Recent market dynamics of Dogecoin (DOGE) have attracted widespread attention, with multiple key technical indicators showing positive signals, suggesting a subtle shift in market sentiment. As price fluctuations intensify near key support levels, the balance of power between buyers and sellers is also undergoing subtle changes.

Key Technical Indicators Strengthen, Market Structure Improves Gradually

Over the past week, Dogecoin's price has shown positive changes within short-term cycles. Analysts point out that the price reaction is more pronounced at key inflection point areas and is currently approaching an important technical zone that could influence the short-term trend.

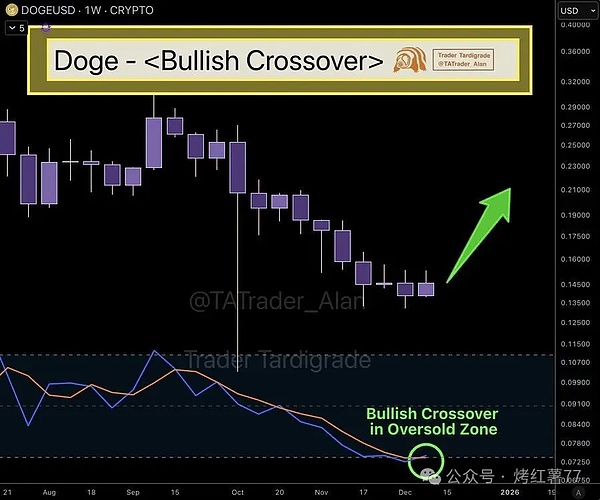

Notably, the weekly MACD indicator has formed a bullish crossover. As the MACD line breaks above the signal line, market buying willingness is gradually increasing. The green histogram shows a rhythmic upward trend, indicating that buying power is accumulating in the early stages. Meanwhile, seller power in the oversold area has significantly weakened, and panic selling is gradually disappearing.

Price Trend Stabilizes, Buyers Actively Entering the Market

Judging from recent trading activity, Dogecoin's price shows a steady upward trend. Each time the price tests a support level, the lower shadows gradually shorten, and the market structure tends to normalize. Buyers react actively in demand zones, with increasing slope and more uniform fluctuations; these technical characteristics are conducive to strengthening the power of the bulls.

Currently, the Dogecoin price is testing key resistance levels with a firmer upward stance. Buyers have shown clear defensive willingness near $0.135. The wicks of multiple trading days have failed to effectively suppress the price decline, and the entity price continues to converge within the channel.

Future Trend Outlook: Key Price Levels and Potential Targets

As market volatility narrows towards the end of December, the downward momentum has significantly weakened. The next phase of movement will revolve around the $0.150 pivot point:

If the price can stabilize above $0.155, it is expected to further test $0.181

If it can consistently remain above the current range, the next target is looking at $0.210

It may then pull back to consolidate strength before directly rising to challenge the $0.270 resistance level

$0.270 will become a key obstacle on the way to the $0.30 mark

In each price fluctuation cycle, buyer activity continues to increase, and sellers find it difficult to suppress the price to lower levels.

Spot Market Reveals Positive Signals

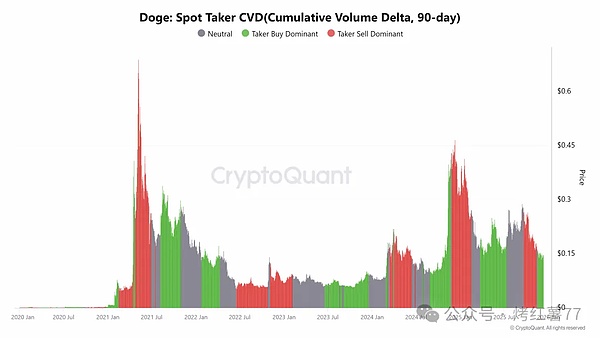

The fund flow in the spot market also releases positive signals. The CVD price for spot traders is steadily rising driven by stable buying, without sudden breakpoints, indicating strong willingness among active buyers to enter the market. Whenever the CVD strengthens, the Dogecoin price also rises simultaneously.

Buyers hold the same demand zone in every retest, and sell orders fail to create new lows. The rebound行情 coincides with tight green cluster distributions in the bottom framework, and the changes in CVD strength are highly consistent with the transformation of the weekly crossover points. This resonance in technical aspects injects more confidence into the market.

Summary: Dogecoin Enters a Critical Development Stage

In summary, supported by stronger technical signals, the Dogecoin price has entered a decisive stage. Buyers have successfully held key areas, effectively stopping the previous downward momentum, and the MACD bullish crossover further reinforces this positive shift.

If the current trend continues, Dogecoin is expected to further expand upward, with the $0.30 region becoming a more widely watched target price. Of course, the cryptocurrency market is highly volatile, and investors still need to closely monitor market changes and reasonably control risks.