By: Sam Kessler, Rebecca Ballhaus, Eliot Brown, Angus Berwick, The Wall Street Journal

Compiled by: Luffy, Foresight News

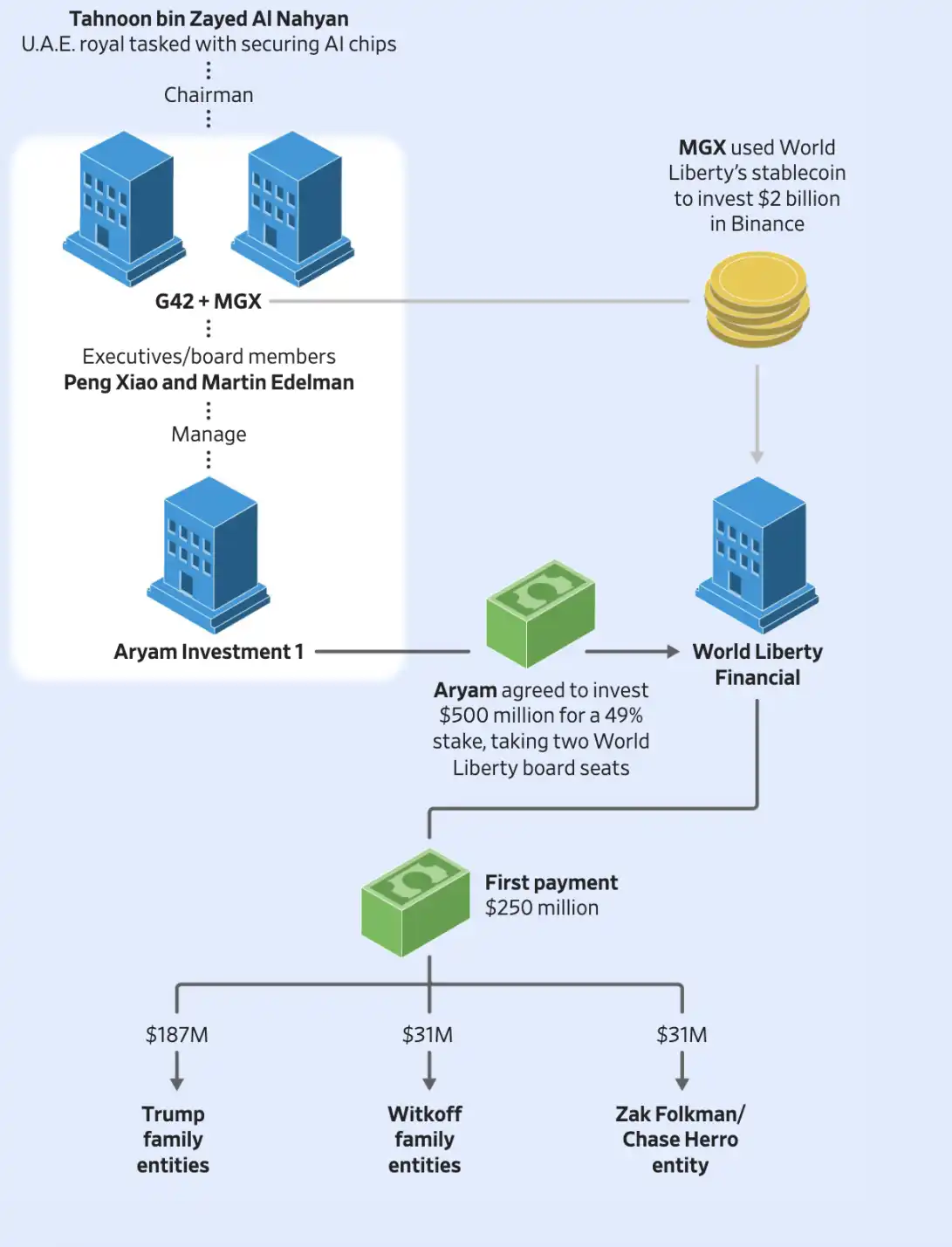

According to company documents and informed sources, four days before Donald Trump's presidential inauguration last year, an aide to an Abu Dhabi royal family member secretly signed an agreement with the Trump family to acquire a 49% stake in their startup cryptocurrency venture for $500 million. The buyer paid half upfront, with $187 million transferred directly to Trump family entities.

This deal with World Liberty Financial, previously unreported, was signed by the president's son, Eric Trump. Documents show that at least an additional $31 million was directed to entities linked to the family of co-founder Steve Witkoff, who had been appointed as a U.S. Middle East envoy just weeks earlier.

Informed sources stated that the investment was backed by Sheikh Tahnoon bin Zayed Al Nahyan, an Abu Dhabi royal who has been lobbying the U.S. for access to tightly controlled artificial intelligence chips. Sometimes called the "spy chief," Tahnoon is the brother of the UAE president, the country's national security advisor, and also heads its largest sovereign wealth fund. He controls a business empire valued at over $1.3 trillion, funded by both personal wealth and state funds, spanning sectors from fish farms and artificial intelligence to surveillance technology, making him one of the world's most powerful individual investors.

This transaction is unprecedented in U.S. political history: a foreign government official acquired a significant stake in a company owned by the incoming U.S. president.

During the Biden administration, Tahnoon's efforts to obtain AI hardware were largely stymied due to concerns about sensitive technology potentially flowing to China. U.S. intelligence officials and lawmakers were particularly alarmed by Tahnoon's AI company, G42, which had close ties to sanctioned tech giant Huawei and other Chinese companies, raising multiple red flags. Although G42 claimed it severed its Chinese connections by the end of 2023, U.S. concerns persisted.

Trump's election victory reopened the door for Tahnoon. Informed sources said that in the months following, Tahnoon met repeatedly with Trump, Witkoff, and other U.S. officials, including during a March visit to the White House, where the Sheikh expressed to U.S. officials his eagerness to cooperate with the U.S. in AI and other fields.

Two months after the March meeting, the Trump administration committed to providing the Gulf state with approximately 500,000 of the most advanced AI chips annually, enough to build one of the world's largest AI data center clusters. As previously reported by The Wall Street Journal, the framework agreement stipulated that about one-fifth of these chips would go to G42.

This agreement is widely seen as a major victory for the UAE's ruling family, breaking through long-standing U.S. national security concerns and allowing the country to compete on the cutting edge of AI alongside the world's strongest economies. Supporters of the deal praised it for attracting massive investment to the U.S. and helping to establish global standards for U.S. technology.

What was not previously known publicly was this: Tahnoon's envoy had signed an agreement that previous January to acquire a 49% stake in World Liberty Financial.

Trump visited Abu Dhabi in May last year

Tahnoon met with Trump and other U.S. officials at the White House in March last year

Details of the $500 Million Deal

Documents show that of the initial $250 million paid by the Tahnoon-backed company Aryam Investment 1, $187 million was transferred directly to Trump family entities DT Marks DEFI LLC and DT Marks SC LLC. Beyond the money directed to Witkoff family entities, another $31 million was transferred to entities associated with co-founders Zak Folkman and Chase Herro. The Wall Street Journal has not determined the specific allocation of the remaining $250 million investment that Aryam is due to pay by July 15, 2025.

The agreement made Aryam the largest shareholder in World Liberty Financial and the only known external investor besides the company's founders. Documents show the deal secured Aryam two seats on World Liberty Financial's five-person board; the two Aryam executives appointed as directors also hold senior positions at Tahnoon's G42. Board members at the time included Eric Trump and Zach Witkoff (son of Steve Witkoff).

Since Trump's election victory, his real estate company has sought deals with foreign firms, and the president himself has accepted gifts from foreign governments, including a $400 million luxury jet from Qatar. But the World Liberty Financial deal is the only known instance of a foreign government official purchasing a large stake in a Trump-owned company after his election victory.

Disclosures on World Liberty Financial's website show the Trump family's equity share dropped from 75% last year to 38%, indicating an external party bought shares, but the company never disclosed the buyer's identity.

Weeks before the U.S.-UAE chip deal was announced in May last year, World Liberty Financial CEO Zach Witkoff announced that Tahnoon's investment vehicle MGX would use a stablecoin issued by World Liberty Financial to complete a $2 billion investment in cryptocurrency exchange Binance. The G42 executives who joined World Liberty Financial's board are also directors at MGX, which is jointly owned with G42.

Zach Witkoff promoted the MGX stablecoin collaboration as an endorsement of World Liberty Financial's technology, without disclosing that MGX and World Liberty Financial are led by the same people.

World Liberty Financial spokesman David Wachsman, regarding the Aryam investment, stated: "We made this deal because we firmly believe it is in the best interest of the company's continued development. The idea that a U.S. private company must adhere to special standards in fundraising that other similar companies do not is both absurd and un-American."

He said that President Trump and Steve Witkoff were not involved in this transaction and have not been involved in World Liberty Financial affairs since taking office, and that Witkoff never held an operational role at the company. He added that the deal does not grant any party access to government decision-making or influence policy, "We comply with the exact same rules and regulations as everyone else in our industry."

A person familiar with Tahnoon's investment said that Tahnoon and his team conducted "months of assessment" of World Liberty Financial's plans before investing, and he completed the investment in the company with "several co-investors," stating that no G42 funds were used. "At no point during due diligence or thereafter was this investment discussed with President Trump." The person said Tahnoon is a "significant investor" in cryptocurrency businesses.

White House spokeswoman Anna Kelly said: "President Trump acts solely in the best interests of the American public." She said the president's assets are held in a trust managed by his children, "there is no conflict of interest," and stated that Witkoff is working to "advance President Trump's global peace goals."

White House Counsel David Warrington said: "The President is not involved in any business transactions that may involve his constitutional duties."

He said Witkoff strictly adheres to government ethics rules, "He has not and will not participate in any official matters that could affect his financial interests," adding that Witkoff has "divested his relevant interests in World Liberty Financial."

A person close to Witkoff said the envoy was not involved in AI chip negotiations related to G42 but was briefed on the discussions.

A Trump Organization spokesperson said the company "takes its ethical obligations extremely seriously and is firmly committed to preventing conflicts of interest," and complies with all applicable laws.

The "Sheikh's" AI Chip Offensive

Trump posed with UAE President Mohammed during his visit to the UAE last May

After Trump's election victory, the UAE side hoped for a more cooperative partner in the U.S.

For Tahnoon, obtaining U.S. chips was a top priority. Tasked by his brother, he leads the UAE's push to become a global leader in AI. During the Biden administration, citing concerns chips could reach China, the U.S. allowed the country only limited access to chips. Although G42 said it cut ties with China by the end of 2023, other UAE entities, including within Tahnoon's business empire, maintained close links with China.

Tahnoon sought approval for a massive additional allocation of chips to build one of the world's largest AI data center clusters, requiring electricity equivalent to two Hoover Dams. Tahnoon and his aides planned a full-court press to secure support from Trump's new administration.

Tahnoon already had business ties to the Trump family through Trump's son-in-law Jared Kushner, whose investment firm raised $1.5 billion in 2024 from a Tahnoon-backed company and Qatar.

Shortly after the election victory, Trump appointed his longtime friend and golfing buddy, Steve Witkoff, as a Middle East envoy. Witkoff moved quickly, informing Biden administration officials he planned to contact his Middle East connections and would travel to the UAE, Qatar, Saudi Arabia, and Israel before the inauguration.

A December 2024 trip to the UAE had both diplomatic and cryptocurrency purposes. Witkoff, who helped found World Liberty Financial in September, attended a cryptocurrency conference in Abu Dhabi, mingling with crypto heavyweights and Eric Trump in a VIP room. Eric Trump declared to the UAE crowd in a keynote speech: "Our family loves you."

As previously reported by The Wall Street Journal, Witkoff also met with Tahnoon, part of a series of regional talks that included issues like a Gaza ceasefire.

About a week after Witkoff's trip, two entities were registered within two days, one in Delaware and one in Abu Dhabi, disclosing no ownership information, both sharing the same name: Aryam Investment 1.

Company records reviewed by The Wall Street Journal show the Delaware Aryam is managed by executives from Tahnoon's G42; the Abu Dhabi entity shares a UAE office address with numerous other companies in the Sheikh's business empire.

Weeks later, on January 16, 2025, Aryam's representatives signed the $500 million deal with Trump and Witkoff's World Liberty Financial.

The Network of Interests Behind the Deal

At the time of the investment, World Liberty Financial had no products, having only $82 million from issuing a token called WLFI. Documents show Aryam's investment did not grant it rights to future WLFI token sales, meaning the Tahnoon-backed entity was excluded from the company's only revenue stream at the time.

The agreement for Aryam to acquire the World Liberty Financial stake was signed by G42 General Counsel Martin Edelman, a core advisor to Tahnoon, and G42 CEO Peng Xiao. The deal also involved Tahnoon's personal investment company, Royal Group, for which Edelman also serves as an advisor.

Edelman and Xiao joined the World Liberty Financial board, but the company's website does not list them in the team roster.

The two played key roles in the UAE's lobbying of the Trump administration for chips.

G42's head of crypto and blockchain, Fiacc Larkin, joined World Liberty Financial in January 2025 as chief strategy advisor. His LinkedIn profile shows he also advises the Abu Dhabi Department of Economic Development, a government agency.

For years, G42 has been closely watched by Biden administration officials and Republican lawmakers. In 2024, Republican lawmakers called for an investigation into the risk of China acquiring U.S. technology through the company.

Peng Xiao, born in China, attended university in Washington, obtained U.S. citizenship, then relinquished it to become a UAE national. He himself came under scrutiny during the Biden administration.

In 2024, a Republican committee chairman, in a letter requesting an investigation from the Commerce Department, said documents showed a "vast network" of UAE and Chinese companies behind Peng Xiao.

Trump met with Mohammed during his visit last May. Peng Xiao, CEO of Tahnoon's artificial intelligence company G42, was present (second from left)

G42 denied the allegations in the letter at the time, stating the company had ceased cooperation with Chinese companies.

Edelman is a prominent New York real estate lawyer who has cultivated connections in the UAE for decades. He advises the UAE royal family and serves on the boards of G42, MGX, and other Tahnoon companies. He is also a longtime friend of Witkoff and publicly praised Witkoff after the election.

The share acquisition deal, according to company documents reviewed by The Wall Street Journal, brought huge windfalls for World Liberty Financial's founders, with Trump family, Witkoff family, Folkman, and Herro-linked entities all receiving quick payouts. Trump's disclosure filings show he personally held a 70% stake in DT Marks DEFI as of the end of 2024, with the remaining 30% held by other family members; he did not disclose the ownership structure of DT Marks SC.

Ethical and Legal Controversies

Analysis of the investment deal details

Trump has long been criticized for retaining control of his private business empire while in office and profiting from overseas. During his first term, Democratic lawmakers sued Trump, alleging he violated the Constitution's "Emoluments Clause" by profiting from foreign governments patronizing his businesses. Trump called it a political witch hunt, and the Justice Department argued Trump's profit-sharing did not constitute an emolument; the Supreme Court ultimately declined to hear the case.

In his second term, Trump's real estate holding company, the Trump Organization, said it would not sign new contracts with foreign governments during the presidency but did not rule out new deals with foreign private companies, a loosening compared to the first term. The company said it would donate profits from identifiable foreign government officials at its hotels and other businesses to the U.S. Treasury. World Liberty Financial made no such promise.

Legal experts said the deal with Aryam could violate the Emoluments Clause, and the proximity in timing between the UAE chip deal and the World Liberty Financial transaction represents a significant conflict of interest.

Kathleen Clark, a law professor at Washington University and former government ethics lawyer in Washington D.C., said the clause is designed to prevent any government official from being "bought off" by a foreign government. "This looks like a clear violation of the foreign emoluments clause, and more importantly, it looks like a bribe."

She said the deal "should be a five-alarm fire for the sale of the federal government."

Ty Cobb, who served as senior White House counsel during Trump's first term, said Trump's conflicts of interest far exceed those of any predecessor, "It's like complaining about a kayak when a B52 flies overhead." "As an ethics lawyer, my advice would be very clear: Don't do business deals with the families of foreign national leaders. It taints U.S. foreign policy."

A White House official said World Liberty Financial's business is separate from Trump, so any emoluments-related claims are "false and irrelevant." White House Counsel Warrington said Trump "fulfills his constitutional duties in an ethical manner."

From Chip Deal to Binance Pardon

Trump and Mohammed examined a model of an AI data center project during the visit in May last year

After taking a stake in World Liberty Financial, Tahnoon's campaign for AI chips accelerated.

The Sheikh hosted CEOs of the world's top tech and finance firms at royal estates in Abu Dhabi, often posting meeting photos on Instagram, most taken on a set of white sofas. He was prepared to commit huge sums of money to the U.S. and emphasize the UAE's alignment with the U.S. in AI.

On Trump's first day in office (five days after Aryam signed the deal with World Liberty Financial), the president announced at the White House that OpenAI and SoftBank planned a $500 billion AI data center project, with Tahnoon's MGX being one of two other designated investors. The project has not advanced to date.

Last spring, Trump administration officials began discussing the framework of the chip deal with the UAE. Some officials did not see a national security risk, but others shared the previous administration's concerns that the technology could ultimately reach China. Informed sources said they discussed plans to restrict control of the chips in the deal, one option being to exclude UAE companies like G42 from direct access, requiring the technology to be held by U.S. partners like Microsoft and OpenAI.

In March, Tahnoon led a delegation to Washington, planning to push for faster U.S. government reviews of UAE investments in the U.S., among other issues, in addition to the chip deal. He met with Trump in the Oval Office and promised the UAE would invest $1.4 trillion in the U.S. over a decade. One informed source said the promise excited the president, though government officials struggled to understand its specifics.

On March 18, Trump hosted a dinner at the White House for Tahnoon and his delegation, inviting the vice president and cabinet members including the secretaries of state, commerce, and treasury. Tahnoon sat next to Witkoff, Edelman at the end of the table. Trump later posted photos on Truth Social, touting the "bonds of friendship" between the two countries, saying they discussed strengthening cooperation in technology and the economy.

Former national security officials expressed shock at the level of access Tahnoon received. During the Biden administration, visiting foreign officials typically met with their U.S. counterparts, not the president and six cabinet members.

Meanwhile, Tahnoon's ties to World Liberty Financial grew tighter. In May, Zach Witkoff announced at a cryptocurrency conference in Dubai that the Sheikh's investment vehicle MGX would use the stablecoin USD1, issued by World Liberty Financial, to complete a $2 billion investment in Binance, the largest single investment in a cryptocurrency company ever. Zach Witkoff smiled, thanking MGX for "their trust in us."

The move placed USD1 among the world's largest stablecoins, boosting its financial credibility, and brought World Liberty Financial $2 billion in cash reserves. The company held these funds as collateral to maintain the stablecoin's 1:1 peg to the dollar and invested them in U.S. Treasury bonds to earn interest, potentially generating about $80 million in收益 over a year.

MGX told The Wall Street Journal last year it evaluated stablecoins across platforms and chose USD1 after considering factors like "business suitability." A World Liberty Financial spokesman called USD1 a "superior product."

Neither company ever disclosed that MGX and World Liberty Financial shared management.

In fact, the Aryam deal laid the groundwork for the launch of USD1. The investment was split between two newly formed World Liberty Financial entities, one to operate the new stablecoin product and the other to manage the rest of the company's business.

A person close to the company said G42's Larkin led the USD1 project at World Liberty Financial.

Tahnoon's $2 billion investment in Binance through MGX meant he had a financial interest in pushing for a pardon for Binance founder Changpeng Zhao. Such a move could pave the way for Binance's return to the U.S. market. In 2023, Binance and Zhao pleaded guilty to violating anti-money laundering rules and were barred from operating in the U.S.

Zhao now resides in Abu Dhabi, having obtained UAE citizenship several years ago. He is close to Tahnoon and has built strong ties with the UAE royal family.

Informed sources said individuals close to the royal family lobbied the Trump administration for Zhao's pardon, arguing it would help the world's largest cryptocurrency exchange return to the U.S. Pardoning Zhao would also open the door for UAE authorities to grant Binance a full regulatory license, completing plans for Binance to make Abu Dhabi its new global headquarters and boosting the capital's global financial ambitions.

Binance itself was also seeking a return to the U.S. through the pardon. As previously reported by The Wall Street Journal, the company took several steps to advance World Liberty Financial's business. Zhao denied having a business relationship with Trump's cryptocurrency company, and Binance said it did not control the stablecoin chosen by MGX and had "limited involvement" with World Liberty Financial-related products. World Liberty Financial denied playing any role in the pardon, its lawyer saying dealings with Binance were routine. A person close to Steve Witkoff said he was not involved in matters related to Zhao's pardon.

Zhao's lawyer, Teresa Goody Guillén, said the pardon for her client did not get Binance into the U.S. market and that the UAE has been broadly attracting cryptocurrency companies. She said interpreting Zhao pardon negatively is an "illegal usurpation of the presidential pardon power."

On May 8 last year, the U.S. Treasury Department announced the launch of a fast-track pilot program for foreign investors, precisely the accelerated investment review process the UAE had sought.

During Trump's visit to Abu Dhabi that month, he announced the two countries had reached "a very significant agreement" for the UAE to purchase U.S. AI chips. Months later, after further negotiations, the Trump administration approved the sale of 35,000 chips to G42, less than the UAE had hoped for.

During a May presentation at the royal palace, Trump examined a bright 3D model of a large AI data center project G42 planned to develop, with Steve Witkoff and Tahnoon watching. Trump repeatedly mentioned Tahnoon at the local meeting, telling UAE President Mohammed that his "good brother" had recently visited Washington; Tahnoon posted photos with Trump and Witkoff on Instagram.

Trump predicted the relationship between the two countries "will only get closer and better." He told Mohammed: "Our relationship couldn't be any better."

In September, under an agreement negotiated by the Trump administration, MGX was selected as one of the few investors to operate TikTok's U.S. business.

On October 22 last year, Steve Witkoff, Jared Kushner, and Tahnoon posted a photo on social media

The following month, Trump pardoned Zhao, sparking anger from Democratic lawmakers who accused him of selling pardons to the highest bidder.

On October 22, the day before the White House confirmed Trump signed the pardon, a White House official said Witkoff and Kushner returned to Abu Dhabi to discuss Gaza, Israel, and Trump's peace commission plans. Their meeting was with none other than Tahnoon.