Author | Chuk(Former Paxos Employee)

Compiled by | Odaily Planet Daily(@OdailyChina)

Translator | DingDang(@XiaMiPP)

Introduction: Everyone is Issuing Stablecoins

Stablecoins are evolving into application-level financial infrastructure. Following the introduction of the GENIUS Act and clearer regulatory frameworks, brands like Western Union, Klarna, Sony Bank, and Fiserv are shifting from "integrating USDC" to "launching their own dollars" through white-label partnership issuances.

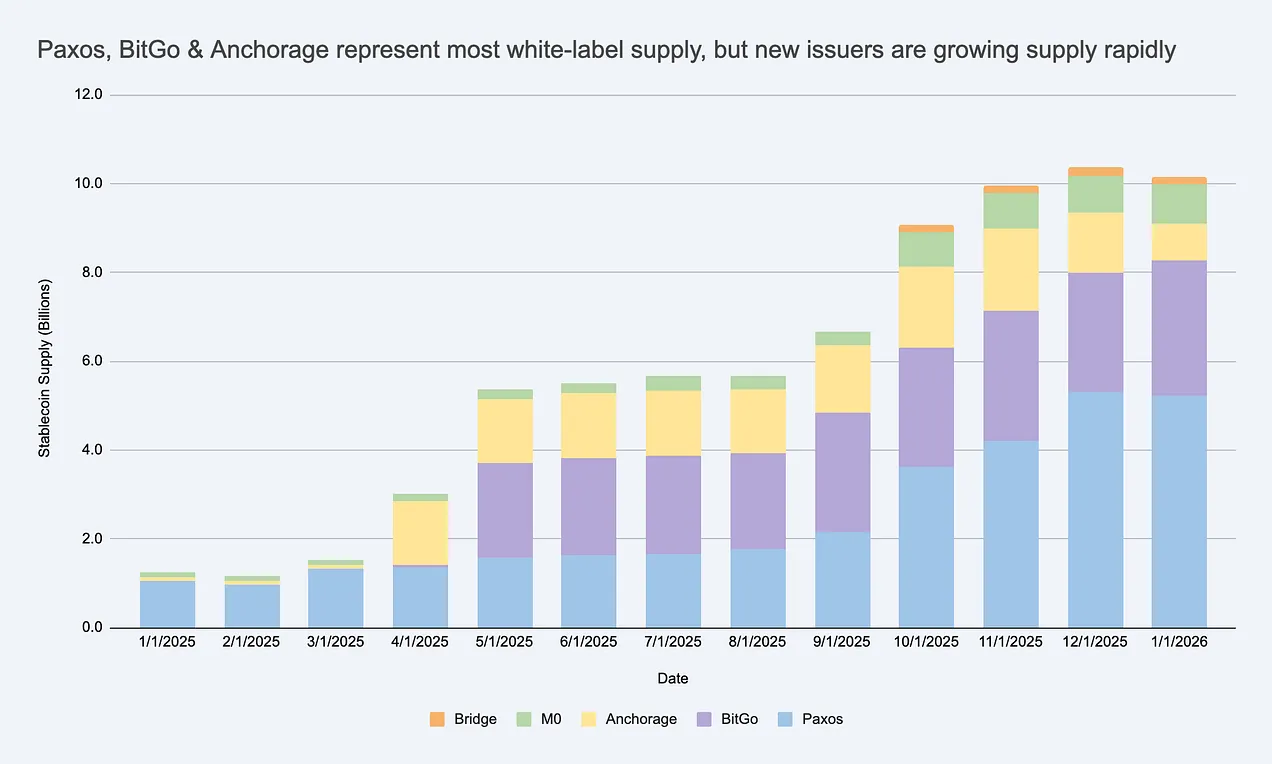

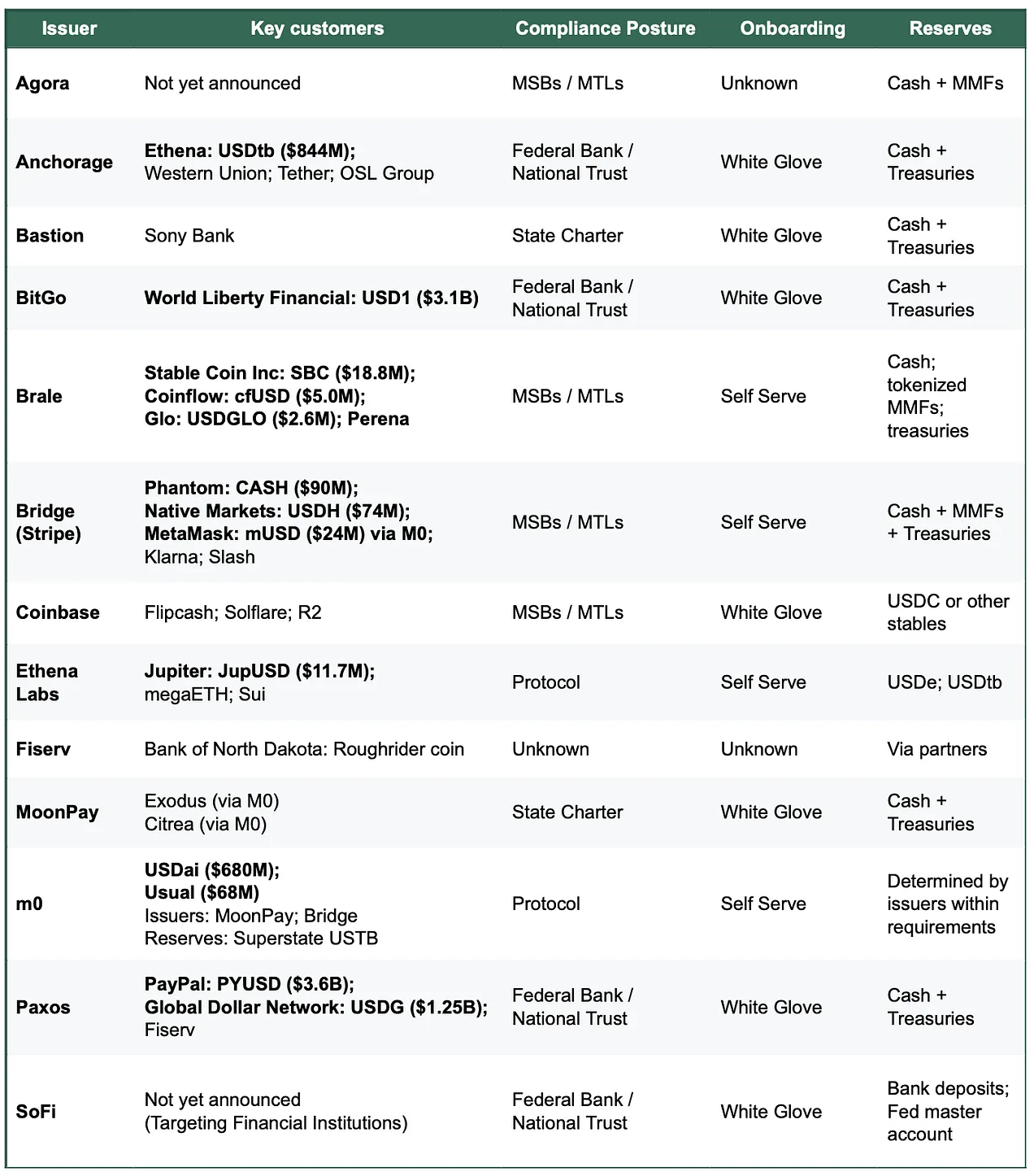

Supporting this shift is the explosive growth of "issuance-as-a-service" platforms. A few years ago, Paxos was almost the only choice on the market; today, depending on the project type, there are over 10 viable paths, including new platforms like Bridge and MoonPay, compliance-first players like Anchorage, and industry giants like Coinbase.

The increase in choices makes stablecoin issuance seem like a capability that is being commoditized—at least at the underlying token architecture level, this is true. But "commoditization" depends on who the buyer is and the specific task to be accomplished. Once the underlying token operation is separated from liquidity operations, regulatory compliance stance, and peripheral capabilities (on/off ramps, treasury management, account systems, card services), this market no longer resembles a price war, but rather a layered competition: the truly difficult-to-replicate "outcomes" are where pricing power is most likely to concentrate.

In other words: Core issuance capabilities are converging, but in areas with high operational outcome requirements like compliance, redemption efficiency, launch time, and bundled services, suppliers are not easily replaceable.

The supply of white-label stablecoins is growing rapidly, creating a vast issuer market beyond USDC/USDT. Source: Artemis

If you view issuers as completely interchangeable, you will miss where the real constraints lie and misjudge where profits might be retained.

Why Do Companies Launch Their Own Branded Stablecoins?

This is a reasonable question. Companies are primarily motivated by three aspects:

- Economic Benefits: Retain more value from customer cash flows and balances, and expand peripheral revenue sources (treasury management, payments, lending, card services).

- Behavioral Control: Embed customized rules and incentive mechanisms (e.g., loyalty programs), and independently decide清算 paths and interoperability to match their own product forms.

- Accelerate Time-to-Market: Stablecoins allow teams to launch new financial experiences globally without rebuilding the entire banking system.

It is worth noting that most branded stablecoins do not need to grow to the size of USDC to be considered successful. In closed or semi-open ecosystems, the core metric may not be market capitalization, but rather ARPU (Average Revenue Per User) or improvements in unit economics—that is, how much new revenue, increased retention, or efficiency gains the stablecoin functionality brings to the business.

How Does White-Label Issuance Work? Deconstructing the Tech and Operations Stack

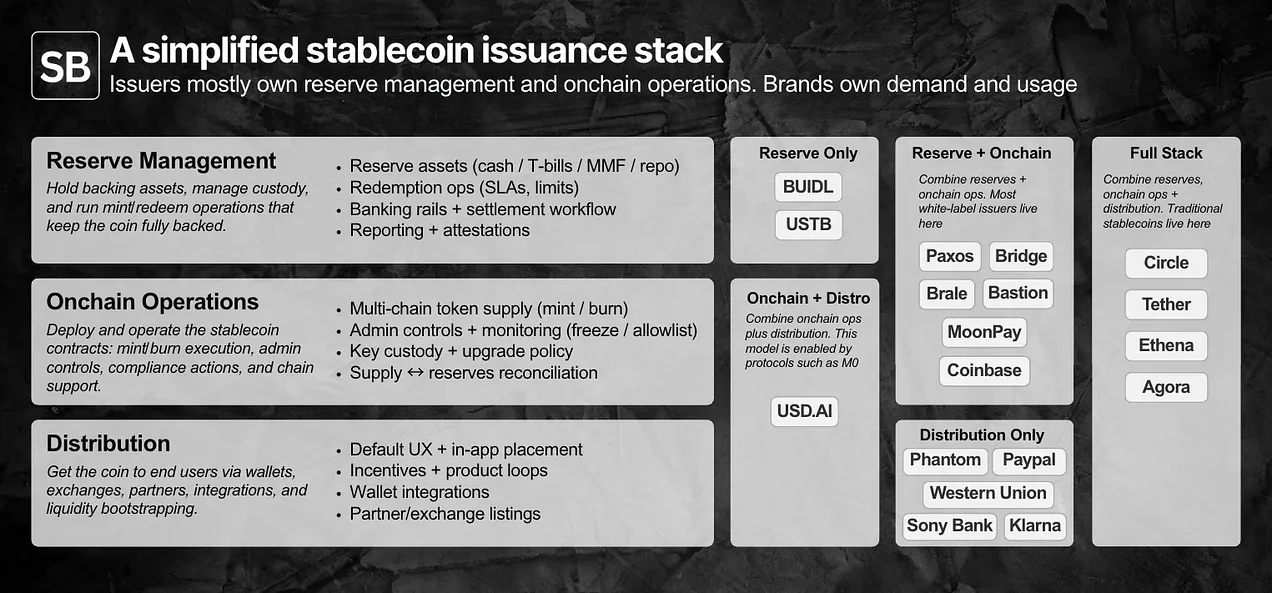

To judge whether issuance is "commoditized," one must first clarify the division of labor: reserve management, smart contracts and on-chain operations, and distribution channels.

The issuer typically controls the reserve and on-chain operations; the brand controls demand and distribution. The real differences lie in the details.

The white-label issuance model allows brands to launch and distribute their own stablecoins while outsourcing the first two layers to a "issuer-of-record."

In practice, responsibilities are roughly split into two categories:

- Primarily controlled by the brand: Distribution and use cases (distribution channels)—including where the stablecoin is used, the default user experience, wallet entry points, and which partners or platforms support it.

- Primarily controlled by the issuer: Issuance operations. The smart contract layer (token rules, admin privileges, mint/burn execution) and the reserve layer (asset composition, custody, redemption process).

From an operational perspective, these capabilities are now mostly productized via APIs and dashboards, with launch cycles ranging from a few days to several weeks depending on complexity. Not all projects need a US-compliant issuer today, but for institutions targeting US enterprise customers, even before the full implementation of the GENIUS Act, compliance capability itself has become part of the product.

Distribution is the hardest part. Within a closed ecosystem, getting the stablecoin used is primarily a product decision; but in open markets, integration and liquidity are the bottlenecks. Here, issuers often step in with secondary liquidity support (exchange/market maker relationships, incentive design, initial liquidity injection). Although demand is still controlled by the brand, this "go-to-market support" is where issuers can significantly alter the outcome.

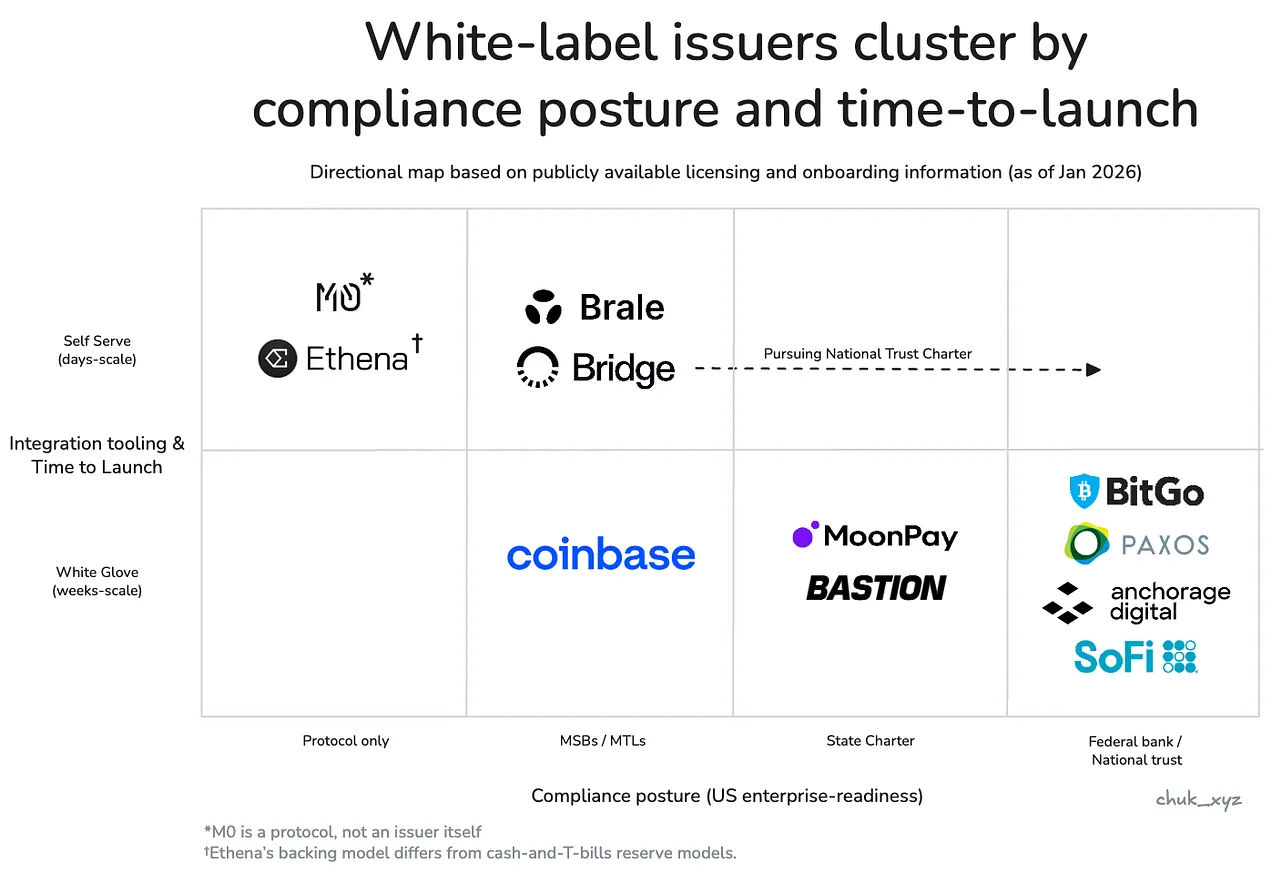

Different buyers weight these responsibilities differently, so the issuer market naturally splits into several clusters.

Market Stratification: Commoditization Depends on the Buyer

Commoditization refers to a service being standardized enough that changing suppliers does not change the outcome, and competition shifts to price rather than differentiation.

If changing the issuer changes the outcome you care about, then for you, issuance is not yet commoditized.

At the underlying token level, changing issuers often doesn't affect the outcome much, making them increasingly interchangeable: most institutions can hold similar Treasury bill-type reserves, deploy audited mint/burn contracts, provide basic control functions like freeze/pause, support major chains, and expose similar APIs.

But brands rarely just buy a "simple token deployment." They buy outcomes, and the outcomes needed depend heavily on the buyer type. Overall, the market roughly splits into several clusters, each with a key point where "substitutability begins to fail." Within each cluster, teams in practice often end up with only a few truly viable choices.

Enterprises and Financial Institutions are led by procurement processes and optimize for trust. Substitutability fails on compliance credibility, custody standards, governance structure, and the reliability of 7x24 redemptions at scale (potentially hundreds of millions of dollars). In practice, this is a "risk committee-style" procurement: the issuer must be defensible on paper and operate stably, predictably, even "boringly" in production.

- Representative institutions: Paxos, Anchorage, BitGo, SoFi.

Fintech Companies and Consumer Wallets are product-oriented, focusing on delivery and distribution capabilities. Substitutability fails on time-to-launch, integration depth, and those value-added peripheral tracks (e.g., on/off ramps) that make the stablecoin usable in real business workflows. In practice, this is a "deliver within this iteration cycle" procurement strategy: the winning issuer is the one that minimizes KYC, on/off ramp, and treasury process coordination work and gets the entire functionality (not just the stablecoin itself) operational the fastest.

- Representative institutions: Bridge, Brale (MoonPay / Coinbase might also fall here, but public information is limited).

DeFi and Investment Platforms are on-chain native applications, focusing on optimizing composability and programmability, including structures designed for different risk trade-offs and yield maximization. Substitutability has a slight impact on reserve model design, liquidity dynamics, and on-chain integration. In practice, this is a "design constraint" compromise: teams are willing to accept different reserve mechanisms if it enhances composability or yield.

- Representative institutions: Ethena Labs, M0 Protocol.

Issuers cluster according to enterprise-grade compliance posture and customer onboarding: Enterprises & Financial Institutions in the bottom right, Fintech / Wallets in the middle, DeFi in the top left.

Differentiation is moving up the stack, which is particularly evident in the Fintech / Wallet space. As issuance itself becomes more of a feature, issuers are beginning to compete by bundling配套的完善服务 to complete the overall job and aid distribution. These services include compliant on/off ramps and virtual accounts, payment orchestration, custody, and card issuance. This approach can maintain pricing power by altering time-to-market and operational outcomes.

Within this framework, the question of "is it commoditized?" becomes clear.

Stablecoin issuance is commoditized at the token level, but not at the outcome level, because buyer constraints make suppliers difficult to replace.

As the market develops, issuers serving each cluster may gradually converge on the capabilities required by that market, but we are not there yet.

Where Might Lasting Advantages Come From?

If the token layer has become table stakes, and peripheral differentiation is slowly eroding, an obvious question is: can any issuer build a lasting moat? For now, it looks more like a customer acquisition competition, with retention achieved through switching costs. Changing issuers involves reserve and custody operations, compliance processes, redemption mechanisms, and downstream system integrations, so issuers are not "replaceable with a click."

Beyond bundling services, the most likely source of a long-term moat is network effects. If branded stablecoins increasingly require seamless 1:1 convertibility and shared liquidity, value could accrue to the issuer or protocol layer that becomes the default interoperability network. What remains uncertain is whether this network will be controlled by issuers (strong value capture) or evolve into a neutral standard (broader adoption, but weaker value capture).

A trend worth watching: Will interoperability become a commoditized function, or a primary source of pricing power?

Conclusion

- Currently, the core of token issuance is commoditized, with the differentiation happening at the edges. Token deployment and basic controls are converging, but outcomes still diverge in operations, liquidity support, and system integration.

- For any buyer, the market is not as crowded as it seems. Actual constraints quickly narrow the candidate list, and the "credible options" are often just a handful, not a dozen.

- Pricing power comes from bundling, regulatory environment, and liquidity constraints. The value is not in "creating the token" itself, but in the entire轨道 infrastructure surrounding the stablecoin's operation.

- Which moats will hold long-term remains unclear. Network effects through shared liquidity and exchange standards are a plausible path, but who captures the value remains uncertain as interoperability matures.

What's next to watch: Will branded stablecoins converge to a few exchange networks, or will interoperability ultimately evolve into a neutral standard. Regardless of the outcome, the conclusion is the same: the token is just the foundation, the business model is the core.