Strategy used its Q4 2025 earnings call to spotlight what Michael Saylor framed as the next long-horizon security agenda for Bitcoin: coordinating a global “Bitcoin security program” aimed at quantum readiness, while warning against rushed protocol changes that could create more risk than they remove.

The remarks came as Strategy reported a quarter shaped by Bitcoin’s drawdown under fair-value accounting, even as it continued to add to its treasury. CFO Andrew Kang said the company ended 2025 with 713,502 Bitcoin—about 3.4% of all Bitcoin that will ever exist—after buying an additional 32,470 BTC in Q4 for roughly $3.1 billion.

Kang added that Strategy raised more than $25 billion of total capital during 2025 and established a $2.25 billion cash reserve designed to cover roughly 2.5 years of interest and dividend obligations.

Strategy Will Initiate A Bitcoin Security Program

Saylor addressed quantum computing directly at the end of the call, calling it the latest in a long sequence of recurring existential narratives around Bitcoin. His message was twofold: treat the risk seriously, but resist a “stampede” into premature changes.

“The concern today is quantum computers and many people ask if quantum computers represent a threat to Bitcoin,” Saylor said, before arguing the debate fits a familiar pattern. “What I would say is whenever dealing with each of these concerns we have to take them seriously... but we have to remember two things. One... ‘Don’t panic.’... The second observation, the hypocratic oath, does no harm... You don’t want an iatrogenic intervention where the cure is worse than the disease.”

In his view, the timing matters as much as the engineering. “Our position on quantum computing... we think it’s probably 10 or more years away before there’s a threat. That is the consensus,” he said. Saylor added that quantum-resistant work is happening broadly across industries that rely on conventional cryptography, and that Bitcoin-specific R&D is already underway, but emphasized that there is not yet “global consensus that existing cryptographic libraries are at risk.”

That lack of consensus, he argued, is precisely why Strategy won’t advocate a specific quantum roadmap today. “To stampede into a hypothetical fix before there is consensus would introduce new attack surfaces and new complexity and new failure modes that don’t currently exist,” Saylor said.

Pressed by Fundstrat’s Tom Lee on how Bitcoin might handle quantum-vulnerable wallet types, Saylor reiterated that Strategy would not try to steer the technical outcome. “I don’t think it’s appropriate for us to advocate a particular solution or a particular approach nor a particular time frame,” he said. “Our role is to support all of the various communities and facilitate the evolution of consensus about what should be done, how it should be done, when it should be done.”

The most concrete announcement was a commitment to formalize that support into an organized effort. “Strategy is going to initiate a Bitcoin security program that coordinates with the global cyber security community, the global crypto security community and the global Bitcoin security committee... to contribute to consensus and solutions to address the quantum computing threat as well as any other emergent security threats that evolve,” Saylor said.

JUST IN: MICHAEL SAYLOR JUST ANNOUNCED STRATEGY WILL LAUNCH A GLOBAL EFFORT TO UPGRADE #BITCOIN FOR QUANTUM

LEGENDARY 🔥 pic.twitter.com/TPoWMb9rj1

— The Bitcoin Historian (@pete_rizzo_) February 5, 2026

He framed the initiative as a responsibility commensurate with Strategy’s scale as a holder, but also as a coordination problem: the goal is to engage “very brilliant minds,” align with the work already being done, and help solutions emerge “at the right time in a responsible fashion.”

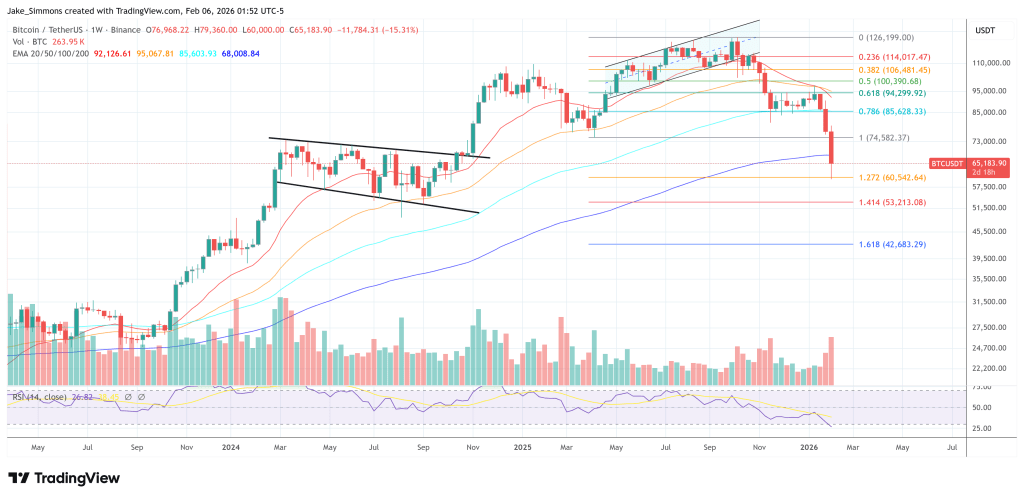

At press time, BTC traded at $65,183.