Author: KarenZ, Foresight News

Original Title: Ten-Billion-Dollar Loss, Strategy's Earnings Report Sounds Alarm! What Do Executives Say?

The current cryptocurrency market is deeply mired in a sharp correction vortex. As Bitcoin's price retreats to $60,000, market sentiment has rapidly turned to extreme panic.

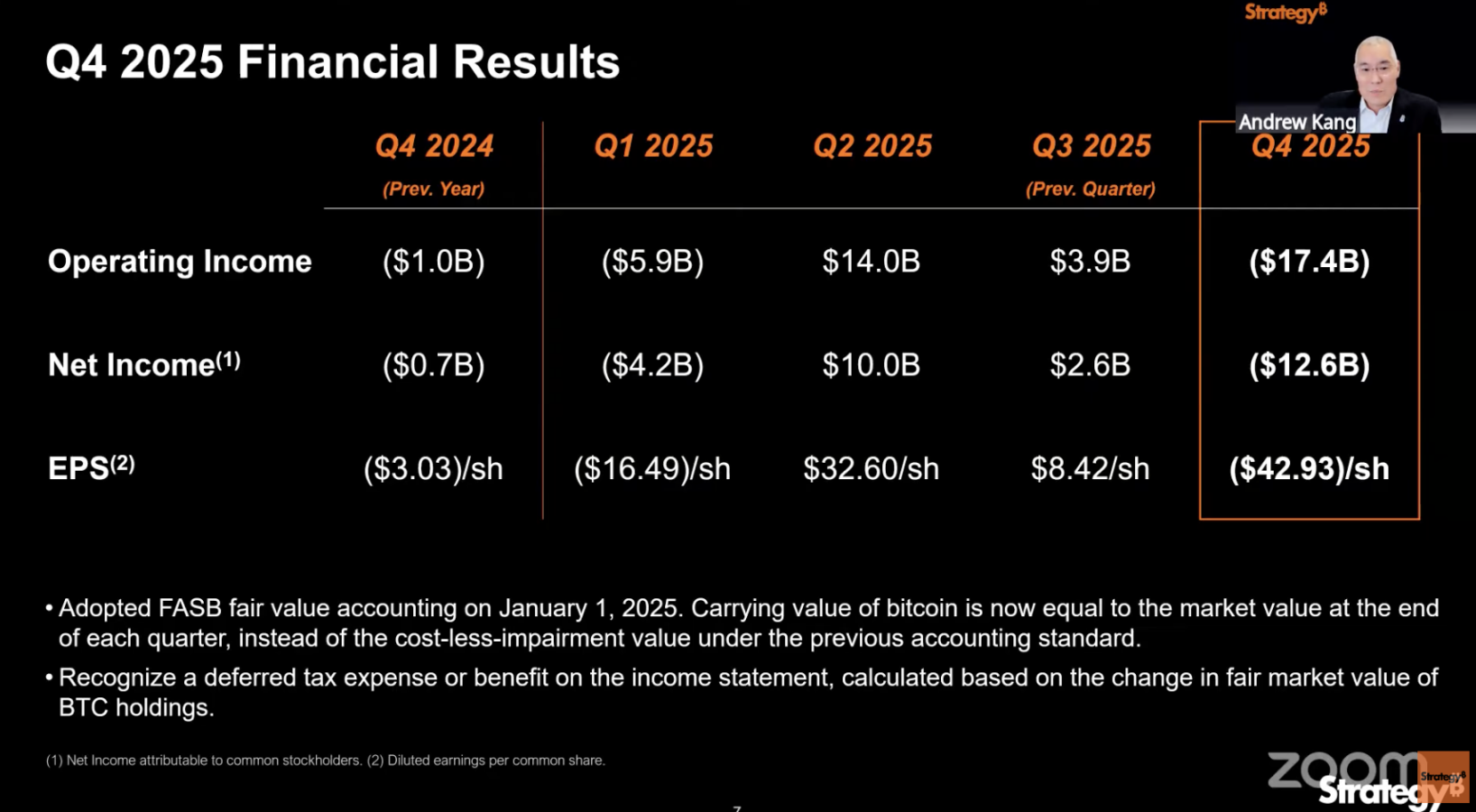

Amid this turmoil, the Q4 2025 earnings report released by the world's largest corporate Bitcoin holder—Strategy (formerly MicroStrategy)—is undoubtedly adding fuel to the fire, pouring a bucket of ice-cold water on an already sluggish market: a net loss of $12.4 billion in a single quarter.

On the day of the earnings release, Strategy's stock price plummeted by approximately 17%. As of now, its stock price has fallen nearly 80% from the all-time high set in November 2024.

From a star company that once soared with its "Bitcoin Treasury Strategy" to now being mired in huge losses and seeing its stock price halved repeatedly, Strategy's situation is the most realistic缩影 of the current cryptocurrency market turmoil—on one hand, there are massive paper losses, and on the other, an almost obsessive hoarding of Bitcoin. With a series of分裂 data, this company is staging a high-stakes gamble betting on its future.

Core Data: Frenzied Accumulation Amid Huge Losses

The core contradiction in Strategy's Q4 2025 earnings report lies in the stark contrast between the record-high paper losses and the all-time high Bitcoin holdings.

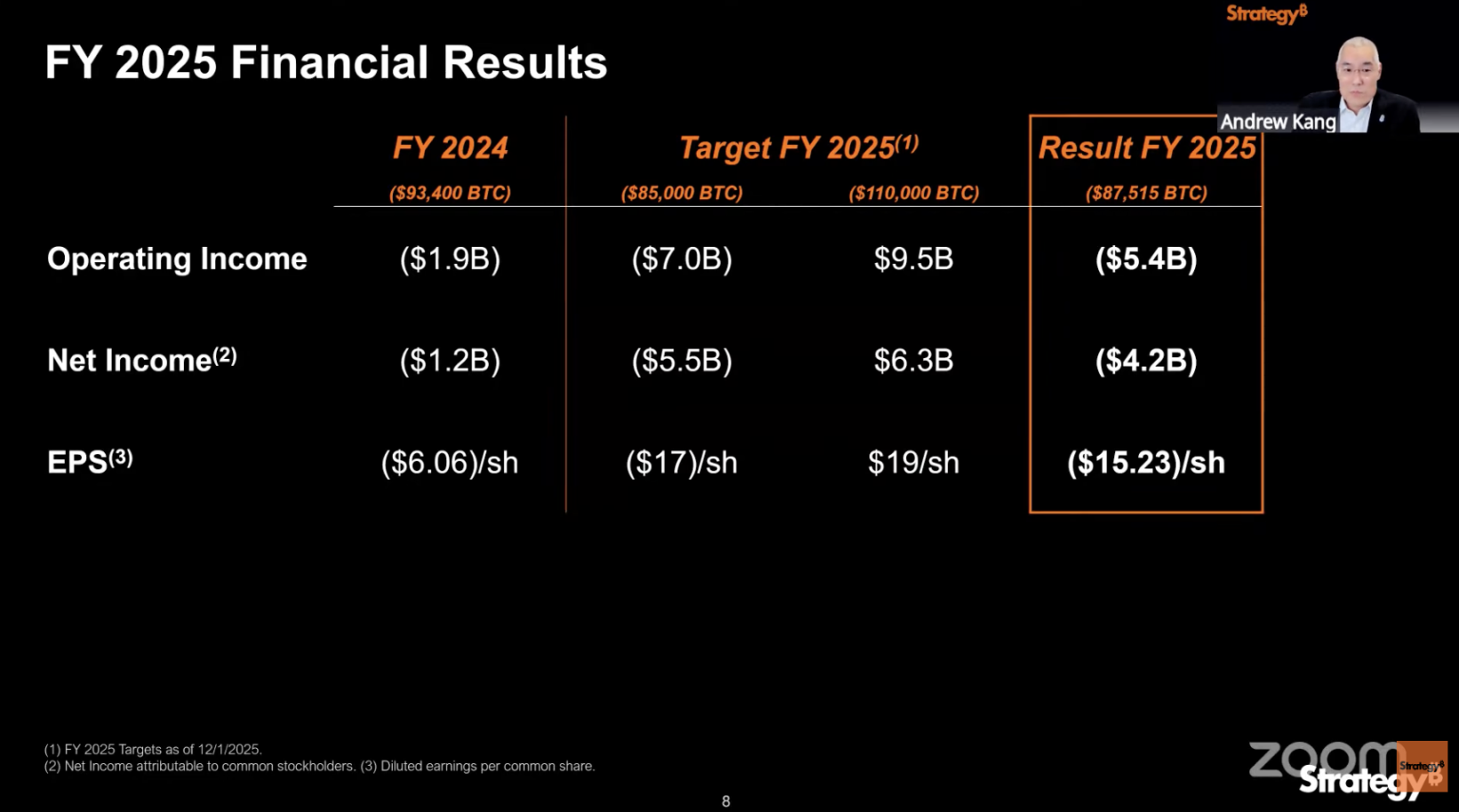

1. Huge paper losses under fair value accounting: In Q4 2025, Strategy's operating loss reached a staggering $17.4 billion, with a net loss of $12.4 billion. This is mainly due to the new fair value accounting standard adopted by the company starting January 1, 2025. According to this standard, the company must re-evaluate all Bitcoin holdings at market price at the end of each quarter, and price fluctuations are directly included in the income statement. The continuous correction in Bitcoin's price has turned the shrinkage in holding value directly into paper losses, becoming the most直观 "bearish" factor in the earnings report.

2. The obsession with buying Bitcoin against the trend: Despite market volatility, Strategy is still buying frantically, purchasing 41,002 Bitcoins in a large transaction in January 2026. As of February 1, 2026, Strategy holds 713,502 Bitcoins, accounting for about 3.4% of the total Bitcoin supply, firmly securing its position as the world's largest corporate Bitcoin holder.

3. Super financing machine: In fiscal year 2025, Strategy raised a total of over $25.3 billion in capital, a figure that accounts for about 8% of the total U.S. equity financing for that year.

4. Special reserve for risk buffer: As of February 1, 2026, Strategy has $2.25 billion in USD reserves specifically to cover preferred stock dividends and debt interest payments for the next 2.5 years, attempting to alleviate market concerns about its cash flow pressure.

In terms of holding cost, Strategy's total original cost for holding Bitcoin is $54.26 billion, with an average cost per coin of $76,052. With the current price of Bitcoin at approximately $65,000, the company's Bitcoin holdings have an unrealized loss of over $7.8 billion.

Marginalized "Main Business" and Amplified "Leverage"

It is highly ironic that Strategy's traditional main business—enterprise analytics software—has been reduced to a nearly forgotten footnote in the earnings report. The scale and contribution of its business are worlds apart from the size of its Bitcoin strategy.

In Q4 2025, the company's software business maintained positive growth, but the data performance was relatively flat: total revenue was $123 million, up only 1.9% year-over-year; subscription service revenue was $51.8 million, up 62.1% year-over-year; overall gross profit for the quarter was $81.3 million, with a gross margin maintained at a high level of 66.1%.

From the data, it is clear that while the software business has stable profitability and high gross margins, its revenue scale is only in the hundreds of millions. Compared to the company's tens of billions in fundraising scale, tens of billions in Bitcoin holding costs, and over ten billion in quarterly losses, the marginal contribution of this main business is almost negligible.

For today's Strategy, the company's core resources and strategic focus have completely shifted towards Bitcoin. Strategy provides investors with a leveraged Bitcoin exposure through complex financial instruments such as stocks, bonds, and preferred shares. It has itself彻底 become a "shadow of Bitcoin," with its corporate development deeply tied to the price of Bitcoin—prospering together and falling together.

What Happens When Convertible Bonds Mature?

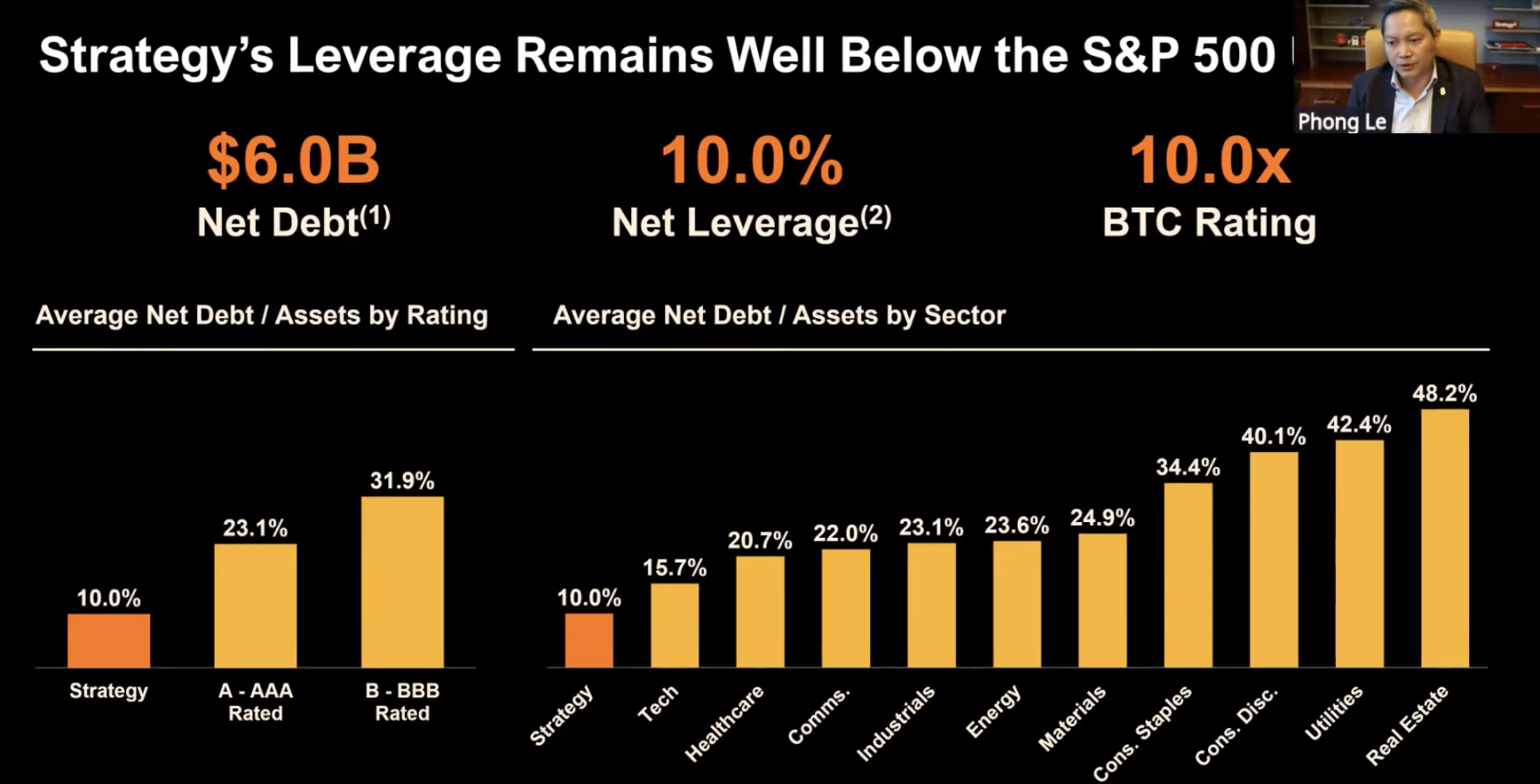

In the latest earnings call, Phong Le stated, "Strategy currently has $6 billion in net debt, and the current leverage ratio is around 13%, which is only half that of investment-grade companies and one-third that of high-yield companies. In an extreme scenario, if the Bitcoin price falls by 90% to $8,000, then our Bitcoin reserves would equal our net debt. At that point, we would be unable to use Bitcoin reserves to repay the convertible bonds and would consider restructuring, issuing additional shares, or issuing more debt."

Additionally, Phong Le hopes the company will gradually achieve equityization. If equityization cannot be achieved by then, they will seek other ways to restructure the debt, aiming to sustainably reduce leverage, avoid selling Bitcoin, and continue the Bitcoin accumulation strategy.

When the "Flywheel" Loosens

Strategy's "Bitcoin flywheel" model is built on a very fragile assumption: that the Bitcoin price will spiral upward in the long term, and the capital market will always be willing to provide premium financing for the company. The two form a positive循环, driving the company's stock price and holding规模 to grow simultaneously.

However, when the Bitcoin price falls below its average holding cost ($76,000), the risks and paradoxes Strategy faces are also exposed.

STRC High Dividend Yield: High Return Corresponds to High Risk

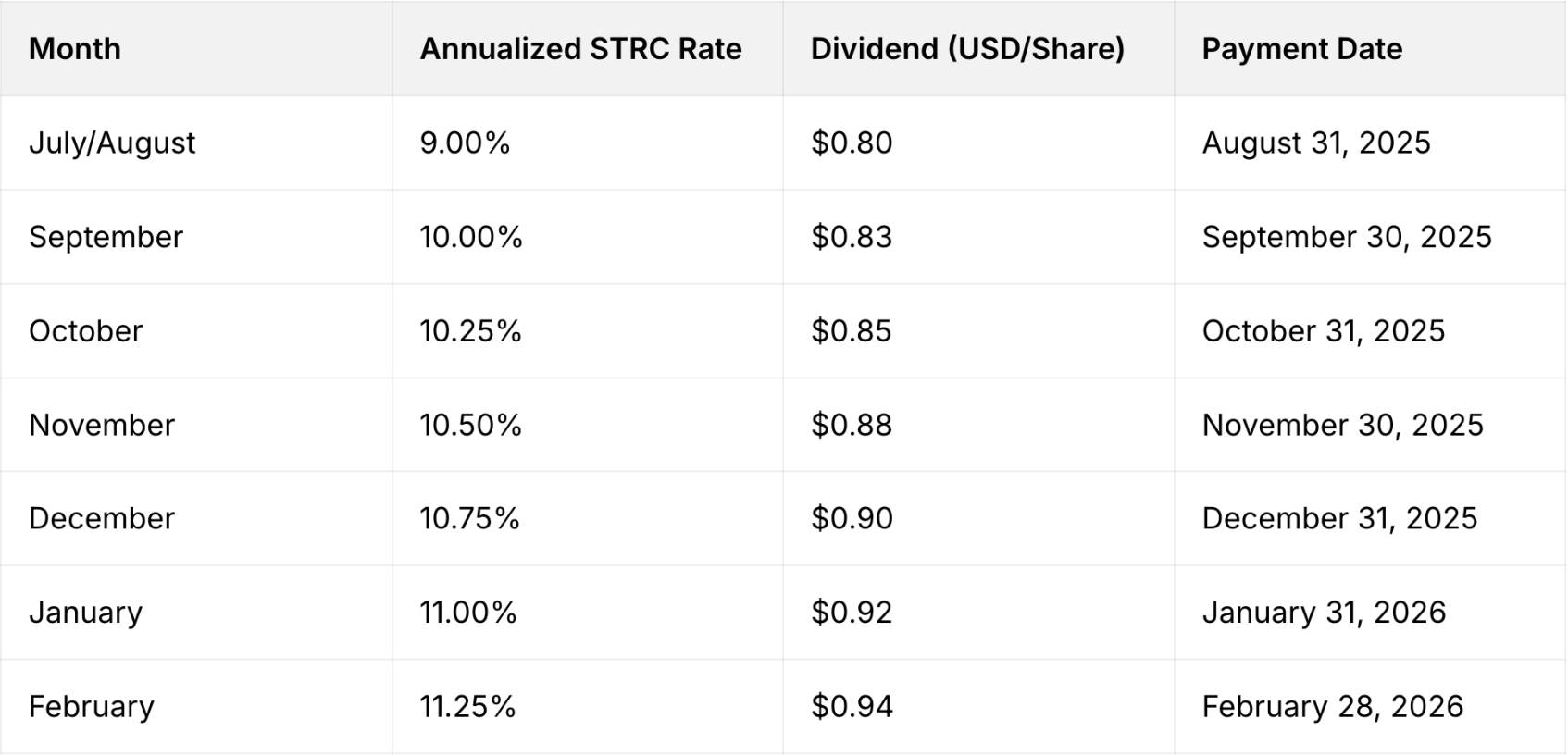

The perpetual preferred stock STRC launched by Strategy currently has a dividend yield of 11.25%, and this yield has been continuously上调 since July 2025.

Strategy designed this variable mechanism to keep the STRC price as stable as possible around the $100 face value, reduce volatility, and position it as a "short-term high-yield credit" or a "high-yield savings account" alternative.

In the current low-interest-rate environment, an 11.25% nominal yield is indeed very attractive, especially for investors seeking high fixed income. But the basic logic of the capital market has never changed: high returns必然 come with high risks. The high dividend of STRC is backed by the huge uncertainty deeply tied to Strategy's Bitcoin strategy.

Strategy's core strategy is "Bitcoin leverage + financing expansion." Its solvency highly depends on: the long-term rise of the Bitcoin price, and continuously raising funds by issuing MSTR common stock, other preferred shares, or debt to buy more BTC.

If a prolonged Bitcoin bear market occurs, with mNAV持续低迷 or even at a discount, and equity financing becomes more difficult, the reserves could be quickly depleted. Although the company has established a $2.25 billion USD reserve as a buffer, this is merely buying a 2.5-year insurance policy for this high-stakes gamble.

The current market has already reflected some concerns: the STRC price is below the $100 face value, currently at $93.67.

mNAV Compressed to 1.07, Can the Financing Channel Remain Smooth?

The core motivation for Strategy to无限 issue shares to buy Bitcoin lies in its mNAV indicator, a key metric used to measure its stock valuation relative to its Bitcoin reserves. When mNAV > 1, it means the market gives Strategy a valuation higher than the value of its Bitcoin holdings (i.e., trading at a premium), and investors are willing to pay an additional premium for its "Bitcoin leverage strategy."

Currently, Strategy's mNAV has been compressed to 1.07. Once it falls below 1, the financing channel may be forced to close. At that point, Strategy may lose its ability to support the stock price and add positions,彻底 becoming a prisoner of Bitcoin price fluctuations.

Contrary to what was emphasized in the latest meeting, Strategy CEO Phong Le said in an interview with "What Bitcoin Done" in November 2025 that if the company's mNAV falls below 1 and financing options dry up, selling Bitcoin would be "mathematically" reasonable. But he clarified this would be a last resort, not a policy adjustment.

Negative Feedback Loop?

For Strategy, the most terrifying thing is not the current huge losses, but the potential触发 of a negative feedback loop, which is also the script that all crypto market players最不愿 face:

Bitcoin price falls → Company's net assets shrink → mNAV falls below 1, premium disappears → Unable to raise new funds through financing → Unable to pay high interest and dividends → Forced to sell Bitcoin to raise funds → Increased Bitcoin selling pressure, price falls further → Net assets shrink further......

Can Policy Benefits and Technical Commitments Restore Confidence?

In the earnings call, Michael Saylor did not focus solely on the short-term bearish news of the company's single-quarter loss. Instead, he used the comprehensive shift in U.S. policy and the accelerated adoption by the financial industry as the centerpiece to outline the long-term bullish blueprint for Bitcoin's development. At the same time, he addressed the market's biggest concerns about quantum technology risks and implementation plans to重塑 market confidence in the company's Bitcoin strategy.

Michael Saylor emphasized that Bitcoin's development is currently迎来 unprecedented policy and financial双重红利期. On the policy front, the U.S. government's attitude towards digital assets has completed a fundamental shift from suspicion to recognition. The President and 12 cabinet members have clearly expressed support for Bitcoin, and bipartisan consensus on digital asset regulation and adoption has made the U.S. a leading阵营 in global digital asset development.

On the financial front, Bitcoin's industry adoption has experienced explosive growth: large banks have纷纷 launched full-chain services for Bitcoin trading, credit, and custody; fintech companies continue to加码 Bitcoin布局. The dual entry of public markets and traditional financial institutions has continuously strengthened Bitcoin's financial attributes, with liquidity and recognition持续提升.

In response to the various FUD sentiments弥漫 in the market, Michael Saylor also gave direct responses, particularly focusing on quantum computing, a core technical concern: The commercial-level threat of quantum computing to Bitcoin will take at least 10 more years to materialize, and the Bitcoin community has the ability to achieve global consensus upgrades to meet future technical challenges.

Michael Saylor further stated that Strategy will proactively shoulder industry responsibility by launching a global Bitcoin security initiative. It will unite global resources in cybersecurity and cryptocurrency security to research and launch consensus solutions for quantum computing and emerging security threats, promoting the healthy and stable development of the entire cryptocurrency industry.

Summary

If the market continues to fall, the $17.4 billion quarterly operating loss and $12.4 billion net loss may only be the beginning of Strategy's困境.

The real test lies in whether faith can overcome gravity when market panic spreads, when the "premium" disappears, and when new funds dry up? For investors, the current Strategy may be an option contract with extremely high risk and extremely high odds: if they bet correctly, the Bitcoin price recovers, the flywheel restarts, and investors get returns; if they bet wrong, the negative feedback loop starts, the company falls into crisis, and investors face heavy losses.

The outcome of this high-stakes gamble betting on the company's future is still unknown, but Strategy has already sounded the alarm for the entire cryptocurrency industry—in a狂热 market sentiment,过度偏执的信仰 and不加节制的杠杆 may face the backlash of reality.

Twitter:https://twitter.com/BitpushNewsCN

Bitpush TG Discussion Group:https://t.me/BitPushCommunity

Bitpush TG Subscription: https://t.me/bitpush