Many major companies continue to lock in on Ethereum, the second-largest digital asset, despite the ongoing volatile action of the altcoin’s price. One of the methods currently adopted by these companies to grow their ETH portfolios is via Ethereum Staking, where they earn notable rewards.

SharpLink Scores Another Major Ethereum Staking

In the ever-evolving world of cryptocurrency, the Ethereum staking economy is still demonstrating its durability. As the staking economy gains traction, SharpLink Gaming, a leading public company, is once again at the center of this wave, with massive rewards from its ETH staking positions.

Being the first publicly traded company to adopt ETH as its primary treasury reserve asset, SharpLink continues to increase its exposure to Ethereum, as evidenced by its staking gains. A recent post on the X platform by the company reveals another round of significant staking rewards in the past week.

This development showcases the power of ETH’s proof-of-stake network in general as well as the company’s increasing yield performance. Furthermore, the most recent gains are bolstering confidence in long-term staking plans, which comes at a time when investors are keeping a closer eye on on-chain returns than ever.

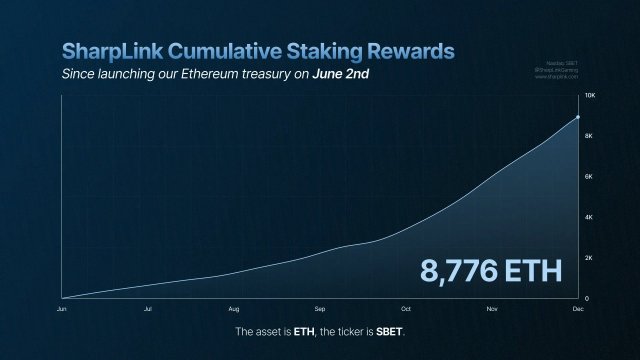

As seen in the latest report, SharpLink scooped in over 446 ETH from staking rewards just last week. It was worth noting that since the company launched its ETH treasury in June 2025, they has experienced a persistent rise in their cumulative staking rewards.

Following the recent gains, the total cumulative rewards have reached 8,776 ETH, which seems to have ignited a frenzy in the community. The firm’s ETH holdings remain 100% staked in an institutional-grade manner and maintain compounding value for the treasury.

Mlik Road, a crypto enthusiast, highlighted that at current prices and holdings, SharpLinks’ latest staking reward in one week is valued at $1.38 million. Interestingly, this amounts to around $70 million in income for the gaming firm annually.

As rewards keep rolling in, the important part of this development is that this figure is only expected to continue growing. When the price of ETH rises, the staking revenue of SharpLink will increase. In addition, when the firm’s ETH holdings increase, its staking income will multiply.

Whales Are Adding More ETH To Their Wallets

Ethereum’s bounce appears to have shifted the sentiment of investors, especially large investors or whales, toward a bullish standpoint. According to Santiment, a leading market intelligence and on-chain data analytics platform, ETH was a notable gainer on Tuesday, with a rise of +8.5% and an optimistic accumulation trend from whales and sharks.

Related Reading: Ethereum Emerges As A Dollar Settlement Powerhouse, Outpacing Traditional Payment Networks – Details

While these big investors have resumed ETH accumulation, retail holders have been offloading their holdings at a fast rate. Data shared by Santiment shows a massive accumulation of 949,240 ETH worth $3.15 billion in the past 3 weeks by whales. Meanwhile, small retail investors have gone on a selling spree, dumping 1,041 ETH over the past week.