Ordinary people see failure, but this player sees mathematical logic. Observe some of their entry prices: 3¢, 5¢, 8¢, 0.8¢. On Polymarket, they specifically buy events the market believes have only a 3%-8% chance of happening (e.g., buying "rebound within 5 minutes" when BTC plummets). If they buy at 3¢ and guess correctly, the return is 33x. This means even if they fail 30 times, succeeding just once covers the cost; succeeding twice is pure profit.

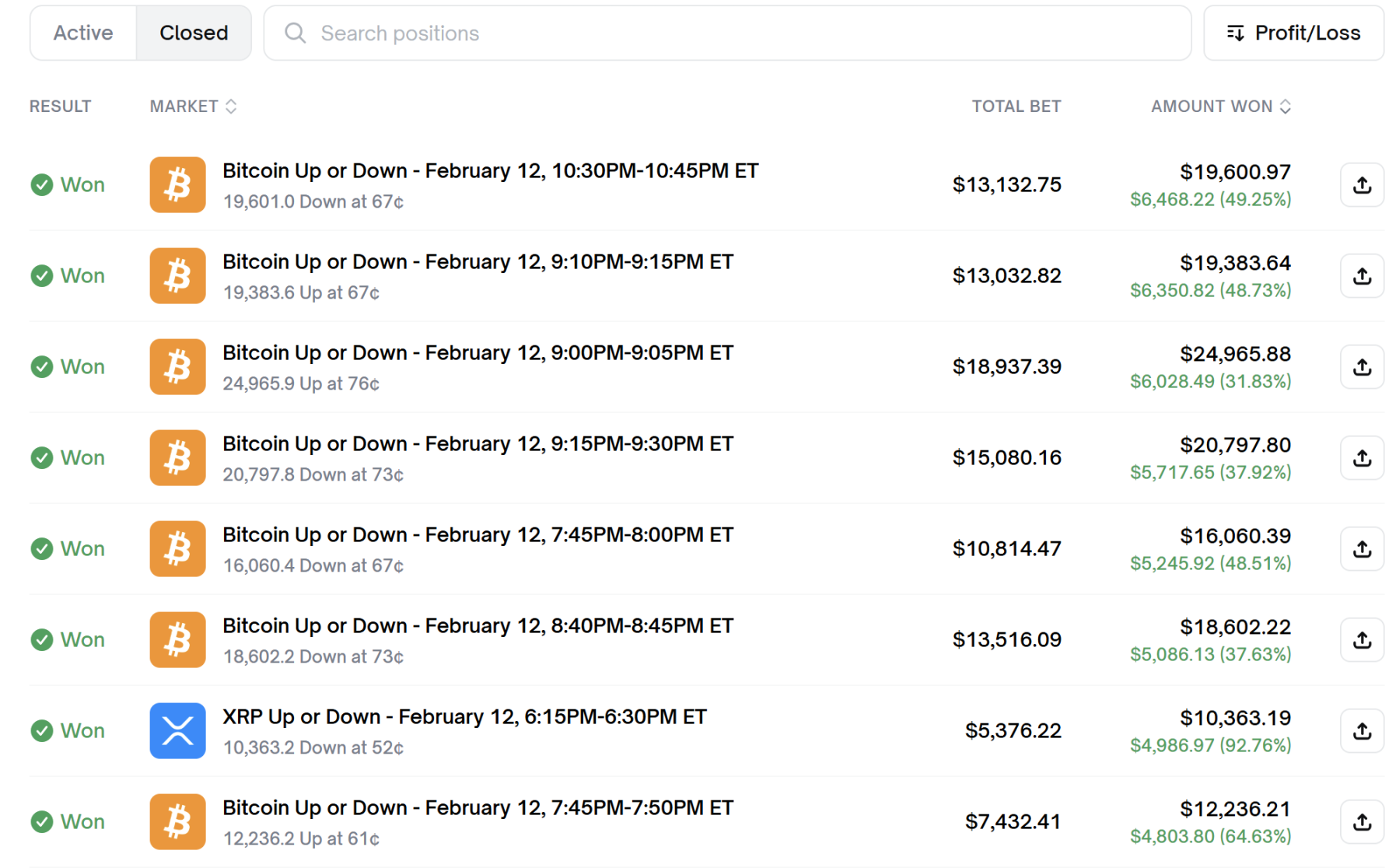

If these failed cases are about betting small to win big, losing more but winning occasionally, then the big wins shown below truly reveal the other side of their top-tier trading skills.

Looking at this screenshot of massive wins, you'll notice a startling pattern: extremely high single-trade investments. Their winning bets generally range from $7,000 to $19,000. Furthermore, their profit amounts are very stable, almost every single one falling between $4,800 and $6,400.

This indicates they have a strict position management model. They aren't gambling for a "double-up"; they are betting on "certainty." Whenever the market shows a signal they recognize, the moment the trend becomes clear, they push in tens of thousands of dollars, capturing 30%-50% of the move before retreating.

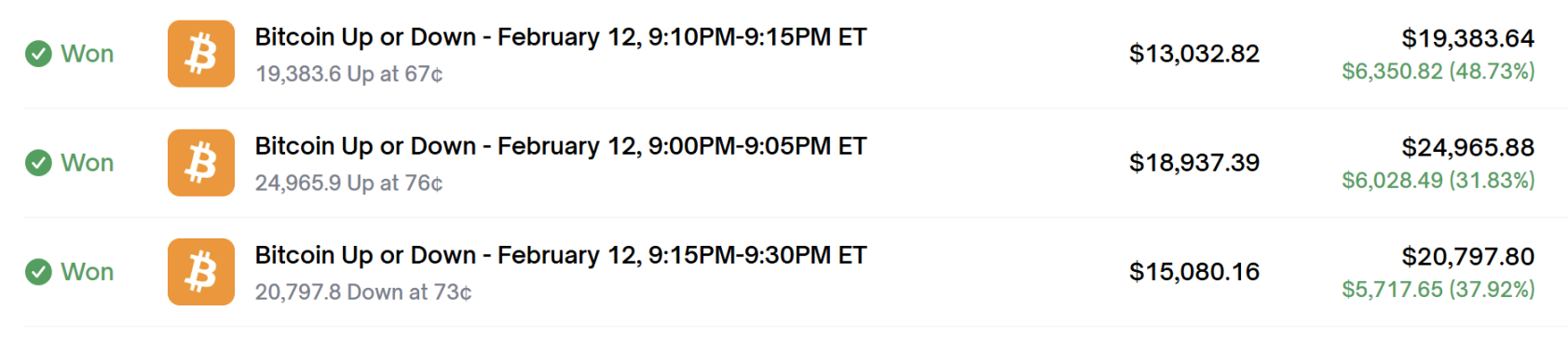

If you think those so-called techniques are child's play, then look at these three bets placed within 15-minute timeframes.

9:00 PM – 9:05 PM: Made $6,028;

9:10 PM – 9:15 PM: Made $6,350;

9:15 PM – 9:30 PM: Made $5,717;

This can be called a textbook example of high-frequency position switching.

Within 30 minutes, they executed three consecutive operations on price predictions for different short timeframes, accumulating over $18,000 in profit. This frequency means they are definitely not making decisions based on news; they are watching second-level candlestick charts or order flow.

Looking carefully at their historical transaction records, most of their trading time is concentrated between 7:30 PM and 11:00 PM EST, which is 8:30 AM to 12:00 PM Beijing Time the next day.

Based on their trading frequency and time, this trader is either a night hunter in North America, perhaps using their evening rest time after the US stock market closes and dinner to specifically harvest volatility in cryptocurrencies during the US post-market session. Or, they could be a "daytime professional trader" in the Asia-Pacific region, as the extremely calm, high-frequency style with single bets in the tens of thousands of dollars matches a professional quantitative trader based in Asia treating this as a full-time job.

In terms of asset selection, they heavily favor BTC, followed by ETH and other major cryptocurrencies, because their high volatility makes them less susceptible to manipulation by single forces, suitable for such large short-term bets.

They allow themselves small losses but dare to place heavy bets on high-probability opportunities (60¢+).

Perhaps, this is the self-cultivation of a Polymarket top player.

Twitter:https://twitter.com/BitpushNewsCN

Bitpush TG Discussion Group:https://t.me/BitPushCommunity

Bitpush TG Subscription: https://t.me/bitpush