The once-considered "iron law" of the four-year halving cycle in the crypto market is facing unprecedented challenges. Top market maker Wintermute pointed out in its latest 2025 annual report that the traditional cycle narrative has become obsolete, and market logic has shifted from "seasonal rotation" to "liquidity lock-up."

2025 did not bring the widespread euphoria as expected; instead, it exhibited extreme emotional polarization: on one hand, BTC and ETH entered the institutional hall of fame with the support of ETFs, while on the other hand, the explosive power of altcoins significantly diminished, and their lifecycles shortened.

Facing 2026, can the crypto market break the current存量困局 (stock dilemma)? Wintermute has outlined three core variables to打破现状 (break the status quo).

Main Text:

2025 did not bring the anticipated broad-based rally, but this may be regarded by future generations as the beginning of cryptocurrency's transition from a speculative tool to a mature asset class.

The traditional four-year cycle is becoming outdated. Market performance is no longer dominated by self-fulfilling timed narratives but depends on the flow of liquidity and the concentration of investor attention.

What Changed in 2025?

Historically, crypto-native wealth manifested as a fungible pool of capital. Profits from Bitcoin would spill over into Ethereum (ETH), then flow to blue-chip assets, and finally reach altcoins.

Wintermute's over-the-counter (OTC) flow data indicates that this传导机制 (transmission mechanism) significantly weakened in 2025.

Spot exchange-traded funds (ETFs) and digital asset trusts (DATs) evolved into "walled gardens." They provided sustained demand for large-cap assets but did not naturally rotate funds into the broader market.

With retail interest being drawn to the stock market, 2025 became a year of extreme polarization.

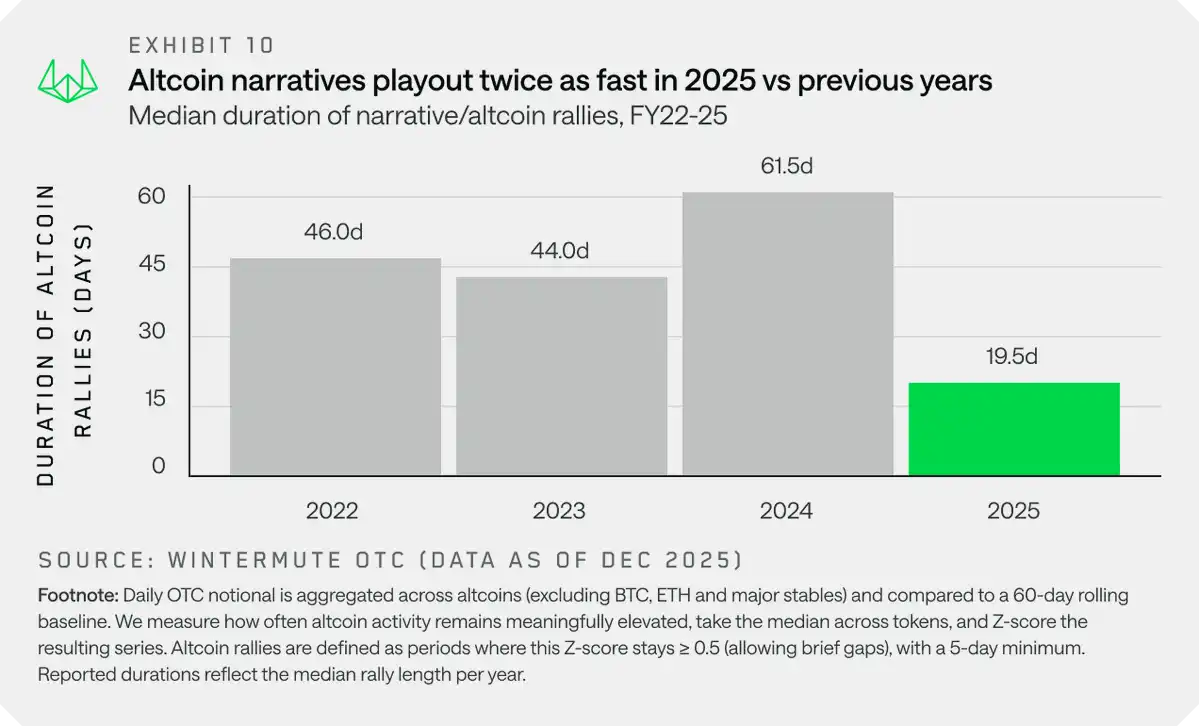

The average duration of altcoin rallies in 2025 was 20 days, far below the 60 days seen in 2024.

A handful of mainstream assets absorbed the vast majority of new funds, while the broader market struggled.

Three Paths for 2026

For market participation to extend beyond mainstream assets and expand further, at least one of the following three things needs to happen:

1. Expanding Institutional Mandates

Currently, most of the new liquidity remains confined to institutional channels. A full market recovery requires institutional investors to broaden the range of assets they can invest in.

Early signs have already emerged through ETF applications for Solana (SOL) and XRP.

2. The Wealth Effect from Mainstream Assets

A strong rebound in Bitcoin or Ethereum could generate a wealth effect, spilling over into the broader market, similar to what happened in 2024.

However, there remains uncertainty about how much capital will ultimately flow back into digital assets.

3. Rotation from Equities

Retail investor attention could rotate back from the stock market (such as AI, rare earths, quantum computing, etc.) to cryptocurrencies, bringing fresh capital inflows and stablecoin minting.

Although this is the least likely scenario, it would significantly expand market participation.

The future outcome will depend on whether the aforementioned catalysts can effectively diffuse liquidity beyond a few large-cap assets or whether this concentration trend will persist.

Understanding where capital flows and what structural changes are needed will determine which strategies will work in 2026.