The race for the new US Federal Reserve chair is nearing the finish line, with US President Donald Trump reportedly set to begin interviewing finalists for the top job this week.

According to a report from the Financial Times (FT) on Tuesday, Treasury Secretary Scott Bessent has presented a list of four names to the White House.

One of these is former Fed governor Kevin Warsh, whom Bessent is scheduled to meet with on Wednesday. Another is National Economic Council director Kevin Hassett, who is seen as the frontrunner for the role.

Another two names would be picked from a list of other finalists, which includes Fed governors Christopher Waller and Michelle Bowman, and BlackRock chief investment officer Rick Rieder.

Trump and Bessent are expected to hold at least one interview next week, as a decision looks likely to be announced in January.

However, Trump has revealed he already has his eye on one particular candidate.

“We’re going to be looking at a couple different people, but I have a pretty good idea of who I want,” Trump said to journalists on Air Force One on Tuesday.

Kevin Hassett is a frontrunner for Fed chair role

The upcoming round of interviews suggests that Hassett may not be the clear lock in for the role as previously thought, though he is seen as the favorite.

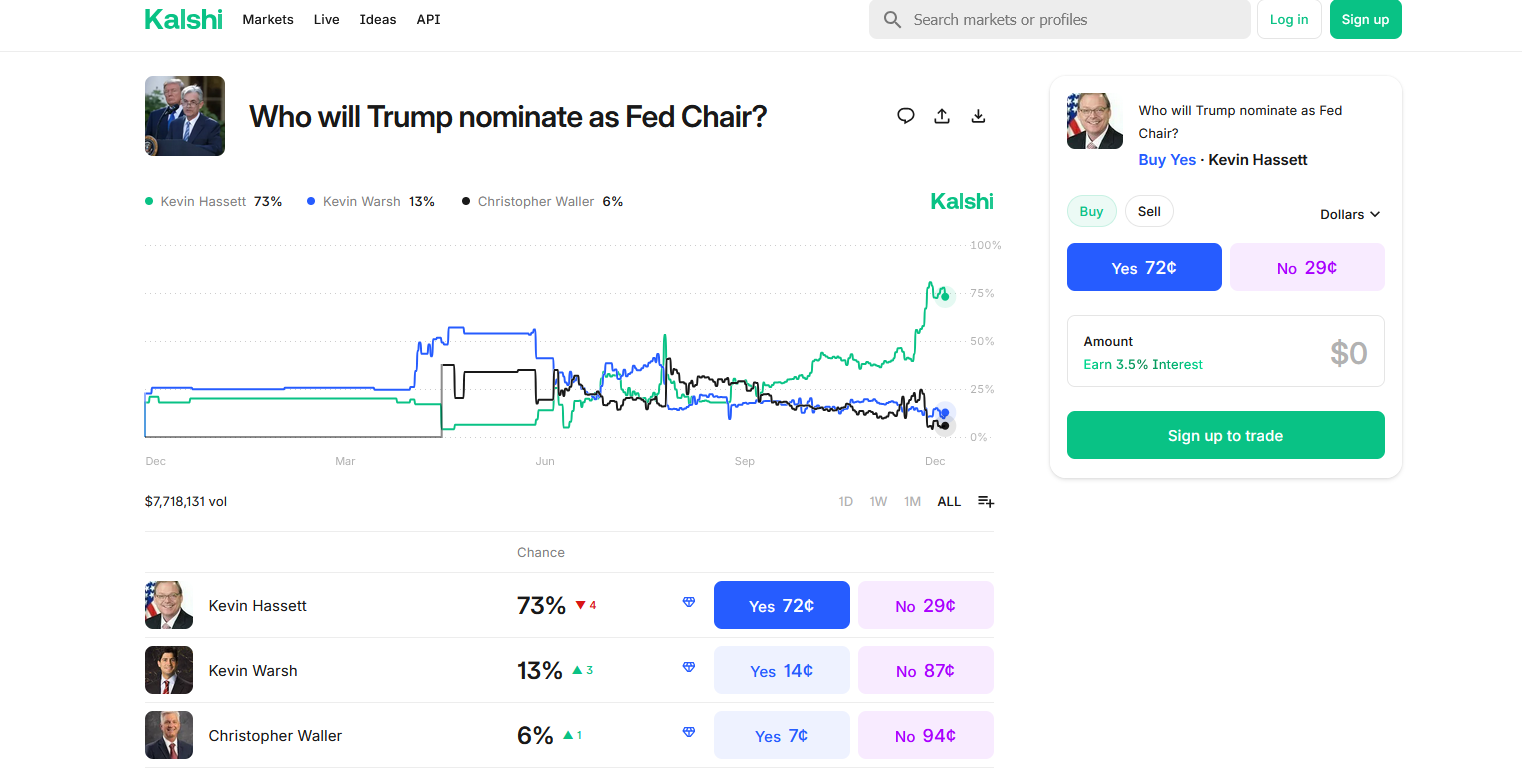

Earlier this month, prediction market odds on Kalshi and Polymarket shot up for Hassett significantly following comments from Trump at the White House on Dec. 2.

While welcoming guests, Trump labeled Hassett as “potential Fed chair” leading many to assume the president had let a major hint slip.

Related: Trump’s national security strategy is silent on crypto, blockchain

With Hassett’s odds spiking to 85% after Trump’s comments last week, they have since declined to around 73% for Hassett, while Warsh’s odds sit at 13% on Kalshi at the time of writing, which has floated around this range over December.

Regardless of who ends up taking over as chair, the move is bound to impact crypto markets under the new leadership.

If elected, Hassett has asserted that he will be apolitical in terms of running the Fed, despite his close ties to Trump. Speaking with The Wall Street Journal this week, Hassett said that “You just do the right thing” when asked if he would blindly follow orders from Trump.

“Suppose that inflation has gotten from, say, 2.5% to 4%. You can’t cut,” Hassett said, adding that he would rely on his own “judgment, which I think the president trusts.”

Magazine: The one thing these 6 global crypto hubs all have in common...