Author: Shisi Jun

On February 6, 2026, the People's Bank of China, in conjunction with eight major departments, once again released [Yin Fa (2026) No. 42] document. There have been many market interpretations already. This article aims to provide a more vertical analysis by combining RWA with the current on-chain market situation.

1. How to Understand Document No. 42

In the author's view, reading the original text together with the attached document "Regulatory Guidelines on the Overseas Issuance of Asset-Backed Security Tokens for Domestic Assets" reveals a lot. The core point is that Document No. 42 devotes significant space to defining and regulating "Real World Asset Tokenization" (RWA). This amounts to the regulatory authorities formally recognizing RWA as a business model and providing a path for compliant application and filing.

There are three key pieces of information, presented here in the original text, followed by an interpretation.

First, the accurate定性 (qualification) of RWA:

"Real World Asset Tokenization refers to the use of encryption technology and distributed ledger or similar technology to convert ownership,收益权 (beneficial rights), etc., of assets into tokens or other equity/debt instruments with token characteristics, and to conduct issuance and trading activities."

With the definition established, how is it applied? The text continues:

"Exceptions are made for related business activities carried out relying on specific financial infrastructure, upon approval by the competent business authorities in accordance with laws and regulations."

So, who can participate? There are also clear process regulations for applying and utilizing RWA assets:

The domestic entity that actually controls the underlying assets needs to file with the China Securities Regulatory Commission (CSRC), submitting a filing report,全套 (complete set of) overseas issuance materials, and other documents, fully explaining the domestic filing entity information, underlying asset information, token issuance plan, and other relevant situations.

Therefore, in the author's view, combining the two, it can be said that RWA assets have been clearly separated from virtual currencies, which were previously heavily crackdown upon, and the two are not subject to the same management approach.

2. The Evolution of Global RWA Standards

Alongside the Mainland's institutional定性 (qualification), how is the current global RWA market developing? When regulatory issues are alleviated, subsequent application becomes a practical reality that must be faced.

In fact, the current market has long been in an era of a Token standard war.

This complexity has brought industry-level compatibility challenges for RWA. Let's delve into the mainstream RWA token application standards.

This article will start from HK ABT (asset-backed token) in 2022, move to ERC-3525 and ERC-3475围绕 (surrounding) bonds, then to AAVE's Atoken, stETH, and AMPL from the DeFi era, and finally to how the leading on-chain stock platforms Ondo and xStock handle the特性迁移 (characteristic migration) of stock tokenization.

2.1 HK and ABT

The Hong Kong government's "Policy Statement on the Development of Virtual Assets in Hong Kong," released on October 31, 2022,重点提及 (highlighted) asset-backed tokens (ABT).

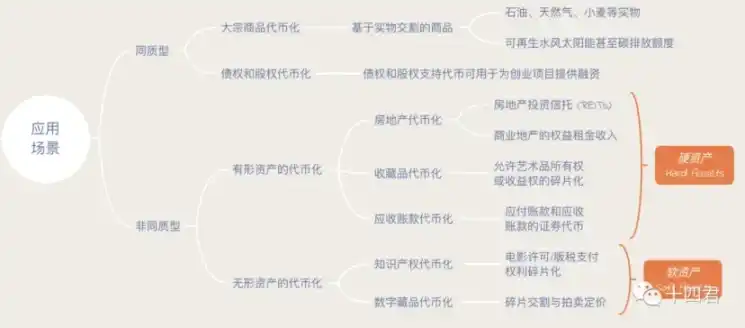

Conventionally, tokens are divided into 4 major types, distinguished by the token's purpose and source of value.

In fact, the thinking behind the Mainland document and the practices previously attempted in HK are continuous. They both必然有 (must have) physical off-chain assets or权益 (rights) as the value标的 (target).

Thus, through compliant tokenization, on-chain characteristics bring enhancements to the assets:

- Fragmentation: Refers to dividing property rights into smaller units for sale, making them easier to trade, price, and circulate.

- Liquidity: Defined by the speed at which an asset can be converted into cash, with order books shared via on-chain广播 (broadcasting).

- Cost Efficiency: When trading based on blockchain smart contracts, the costs of these external third parties are eliminated or significantly reduced.

- Automation: Blockchain-based smart contracts do not require these manual interactions, providing a trustworthy technological foundation.

- Transparency: One of the most significant features of on-chain transactions is the immutable record-keeping.

From the audience's perspective:

- For institutions: The splitting and conversion of large orders bring benefits in terms of fragmented liquidity efficiency and cost reduction.

- For users: Possessing a transparent and automated trustworthy environment to ensure their rights and interests.

Currently, the most直观有应用价值的 (intuitively valuable for application) are stocks and bonds, as both can perfectly adapt to the aforementioned advantages of liquidity, automation, and fragmentation.

3. Bond Scenario Standards: ERC-3525 and ERC-3475

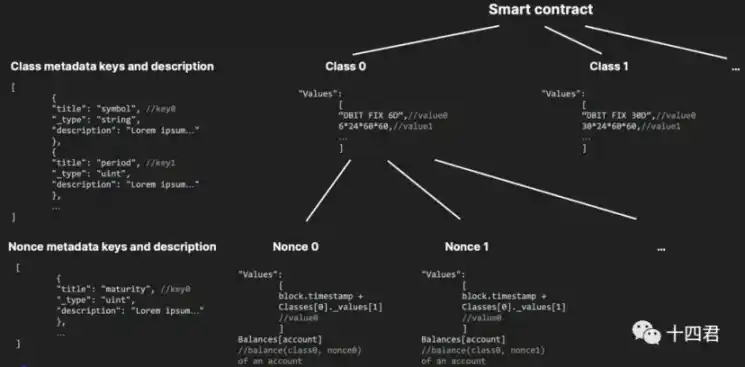

There was significant爆发 (explosion) around this asset type before and after HKABT, leading to industry standards like ERC-3525 and ERC-3475:

- ERC-3525 focuses on the management of semi-fungible tokens,完善 (perfecting) the combination and splitting of assets at the numerical level,侧重 (focusing on) traditional financial assets on-chain.

- ERC-3475 focuses on the definition of semi-fungible tokens, providing better规范 (standardization) for defining contracts with low standardization,侧重 (focusing on) traditional commercial contracts on-chain.

Objectively speaking, these two standards are not widely used. This is because they were standards first, business second, rather than being summarized from existing business practices. Hence, their actual influence has been decreasing (far less than Atoken and stEth discussed later).

In the author's view, this is because the初衷 (original intention) of such standard designs aimed to be all-encompassing. For example, ERC-3475 (see image below) is practically a representative of包容万物 (encompassing everything), which directly led to high barriers to user understanding and high barriers to app adaptation.

Ultimately, aiming too high meant writing everything等于没写 (was equivalent to writing nothing), so it's understandable that there are few market applications.

4. Bond Scenario Applications: AToken & stEth

Compared to the "standard first, application later" type, let's look at the典范 (paradigm) of "application first, standard later".

4.1 Real-Time Compound Interest Model: Aave's Atoken

Aave is the top DeFi infrastructure in the web3 industry, dealing in on-chain asset collateralized lending for interest. The Atoken is the collateral certificate, with core functions as follows:

- Proof of Deposit: Holding aToken is equivalent to the user owning a corresponding amount of assets in the Aave protocol, and these assets automatically earn interest over time.

- Lending Mechanism: aTokens can be used to evaluate a user's deposit amount and determine their loan额度 (quota).

- Automatic Interest Distribution: The quantity of aTokens automatically increases according to the current deposit interest rate.

- Transferability and Liquidity: Users can transfer or collateralize aTokens into other protocols to obtain more收益 (yield) or use them in other DeFi products.

Looking at it this way, it can be said that each point is also the path RWA must take in the future.

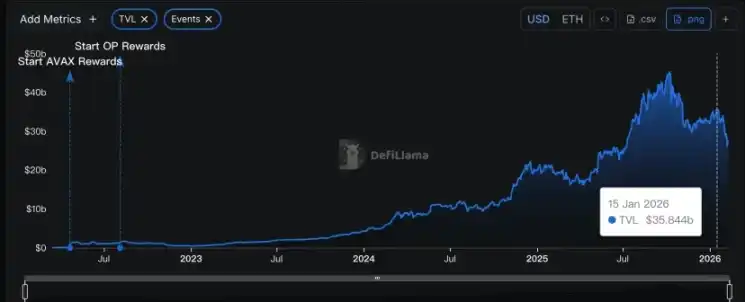

Looking at its market status, it has been growing robustly, with Atoken's total assets reaching around $30 billion.

Why is Atoken so successful?

Clearly, with almost 100% growth annually, it can be called a successful典范 (paradigm).

Ultimately, because atoken is already very well-adapted to the existing market. After all, originating from Aave, they understand that adaptability is a key path for development in the blockchain market. The two standards mentioned above ultimately got stuck on adaptability; existing asset dashboards and wallets found it difficult to integrate this type of asset.

Adaptability is not a simple word because it has a key problem to solve: if on-chain assets cannot generate interest, their practical significance is greatly reduced.

But if they are to generate interest, how should this interest be given to users?

After all, everyone's质押时间 (staking time) is different, and the staking interest rates vary across periods. Different assets have different market demands, corresponding to different lending spreads.

If interest is simply transferred to users periodically, the project's cost and management complexity would significantly increase, ultimately passing the cost to the users.

Some say this is an on-chain performance issue, so they built new high-performance public chains to rival web2 server performance, but they then face the cost of user migration.

Aave's answer is to hide the interest in the user's daily transactions.

AToken essentially uses a Scaled Balance mechanism to calculate the user's actual balance:

Liquidity Index = Initial Index × (1 + Interest Rate × Time)

This logic ensures that interest is automatically calculated and accumulated during transfers (whether sending or receiving), triggering new minting events to increase supply during the transfer.

For the project side, this eliminates a dividend distribution transaction, and users see their interest不知不觉中 (unconsciously). Even if not seen, it will be calculated in the next operation, so there is no loss.

This clever design, requiring just a few lines of code, is very native-thinking.

Moreover, this line of thinking paved the way for the inheritance and evolution of subsequent on-chain asset standards like stEth, ondo, and xStock.

4.2 Rebase Model: Lido's stETH

stETH, based on the previous interest concept, further simplifies the logic of staking and withdrawal, no longer calculating based on interest + time accumulation, but rather on shares.

stETH = Amount of ETH staked by user * (Total protocol assets / Total internal shares)

You might find it strange: How can it have no interest? It's all about staking for interest. If someone stakes for 1 year and I stake for 1 day, shouldn't the share change?

This is because of Lido's daily automatic rebase mechanism. For example:

- Suppose I bought 1 ETH a year ago and joined a total stake of 100 ETH. My share is 1%.

- Lido daily obtains staking rewards from the Ethereum Beacon Chain and then performs a rebase on the protocol.

- Thus, when I withdraw after one year, I naturally get the 4% (assuming 4% APY).

- If I buy this 1% share on the last day, I am buying based on a share that has accumulated costs for nearly 364 days, approaching 104% of the original value, and can only benefit from 1 rebase.

Why design it this way?

Because making stETH's yield automatically arrive daily,无需等待 (no waiting) and无需手动领取 (no manual claiming), is its greatest convenience.

The previous Atoken required a transaction to realize the interest, whereas stETH can automatically update the balance daily, making it easy for various wallets to兼容 (be compatible).

This ultimately allows users to see the interest increase on their balance sheet, aligning with our conventional concept of saving: interest automatically arriving daily, providing peace of mind.

Comparing the two归根究底 (in the final analysis), it comes down to different scenarios.

Aave is for lending, with interest rates fluctuating greatly in real-time; high-rate periods can yield a day's worth equal to a month. Lido, with fixed income, is smooth and steady, less concerned with one day's interest, thus allowing for further optimized user experience.

Are these two suitable as Token standard methods for the RWA era?

The author believes neither is perfectly suitable, but they can be used for reference. Let's look at the final主角 (main character) of today: the on-chain stock model.

5. On-Chain Stock RWA Scenario

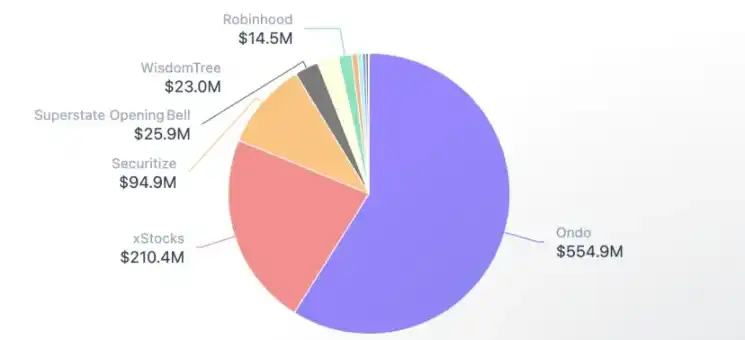

Although not large in the overall RWA total value (900M vs 27B), due to the characteristics of stocks, it is one of the most promising scenarios for trading liquidity and on-chain application imagination.

The main players here are: Ondo, xStock.

We can see that over the past six months, the top DEXs and wallets in the market have been investing here. Objectively speaking, the judgment of these leading platforms regarding future trends seems remarkably consistent.

- 2025.7.1: Jupipter supports xStock trading and begins large-scale promotion.

- 2025.9.25: Solana official launches new RWA Twitter account.

- 2026.1.22: Jupiter partners with Ondo Finance to list 200+ types of tokenized stocks.

- 2026.1.24: Binance Wallet supports Ondo asset trading in professional mode.

- 2026.2.3: MetaMask launches tokenized US stocks and ETFs, stating the market is shifting on-chain.

They actually use a share-based Rebase model, specifically an "On-Chain Shares + Multiplier Scaling" Rebase mechanism.

On the Solana chain, this mechanism is an extension in its mainstream token2022 standard. Each token can have a parameter called a Multiplier set by the project. The balance the user holds is called the raw amount, meaning the number of shares.

Then, the project dynamically adjusts the Multiplier parameter in the token settings during scenarios like stock splits, reverse splits, dividend distributions, etc., modifying the display amount.

This creates a divide: if users use a wallet that doesn't support this parameter, they might feel something is wrong with their assets. In supported cases, they see the UI amount, i.e., the amount displayed on the client.

6. Summary and Reflection

The preceding text,洋洋洒洒 (voluminously) over four thousand words, has reviewed the mainstream on-chain asset tokenization and real-world asset tokenization leading players and evolution paths.

Various partial reflections have been mentioned in each module. So now it's time to return to the core of the title: "Cold Thinking".

Because, looking at the extended timeline, RWA has been around for almost 10 years.

- Early Exploration, 2016-2019: Experimental stage of asset on-chain, mainly stablecoins.

- Initial Institutional Phase, 2020-2022: RWA entered the DeFi lending field, i.e., the Tokenised Stocks尝试 (attempted) by BN/FTX (which closed down not long after).

- Compliance Stage, 2023 - Present: Compliance began to clarify / Some RWA assets expanded rapidly (stablecoins, US Treasuries, etc.), and new asset types and platforms gained traction.

Therefore, in the author's view, the Mainland's定性 (qualification) of RWA is objectively a positive development, but not entirely so. It could even be said to be a belated notice. Moreover, HK previously introduced a similar system, ABT, but did it develop?

Clearly, compared to the state of affairs in the other hemisphere, it hasn't flourished much. This is closely related to HK's very cautious management of licenses. Whether it's about acting boldly from the start or试探和约束 (testing and constraining) bit by bit – the latter can scare away many platform operators hoping to build.

The new system has openness, but what is opened up is not necessarily what users真正要用 (truly want to use) or what the market needs.

We can see that Aave's Atoken is very successful because it addresses the use of idle on-chain assets, allowing users to lend them out.

stETH is also great because it solves the pathway for POS (Proof of Stake) staking. Although there is a risk of Lido concentrating too much value (power), it provides stable收益 (yield) for staking. Similarly, one can read the author's article on Jito, which is another staking model.

And they all care deeply about user experience, meticulously handling compatibility and project costs bit by bit.

Therefore, issuance itself is not the goal; applying on-chain liquidity, fragmentation, transparency, and automation to the tokens is where the value lies.

It's not about defining a perfect standard first, but respecting rules and consensus, leveraging strengths step by step.

Just like common stocks: various exchanges are not 7*24 hours, but on-chain ones are.

Gold markets in various regions have their own opening hours, but on-chain does not.

This time gap is the true value (Gap) of being on-chain, as it can solve the problem of value discovery in non-trading markets. Compared to pre-market trading, it is more敏锐 (sensitive). Compared to cross-exchange price differences, it has lower磨损 (friction). Moreover, liquidity spanning the globe offers value discovery from a completely different交叉视角 (intersecting perspective). In the future, company pricing might not rely on the NYSE on-chain but rather the NYSE listing might first look at the on-chain price.