New reports reveal that XRP exchange balances have experienced an uncharacteristic decline in recent weeks, recording a brand new low since the cryptocurrency’s launch in June 2012. While XRP’s price action has posted notable losses this year, the decline in exchange-held tokens appears to be much greater.

XRP Supply On Exchanges Falls To Historic Lows

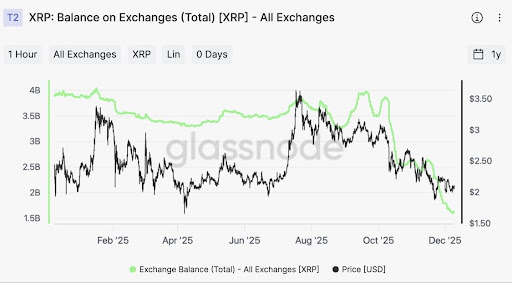

Crypto market expert Chad Steingraber drew attention this week to fresh data from Glassnode, highlighting an unusual divergence in XRP’s market behavior. The analytics firm shared a chart tracking the amount of XRP held on crypto exchanges alongside the asset’s market price.

According to Steingraber, the chart’s readings show that exchange balances have fallen well below the XRP’s price structure for the first time since the cryptocurrency’s inception. Glassnode highlighted XRP’s exchange supply with a green line on the chart and its price with a black line. At the start of the year, the supply on exchanges was around 3.8-4 billion XRP. However, through the middle, reserves gradually trended downward but mostly stayed within the 3.2-3.6 billion range.

Notably, a Glassnode chart shared by crypto analyst ChartNerd reveals that XRP exchange balances dropped sharply from around 3.95 billion XRP to 2.6 billion XRP from November to December 2025. About 1.35 billion XRP was removed from public order books recently, representing a staggering 45% decrease in under 60 days.

Usually, exchange supply and price move together without significant divergence because the former tends to influence sell-side liquidity, which, in turn, can affect market movements. When more XRP is held on these crypto platforms, traders have a larger pool of tokens to sell, which can increase market pressure.

Conversely, when reserves shrink, it often signals that investors are withdrawing their assets, either for long-term storage or profit-taking after recent price moves. While the vast gap between XRP’s exchange balances and its price action raises concerns, whales have reportedly been selling off their holdings amid ongoing market volatility and as prices struggle to stage a meaningful rebound.

Glassnode Reports Massive Collapse In Daily XRP Fees

In addition to the collapse in XRP exchange balances, Glassnode’s data shows a steep drop in the cryptocurrency’s network activity, with average total fees falling dramatically. Since early February, the 90-day SMA of daily fees paid has decreased from about 5,900 XRP to only 650 XRP. This marks an estimated 89% drop and brings activity to its lowest point since December 2020.

The decline in daily fees suggests a cooling in on-chain demand for XRP transactions, even as the price has remained weak amid broader market uncertainty. The cryptocurrency is currently trading around $2.00, reflecting a 7.7% weekly decline and a much larger 18% crash over the past month, according to CoinMarketCap.