Author | Ethan(@ethanzhang_web3)

Large sales marked as "1inch team" have once again sparked criticism.

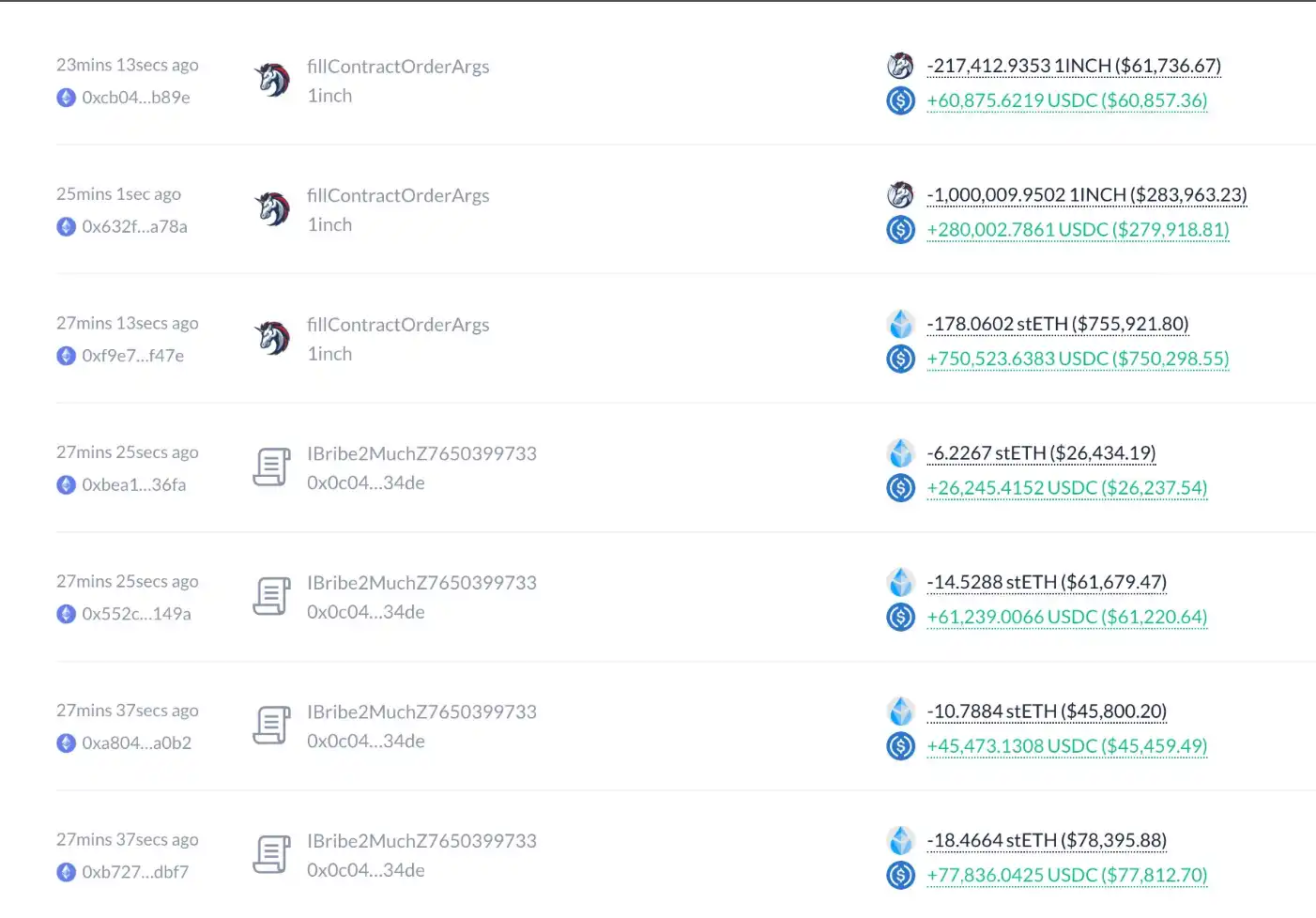

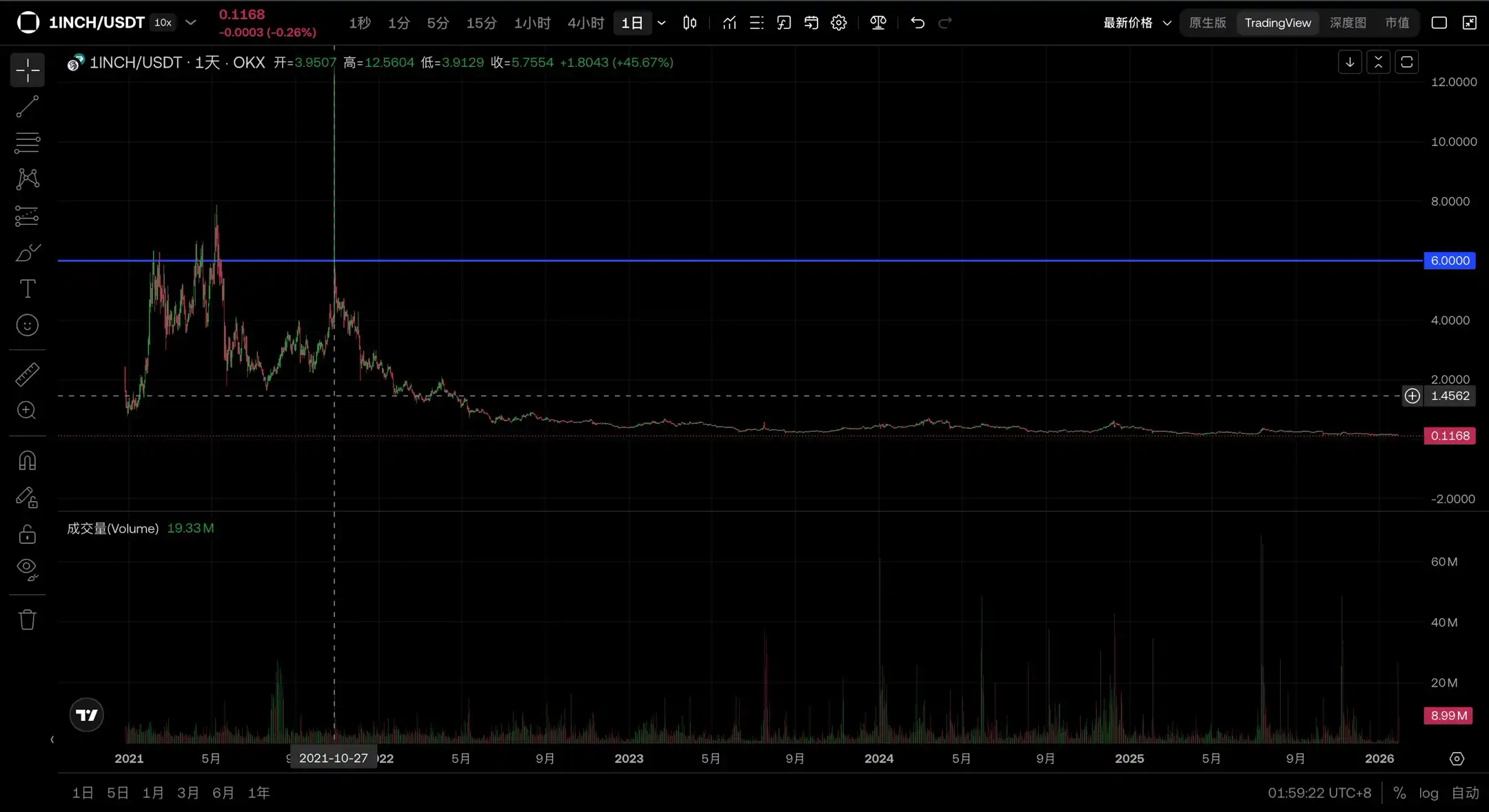

Recently, the on-chain data platform ARKHAM showed that three wallets marked as "1inch team" sold a total of 36.36 million 1INCH tokens, worth $5.04 million. According to OKX market data, affected by this, the price of 1INCH briefly fell by 16.7% to $0.1155, currently reported at $0.1164. A question quickly arose in the market: Is the project team really dumping the tokens themselves?

Looking at this sale alone, the outcome was not ideal. On-chain data shows that the above 1INCH tokens were mainly transferred to the relevant addresses in late November 2024. Based on the price at that time, the cost was approximately $0.42, corresponding to a total value of about $15.27 million. Before this sale, the price of 1INCH had already fallen to around $0.14. Combined with the slippage impact due to the large volume of the sale, the actual loss for this batch of positions may exceed $10 million.

Reference: 1inch Team's Previous Trading Style

Previously, the on-chain operations of the 1inch team investment fund during multiple market fluctuations were regarded by the market as the presence of a "professional trading team."

As early as February to April, the 1inch team investment fund had already begun accumulating 1INCH at low levels. At that time, market sentiment had not yet recovered, and 1INCH had been lingering around $0.2. During this phase, the team invested a total of approximately $6.648 million to buy 33.19 million 1INCH tokens, with an average entry price of about $0.2.

However, this round of buying did not cause significant price fluctuations. What really caught the market's attention was the concentrated buying in early July. From July 6 to 9, the 1inch team investment fund made another move, investing an additional $4.4 million in just a few days to buy 22.99 million 1INCH tokens. As buying continued, the price of 1INCH rose from around $0.18 to $0.206, a short-term increase of about 14%. During this period, the team transferred 3 million USDC to Binance and withdrew 1INCH in batches to their own addresses. The funds were not used all at once, possibly waiting for opportunities, and continued buying.

After July 10, the pace of operations noticeably accelerated. On the afternoon of July 10, the team bought another 4.12 million 1INCH tokens for about $880,000, while also transferring 2 million USDT to Binance to prepare ammunition for subsequent trades. On the evening of July 11, on-chain monitoring showed that the team likely bought another 11.81 million 1INCH tokens at a higher price range, around $0.28. By this point, the address's holdings had increased to 83.97 million 1INCH tokens, with a book value exceeding $23 million. On July 13, the team continued to withdraw 6.334 million 1INCH tokens from Binance.

Looking back to early February, the 1inch team investment fund had cumulatively invested about $13.64 million since the beginning of the year to buy 55.85 million 1INCH tokens, with a comprehensive cost of about $0.244. With the price of 1INCH rising to above $0.39 in mid-July, these positions had already generated paper profits of several million dollars.

It is worth noting that the team was not "only buying and not selling." On the evening of July 13, they began to realize profits on a small scale, selling about 904,000 1INCH tokens at $0.33, exchanging them for $298,000; and in earlier stages, they had already sold some 1INCH tokens in batches at around $0.28.

At the same time, the team also took profits on another important position: ETH, which was bought in February at an average price of $2,577, began to be sold in batches above $4,200, with the ETH position alone realizing profits of millions of dollars.

On August 11, according to on-chain analyst Yu Jin's monitoring, the 1inch team investment fund began to realize some of its earlier positions on-chain. Data showed that they sold 5,000 ETH at an average price of $4,215, exchanging them for 21.07 million USDC; simultaneously, they sold 6.45 million 1INCH tokens at an average price of $0.28, exchanging them for about $1.8 million USDC.

Based on the entry costs, the above ETH was bought by the 1inch team in February this year at an average price of about $2,577; the corresponding 1INCH was mainly accumulated in July, with a comprehensive cost of about $0.253. Based solely on the sold ETH and 1INCH positions, the 1inch team investment fund has realized paper profits of about $8.36 million.

Looking further back, the 1inch team's operational path on BTC is equally clear: "buying against the trend, selling with the trend." During February to March this year, they bought 160.8 WBTC at an average price of about $88,000 during a BTC correction, and completed the sale when BTC approached the $100,000 mark again in May, realizing a total profit of nearly $1 million.

Combining the clues of BTC, ETH, and 1INCH assets, the on-chain operations of the 1inch team investment fund resemble a well-rehearsed capital strategy: completing accumulation during market adjustments, continuously adding positions during the upward trend, and realizing profits in batches when prices enter high ranges.

But This Time, Was It Really Them Operating?

It should be pointed out that comparing this large sale near $0.14 with the past on-chain operations of the 1inch team investment fund reveals: if this sale was indeed directly led by the team, its execution method itself significantly deviates from its past trading logic. Whether in historical operations of BTC, ETH, or 1INCH, the team's more common practice was to realize profits in batches after the price trend was confirmed, rather than selling concentratedly in an obvious low-liquidity range.

For this reason, some market participants began to question: did this selling behavior marked as "1inch team" really come from the team or wallets directly controlled by them.

Subsequently, 1inch official also responded to the related controversy. In a statement, they clearly stated that this selling behavior did not occur in any wallet controlled by the 1inch team, entity, or treasury multi-signature, and the team cannot interfere with the asset allocation and trading decisions of third-party holders.

In other words, the association indicated by on-chain labels does not equate to actual control. Judging from the execution rhythm and price range, this sale is more likely to come from a third-party holder who is no longer under the project's control, rather than a shift in the 1inch team's own trading logic.

In a stage of inherently limited liquidity, a single large sale being quickly equated to "team dumping" is itself an overly compressed interpretation of information. It ignores the natural disconnect between address labels and actual control rights after long-term token circulation.

Returning to 1inch itself. The official statement emphasized that this market fluctuation did not change its core business and long-term direction. Since 2019, 1inch has accumulated a trading volume of nearly $800 billion, and even during market downturns, it can maintain a daily trading scale of hundreds of millions of dollars. The team also stated that it plans to review the token economic model this year to improve overall resilience during periods of low liquidity and downturns. In this context, the discussion around "whether the 1inch team dumped tokens" is more like a misinterpretation amplified by on-chain labels, liquidity environment, and emotional interpretation.

However, even if it is eventually proven to be a misinterpretation, this sale still constituted a secondary impact on the already weakening price of 1INCH. Since the last cycle high of $6, 1INCH has experienced a long-term unilateral decline and is now hovering near $0.11.

On such a trend, the market clearly no longer has enough buffer space to digest any sudden selling signals. This type of amplified selling event ultimately bears the brunt of emotional impact on the weakest end of risk tolerance—retail investors.