Author: David, Deep Tide TechFlow

The recent market has entered a typical period of low activity, with sentiment fluctuating between fatigue and anxiety.

During this quiet phase with little wealth effect, focusing on niche narratives is a cost-effective strategy, such as infrastructure that continues to be built and even quietly iterated.

About 1-2 months ago, we introduced Coinbase's x402 protocol and its associated ERC-8004 protocol relatively early. There was a 1-2 week window of opportunity then, and tokens related to this narrative saw significant gains.

(Related reading: Google and Visa Are Both Investing, What Investment Opportunities Are Hidden in the Underestimated x402 Protocol?)

In the previous analysis, I argued that the core narrative of x402 v1 was solving the problem of "AI owning a wallet," enabling AI Agents to perform on-chain payments via simple API calls. This was seen as a significant move by the Base chain in the AI sector at the time.

Although the logic was validated, x402 was limited by its single-chain environment and单一的结算模式, preventing it from exploding on a large scale.

Just yesterday, something many might have missed: the developers of x402 quietly released the V2 version.

If V1 was just an experimental tool allowing AI to "make payments," then the V2 changelog reveals greater ambitions:

Full-chain compatibility, hybrid crypto and non-crypto payment rails, and the crucial credit capability of "service first, payment later." These features aren't mere patches; they attempt to build a true financial底层 for a "machine commercial society."

It fits perfectly with the AI narrative.

You could say the crypto market lacks赚钱效应 right now, but it's not a bad thing to learn about the updates of protocols that are still alive.

What if you find some Alpha?

From Giving AI a Wallet to Letting AI "Buy Now, Pay Later"

For those who have forgotten what x402 is, here's a one-sentence explanation of the initial version's purpose:

"Revive the dormant 402 code in the internet protocol, enabling AI to automatically purchase data and services by calling APIs through a crypto wallet, just like humans swipe a card."

Although V1 made this logic work, it was cumbersome in practical application.

If your AI Agent had to sign a transaction and pay Gas fees on-chain every time it performed an inference or fetched data, this atomic, "pay-as-you-go" transaction mode would be extremely inefficient and costly.

This made V1 more of a technical demo than infrastructure capable of handling commercial traffic.

The core change in V2 lies precisely in its attempt to normalize AI's commercial behavior.

After carefully studying the V2 documentation, I believe the most noteworthy update is the introduction of the delayed payment mechanism.

The original text states:

This sounds technical. Translated into financial language, it roughly means:

Allowing service providers and AI to establish a kind of "accounting" relationship: The AI can first use the service through verification (e.g., calling a computing power interface 1000 times consecutively), the system keeps track in the background, and finally performs a one-time unified settlement.

This might sound like it just saves Gas fees, but from a narrative perspective, it means AI Agents begin to possess "credit."

Once "buy now, pay later" is allowed, the细分赛道 for speculation and narrative expands. For instance, the market will need to assess the default risk of these Agents, requiring someone to provide guarantees for newly created Agents.

This essentially lays the groundwork for AgentFi, evolving from a mere payment tool to the level of credit and finance.

Besides this hidden "credit layer," V2 has two other major, visible infrastructure updates:

-

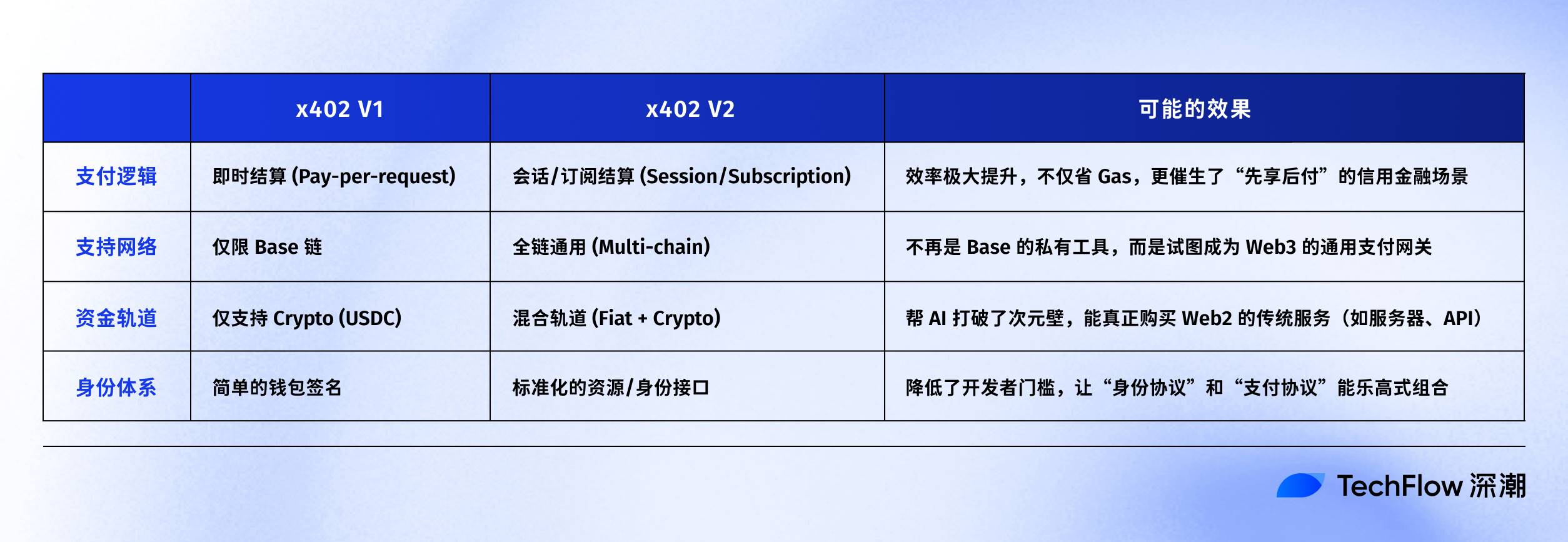

From "Base First" to "Multi-chain by Default": V1 had a strong experimental flavor within the Base ecosystem, while V2 defines a set of universal HTTP header interaction standards. This means that whether on Solana, Ethereum mainnet, or L2s, as long as they adapt to this standard, they can integrate. This breaks down the "cross-chain孤岛" of funds.

-

Hybrid Rails: V2 bridges the gap between fiat and cryptocurrency. An Agent can pay in USDC, and through the x402 gateway, traditional cloud service providers (AWS, Google Cloud) can directly receive fiat currency. This is a key step for AI to move from on-chain hype to procuring resources from the real world.

To understand the span of this iteration more intuitively, I've compiled a core comparison table between V1 and V2:

In summary, the V2 version seems intent on moving beyond being a toy on the Base chain, leaning more towards becoming the VISA network for the AI economy, attempting to issue AI a universally accepted "credit card":

-

Using "delayed payment" to solve the efficiency problem of high-frequency transactions.

-

Using "multi-chain compatibility" to solve the problem of funding sources.

For players seeking Alpha, the author predicts this might暗示 two sectors poised for revaluation:

-

Who will provide credit ratings and guarantees for these AIs? i.e., the AI credit rating layer.

-

Who can be the first to sellcomputing powerto AI through this streaming payment method? Potentially related to DePIN's payment落地.

Following the Clues, Which Projects Are Positioned at the V2风口?

After understanding the core upgrade logic of x402 V2, the思路 for finding targets becomes clear.

If x402 V2 is the "Visa settlement network" in the AI economy, then the following three types of protocols constitute the key nodes enabling this network to operate.

First Category: AI's Credit Bureaus and Fulfillment Layer

The introduction of the "service first, settle later" subscription model in V2 directly presents a challenge:

Why should a service provider trust that an anonymous AI Agent will pay as promised at the end of the month?

Solving this problem requires two layers of guarantee:一是credit score, judging if you have the money to pay, and二是fulfillment verification, judging if the job was done well. This is precisely where the narratives of x402 and ERC-8004, which we introduced earlier, intersect.

Some projects that clearly fit this narrative include:

-

Spectral ($SPEC), @Spectral_Labs

Positioning: On-chain credit scoring and machine intelligence network.

Connection: Spectral's core product is the MACRO score (similar to an on-chain FICO). In the x402 V2 environment, service providers can set thresholds: only Agents with a credit score above a certain level can enable the "post-payment" mode. This is the prerequisite for the "credit" logic to hold.

Spectral's正在推的 Inferchain aims to solve Agent verification issues, complementing the settlement needs of x402 V2.

-

Bond Credit, @bondoncredit

Positioning: A credit lending layer specifically designed for AI agents.

Connection: Currently one of the very few projects promoting the "Credit for Agents" slogan. When a new Agent wants to use cloud computing power via x402 V2 but lacks funds, Bond Credit uses TEE to monitor its historical performance, providing credit guarantees so service providers dare to enable "delayed payment."

Note: The project is in its early stages, DYOR. However, the赛道 is very vertical, filling a gap in AI lending.

-

CARV ($CARV), @carv_official

Positioning: Modular data and identity layer.

Connection: Solves the "who am I" problem. x402 V2 supports multiple chains; CARV's ID standard allows an Agent to maintain a unified identity across different chains.

Official tweets show testing of actual payment scenarios.

Incidentally, the "fulfillment verification" logic here再次印证了 our previous judgment in the article about the ERC-8004 standard.

x402 V2 handles the settlement of the "capital flow," while the ERC-8004 standard handles the verification of the "business flow."

Delayed payment is only triggered once service delivery is confirmed. The logic of the related赛道 we mentioned at that time is also applicable in this wave of x402 V2 updates. Re-sharing the chart:

(Related reading: As x402 Gets Crowded, Digging Early for New Asset Opportunities in ERC-8004)

Second Category: AI's "Utilities" and Inspectors

The "Session-based结算" of x402 V2 significantly reduces friction in high-frequency payments. Theoretically, this benefits DePIN selling computing power, as well as verification protocols that prove "computing power isn't fake."

Typical established protocols include:

-

Akash Network ($AKT)

Positioning: Decentralized computing power marketplace.

Connection: Computing power rental is a typical "per-second/per-usage" billing scenario. x402 V2 allows AI to use USDC or even fiat channels directly for streaming payments, greatly lowering the barrier for AI to purchase computing power.

Logically, this is more of a passive benefit; the connection is less direct.

-

Giza ($GIZA), @gizatechxyz

Positioning: Verifiable Machine Learning protocol (ZKML) and DeFi Agent applications.

Connection: Giza has a dual identity. As a technology layer, it acts as the "inspector" before payment settlement. Before paying expensive inference fees using x402, Giza's ZKML technology can prove "the model indeed ran as required."

As an application, its flagship products (like ARMA) are DeFi Agents that themselves rely on payment rails like x402 to operate.

Third Category: AI's "Asset Side" and Execution Layer

The narrative logic here is: if x402 v2 makes AI payments better, then who is producing these Agents? Who is using these tools to make money for users?

An old friend returns: Virtuals Protocol ($VIRTUAL).

As a leading AI Agent发行平台, x402 V2 essentially provides Agents on Virtuals with a "cross-chain passport." Users holding VIRTUAL-based Agents could, in the future, use the x402 protocol to command Agents to participate in Solana IDOs or arbitrage on the mainnet.

-

Brahma, @BrahmaFi

Positioning: On-chain execution and strategy orchestration layer.

Connection: Since Brahma's core business is helping users automatically execute complex DeFi strategies, they could use x402 to统一支付 the Gas fees and execution fees of various Keepers (executors), achieving full automation.

This also fits into a category of scenarios related to DeFAI. Key infrastructure for the transition from DeFi to AgentFi.

Conclusion

Finally, let's step back and冷静地思考 the signal sent by the x402 V2 release.

x402 is technically a payment protocol, but in the crypto context, it can lead to many financial玩法.

V2, by introducing "delayed payment (credit)" and multi-chain accounts, can also give AI the concept of a balance sheet.

When an Agent is allowed "service first, payment later," it acquires liabilities; when it can hold various assets across chains, it acquires equity.

Once it has assets and liabilities, AI is no longer just a code script but becomes an independent economic entity, and the玩法 become diverse.

This is the true starting point of the AgentFi (Agent Finance) narrative.

For speculation, in the current market downturn, there's no need to fantasize about how AI will build complex commercial empires in the future. Just focus on the changes in the most fundamental narrative logic:

Previously, we invested in AI at the model layer, i.e., "who is smarter"; in the future, we will invest in AI at the financial layer, i.e., "who is richer."

x402 V2 is just the starting gun. Once the market improves, keep a close eye on those issuing IDs for AI, doing credit scoring for AI, and turning computing power into retail commodities.

These are the kind of projects that sound very sexy, are hard to disprove, and have narrative foresight.

In the process of AI's narrative upgrade from a tool to an economy, these pick-and-shovel projects will collect the first wave of tolls, regardless of market bull or bear.