要点摘要:

- 比特币回落至 12.2 万美元,从历史高点下跌约 3%,与此同时,主要山寨币如 XRP、DOGE、ADA 也下跌了 4% 至 5%。

- 分析师警告称,多项指标显示,加密市场的短期涨势正变得过热。

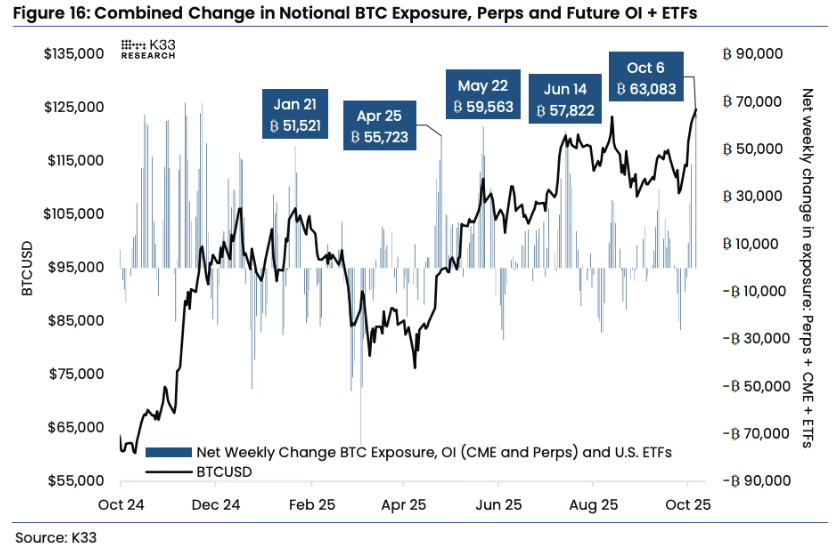

- K33 分析师指出,上周比特币的资金流入量和衍生品交易活动创下今年新高,或为市场潜在的震荡埋下伏笔。

加密市场短期过热

加密市场的涨势在周二暂时按下暂停键。比特币在突破 12.6 万美元 创下历史新高后迅速回落,分析师指出,市场短期内出现了过热迹象。比特币跌破 12.2 万美元,抹去了过去三天的涨幅,24 小时内下跌约 2.4%。这一抛售浪潮波及整个加密市场,XRP、DOGE、ADA 和 AVAX 在同一时期内均下跌 5% 至 7%。

如果比特币的价格走势让你感到似曾相识,那是因为它确实如此。尽管今年迄今涨幅已达 31%,但多头几乎没有机会好好享受胜利的喜悦。每一次创下历史新高,似乎都紧随其后遭遇迅速而猛烈的抛售。

回想一下 1 月特朗普就职典礼前 的那波上涨——比特币首次冲至 10.9 万美元,但几个小时内就回落至 10 万美元,三个月后更是跌至 7.5 万美元。

比特币在 7 月初首次突破 12.3 万美元后,数日内便下跌约 10%。

类似地,8 月中旬 冲上 12 万美元 的行情,也在随后几天内回调约 15%。

此次回调发生在比特币自 9 月下旬低于 10.9 万美元 的低点以来,经历近乎垂直式的 16% 急涨 之后。

Deribit 期权市场首席商务官 Jean-David Péquignot 在周一的报告中表示,比特币可能会回撤 11.8 万至 12 万美元区间,以洗出那些错过低点、在涨势后期追入的交易者。

他指出,如果这一回调出现,将构成逢低买入的良机,因为技术面与宏观环境正在为比特币在年内最后一个季度突破 13 万美元 奠定基础。

K33 研究主管 Vetle Lunde 则认为,衍生品市场与 ETF 的资金流入也出现过热迹象。

他指出,过去一周是今年以来 比特币资金流入最强劲的一周 —— 美国 ETF、CME 期货和永续合约的合计新增持仓达 63,083 枚 BTC(约 77 亿美元),超越 5 月份的峰值。

这波资金主要来自缺乏明显宏观驱动因素的多头押注,交易者普遍在高位建仓,为潜在的市场回调埋下伏笔。

“历史上,类似的高杠杆加仓通常出现在阶段性顶部,”Lunde 表示,

“当前市场结构显示,短期内市场可能过热,存在较高的盘整或回调风险。”

比特币名义持仓变化(结合永续合约、期货未平仓合约及 ETF 持仓,数据来源:K33)

美联储官员 Miran:中性利率应为 0.5%

美联储理事、近期由特朗普任命的 Stephen Miran 周二在 2025 年管理基金协会政策展望讨论会上表示,他对中性利率的看法已从“区间一端”转向“另一端”。他目前认为,中性利率应维持在 0.5%。Miran 指出,收紧的移民政策以及对联邦赤字预期的变化,是他重新评估的主要原因。

Miran 的言论暗示,美国经济的长期结构性因素正在发生变化。劳动力规模缩小可能限制经济增长,而财政压力上升可能使美联储在通胀与就业之间的平衡更加复杂。他的表态正值政策制定者就央行在不引发通胀压力的情况下还能降息多少进行讨论之际。

美联储官员将在本月底召开会议,讨论可能的进一步降息计划,但由于政府部分停摆,关键经济数据尚未公布。

Miran 还指出,今年上半年经济增长低于预期,主要受到贸易和税收政策不确定性的拖累。不过,他对未来几个月持更乐观态度,称大部分不确定性已逐渐消除:“随着政策信号更加明晰,我预计经济增长将保持更稳健的节奏。”

加密股承压

随着加密货币价格普遍回调,相关股票也受到冲击。Strategy(MSTR)下跌 7%,Coinbase(COIN)下跌 4%。以太坊相关企业 Bitmine Immersion(BMNR)和 Sharplink Gaming(SBET)分别下跌 3% 和 7%。

比特币矿企多数下跌,其中 MARA Holdings 下跌 4%,Riot Platforms(RIOT)下跌 3%,Hut 8(HUT)下跌 2%。