crypto analysis

07/19 00:25

Is rising leverage building a powder keg?

Is rising leverage building a powder keg?

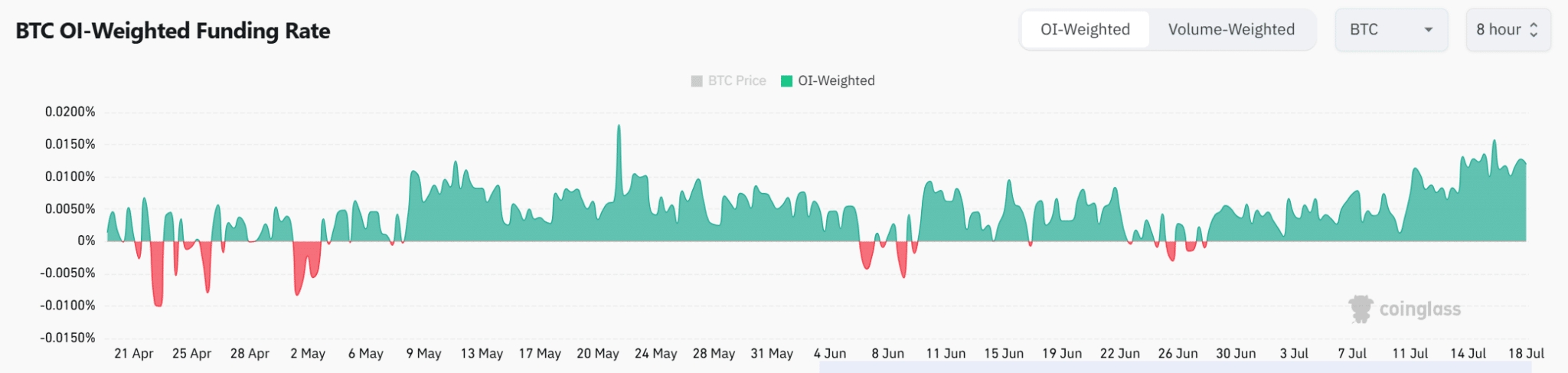

Bitcoin’s Open Interest-Weighted Funding Rate has turned increasingly positive since early July, suggesting growing bullish bias among derivatives traders.

As long positions accumulate, the market becomes more exposed to sudden liquidation cascades if the price drops.

Historically, such periods of aggressive long build-up have ended with volatile shakeouts. However, Funding Rates have remained relatively stable, without extreme spikes, which suggests measured optimism rather than outright euphoria.

Still, if the SOPR crosses 1.02 and funding surges simultaneously, a violent unwinding could follow. Therefore, traders may look to hedge against overleveraged conditions brewing under the surface.

#Check In Daily, Win Prizes Daily — Join the Fun!#HTX 12th-Anniversary Carnival#Claim1,200 USDT in the Monthly Creation Challenge

69分享

全部评论0最新最热

暂无记录