撰文:Marine,MC² Finance Founder

编译:白话区块链

1:Balaji 称以太坊是加密货币的中左翼。Vitalik 致力于构建公共产品。他追求可编程的平等、去中心化的机构和公平的协调。

Balaji 属于中右翼。他追求选择退出、自主权。以太坊成为「技术官僚左派」的家园。

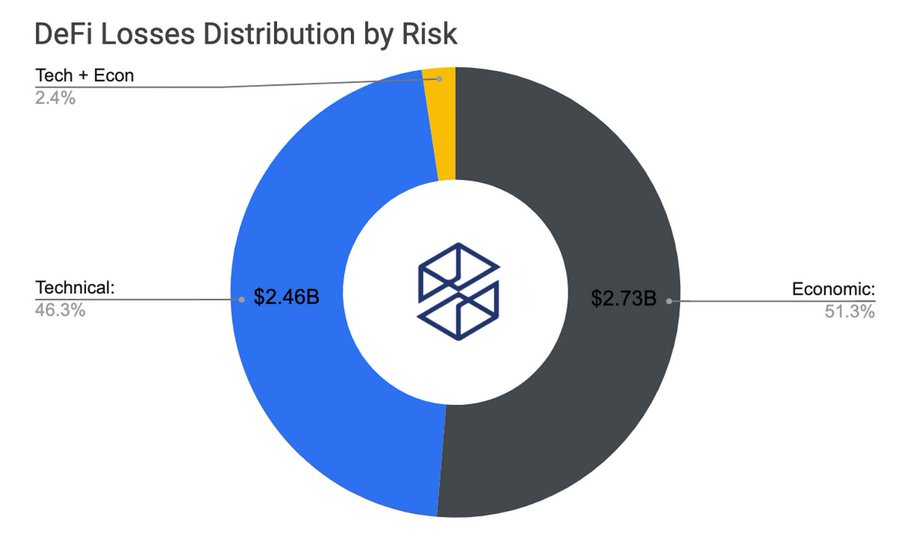

2:DeFi 正在变得更安全,但尚未完全安全。

Vitalik:「风险正在逼近传统金融。」

Balaji:「你冒着 100% 的损失去获得 5% 的收益。」协议只有在经历危机后才能真正安全,而不仅仅是审计。时间 > 总损失限额。

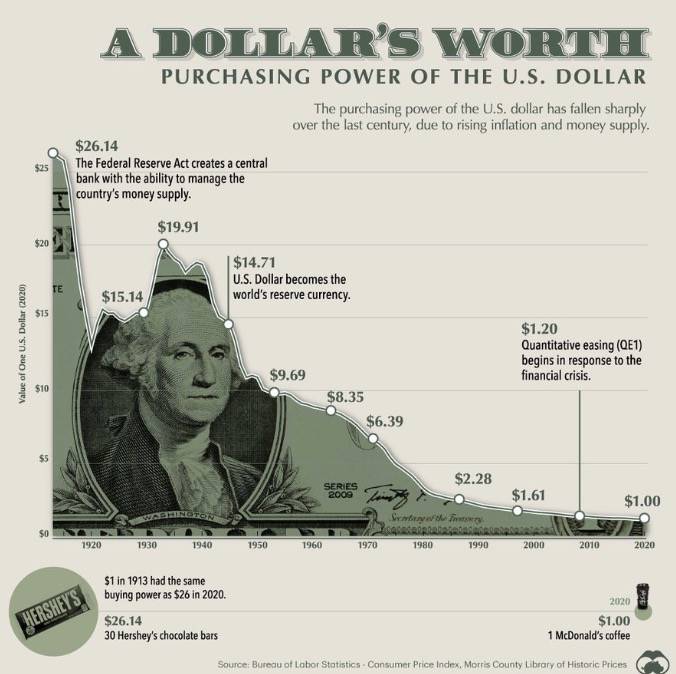

3:美元并不像你想象的那么安全。「只投资你能承受损失的美元。」这听起来像个梗。但对于阿根廷、尼日利亚和黎巴嫩的数十亿人来说,这已经是事实。稳定币现在是基础设施 ( 而不是实验 )。

4:DeFi 的定义正在改变。

Balaji:「它是系统结束后的接管者。」不是升级,而是替代。始终在线、无边界、可组合。 DeFi 不仅仅是更好的管道。它是价值的不同物理学。( 为此获得热烈掌声 )

5:加密货币不会削弱美元,但它会暴露美元。

Vitalik:99% 的稳定币支持美元。但这会巩固美元的主导地位,直到它不再如此。一旦法定货币首先上线,它就会失去其地理垄断地位。法定货币会像报纸一样消亡 ( 慢慢地,然后一下子全部消亡 )

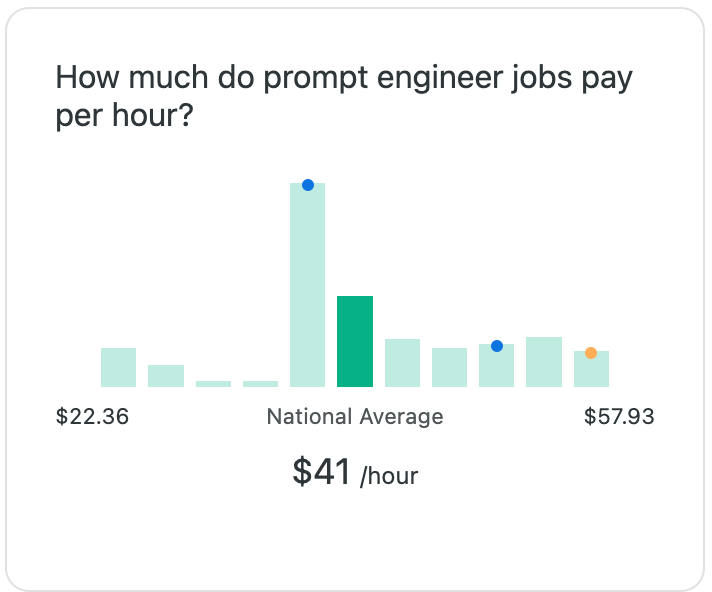

6:提示将继续存在。

Balaji:「提示就是用英语编程。」这不是一种解决方法,而是一种技能。人工智能不会取代人类,但它会放大最敏锐的人。清晰度=杠杆。

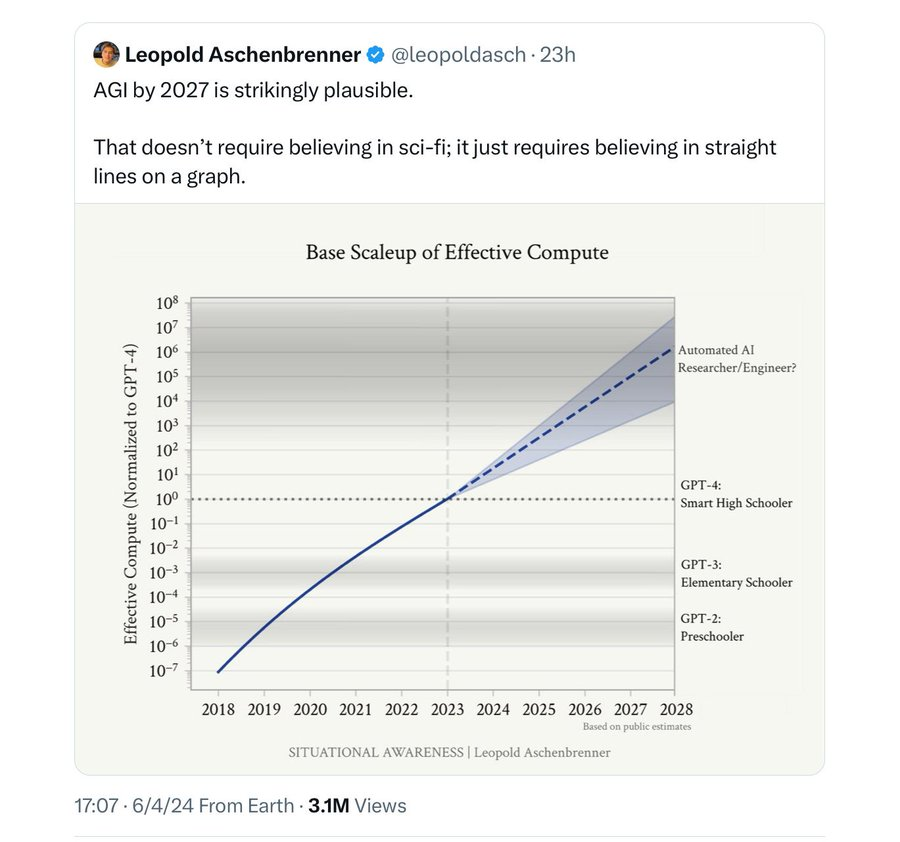

7:AGI?不是上帝,只是一位创始人。

Vitalik:「当 AGI 建立一家盈利的公司时,它就是真实的。」这是可衡量的。实用的。

Balaji 同意:人工智能不是目标寻求,而是模式匹配。世界仍然依靠人类意图运转。

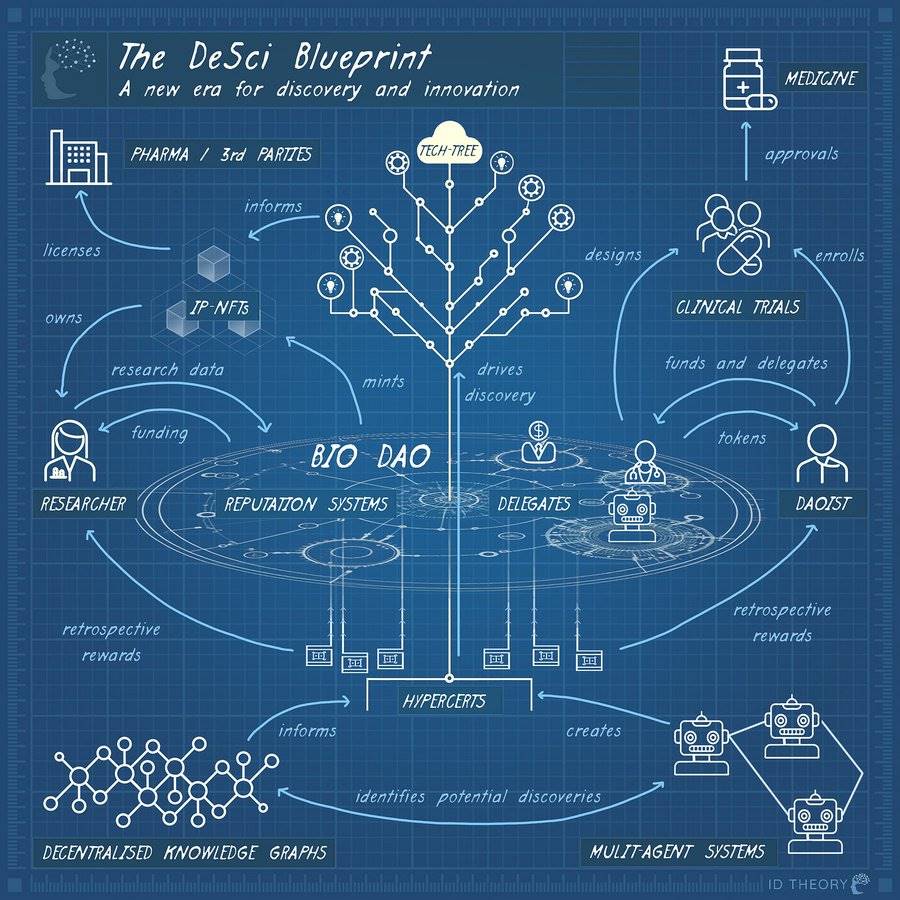

8:DeSci = 医学界的 DeFi。当今的医疗系统从疾病中获利。DeSci 则颠覆了这一点。真理至上。同行验证。科学即代码,而非制药营销。

Balaji 的赌注:DeSci 是制度衰败的真正替代方案。

9:以太坊需要一颗北极星。DAU?价格?TVL?

Vitalik:只要让人们使用它就行。

Balaji:DeFi 是后法定矩阵。一旦价值上线,一切都可以交易。没有银行的流动性。没有边界的市场。( 问了很多问题,我不能透露 xD)

10:系统不会改革。它将被重建。

Balaji 认为互联网与 DC 是对立的。

Vitalik 认为加密货币是一个更公平规则的体系。

两人都同意:旧世界正在崩塌。下一个世界不会建在 DC。它将被编码。在链上。