Written by: Jill Gunter, Co-founder of Espresso

Compiled by: Luffy, Foresight News

Ten years ago, I embarked on my career in the crypto industry because, in my view, it was the most suitable and fastest-acting tool to address the various problems I witnessed during my brief career on Wall Street.

I found that the current state of the financial system has given rise to three major social ills, and I firmly believed that crypto technology could overcome these challenges.

1) Mismanagement of Currency

Hugo Chávez single-handedly caused Venezuela's inflation rate to soar to over 20,000%

My career began as a bond trader, handling Latin American sovereign debt, so I personally experienced hyperinflation and capital controls in countries like Venezuela and Argentina. The willful actions of heads of state deprived entire generations of their livelihoods and savings, causing sovereign bond spreads to widen dramatically and shutting the countries out of capital markets. The injustice this situation inflicted on individuals was, and still is, a tragedy.

Of course, Hugo Chávez and Cristina Fernández de Kirchner (former presidents of Venezuela and Argentina, respectively) were not the only "villains" in this tragedy.

2) Wall Street's Financial Barriers

Remember the 2011 Occupy Wall Street protests at Zuccotti Park in Manhattan?

A few years after the 2008 financial crisis, I joined Wall Street. Before starting, I had read Michael Lewis's "Liar's Poker," and I believed the portrayal of the疯狂投机 culture of 80s Wall Street was an outdated stereotype. I also knew that the Dodd-Frank Act had been passed the year before I joined, and this congressional-level cleanup was supposed to彻底肃清 the speculative atmosphere at the trading desks in Lower Manhattan.

From an institutional perspective, rampant risk-taking speculation did indeed subside, and trading departments focused on directional bets were largely eliminated. But if you knew where to look, you'd find that speculation never really disappeared. Many of the leaders left after the 2008 industry purge were young traders who had taken over their superiors' risk positions at the market bottom and then made a fortune thanks to Ben Bernanke's quantitative easing policy. What kind of incentive orientation would this experience埋下 for these new trading "big shots"? Even after witnessing the severity of the crisis, this new generation was still灌输 with the notion that betting big with the company's balance sheet could still make a career.

During my first year on Wall Street, I passed by the "Occupy Wall Street" protesters every day on my way to and from work. The longer I stayed on Wall Street, the more I agreed with this street movement. They wanted to break Wall Street's privileges and end the现状 where it could gamble recklessly while ordinary people were left to foot the bill.

I agreed with the movement, but not its methods. The process of passing through the protesters was actually毫无戏剧性; their actions were not proactive. They held signs claiming to be the "99%," but in my view, they had no clear demands for what they wanted from the "1%."

In my eyes, the answer was obvious: the problem wasn't just that Wall Street was addicted to gambling, but that Wall Street had access to "casinos," investment opportunities, and industry information that ordinary people could never reach; and when Wall Street lost its bets, it was the common people who paid the bill.

This could never be solved by just adding a few more rules for Wall Street. The core was to create a level playing field for ordinary people.

3) Obscure and Outdated Financial Systems

As early as 2012, I realized that to push the financial system towards a more open, fair, transparent, and inclusive direction, its underlying systems needed to be upgraded.

As a junior trader in the trading room, I spent hours on the phone with the back office after the market closed every day, tracking down bonds that should have arrived weeks ago, and confirming that all derivative positions had no "wrong-way risk."

How had these processes not been fully digitized yet!

Of course, on the surface, many steps were already digitized; we used computers and electronic databases. But all these databases required manual intervention to update. Keeping information consistent across parties was a massive, costly, and often opaque task.

I still remember one thing: even four years after Lehman Brothers' bankruptcy, Barclays Bank, which acquired its assets, still couldn't clarify Lehman Brothers' exact assets and liabilities. It sounds outrageous, but it makes sense when you think about those conflicting or incomplete database records.

Bitcoin: A Peer-to-Peer Electronic Cash System

Bitcoin is just so cool.

Like gold, it is an asset不受操控, independent of monetary policy; its issuance and circulation model gave ordinary people around the world a full decade to use it as an investment tool before institutions could介入 on a large scale; it also introduced a new type of database called blockchain, eliminating the need for clearing, settlement, or reconciliation processes, allowing anyone to run and update it directly.

Bitcoin was (and still is) an antidote to my disillusionment with Wall Street. Some use it to avoid inflation and capital controls; it allowed the "99%" to get ahead of Wall Street in investments; its underlying technology has the potential to completely replace the obscure and inefficient systems relied upon by banks, building a new digital, transparent system.

I had to drop everything and devote myself to this cause. But at the time, external skepticism was overwhelming, with the most common argument being "Isn't this just something drug dealers use?" In 2014, besides darknet markets like "Silk Road," Bitcoin had almost no other application scenarios. Refuting this skepticism was not easy; you had to use a lot of "脑补" to see its potential.

During those agonizing years, I once felt this technology might never truly take off... Then suddenly, the whole world started paying attention to it and projecting their own fantasies onto this technology.

The Peak of Fantasy

For years I had hoped people would see the potential of blockchain technology, but in 2017, I suddenly became a skeptic within the industry. It was a complex feeling.

On one hand, it was because I was in the Silicon Valley industry environment; on the other hand, it was the zeitgeist—everyone wanted to do a blockchain project. People pitched me创业点子 like "blockchain + journalism," and there were headlines like "Blockchain Enters the Dental Field." At times like these, I couldn't help but say, "No, that's not how it's used at all!"

However, most of these people weren't trying to run scams; they weren't creating vaporware projects, issuing tokens to rip off retail investors, or launching meme coins. They genuinely believed in the diverse potential of the technology, but this enthusiasm was both misleading and irrational.

2017 to 2018 was the phase where industry fantasy peaked.

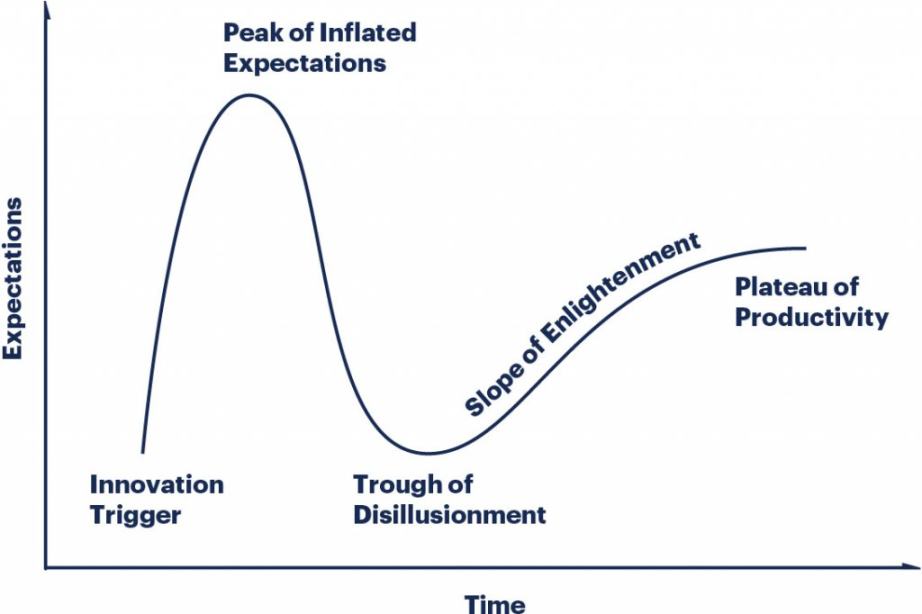

Gartner Hype Cycle

The cryptocurrency and blockchain industry did not follow the path promised by Gartner's classic "hype cycle" chart, climbing the slope of enlightenment. Instead, it oscillated between狂热 and幻灭 every 3 to 4 years.

To understand the reason behind this, one must recognize a fact: although blockchain is a technology, it is deeply tied to the asset class of crypto assets, and these crypto assets have an extremely high beta coefficient and are very risky, making them highly susceptible to macro market fluctuations. The past decade has seen剧烈起伏: during the zero-interest-rate era, risk appetite rose, and crypto assets experienced a boom; when trade wars hit, risk appetite fell, and crypto assets were pronounced "dead."

Making matters worse, the regulatory environment in this emerging field has also been extremely volatile. Coupled with catastrophic events that destroyed huge amounts of capital, like Terra/Luna and FTX, the industry's high volatility is not surprising.

Remember, We All Want to Change the World

Persisting in deep cultivation within the industry (whether building projects, investing, commenting, or other work) is an extremely difficult task in itself.

Everyone knows entrepreneurship is hard, but entrepreneurship in the crypto industry is even harder. Industry sentiment and funding environments are unpredictable, product-market fit is hard to define, legitimate entrepreneurs can be subpoenaed or even jailed, and you have to watch a president issue tokens for a scam, destroying the industry's remaining mainstream credibility... It's insane.

So I completely understand that someone, after深耕 the industry for 8 years, might feel their life has been wasted.

https://x.com/kenchangh/status/1994854381267947640

The author of this tweet坦言 that he thought he was joining a revolution, but in the end found he was just helping to build a giant casino. He expressed remorse for助推了 the "casino-fication" of the economy.

But it's important to know that no counter-traditional movement can be perfect; every revolution has its costs, and any transformation must go through growing pains.

Elizabeth Warren and the "Occupy Wall Street" movement tried to shut down the Wall Street casino, but phenomena like the meme stock frenzy, the crypto altcoin bull market, prediction markets, and decentralized exchanges for perpetual contracts have brought Wall Street's casino to the masses.

Is this a good thing? To be honest, I'm not sure. For most of my time in the crypto industry, I felt we were just rebuilding the consumer protection system from scratch. But many of the so-called consumer protection rules are either outdated or misleading, so I think pushing boundaries again might be a good thing. If my initial goal was to create a level playing field, then it must be said that we have indeed made progress.

This step is necessary to彻底改革 the financial system. If you want to fundamentally change who gets financial returns and how, it will inevitably make the economy more "casino-fied."

Report Card

It's easy to become disillusioned; it's hard to stay optimistic.

But if I review the current state of the industry against my goals when I entered, I'd say overall it's not bad.

Regarding currency mismanagement: We have Bitcoin, and other sufficiently decentralized cryptocurrencies that serve as practical alternatives to fiat, neither subject to seizure nor devaluation; enhanced by privacy coins, assets can even be untraceable. This is tangible progress in human freedom.

Regarding Wall Street's monopoly: Admittedly, the casino has been "democratized"—now it's not just Wall Street that can gamble recklessly on junk assets with high leverage and blow itself up! But seriously, I believe society is progressing towards less over-intervention in how and what risks ordinary people can take. After all, we've always allowed people to buy lottery tickets freely, while shutting them out of some of the best-performing stock investment opportunities of the past decade. The early retail investors in quality assets like Bitcoin and Ethereum have given us a glimpse of what a more balanced world should look like.

As for the problem of obscure and outdated database systems: The financial industry is finally正视更优的技术方案. Robinhood is already using blockchain as the underlying technology for stock trading products in the EU; Stripe is building a new global payment system based on crypto rails; stablecoins have become mainstream products.

If you joined for the revolution, take a closer look: everything you hoped for might already be here, it just doesn't look exactly how you imagined.