US-based asset management company BlackRock has applied to list and trade shares of an investment vehicle tied to staked Ether, following its offering of other cryptocurrency products.

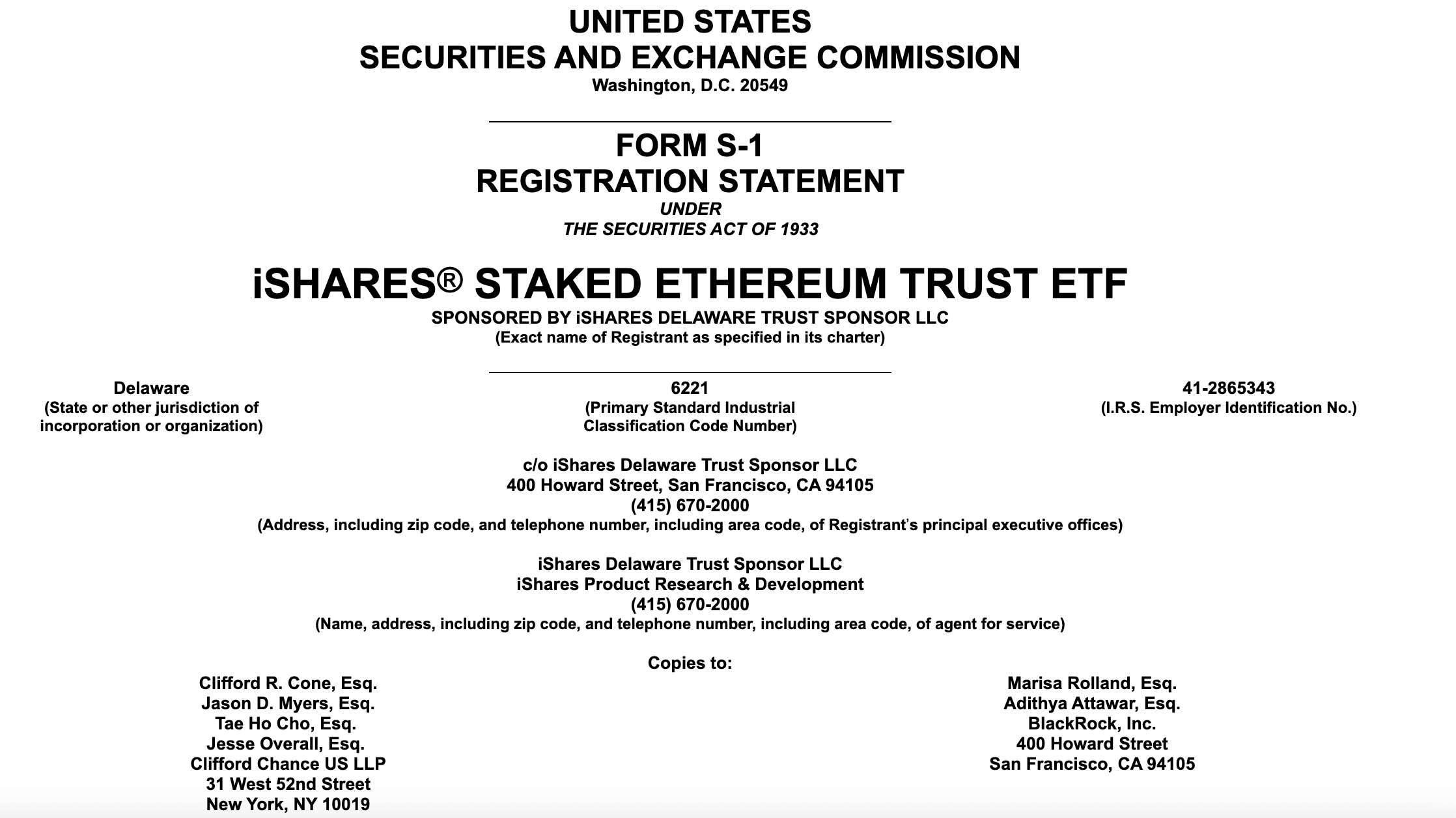

In a Friday filing with the US Securities and Exchange Commission, BlackRock filed a Form S-1 registration statement for its iShares Staked Ethereum Trust exchange-traded fund. The filing is part of the SEC’s process for companies to list investment vehicles such as ETFs, but does not guarantee approval.

Shares of the staked Ether (ETH) fund, which BlackRock intends to list and trade on the Nasdaq exchange under the ticker ETHB, could be one of the first offerings tied to staked cryptocurrencies. Grayscale Investments added staking functionality to its previously approved spot ETH and mini ETH trusts in October.

The regulator has not greenlighted many crypto staking funds since initially approving spot Ether ETFs in May 2024. However, Canary Capital made a similar SEC filing for a staked Injective (INJ) product in July, and Grayscale and Bitwise launched separate staking products tied to Solana (SOL) in October.

BlackRock manages the largest spot Bitcoin (BTC) exchange-traded fund, the iShares Bitcoin Trust ETF, which is listed under the ticker symbol IBIT.

Related: Spot Ether ETF staking could ‘dramatically reshape the market’

Has BlackRock’s CEO softened on crypto?

Larry Fink, who co-founded BlackRock in 1988, said before Bitcoin’s 2017 bull run that the cryptocurrency “shows you how much demand for money laundering there is in the world.”

In the years since, and as the US digital asset market grew in volume and usage, the CEO has made more bullish remarks on crypto investments, including by supporting BlackRock’s launch of a spot Bitcoin ETF and others.

In The New York Times’ DealBook Summit last week, Fink said he had had a “big shift” in his opinions of crypto, but still referred to BTC as an “asset of fear.”

Magazine: XRP’s ‘now or never’ moment, Kalshi taps Solana: Hodler’s Digest, Nov. 30 – Dec. 6