? In the past 24 hours, 129,603 people were liquidated globally, with a total liquidation amount of $445 million. The largest single liquidation occurred on Hyperliquid-ETH-USD, worth $17.8128 million.

? A strong start! Rising on a weekday, saying goodbye to the anxiety of "giving money away"~

From a data perspective, the market turnover rate has finally decreased. Although weekend factors play a part, it also helps cool down market sentiment to some extent. Essentially, the current market is similar to last week, with no actual negative news, and the market still generally expects the Fed to cut rates in December.

However, this market pullback is mainly based on two concerns: first, expectations for various data are not optimistic, and the economy may be heading downward; second, there is insufficient confidence in further rate cuts in January next year. But as mentioned before, only two rate cuts were expected this year, but four actually occurred, indicating that the dot plot cannot fully predict the future path.

The key question now is: faced with a less-than-optimistic economy, will the Fed prioritize fighting inflation or supporting growth? If it chooses the former, it may trigger a recession; if it chooses the latter, there might still be hope for the economy in 2026.

✅ Today's Market Analysis:

BTC

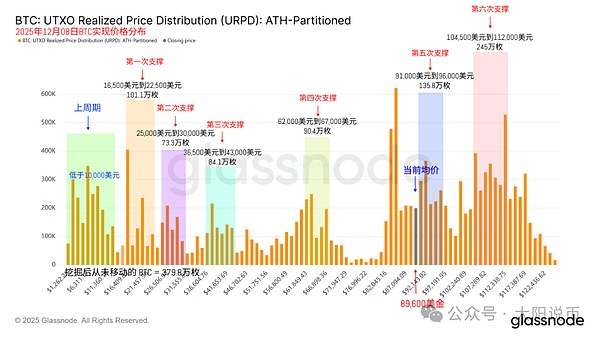

Bitcoin's short-term resistance today is focused at 93,400. If it holds above this level, there's no rush to short. The subsequent upward resistance will shift to 95,050. The short-term support below is at 88,500. If it doesn't break below this level, the upward trend remains strong. Key support intervals to watch are 86,100-85,700.

SOL

Solana's resistance today is around 140. If broken, the next resistance interval is 144-149. Operationally, it is recommended to focus on buying on dips. Key support levels to watch are 125-124 and 119. The market is currently in a bottom consolidation phase. Holding contracts long-term is difficult for ordinary investors, making spot buying a more suitable strategy for accumulation.

ETH

Ethereum's short-term resistance is at 3,210, with further upward resistance at 3,282. The short-term support below is at 2,955. If it doesn't break below this level, the upward trend remains strong. If it continues to decline, watch the 2,830-2,810 support interval. It is also in a bottom consolidation cycle, making long-term contract holding difficult. Spot buying is a safer choice.

BNB

BNB's core support level to watch today is 895: if it pulls back without breaking below this level, the minor bullish trend continues. Upward resistance levels to note are 910 (minor resistance), 926, 939, and 950. If it breaks below 895, the 1-2 hour level will start a pullback, with support levels to watch at 882 (minor support), 870, 857, and 844.

Simply put, the market's bottom consolidation is almost over. The most cost-effective approach now is to follow the main players' steps, accumulate on dips, and wait for them to drive the price up before taking profits. Don't always think about fighting against the main players; following behind them, even getting a sip of the soup is good enough.

? Also: Don't chase trades on Sundays, beware of "fake moves"

Short-term contract traders need to understand a market规律: weekend行情, especially rapid rises or falls after 8 PM on Sunday, often have a "fake move" attribute, commonly known as "fake pump."

This Sunday volatility is more favorable for players skilled in left-side trading. Even if it's difficult to profit from both long and short sides, at least one direction's profit can be captured. However, if a right-side strategy of chasing rallies and selling dips is used, it's easy to fall into a passive situation of losing on both long and short trades.

Therefore, Sundays are not suitable for blindly using right-side thinking to chase trades. Real trend-chasing trades are more suitable for times when the U.S. stock market is open, with higher liquidity and more stable trends.

? Personally, I think $Binance Life and $Hachimi will soon be listed on spot or contracts in Chinese, so I bought some. My logic is:

If $Binance Life gets listed, $Hachimi, as a strong token in the same Chinese sector, will likely benefit, and a gain of 30%-100% is possible. Alternatively, you can also find opportunities to directly position yourself in $Binance Life. Why did I choose $Hachimi?

Because it is one of the few resilient tokens in the recent Chinese sector, with a trend similar to Life, both accumulating in a sideways pattern. $Binance Life is almost certain to be listed. If Chinese projects are to be listed, not listing it would be heavily criticized. Either no Chinese projects get listed, or if they do, $Binance Life definitely won't be left out.

$ZEC

ZEC is starting to take off. After this breakout, it has directly entered an accelerated rising phase. Hopefully, it's not a fake breakout, but a real secondary爆发!

$HYPE

In the CEX altcoin sector, if the大盘 continues to rally and rebound, quality altcoins will also follow with significant rises. Projects like HYPE are typical examples, so this sector deserves close attention.