Original | Odaily Planet Daily (@OdailyChina)

Author | Asher (@Asher_ 0210)

As 2025 is about to end, as the person at Odaily Planet Daily who "loves to talk about airdrops and write interaction guides the most" (the vast majority of articles in this year's interaction tutorial section were written by me), it's time for an annual summary on airdrop hunting.

After liquidating my holdings of Meme coins in the on-chain AI Agent sector at the beginning of the year, I devoted most of my time to interacting with various hot projects. I've tried almost all the popular airdrop projects, and of course, I've stepped into almost every pitfall there is. As the year-end approaches, I've had many conversations with friends who are also passionate about airdrop hunting, summarizing the changes in the sector this year.Because of this, I deeply feel that airdrop hunting in 2025 has quietly slid from "a gold rush for all" to "a collective ebb tide".

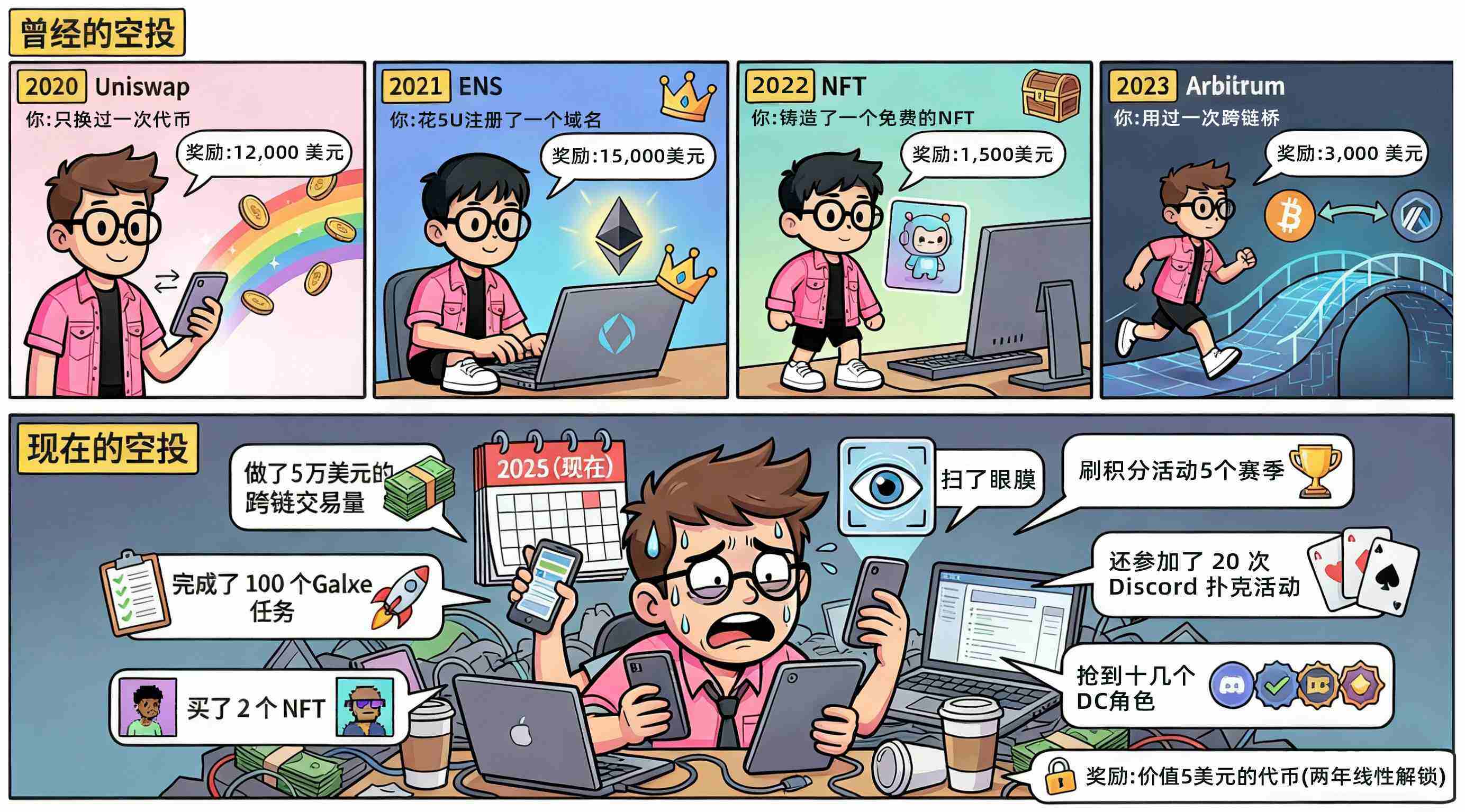

Plummeting Airdrop Returns, Studios Exit En Masse

Looking back at 2025, the airdrop hunting sector plummeted from "get-rich-quick myths" into a "winter of intense competition". Big airdrops disappeared, small airdrops shrank, and "getting rekt by the airdrop" became the norm. The most common phrase among "airdrop hunters" this year most直观地揭示了这一变化: "Small airdrops are only $5 to $10, and the Gas fee to claim them is more expensive than the tokens; the unvested airdrop rewards that used to be over 10% are now only 2-3%, and they are released in batches."

The sharp drop in returns directly triggered a mass exodus of studios."From the days when随便撸都是钱(easy money everywhere), to now not even being able to cover the basic team salary. It's not that we didn't work hard, it's that the door of the era has quietly closed." Odaily Planet Daily learned from interviews that large numbers of teams have either shut down directly or shifted to more controllable businesses like cross-border e-commerce; the few teams that remain are almost entirely relying on Binance Alpha's daily 'deterministic airdrops' to scrape by. However, with the significant drop in the value of airdropped tokens on Binance Alpha throughout November, studios will likely face a second wave of concentrated exits in the short term.

Even more absurdly, the biggest source of profit for many studios this year was not token airdrops, but hoarding hardware. A studio friend自嘲: "Didn't make much from airdrop hunting this year, but the RAM sticks I囤积in February rose from 55 yuan to 240 yuan, a裤裆full of RAM sticks became the most profitable investment of the year."

The airdrop hunting sector moves from "get-rich-quick myths" to "winter of intense competition"

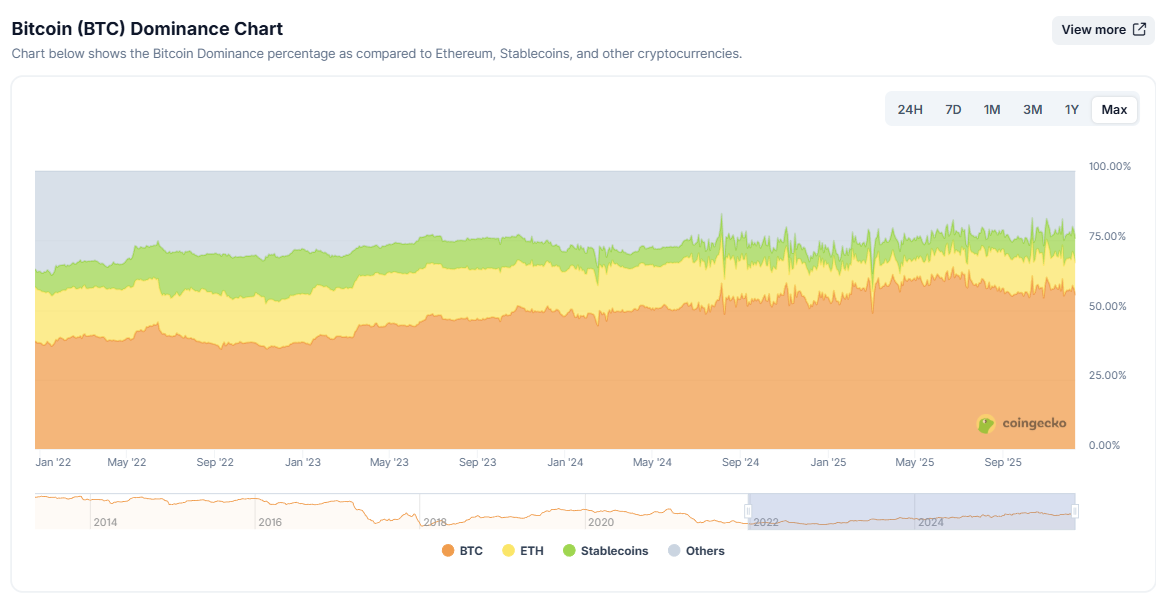

No Altcoin Season is the Root Cause of Declining Airdrop Returns

Airdrop returns本质上依赖于the subsequent performance of the airdropped tokens, and the amplification of airdrop value often离不开the tailwind of the "altseason"—that golden window when altcoins collectively rotated and surged hundredfold. However, throughout 2025, the crypto market was stuck in a prolonged BTC-dominant格局, with altcoins generally depressed. According to on-chain data, BTC's market share continued to rise, hitting a high of 63% at one point this year. BTC dominance meansliquidity does not溢出, altcoins do not rotate, and new projects find it harder to gain momentum—without a price amplifier, airdrop value cannot rise, and airdrop returns are注定to weaken.

BTC Market Dominance

This "no altseason" situation directly hits the core pain point of airdrop hunting—the upfront investment in Gas fees, time, and resources is often换来tokens that open low and go lower, or even go to zero. Per-account returns have shrunk from tens or even hundreds of dollars in the past to just a few dollars, not even covering the Gas fees.

Further analysis shows that, on one hand, the opening market caps of newly launched projects this year are generally lower, with a comprehensive塌缩of valuation systems. From the heyday of ARB and STARK airdrops opening with FDVs动不动就$10-20 billion, to now many projects starting with only a few billion, or even million-level FDVs, the price lacks imagination space, and the airdrops are already worthless at launch.(It must be said, the景象of overvalued天王projects in the past is also离不开the responsibility of airdrop hunters who狂刷data, have no stickiness, and abandon projects after hunting.)

On the other hand, even if the opening valuation is not high, it's hard to expect a "catch-up rally." Many projects have "rat warehouses" entering early, who无情dump on the market upon listing, or even run away directly.花样崩盘emerge endlessly: halving in a single day, crashing over 80%, pumping at open then阴跌ing all the way down, concentrated selling of airdrops, etc., happen repeatedly(For more related content, read: From Sahara to Tradoor, a rundown of recent altcoin "variety show crash" tactics). Many "veteran hunters" sigh that "sell upon receipt" should be an iron rule, because 90% of altcoins are注定to go to zero, and the risk of heavy betting far outweighs the potential reward.

Therefore, the opening收益of airdrops is already extremely limited. If one still chooses to HODL through the market and be a "diamond hands", they often not only miss the rebound but also end up with even lower final returns.

Although airdrop returns dropped significantly in 2025, the sector did not completely stall. Odaily Planet Daily observed thatthe methods of airdrop hunting are quietly diversifying, no longer just单纯daily participating in testnet interactions, brushing主网transaction volume, etc., to gamble on token airdrops, but gradually forming multiple细分directions.

Diversification of Airdrop Hunting

From Traditional Airdrop Hunting to "Skill-Based Airdrop Hunting"

The biggest innovation in the airdrop hunting sector in 2025 is undoubtedly the "Talk-to-Earn economy". InfoFi (Information Finance) incentivizes high-quality information creators directly with tokens through代币激励, while also alleviating the problems of information fragmentation and lack of trust in the crypto world.

Since Kaito launched its "Yap-to-Earn" mechanism, it's easy to see a flood of posts like "Upcoming TGE Project Analysis" while scrolling through X (Twitter). Subsequently, Cookie launched Cookie Snaps, highlighting "analyzing crypto projects & KOLs to get rewards for quality CT content", and Galxe used Starboard in a data-driven way to help projects screen and incentivize key contributors. The launch of these mechanisms triggered KOLs to compete in posting project analysis threads, vying for token airdrops, and also made the concept of "Talk-to-Earn" (嘴撸) popular within the circle—earning project airdrops easily by posting and writing reviews.

Traditional airdrop hunting may have reached a turning point. The hard work of "running scripts on multiple accounts, grinding interactions desperately" often ends with being slashed by the sybil system—not only working in vain but also not seeing a single hair (airdrop). Having陪跑ed projects for years, full of expectations, only to be met with the outcome of "getting rekt" is utterly disheartening.

With the arrival of the "Talk-to-Earn" era, platforms like Kaito and Cookie, in the form of content points and influence rewards, have lowered the barrier to entry, offering faster returns, lower costs, and greater potential. Under the new格局, a high-quality post on X platform, with images and观点, can generate even more value than a week of on-chain interactions.

Now, "Talk-to-Earn" on X platform is essentially doing a "premium airdrop hunting account" in another form. Going with the flow and actively adapting to the new model of airdrop hunting is the way to obtain more token airdrops.

Binance Alpha: The Main Source of Income for Studios Scraping By

Since its launch in May 2025, Binance Alpha was once hailed as the "wealth engine" of the airdrop hunting world, especially reaching its peak during the "golden month" of September. Starting in May, Binance Alpha, along with Binance Booster(For more related content, read: Don't just刷分抢空投, Binance Alpha's Booster event is also worth participating in), provided studios with "stable startup capital", earning $500 to $2000 per month, allowing studios to go from "survival" to "expansion". Many airdrop hunters joked: "Binance is疯狂撒钱(money raining like crazy), making people错觉(misperceive) that money is blown in by the wind."

In September, Binance Alpha entered an "inflationary period of token generation events (TGEs)", with a flood of projects rushing to conduct TGEs, and airdrop frequency reaching 1 to 2 per day. Influenced by the "wealth effect" brought by Binance Alpha, on-chain data showed that Binance Web3 Wallet's daily transaction volume once soared to $5 billion, accounting for 95% of the market share among mainstream wallets; the number of users also暴增from 100,000 in August to 400,000.

Despite the surge in users, returns presented a situation of "few monks, much meat". According to the Binance Alpha income report published by crypto KOL Pump Pump Superman on September 17th, among the 26 airdropped projects from September 2nd to September 16th, the project with the highest return was STBL, with a sell-at-open value of $200. If held until September 17th, the value was as high as $675. If all 26 projects were held until September 17th, the total value would be $2529; even if all were sold at open, one could获得$1544.

Binance Alpha Income Report (Statistics as of Sept 17)

However, since October, the airdrop hunting returns from Binance Alpha have shown a clear downward trend. The community普遍吐槽: "Some studios have already started to stop刷ing, some accounts with less than $1000 have也开始离职(resigned)". Binance Alpha has shifted from the era of "big airdrops" in September (single-account airdrops often exceeding $100, with highs at open reaching $300, even over $500) to a phase of "small airdrops" or "break-even/slight loss".

Two reasons caused this change. First, "more monks", the wealth effect in September attracted a large number of new users, especially airdrop hunting studios. The points threshold kept increasing, and competition during the claiming phase became fiercer. Many could only watch helplessly as份额were snatched away amidst endless errors and verifications. But more致命的是 "less meat", although the number of participating users on Binance Alpha dropped from over 400,000 to 200,000 in November, seemingly a significant decrease, the actual value shrinkage of the airdropped tokens was even more夸张. Many projects opened down or flash crashed, causing single-token returns to drop大幅, making the profit impact worse than the effect of the reduced number of people.

Admittedly, "Talk-to-Earn" and Binance Alpha have brought new ways to make money in the airdrop hunting sector, but in the cold crypto market of 2025, they are only short-term stimuli with very limited profit windows.What truly allows airdrop hunting to persist and stabilize returns are the two major backstops: "New Coin Launches (打新)" and "Stablecoin Yield Farming".

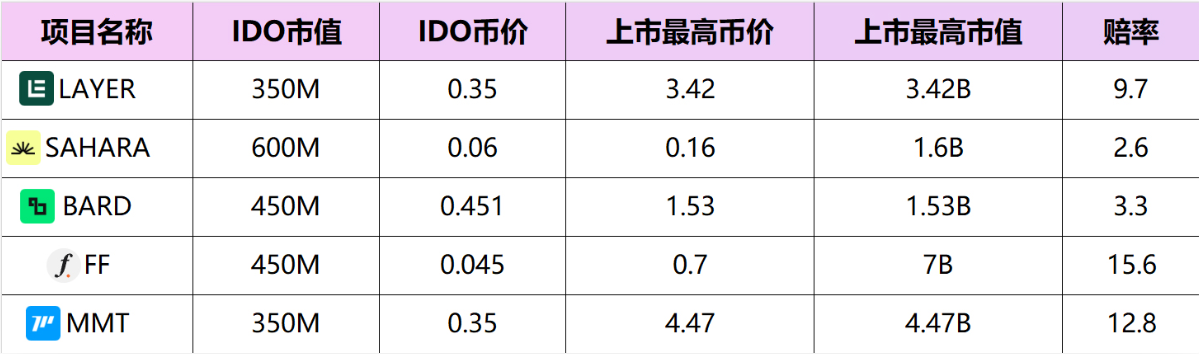

New Coin Launches Are Also an Important Part of Airdrop Hunting Returns

Although new coins this year are basically "high open, low go", with halving from highs or even dropping 90% not being rare, for projects with high social media discussion热度and concentrated sentiment, especially those with high fundraising, the returns from participating in their launch are still quite bright. For such projects, if the launch pricing is reasonable and the TGE is fully unlocked, it's basically "get it and profit".

The logic behind this is not complicated. Such high-funding projects often have intensive promotions around their launch, combined with a collective喊单by numerous KOLs boosting sentiment, causing market heat to rapidly peak in a short time. The higher the sentiment, the easier it is to form a liquidity rush effect at open, and the first-day pricing is also significantly抬高as a result.For airdrop hunters, there's no need to bet on sectors or go long-term; just抓住the opening window to eat this "short-term premium".

The 5 projects launched on the BuidlPad platform this year were all "sure-win" launch opportunities. Overall, there were generally immediate returns of 2x to 5x post-TGE, with FF and MMT even surging to over 10x returns at their historical highs.

BuidlPad New Coin Launch Returns Chart

Besides BuidlPad, other popular launch platforms like Kaito, Legion, etc., although some projects' launch prices are not fixed, as long as two signals are present simultaneously:sufficient community heat before launch and significant oversubscription during the认购phase, they basically belong to opportunities worth participating in, selling on TGE day can yield good returns. Therefore, entering December, a new wave of launch热潮has already begun, but not all projects are worth participating in. It's still necessary to坚持do basic research, focusing on projects with high fundraising, high oversubscription ratios, and high community discussion, to have a chance at good returns.

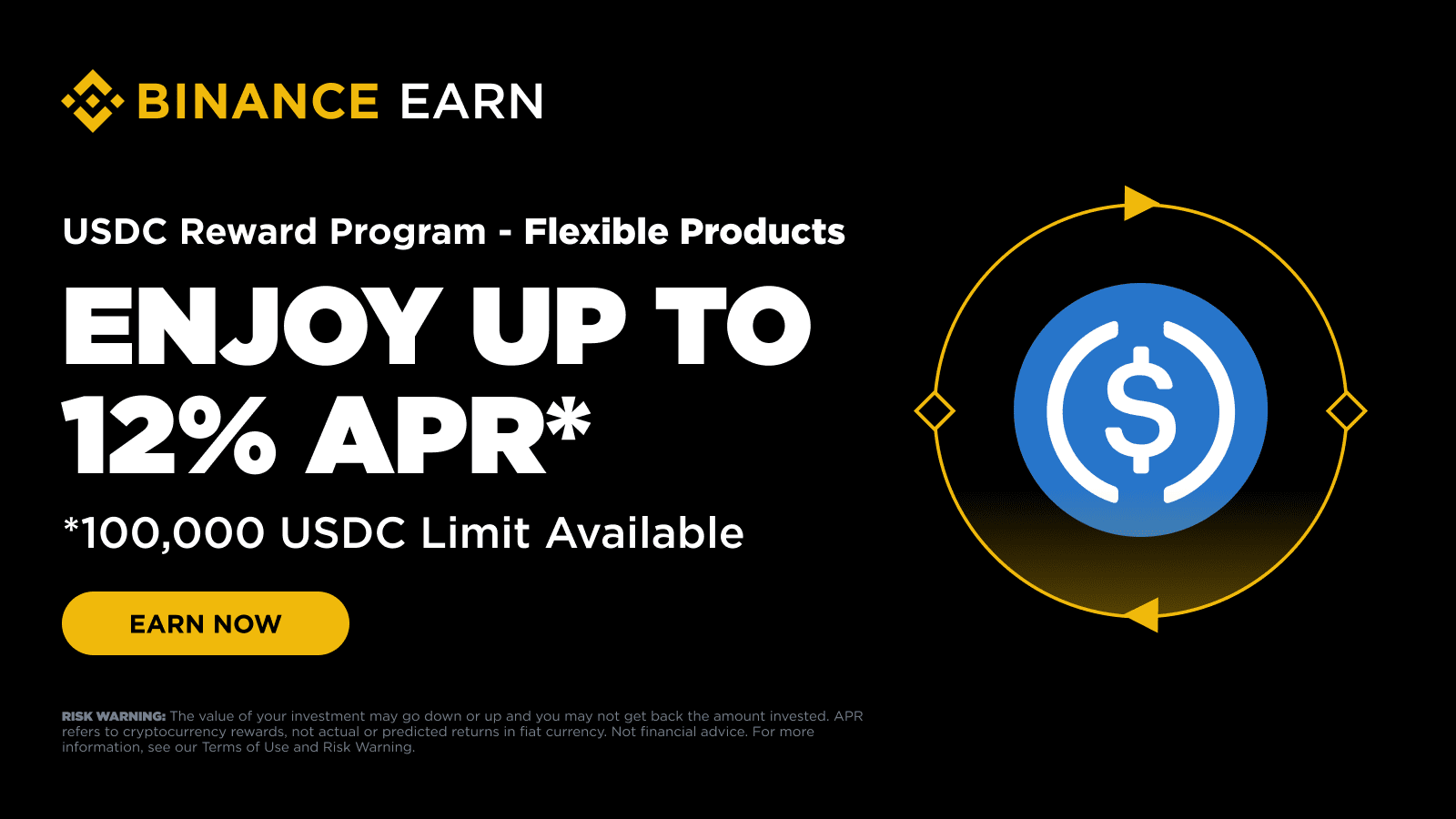

"Stablecoin Yield Farming" is Not a Side Branch, But the Foundation of Long-Term Airdrop Hunting

Airdrop hunting is not just about "betting small to win big"; earning stable returns is also a required course. The core of airdrop hunting is never about taking risks, but about exchanging for more确定性chips with as little capital磨损as possible. Therefore, depositing stablecoins to mine and receive airdrops本质上belongs to airdrop hunting—simple operation, low risk,磨损close to 0.

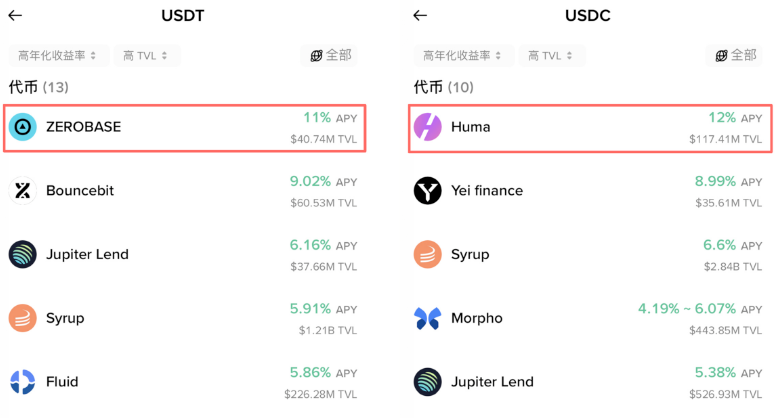

In August this year, Binance launched a one-month USDC flexible deposit activity with a single account上限of $100,000 and an APR as high as 12%. This was a typical "high yield, low risk" airdrop hunting opportunity. Therefore, similar products that can stably offer around 10% APR are worth allocating a portion of funds to—they are the "HP recovery devices" that maintain your health bar in a bear market.

Binance Launches USDC Flexible Deposit Activity

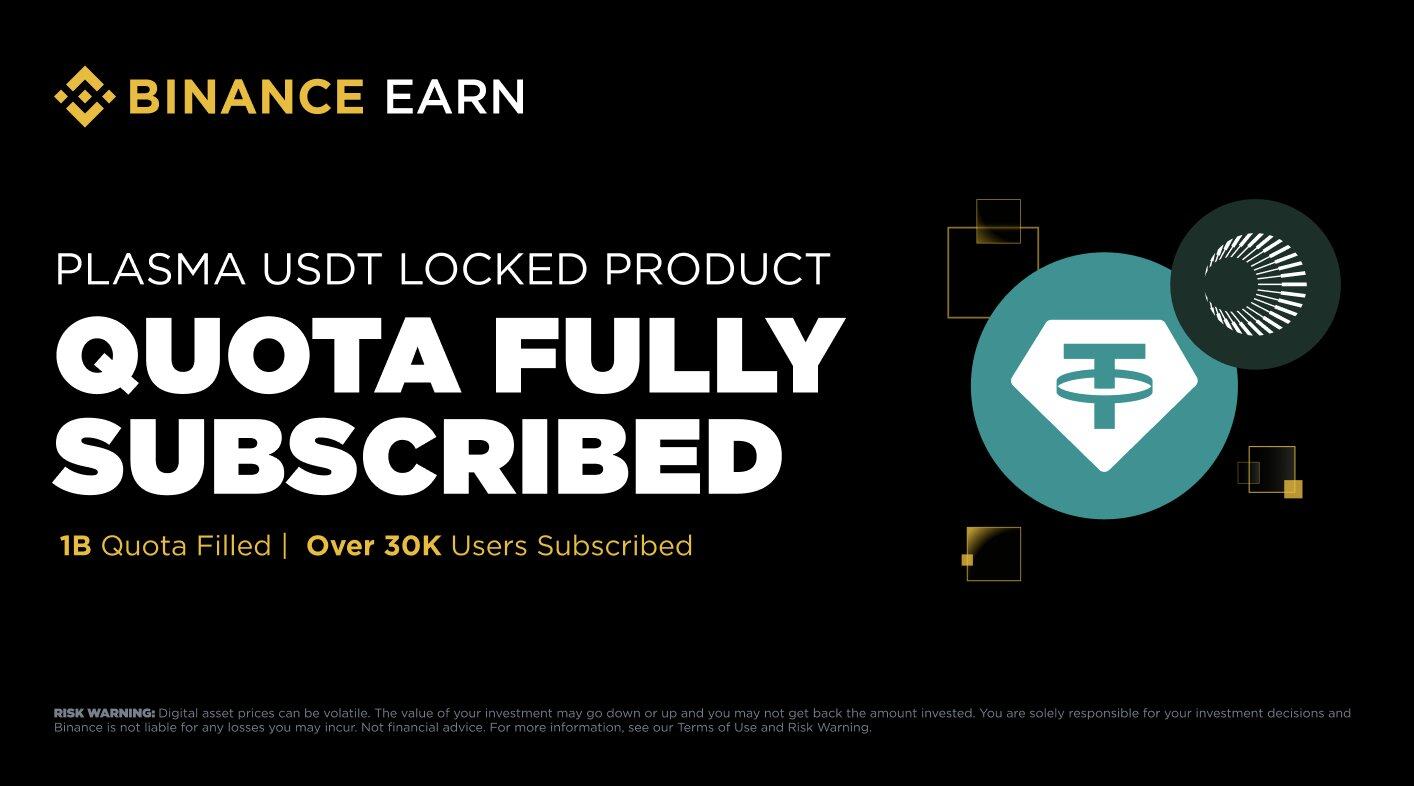

The "ceiling" for stablecoin mining returns in 2025 is undoubtedly Plasma. On August 20th, Plasma and Binance jointly launched an on-chain earn activity, allocating 1% of the total supply (100 million XPL) as deposit rewards, and offering a 2% APR on USDT deposits. The activity引爆the entire network upon launch: the first round of $250 million USDT quota was snapped up in less than an hour; the second round of $250 million USDT lasted only 5 minutes. Subsequently, Binance lowered the single-account subscription上限to $10,000 USDT and opened the final $500 million USDT quota. The remaining quota was fully subscribed within hours,最终involving over 30,000 Binance users.

Calculating based on the final allocated total quota of $1 billion USDT by Binance, users depositing $10,000 USDT would approximately receive 1000 XPL. At the opening price of $0.6, the airdrop return was about $600.More crucially, this return only took about 1 month,折算an annualized return of over 70%;加上the inherent ~2% APR on USDT, the actual到手return for airdrop hunters would only be higher. For stablecoin mining, this opportunity was already妥妥的"once in a blue moon".

Plasma and Binance Jointly Launch On-Chain Earn Activity

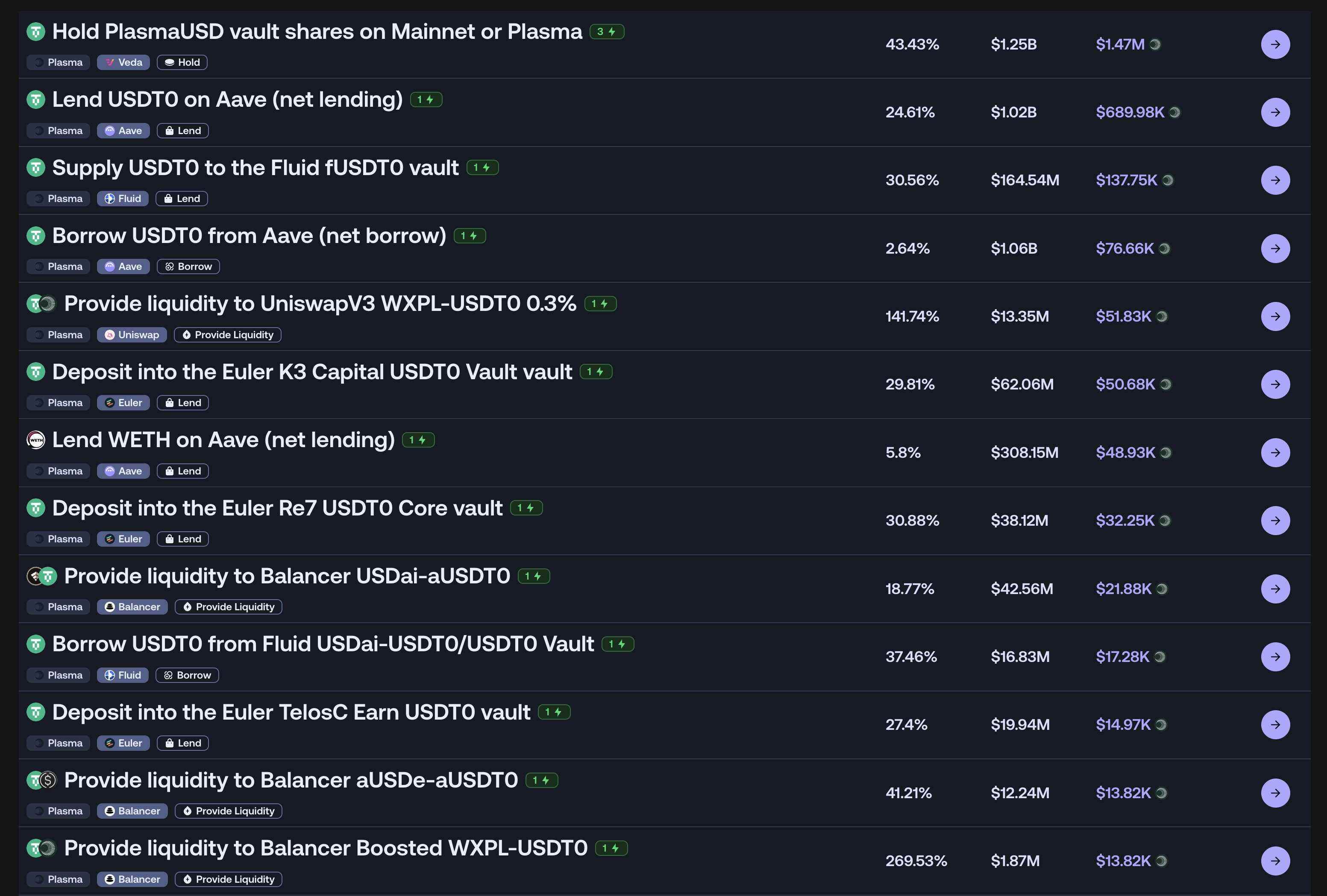

Furthermore,"farming the initial mining phase (冲头矿)" is also a golden opportunity for airdrop hunters, with short-term annualized returns often reaching 30% to 40%. Community-hotly-discussed projects like Plasma, Monad, or Linea, after their mainnet launch, all have token airdrops to reward network participants. These "initial mining windows" are short-lived but offer considerable returns, making them红利worth focusing on抓住.

Plasma Mainnet Launch Day "Initial Mining" Returns Chart

Finally, for individuals, among the USDT and USDC wealth management products in the Binance Web3 Wallet,DeFi projects with APYs exceeding 10% are generally worth participating in. Rather than clicking around on-chain yourself, struggling to distinguish real from fake, it's better to directly choose DeFi products within the Binance Wallet, which offers higher security and more省心operation.

Wealth Management Products in Binance Web3 Wallet

"Stablecoin Yield Farming" is not a side branch, but the foundation of long-term airdrop hunting. Only by allowing funds to grow steadily and守住the basic盘can one avoid being耗尽during cold markets and have "充足ammunition" when the market heats up.

The Industry Stands, Airdrop Hunting Lives

In 2025, it's not that the airdrop hunting sector is dead, but that the altcoin market is too poor. Whether short-term speculation or long-term埋伏, it's almost very hard to make money; everyone is getting beaten up. Futures traders get liquidated six times a month, going into debt and losing their heads; spot traders get wiped out twice a year, doubting life itself; airdrop hunters, although not waking up to hundreds of dollars more in their wallets every day like the previous two years, have controllable losses,反而becoming one of the few groups that can still苟住in this bearish market.

Regardless of whether the market is cold or hot, airdrop hunting始终is a low-cost, sustainable path to making money.

When the market is cold, airdrop hunting allows us to slow down the pace. Although airdrop projects are decreasing, the slower pace反而gives time to research each project more thoroughly, to understand the mechanisms,玩法, and long-term value.Rather than opening high-leverage futures contracts recklessly on exchanges or blindly囤积a bunch of altcoins, it's better to focus on polishing "premium accounts". Bear markets seem boring, but they are the most suitable stage for doing good investment research planning and preparing "premium accounts".

When the market is hot, airdrop hunting is more like a stable strategy of "taking profits and securing gains". In a bull market, altcoins rise across the board, and the market valuation of new projects at TGE is higher, so airdrop returns naturally rise accordingly. Compared to囤币党who place heavy bets,动不动relying on one project to reach A7 (a million),the advantage of airdrop hunting is that you can无情sell at open, cash out upon mining, not being completely tied to market sentiment. This not only allows稳稳锁定profits but also enables returns to持续滚动accumulate, obtaining controllable cash flow in a volatile bull market.

Therefore, regarding the changes in the airdrop hunting sector this year, more strategic operation is needed in 2026. While polishing your X account, "Talk-to-Earn" is worth continuing to participate in; Binance Alpha requires comprehensive evaluation of token value, airdrop thresholds, transaction磨损, and other multidimensional factors before deciding whether to participate; for new coin launches and stablecoin yield farming, it is necessary to坚持寻找high-quality targets to maintain stable returns under different market conditions.

Currently, airdrop hunting, although unable to make people overnight wealthy like in previous years, can still achieve steady wealth accumulation. The path of airdrop hunting is ultimately lonely, testing judgment, patience, and execution. Luck always exists, but those who can truly survive in the airdrop hunting sector and continuously accumulate wealth are those who understand persistence, learning, and mastering the rhythm.

The industry stands, airdrop hunting lives—I believe that as long as you persevere, there will still be opportunities to have the last laugh in 2026.