Key takeaways:

SOL funding rates signal low bullish conviction after a 46% price drop, despite Firedancer’s launch and rising Solana network transactions.

Solana DApp revenues and DEX activity have weakened sharply, suggesting broader market fatigue even as Solana’s ecosystem grows.

Solana’s native token, SOL (SOL), has failed to sustain prices above $145 for the past four weeks. A decline in network activity amid reduced demand for decentralized applications has negatively impacted SOL’s outlook.

With Solana’s TVL now down more than $10 billion from its September peak, onchain metrics are flashing signs that user participation is cooling faster than expected.

The total value locked (TVL) on Solana has been in decline since reaching its all-time high of $15 billion in September. Falling smart contract deposits increase the immediately available SOL supply for sale. Meanwhile, revenues from decentralized applications (DApps) on Solana dropped to $26 million per week, down from $37 million two months earlier.

Traders’ appetite for memecoins has also weakened since the cryptocurrency market flash crash on Oct. 10, an event that exposed critical flaws in leveraged positions and the overall liquidity of smaller altcoins. Regardless of whether derivatives markets amplified the move, traders became less comfortable with DEX platforms following the $19 billion liquidation event.

Memecoins have been a major driver for SOL, especially after the Official Trump (TRUMP) launch in January, which pushed decentralized exchange (DEX) volumes on Solana to $313.3 billion that month. According to DefiLlama data, this activity has since dropped by 67%, partly explaining the softer revenue trends across Solana DApps.

Still, the reduced demand for blockchain-based applications may reflect a broader market slowdown rather than a specific weakness in Solana.

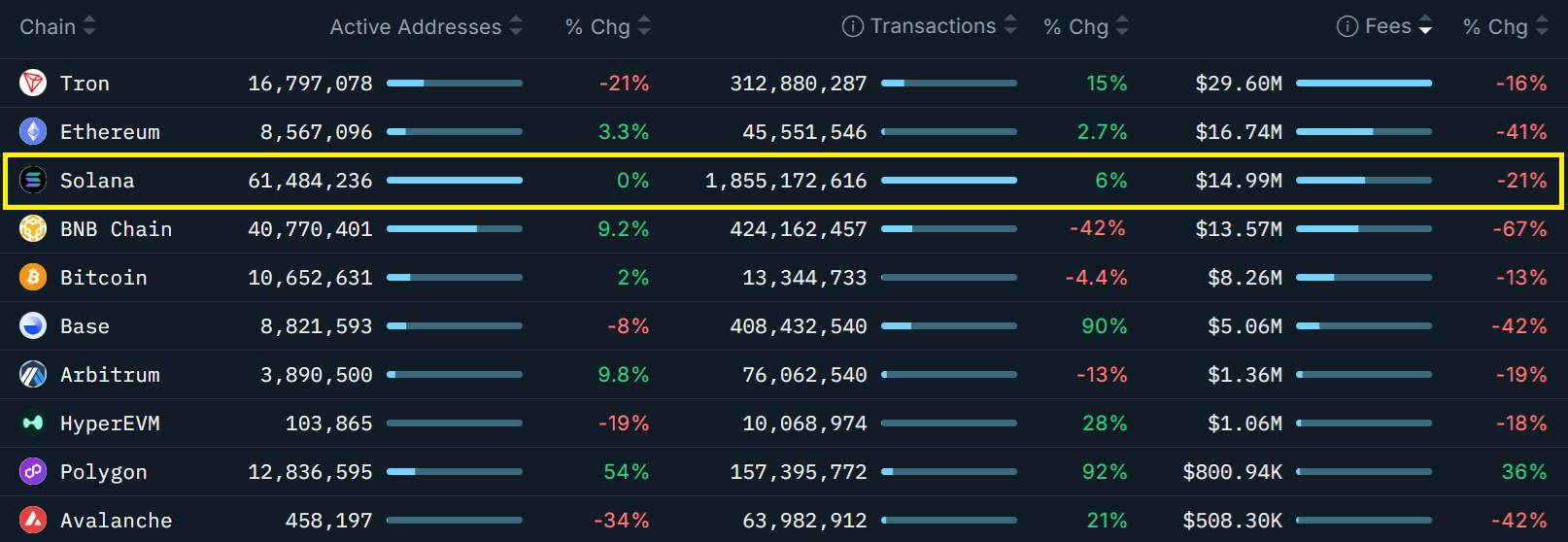

Solana network fees fell by 21% over the past 30 days, yet competing blockchains experienced steeper declines. Fees on the BNB Chain dropped 67%, while Ethereum saw a 41% decrease over the same period, according to Nansen data. Additionally, the number of transactions on Solana increased by 6%, while activity on the BNB Chain decreased by 42%.

SOL long leverage demand vanishes

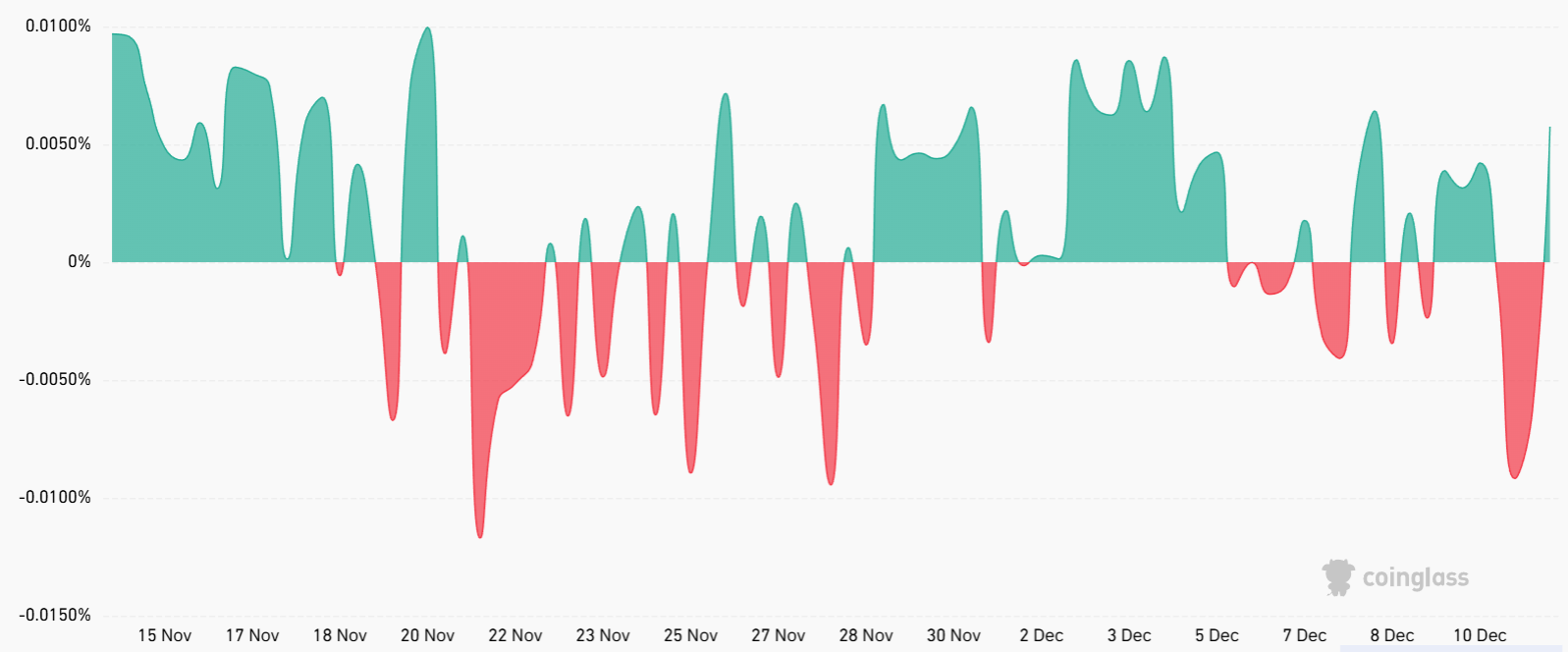

SOL perpetual futures can provide a useful gauge of traders’ sentiment, as exchanges charge either buyers (longs) or sellers (shorts) based on leverage demand. In neutral conditions, the funding rate typically ranges between 6% and 12% per year, with longs paying to keep their positions open given the cost of capital. Conversely, a negative funding rate signals broader bearish sentiment.

SOL’s annualized funding rate stood at 6% on Friday, showing weak demand for bullish leverage. The unusual 11% negative reading on Thursday should not be interpreted as heavy demand for bearish positions, as market makers moved quickly to stabilize imbalances. Still, it may take time for bulls to rebuild conviction after SOL’s 46% price decline over three months.

Several recent developments in the Solana ecosystem are expected to draw renewed investor interest, including Friday’s mainnet launch of Firedancer, a new validator client designed to expand processing capacity. The project took more than three years to build under the guidance of Jump Trading, one of the industry’s top market makers. Developers reported a strong response after the validator node re-synced in under two minutes.

Related: J.P. Morgan taps Solana for Galaxy’s tokenized corporate bond issuance

Kamino, the second-largest Solana DApp by TVL, also announced new products on Friday, including fixed-rate and fixed-term borrowing, offchain collateral, private credit and an onchain Bitcoin-backed institutional credit line. Kamino’s $69 million in annualized fees and an average 10% annualized yield on deposits offer a clear indication of the ecosystem’s expansion.

Whether SOL can reclaim the $190 level last seen two months ago remains uncertain, and it is unlikely that improved validation software or expanded DApp offerings alone will restore the confidence needed to support a sustainable bullish trend.

This article is for general information purposes and is not intended to be and should not be taken as, legal, tax, investment, financial, or other advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.