Crypto giant Binance has been granted three separate licenses from Abu Dhabi’s financial regulator, providing a green light to operate its exchange, clearing house and broker-dealer services under the Financial Services Regulatory Authority’s (FSRA) regulatory framework.

The FSRA, an independent financial regulator of the Abu Dhabi Global Market (ADGM), a financial free zone in Abu Dhabi, has approved licenses for Binance’s Nest Exchange Limited, Nest Clearing and Custody Limited, and Nest Trading Limited, according to a press release and announcement from Binance on Monday.

Richard Teng, the co-CEO of Binance, said in a statement the licenses provide regulatory clarity and legitimacy, enabling Binance to support its global operations from ADGM.

“While our global operations remain distributed, leveraging talent and innovation worldwide, this regulatory foundation offers our users peace of mind knowing Binance operates under a globally recognised, gold standard framework,” he said

“We are grateful for the FSRA’s forward-thinking approach, which safeguards users while fostering innovation.”

Binance could set up shop in Abu Dhabi

Binance doesn’t have an official corporate headquarters, which can dictate tax obligations and the regulations a company must follow.

Cointelegraph has contacted Binance for additional comment.

Related: Former Binance US CEO launches stablecoin platform ahead of L1 network

Under a February 2020 guidance, the FSRA outlines that authorised entities conducting regulated activities within the ADGM need to have “mind and management” operating out of the zone, which includes devoting resources to commercial, governance, compliance, surveillance, operations, technical, IT and HR functions.

Operating under the ADGM’s financial services regime provides Binance users with additional consumer protections, along with enhanced oversight from regulators, according to Binance. The exchange plans to start operating its “regulated activities” starting Jan. 5, 2026.

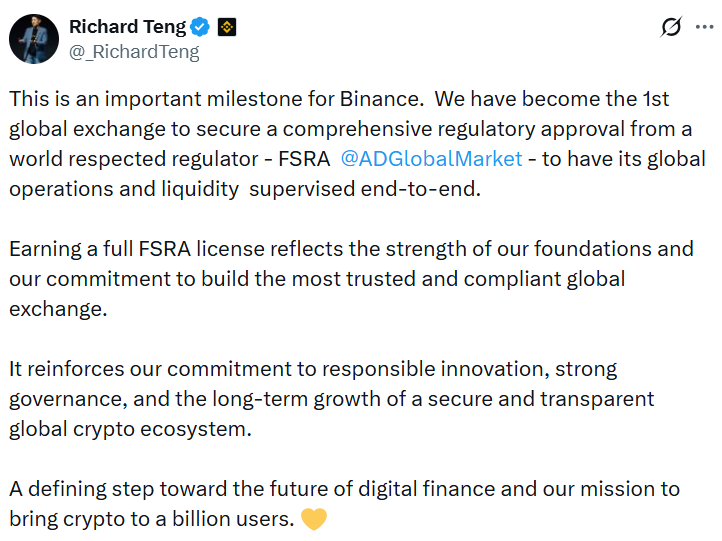

Teng said in an X post on Monday that it’s an “important milestone for Binance,” because it’s become the first global exchange to secure regulatory approval from a respected regulator, and will now have its international operations and liquidity supervised end-to-end.

Binance already has a foothold in the United Arab Emirates, with its virtual asset service provider license in Dubai, which it obtained in April 2024, and a $2 billion investment from MGX, an Abu Dhabi-based artificial and technology venture firm, in March.

Magazine: When privacy and AML laws conflict: Crypto projects’ impossible choice