Original Title: Wall Street Pulls Back From Bitcoin』s Money-Spinning Basis Trade

Original Author: Sidhartha Shukla,Bloomberg

Compiled by: Peggy,BlockBeats

Editor's Note: The bitcoin basis arbitrage, once seen as a "sure win," is quietly losing its appeal: the open interest on CME and Binance is shifting, and the spread has narrowed to the point where it barely covers funding and execution costs.

On the surface, this is about arbitrage opportunities being squeezed; at a deeper level, the crypto derivatives market is maturing. Institutions no longer need to rely on "arbitrage" for returns, and traders are shifting from leverage to options and hedging. The simple era of high returns is fading, and new competition will occur in more complex and sophisticated strategies.

Below is the original text:

A quiet but significant change is taking place in the crypto derivatives market: signs are emerging that one of the most stable and profitable trading strategies is now failing.

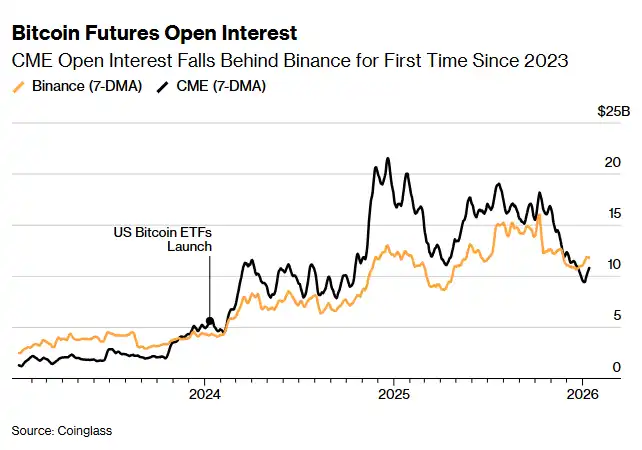

The "cash-and-carry" trade commonly used by institutions—buying bitcoin spot while selling futures to profit from the spread—is collapsing. This not only indicates that arbitrage opportunities are rapidly shrinking but also signals a deeper change in the structure of the crypto market. The open interest in Bitcoin futures on the Chicago Mercantile Exchange (CME) has fallen below that of Binance for the first time since 2023, further illustrating that as spreads narrow and market access becomes more efficient, the highly profitable arbitrage opportunities of the past are being rapidly eroded.

After the launch of spot bitcoin ETFs in early 2024, CME一度 became the preferred venue for Wall Street trading desks to execute this strategy. This operation is highly similar to the "basis trade" in traditional markets: buying bitcoin spot through an ETF while selling futures contracts to profit from the spread between the two.

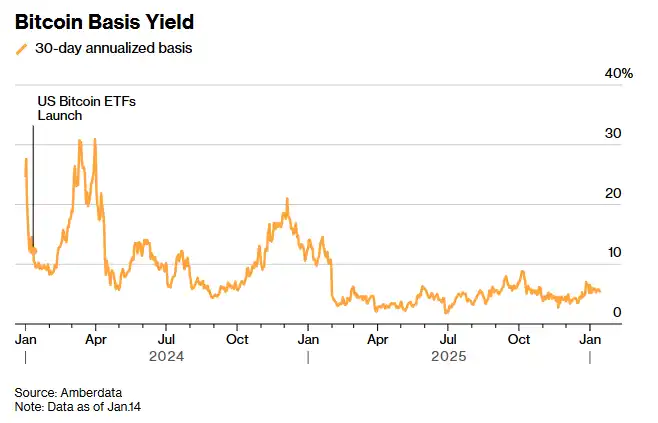

In the months following the ETF approval, this so-called "delta-neutral strategy" often yielded double-digit annualized returns, attracting billions of dollars in capital—capital that was indifferent to the direction of bitcoin's price movement, caring only about capturing the yield. But it was precisely the ETF that drove the rapid expansion of this trade that also sowed the seeds of its demise: as more and more trading desks rushed in, the arbitrage spread was quickly erased. Today, the returns from this trade can barely cover funding costs.

According to data compiled by Amberdata, the annualized yield for a one-month tenure is currently hovering around 5%, near recent lows. Greg Magadini, head of derivatives at Amberdata, said that around this time last year, the basis was close to 17%, but has now fallen to about 4.7%, barely enough to cover the threshold of funding and execution costs. Meanwhile, the one-year US Treasury yield is around 3.5%, making the trade's appeal fade quickly.

Against the backdrop of持续 narrowing basis, according to data compiled by Coinglass, the open interest规模 of CME Bitcoin futures has fallen from a peak of over $21 billion to below $10 billion; while Binance's open interest has remained relatively stable, at around $11 billion. James Harris, CEO of digital asset management firm Tesseract, said this change reflects more of a pullback by hedge funds and large US accounts, rather than a broad retreat from crypto assets after bitcoin prices peaked in October.

Crypto exchanges like Binance are the main venues for trading perpetual contracts. These contracts are settled, priced, and have their margin calculated continuously, often updated multiple times a day. Perpetual contracts, often abbreviated as "perps," account for the largest share of crypto market trading volume. Last year, CME also launched futures contracts with smaller notional values and longer tenors, covering crypto assets and equity indices, offering futures positions close to the spot market, allowing investors to hold contracts for up to five years without frequent rolling.

Tesseract's Harris said that historically, CME has been the preferred venue for institutional capital and "cash-and-carry" trades. He added that CME's open interest being overtaken by Binance "is a significant signal that the structure of market participation is shifting." He described the current situation as a "tactical reset," driven by lower yields and thinner liquidity, rather than a loss of market confidence.

According to a note from CME Group, 2025 is a key inflection point for the market: as the regulatory framework gradually clarifies, investor expectations for this space improve, and institutional capital begins to expand from单纯 betting on bitcoin to tokens like Ethereum, Ripple's XRP, and Solana.

CME Group stated: "Our average daily nominal open interest for Ethereum futures in 2024 was about $1 billion, and by 2025, this number has grown to nearly $5 billion."

Although the Federal Reserve's interest rate cuts have reduced funding costs, this has not driven a sustained rally in the crypto market since the collective crash of various token prices on October 10. Current borrowing demand is weak, decentralized finance (DeFi) yields are low, and traders are more inclined to use options and hedging tools rather than directly adding leverage to bet on direction.

Le Shi, Managing Director of Hong Kong at market maker Auros, said that as the market matures, traditional participants now have more channels to express directional views, from ETFs to direct access to exchanges. This increase in choice has narrowed the price differences between different trading venues, naturally compressing the arbitrage space that once drove the growth of CME's open interest.

Le said: "There is a self-balancing effect here." He believes that when market participants continuously flock to the trading venue with the lowest cost, the basis narrows, and the incentive to conduct cash-and-carry trades也随之减弱.

On Wednesday, bitcoin fell as much as 2.4% to $87,188 before paring losses. This decline一度 erased all gains for the year to date.

Bohumil Vosalik, Chief Investment Officer of 319 Capital, said the era of近乎 risk-free high returns may be over, which will force traders to turn to more complex strategies in decentralized markets. For high-frequency and arbitrage-type institutions, this means they need to look elsewhere for opportunities.

[Original link]