In an interesting development, Grayscale has applied to the United States Securities and Exchange Committee to launch a spot exchange-traded fund (ETF) linked to BNB, the Binance Ecosystem’s native token. This move marks a power play by the asset management firm to further establish itself in the cryptocurrency space.

Grayscale Looks To Add To List Of Crypto-Linked ETFs

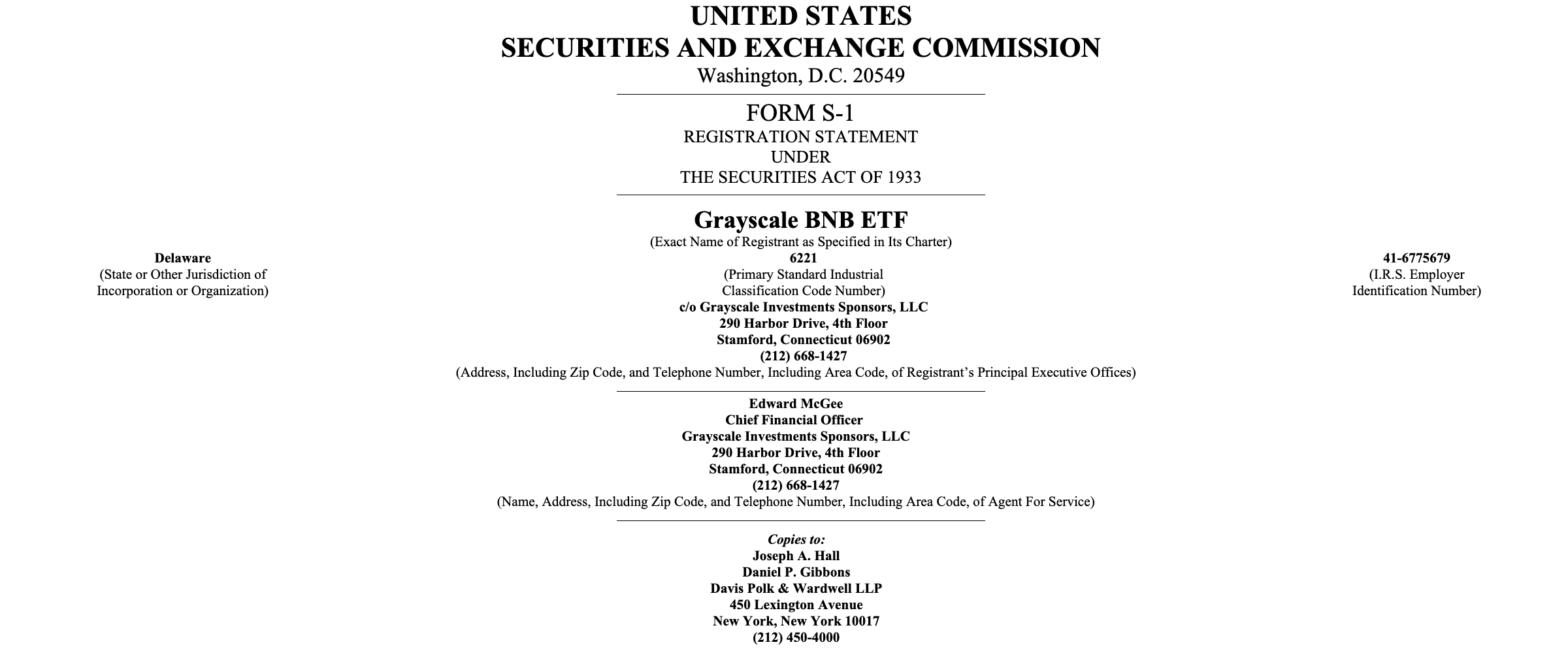

On Friday, January 23, Grayscale filed an S-1 registration statement with the SEC to launch a spot BNB exchange-traded fund in the US. According to the SEC filing, the proposed Grayscale ETF would hold the Binance ecosystem’s native token directly and issue shares designed to track the token’s market value.

This Grayscale investment product, if approved, would offer US investors exposure to the BNB token without having to own or hold the asset themselves. The asset manager’s registration statement also revealed that the exchange-traded fund would trade on the Nasdaq exchange under the ticker symbol GBNB, subject to regulatory approval.

Source: SEC

It is worth mentioning that Grayscale is not the first asset manager to file for a spot BNB ETF, as VanEck applied as far back as April 2025. However, this latest filing reflects the firm’s resolve to expand its list of crypto-linked investment products, especially after the successful launch of the Bitcoin and Ethereum ETFs.

It was always only a matter of time before BNB, the fourth-largest cryptocurrency by market capitalization, received extra attention from institutions focused on exchange-traded products. As such, this move by Grayscale has caught the attention of the cryptocurrency market, including former Binance CEO Changpeng ‘CZ’ Zhao.

In a Friday post on the social media platform X, CZ said that Grayscale’s submission of its S-1 filing to the SEC represents a small step toward making the United States the capital of crypto. “A small step in helping to make America the Capital of Crypto, by giving access to the 3rd largest crypto,” the Binance co-founder wrote on Friday.

Meanwhile, Bloomberg ETF expert James Seyffart concurred that a spot ETF approval could mean that the BNB token will be classified as a commodity rather than a security. This is because the approval of an exchange-traded fund is often an indication that the SEC views the underlying asset as a commodity rather than as a security.

BNB Price At A Glance

After making a play for $900 on Friday afternoon, the price of BNB now stands at around $890. According to data from CoinGecko, the fourth-largest cryptocurrency is down by nearly 5% in the past seven days.

The price of BNB on the daily timeframe | Source: BNBUSDT chart on TradingView