在政策利好、机构加仓与主流币突破的多重刺激下,今日加密市场全面开花——比特币稳守高位、以太坊强势突破 4200 美元关口,狗狗币等模因币更是乘势飙升。无论你是资深玩家还是观望新人,这一波行情都在释放同一个信号:新一轮加密盛夏,正在开启。

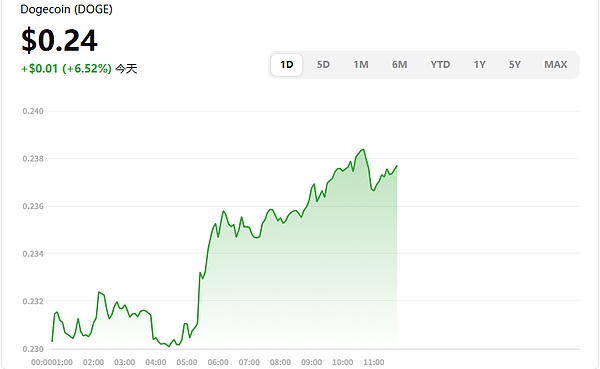

今日行情图(K 线行情一览)

当前**比特币(BTC)**价格约为 117,249 美元,较前一日上涨约 459 美元,全天振幅介于 115,978 – 117,796 美元之间,整体维持高位震荡。

**以太坊(ETH)**表现抢眼,目前为 4,207.8 美元,单日涨幅约 7.7%,价格波动介于 3,894 – 4,237 美元,呈现强势突破趋势。

模因币代表 **狗狗币(DOGE)**涨势十分亮眼,当前报 0.2378 美元,上涨幅度约 6.5%,全天振幅在 0.220 – 0.238 美元之间,交投活跃。

今日聚焦:热点新闻一网打尽

Ripple 与 SEC 和解Ripple 与美国证监会达成协议,结束长达数年的诉讼纠葛,XRP 市场压力大幅缓解。

“加密夏季”热浪涌动传统资本市场对加密资产的信心回升,多家大机构推动区块链公司上市热潮。这波“Crypto Summer”势头迅猛。

Trump 持续推动行业变革前总统特朗普推动金融领域深度变革,支持股权代币化与稳定币立法,传统金融与加密行业的融合进一步提速。

加密纳入退休账户皆有可能最新行政令显示,美国或将允许401(k)等退休计划配置加密资产,为市场注入新的制度级动能。

市场动能与技术态势速报

整体市场情绪回暖,情绪指标已冲破“贪婪”门槛,多数币种今日大幅上涨。

Altcoin 开启活力潮:SOL、XRP、SHIB 等均录得 6–15% 不等涨幅,同时 DeFi 总锁仓(TVL)与 NFT 售量双双上扬。

ETH 强势突破 $4,200,创2021年后新高,ETF 带动资金正在回流。

鲸鱼持续加仓:以太坊大户净流入激增 270%,加持上涨趋势。

BTC 主导权震荡:比特币支配率接近 72% 阻力位,暗示资金有望逐步流向山寨币。

智能导读:行情解读 & 投资建议

趋势已启,时机可期

从主流币强势突破,到政策红利加速落地,再到情绪指数显著回升——一切都显示加密市场正驶向下一轮结构性上涨周期。既要抓住 BTC/ETH 的突破节奏,也不能忽视小币种的爆发机会。关键在于,顺势而为,稳步跟进,等待下一次爆发。