Following the sudden recovery of the broader cryptocurrency market, the Bitcoin price is slowly heading back towards the $100,000 mark, showing that bulls are reentering the market. Despite bulls returning to the market, on-chain data suggests that the current state of BTC is not in an accumulation phase.

Bitcoin Is Not In An Accumulation Phase

Bitcoin’s price appears to have regained bullish traction once again, breaking past key resistance levels that previously halted upward attempts. However, the current market structure of BTC is triggering questions about whether the flagship asset is now in an accumulation phase.

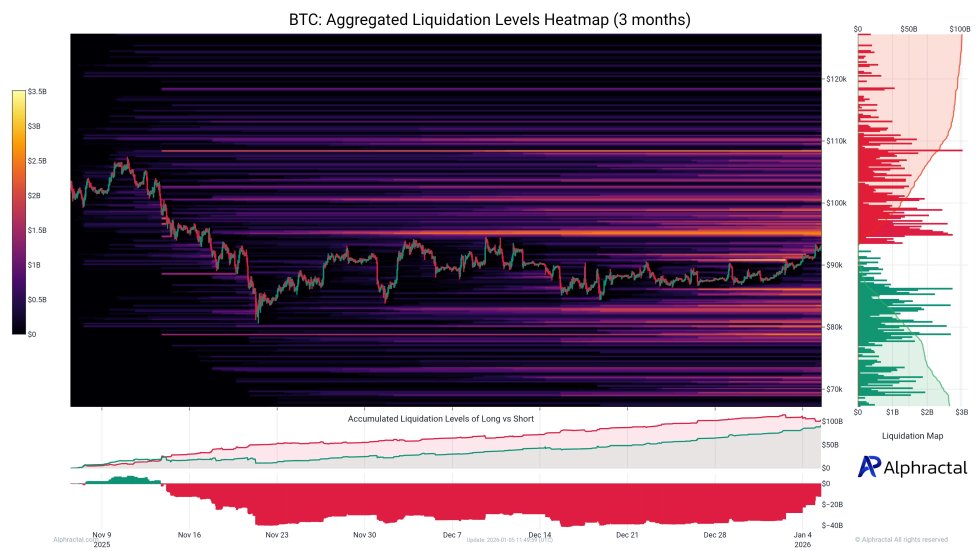

Joao Wedson, a market expert and the founder of Alphactal on-chain platform, has offered insights into Bitcoin’s market dynamics, revealing what the current market structure actually looks like rather than accumulation. Although price action may appear stable on the surface, on-chain and flow statistics indicate that buyers are not yet intervening with the conviction usually observed during classic accumulation periods.

According to the market expert, BTC’s current market structure leans heavily towards a redistribution phase rather than an accumulation phase. This suggests that activity is more of a transitory scenario where distribution and cautious participation continue to prevail, as the market looks for a clearer direction.

If the price of BTC reaches the $95,000 to $96,700 range, Wedson claims that the market could witness strong selling interest from large investors or whales in the area, fueled by liquidity escape. Meanwhile, for those thinking about opening short positions, the expert has declared that this is the region where the decision makes the most sense.

Wedson’s bold statement is supported by the fact that the market usually deceives. However, before a real move is carried out in the current market state, even those who are positioned correctly typically need to be liquidated.

Realized Losses Are Still Dominant In The Market

Price action may have turned bullish, but on-chain activity has not completely moved into positive zones. Despite the current rebound in Bitcoin Darkfost, a CryptoQuant author and market expert has disclosed that realized losses continue to dominate the market.

Darkfost’s research is mainly centered on the Bitcoin weekly average of realized profits and losses. As observed on the chart, the realized profits of BTC are at $312 million, while realized losses are maintaining a value of $511 million.

This divergence shows that some investors are choosing to capitulate and exit the market by reducing their losses in spite of the ongoing recovery in BTC’s price. Furthermore, these phases of capitulation have frequently signaled the end of corrective phases.

The current capitulation has intensified over the past week. Data shows that it is approaching levels comparable to the previous bear market phase, which might have made it possible for the market to be sufficiently cleansed to begin on a healthier basis.