Tether and Circle, issuers of the two largest stablecoins in the world, have just received major regulatory greenlights in UAE’s Abu Dhabi.

Tether’s Stablecoin Recognized As ARFT, While Circle Obtains FSP License

Major developments related to the cryptocurrency sector have occurred in the United Arab Emirates (UAE) this week, with Tether and Circle both winning approvals in Abu Dhabi Global Market (ADGM), the international financial center and free economic zone of Abu Dhabi, UAE’s capital.

First, as Tether has announced in a press release, USDT issued on a number of blockchains has been recognized as an Accepted Fiat-Referenced Token (ARFT) in ADGM. USDT already received approval from ADGM last year, but the previous recognition only included the Ethereum, Solana, and Avalanche versions. With the new regulatory nod, USDT available on Aptos, Celo, Cosmos, Kaia, Near, Polkadot, Tezos, TON, and TRON has also entered the market.

“By extending recognition to USD₮ on several major blockchains, ADGM further strengthens Abu Dhabi’s position as a global hub for compliant digital finance,” said Tether CEO Paolo Ardoino.

USDT being considered as an ARFT means that authorized persons licensed by ADGM’s Financial Services Regulatory Authority (FSRA) can offer regulated activities involving the stablecoin on nearly all its native blockchains. “Introducing USD₮ within ADGM’s regulated digital asset framework reinforces the role of stablecoins as essential components of today’s financial landscape,” noted Ardoino.

Meanwhile, Circle, the issuer of USDC, has also advanced in the region with a new license from the FSRA, according to an announcement. The license, called the Financial Services Permission (FSP), allows the company to operate as a Money Services Provider in ADGM.

Arvind Ramamurthy, ADGM Chief Market Development Officer, said:

Circle’s regulated presence in ADGM reinforces our ambition to build a trusted, institutional-grade digital asset ecosystem in Abu Dhabi, one that enhances market confidence, supports real-world use cases, and cements the UAE’s role as a leading hub for regulated digital finance.

The greenlight from ADGM follows the recognition of Circle’s USD and EUR stablecoins by the Dubai Financial Services Authority (DFSA) in February of this year. The move made USDC and EURC the first stablecoins to be approved in the Dubai International Financial Centre (DIFC).

The new FSP license means “Circle is positioned to expand regulated payment and settlement use cases in the UAE for businesses, developers, and financial institutions,” the statement noted.

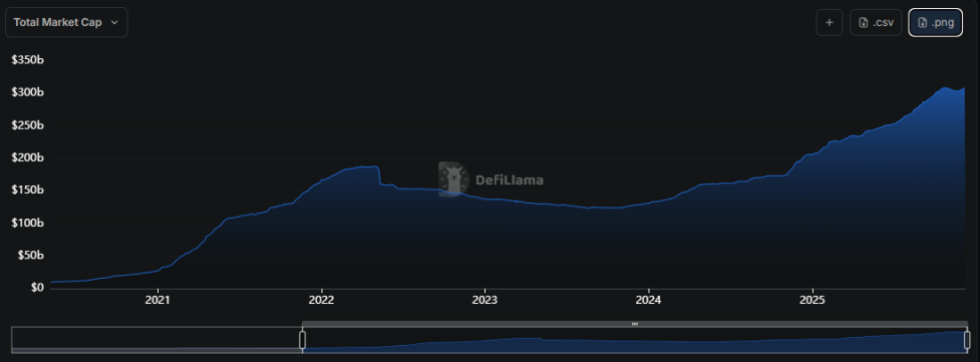

Stablecoins have witnessed rapid growth throughout 2025, setting multiple records. The near-constant growth in these tokens, however, saw a break in October, as the combined market cap of this side of the cryptocurrency sector reversed course.

The trend in the market cap of the stablecoins | Source: DefiLlama

As the above chart from DefiLlama shows, the stablecoin market cap declined to a low in mid-November. Since this bottom, though, capital inflows have returned for these fiat-tied assets, with the market cap once again nearing in on a new record.

Bitcoin Price

At the time of writing, Bitcoin is floating around $90,100, up almost 4% in the last seven days.

Looks like the price of the coin has moved sideways over the last few days | Source: BTCUSDT on TradingView