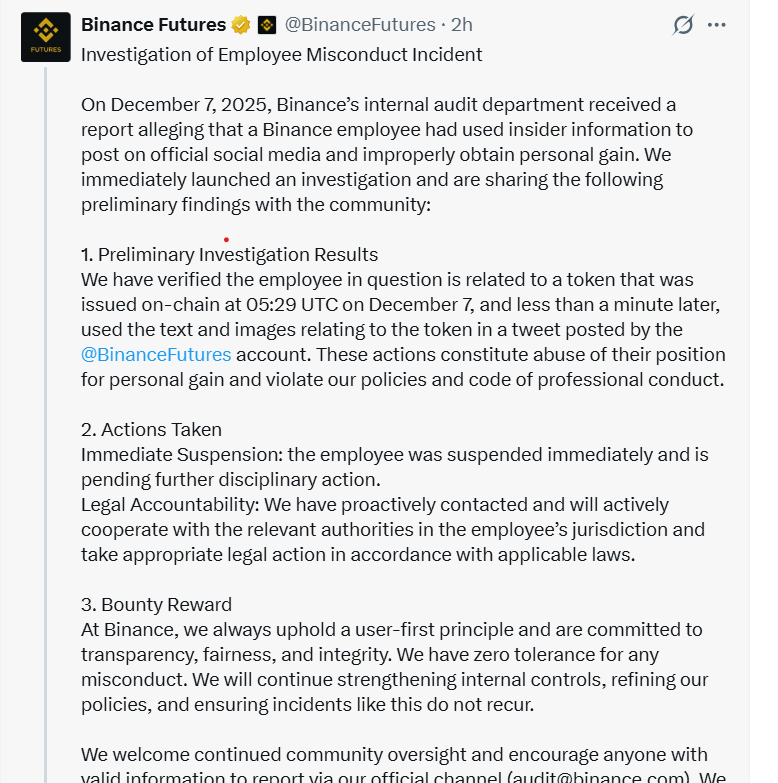

Binance said Monday it launched an internal investigation on Dec. 7 into an employee it suspected of abusing access to insider information by posting from an official Binance Futures social media account for personal gain.

The exchange said in an X post that its audit team received a report alleging the employee used non‐public information to craft a post on the official Binance Futures X account “less than a minute” after the token was issued onchain.

The employee in question was immediately suspended, and Binance said it has contacted authorities in the jurisdiction where the employee is based to pursue potential legal action.

Cointelegraph reached out to Binance to request further details on the cryptocurrency in question and the profit made, but had not received a reply by publication.

Binance leans on whistleblowers

The exchange is leaning into whistleblowing as a governance tool, confirming that its promised $100,000 reward will be split among several users who submitted the earliest valid reports through its official [email protected] channel after those tips were verified and deduplicated.

Binance stressed that only reports sent via this internal channel qualify for bounties, even though some information about the incident also surfaced publicly on X, and urged the community to continue flagging suspicious activity.

Related: DATs bring crypto’s insider trading problem to TradFi: Shane Molidor

The exchange reiterated its “zero tolerance” stance on employees using their positions for personal gain, pledging tougher internal controls and process improvements to “close off all possible spaces for abuse” and prevent similar misconduct in the future, using the incident as a chance to show it will suspend employees, cooperate with regulators, and pay informants rather than quietly handle such cases in‐house.

The case demonstrates how quickly whistleblowers can identify suspicious patterns in onchain activity and social posts, and how exchanges can utilize this information through structured bounty programs.

Related: How mass decoy messaging protects whistleblowers — CoverDrop inventor

Deja vu for the Binance team

This is not the first time a Binance employee has been accused of abusing their position. In March, Binance Wallet said it suspended a staff member and opened an investigation after whistleblowers alleged the employee used insider information about an upcoming token generation event to front‐run trades.

The employee bought a large amount of the token via multiple linked wallets before the public announcement and then sold part of the position for significant profits once the launch went live.

Binance is not the only exchange to face insider-trading allegations tied to staff access and market‐moving information. In 2022, US authorities charged a former Coinbase product manager and two associates, accusing them of using confidential knowledge of upcoming token listings on the exchange to trade at least 25 assets ahead of public announcements and generate more than $1 million in illicit profit.

Magazine: Bitcoin OG Kyle Chassé is one strike away from a YouTube permaban