Bitcoin (BTC) fell back below $90,000 around Monday’s Wall Street open as US selling pressure returned.

Key points:

- Bitcoin keeps volatility coming as US sellers send price back below $90,000.

- Liquidations remain steady as investors stay on the sidelines amid indecisive price action.

- Evidence of buying the dip is visible across exchanges over the past two weeks.

BTC price runs out of room as Wall Street returns

Data from Cointelegraph Markets Pro and TradingView showed BTC price action staying volatile as the TradFi trading week got underway.

BTC/USD one-hour chart. Source: Cointelegraph/TradingView

Having passed $92,000 during the Asia session, BTC/USD soon ran out of upward momentum, abandoning a potential retest of the yearly open at $93,500.

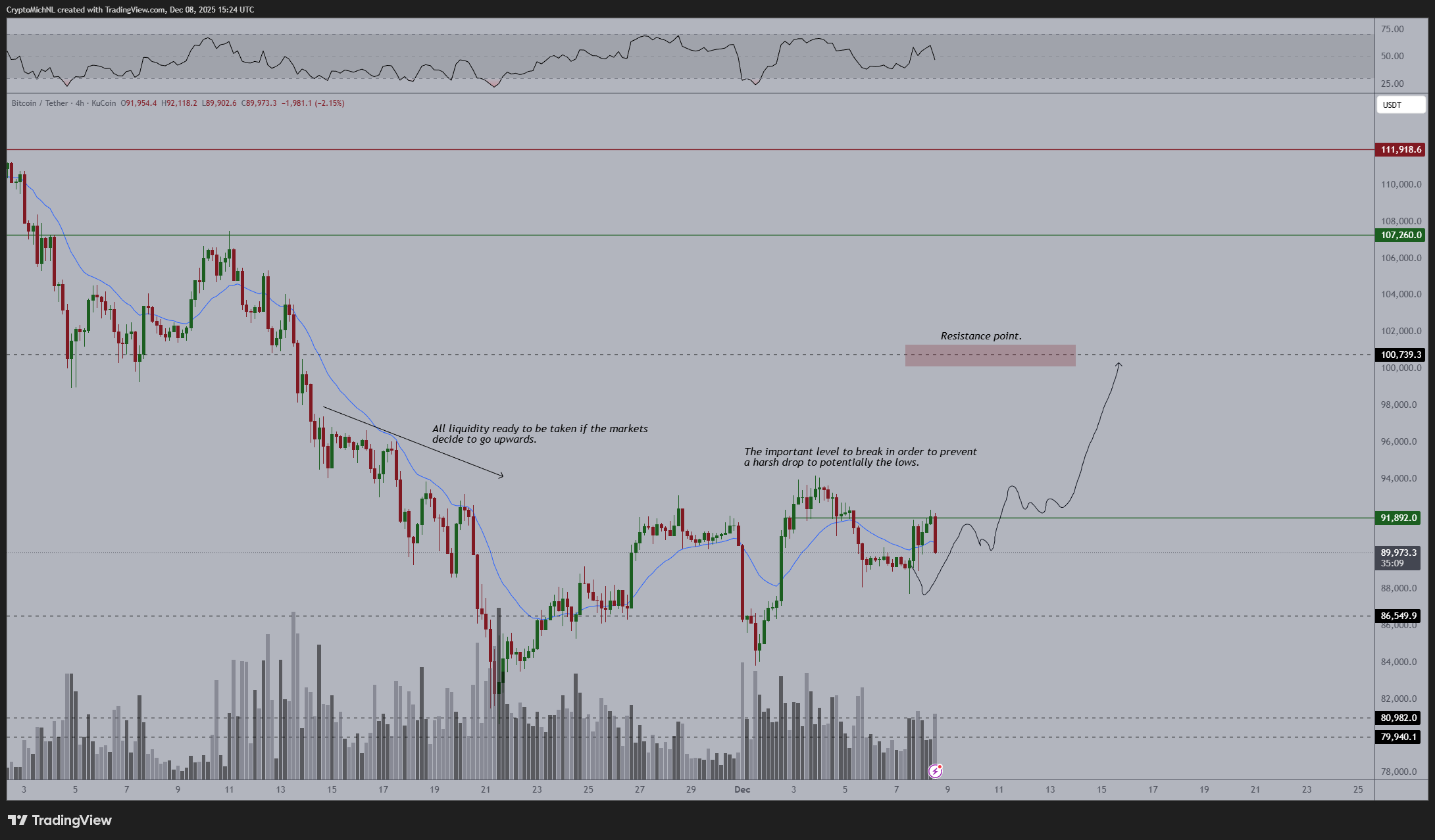

“This is exactly why you'll need to stay calm for a little bit if there's a move on $BTC. Great move on some Altcoins today, but harsh rejection on the crucial resistance of Bitcoin,” crypto trader, analyst and entrepreneur Michaël van de Poppe reacted in a post on X.

Van de Poppe said that he hoped for a higher low to form next, also flagging $86,000 as an important level.

“And, what if that doesn't happen?” he continued about the higher low.

“Exactly, that's the moment that I'm looking at a sweep of the lows and $86K to hold, that's the final level of support before a test of the lows.”

BTC/USDT four-hour chart with RSI, volume data. Source: Michaël van de Poppe/X

Trading company QCP Capital noted that liquidations through the volatility had remained “relatively modest.”

“This reflects a notable drop in positioning as broader interest in crypto continues to fade, whether due to fatigue, caution or simple indifference while traders wait for clearer direction,” it wrote in its latest “Asia Color” market update.

24-hour cross-crypto liquidations stood at $330 million at the time of writing, per data from monitoring resource CoinGlass.

Crypto total liquidations (screenshot). Source: CoinGlass

“Migrating” BTC supply poses liquidity question

Business intelligence company Strategy announcing a new Bitcoin purchase worth almost $1 billion, meanwhile, failed to boost market confidence.

As Cointelegraph reported, Strategy boosted its BTC holdings by 10,624 BTC last week, at an average cost of just over $90,000 per coin.

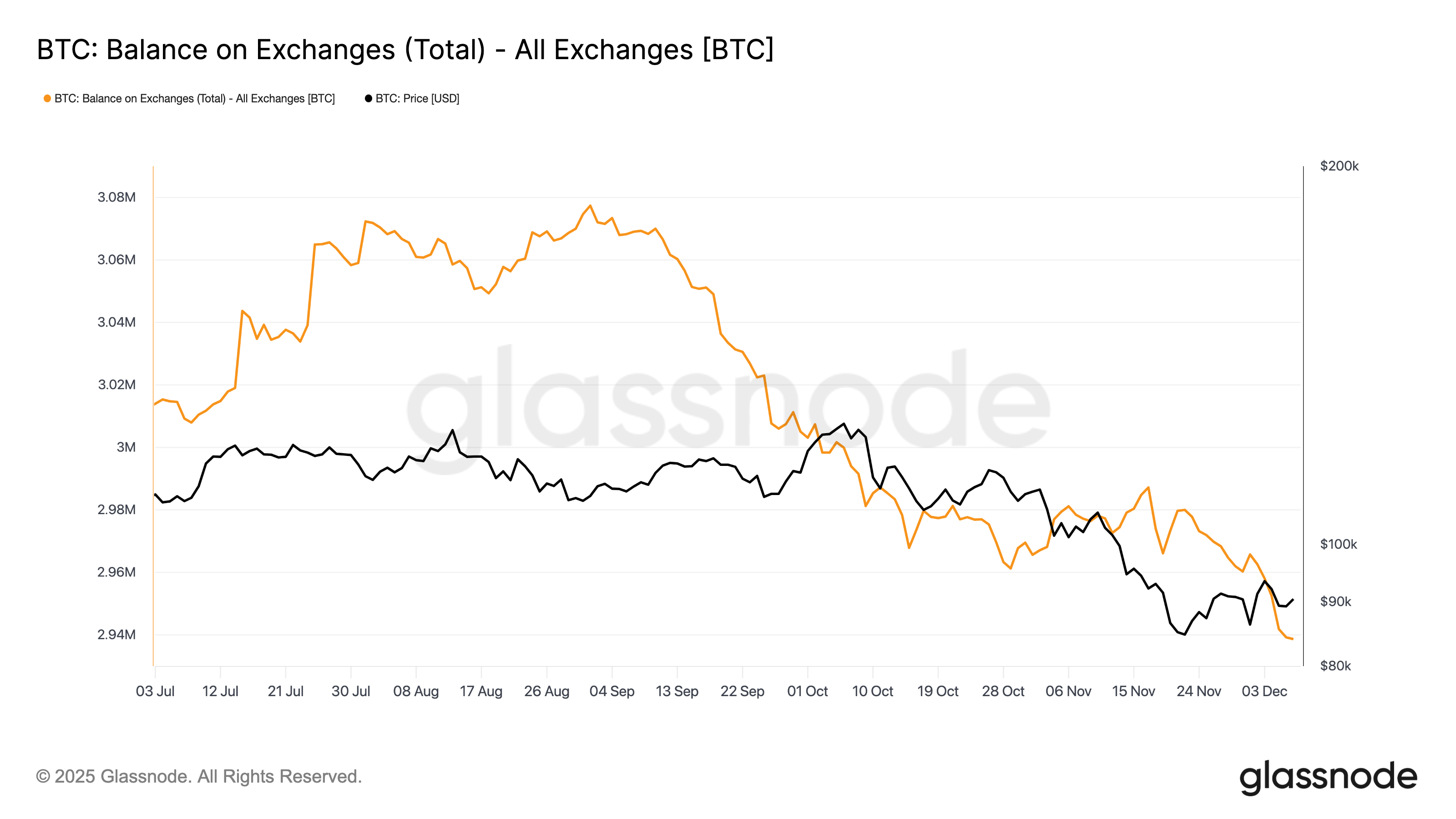

QCP, however, said that buyer appetite for both Bitcoin and altcoins extended to the broader exchange user base.

Over the past two weeks, it said, over 25,000 BTC left exchange order books. Data from onchain analytics platform Glassnode put two-week exchange outflows at closer to 35,000 BTC.

BTC balance on exchanges. Source: Glassnode

“Bitcoin ETFs and corporate treasuries now collectively hold more BTC than exchanges, a meaningful shift that signals supply migrating into longer-term custody and tightening the available float,” Asia Color added.

“ETH is showing a similar pattern, with exchange balances falling to decade lows. Against this backdrop, Sunday’s moves underscored how little market depth remains as year-end liquidity thins.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.