Last night, Bitcoin once again became the center of attention as its price strongly rebounded to the $94,000 mark. This breakthrough move has sparked widespread discussion in the market: does this mark the start of a new bull market, or is it just a brief technical rebound?

Despite the strong price performance, trading volume data did not fully support the upward trend.

Battle at Key Resistance and Market Sentiment Ahead of FOMC Meeting

After experiencing brief structural weakness on December 3rd, Bitcoin once struggled to secure a daily close above $93,000.

As the important macroeconomic event—the Federal Open Market Committee (FOMC) meeting—approached, most market participants chose to wait and see, leading to several days of sideways consolidation.

This stalemate was broken on December 5th when Bitcoin's price successfully broke through $93,500, forming the higher high needed to restore the short-term bullish trend.

From a technical analysis perspective, on the four-hour chart, Bitcoin not only completely filled the fair value gap between $87,500 and $90,000 but also showed firm buying intent. The effectiveness of this breakthrough is particularly significant against the backdrop of potential volatility from upcoming macro events.

Technical Patterns and Key Level Analysis

Multiple bullish technical patterns have recently formed. A confirmed 'cup and handle pattern' is observed on the four-hour chart, suggesting that if Bitcoin can break above $96,000, the next target could be $104,000. Simultaneously, an 'inverse head and shoulders pattern' has also largely taken shape. These two bullish patterns together strengthen confidence among the bulls.

Market analysts generally view $94,000 as a key psychological level, coinciding with a descending trendline resistance. The criteria for judging trend sustainability are clear: if Bitcoin's daily closing price can stabilize above $96,000, it will be seen as a strong bullish reversal signal; conversely, failure at this resistance could lead to a rapid pullback to the $88,000-$89,000 range.

More broadly, the $95,000 area is seen as the 'main battlefield' between bulls and bears. A successful breakout above this area could open the door for the price to test the $99,000 to $107,000 range; whereas a failure to break through could result in a deeper correction, potentially retesting the $85,000 support, or even plunging further to $76,000 in extreme cases.

Contradictory Signals from Liquidity Conditions and Market Participation

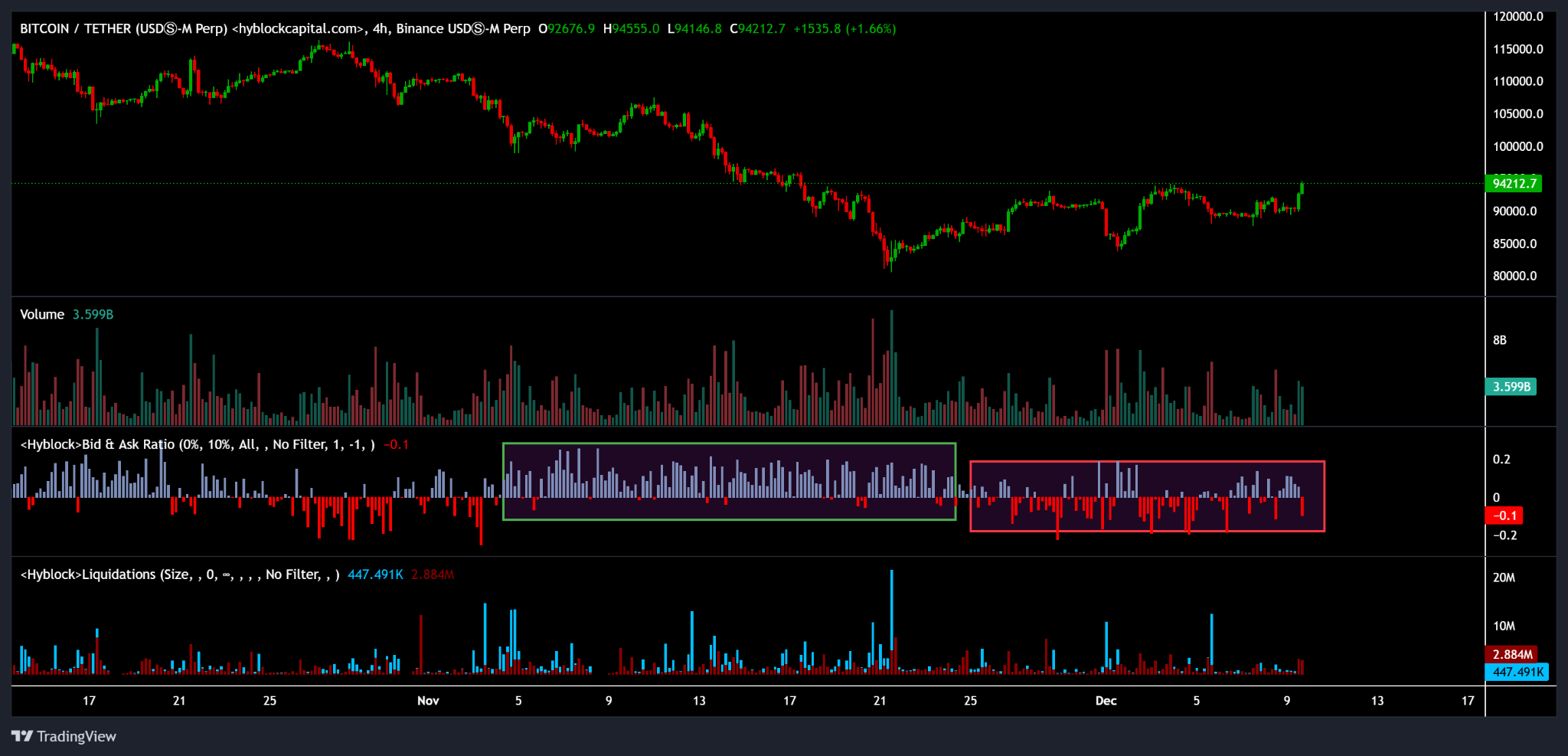

Analysis of Bitcoin's Preference-Sell Ratio and Liquidation Data. Source: Hyblock

Although the price action is encouraging, market liquidity indicators do not fully validate the upward trend. Bitcoin's buy-sell ratio remains at a relatively low and unstable level.

Unlike the aggressive buying seen during November's plunge from $100,000 to $80,000, the current rebound lacks the same intensity of buying support. This suggests that the recent rise is primarily driven by price movement rather than solid new demand. Exchange premium data also paints a complex picture.

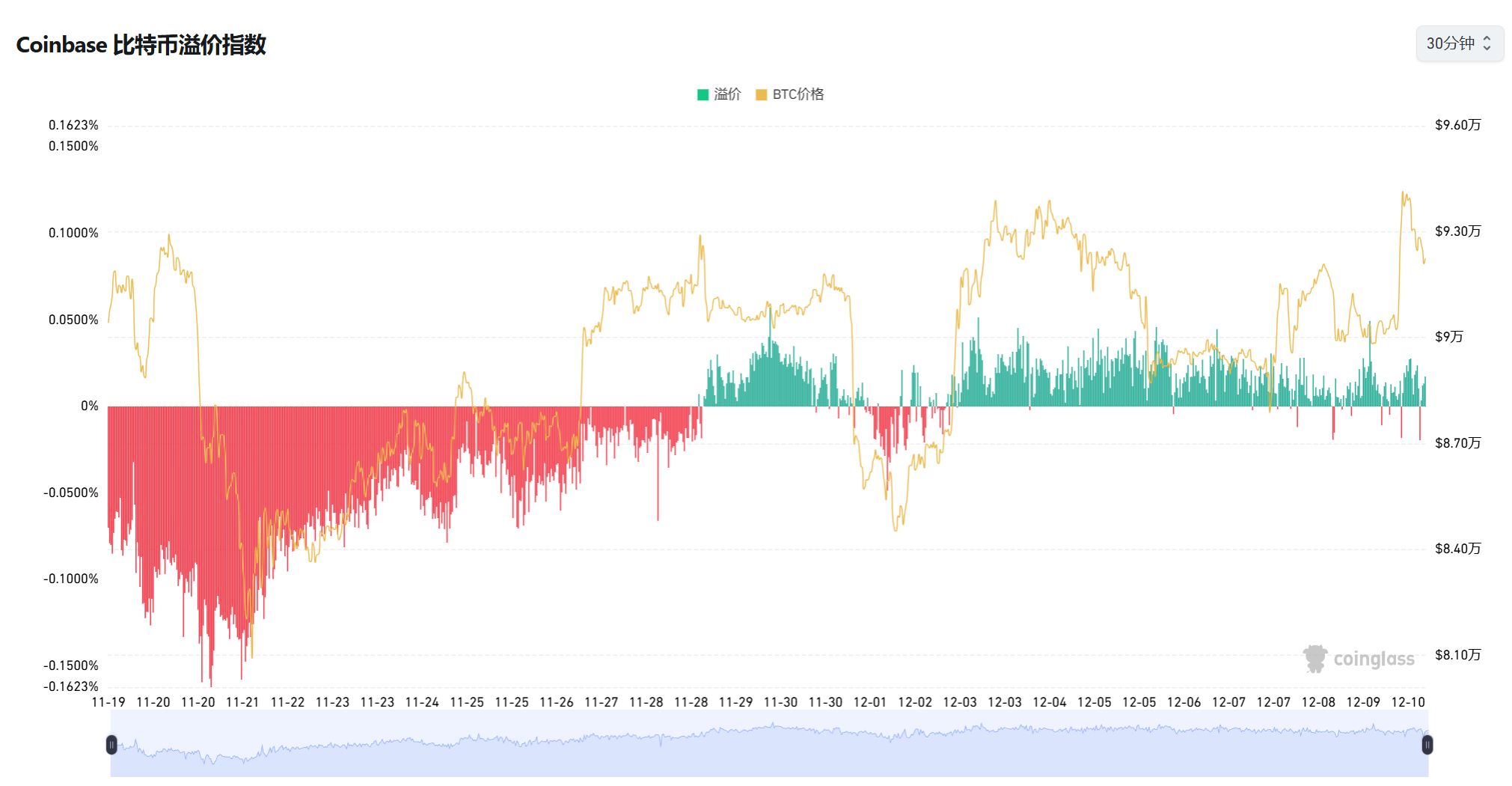

The Kimchi Premium (a key indicator of retail sentiment in South Korea) has significantly cooled. Previously, the Korean market often traded at a premium during rallies, but this enthusiasm has now waned, approaching parity or slightly negative, indicating that retail speculators have not yet entered the market en masse.

Meanwhile, the Coinbase Premium Index (representing U.S. institutional demand) has turned positive again.

Historical data shows that moderate positive readings often appear during early trend reversals and spot accumulation phases. This regional divergence makes the market outlook more complex.

On-chain data provides further insight. The number of 'whale' addresses holding at least 100 BTC has hit a new high for 2025, and large transfers have reached a three-month peak. This typically indicates that 'smart money' is building positions, rather than the market being dominated by short-term speculators. The average cost basis for short-term holders is now near $90,000, forming a psychological support level.

Macro Backdrop and Policy Catalysts

The Federal Reserve's monetary policy moves remain a key macro factor influencing Bitcoin's trajectory. Ahead of the FOMC meeting, the market widely anticipates a potential 25 basis point rate cut. Historical data shows that five out of the six FOMC meetings this year coincided with Bitcoin price pullbacks.

Furthermore, policy expectations have also become a major market driver. The Trump administration's proposed concept of a 'Bitcoin Strategic Reserve' and the advancement of U.S. stablecoin legislation have injected optimism into the market.

More crucially, the approval process for Bitcoin spot ETFs is entering its final stages, with Bloomberg analysts expecting a result by mid-May. Applications from institutions like BlackRock and Fidelity are queued awaiting approval.

Participation from traditional financial institutions is also deepening. Global asset management giant Vanguard has opened cryptocurrency ETF access to specific clients, including Bitcoin and Ethereum-related products. This widening of traditional financial channels removes another barrier for large-scale institutional capital inflows into the crypto market.

Market Risks and Potential Challenges

Despite the seemingly optimistic outlook, several risk factors cannot be ignored. From a technical indicator perspective, Bitcoin's Relative Strength Index (RSI) has entered overbought territory (>70), and the 200-day moving average around $96,216 poses strong resistance.

Leverage risk is particularly prominent. Data from Bybit and OKX shows that long positions account for 58%. If the price falls below $87,000, it could trigger a cascade of liquidations exceeding $120 million.

This high-leverage environment makes the market more prone to violent fluctuations. Regulatory uncertainty persists.

Although U.S. policy winds are warming, the EU's MiCA framework is just beginning to be implemented, and regulatory attitudes remain strict in some Asian countries. This global lack of regulatory synchronization could continue to affect market stability.

Conclusion

Bitcoin's climb back above $94,000 has undoubtedly injected new optimism into the market, but whether the bull market has truly restarted requires more evidence. The current market is at a resonance point of bullish technical signals and macro tailwinds, yet constrained by key resistance levels and liquidity concerns.

Investors should closely watch the situation around the $96,000 breakout and the Federal Reserve's policy moves, as these factors are more important than any single candlestick pattern. In an environment where volatility may intensify, position management and risk control are more crucial than chasing short-term gains.

The Bitcoin market has entered a new era of complex dynamics driven by ETF flows, leverage cycles, stablecoin liquidity, holder structure, and macro liquidity. Understanding the interrelationships of these signals will be key to navigating future markets.