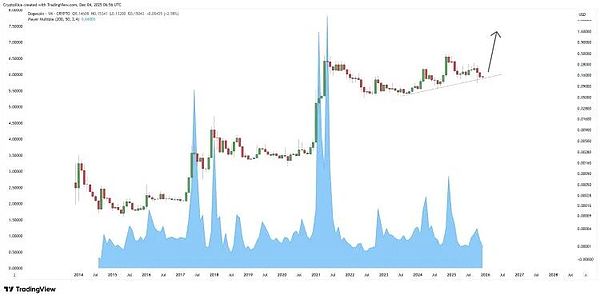

This year, DOGE celebrates its 12th birthday—that’s right, the former "joke coin" has made it to twelve! This "King of Meme Coins" is no ordinary story—from its birth as an internet meme in 2013 to today, where it still ranks among the top ten cryptocurrencies by market cap, it has truly traveled a legendary path.

Analysts are still debating whether Dogecoin’s long-term accumulation structure is on the verge of a major reversal, and its next wave of growth could very well define its 13th year.

From Joke to Legend: The Growth Story of Dogecoin

Dogecoin started as a lighthearted project by Billy Markus and Jackson Palmer to poke fun at the then-booming Bitcoin. Who would have guessed that this "joke coin" would later become one of the world’s most well-known cryptocurrencies?

Looking back, on May 8, 2021, DOGE hit its all-time high of $0.73, with a market cap nearing $88.7 billion. Although its price has since pulled back to around $0.14, with a market cap of approximately $22.5 billion, it still firmly holds its place among the top ten cryptocurrencies.

On its 12th anniversary, Dogecoin saw a slight dip of 3.1%, a bit more than the broader market decline, but the celebratory mood remains—after all, twelve years is no small feat!

Milestone Event: ETF Launch Draws Attention

Recently, the launch of a Dogecoin spot ETF became the biggest highlight. This not only means mainstream financial institutions are starting to take Dogecoin seriously but also symbolizes its transition from a "meme" to a structured, regulated investment stage.

Although early adoption has been modest, entering the ETF space is significant—it shows that the Dogecoin ecosystem is undergoing profound changes, and perhaps we might even see new all-time highs in the coming months?.

DOGE After 12 Years: Full of Resilience

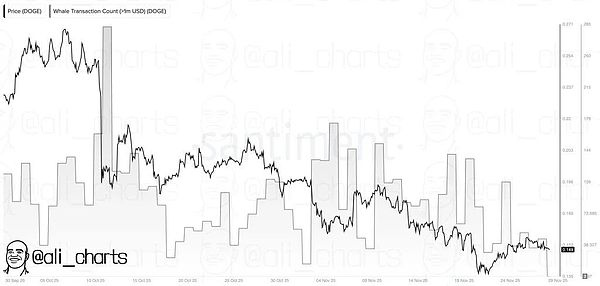

Twelve years on, Dogecoin remains active at the forefront of the market, demonstrating its unusual resilience. Recently, some large wallets have started accumulating again after a drop in trading volume, injecting confidence into the market.

Additionally, there’s been no shortage of rumors about Dogecoin payments—internal code on Tesla’s website seems to hint that Model 3 and Cybertruck might deepen DOGE payment mechanisms, which could also be related to the X platform’s XMoney system.

Of course, you can’t talk about Dogecoin without mentioning Elon Musk. Over the years, the billionaire has continuously boosted DOGE with tweets, product endorsements, and early payment integrations, keeping it in the public eye.

Price Outlook: Can It Break Through the Highs?

As for price predictions, analysts are divided: target prices generally range from $0.75 to $1.30, with some boldly calling for $10. Regardless, twelve years of accumulation and resilience ensure that Dogecoin still has a voice in the crypto world.

Dogecoin is 12 years old. It’s more than just a meme coin; it’s like an "old friend" in the crypto world, having weathered the ups and downs with you. What surprises does it still have in store for us? Let’s wait and see!

Like, share, and follow me, to catch more market trends and ride the bull and bear waves with a smile! Let’s keep pushing forward together!

Struggling in the crypto world? Don’t tough it out alone!Xiao Yunshares real-time swing and long-term strategies, helping you stand on the shoulders of giants, quickly leapfrog wealth tiers. Missing one wave could mean missing 100x gains! Join us!