Bitcoin (BTC) price is under scrutiny again as veteran trader Peter Brandt is cautioning that BTC has violated its parabolic trendline, a technical feature that preceded deep drawdowns in previous bull markets. While the signal is bearish, the current market structure reflects a key difference from previous market cycles.

Key takeaways:

Peter Brandt said that Bitcoin has broken its current parabolic advance, a bearish signal that has previously led to drawdowns of more than 80%.

Despite the current risks, Bitcoin’s accumulation and adoption base is far stronger than in prior market cycles, according to data.

Bitcoin’s parabolic breakdown raises chance of 80% drop

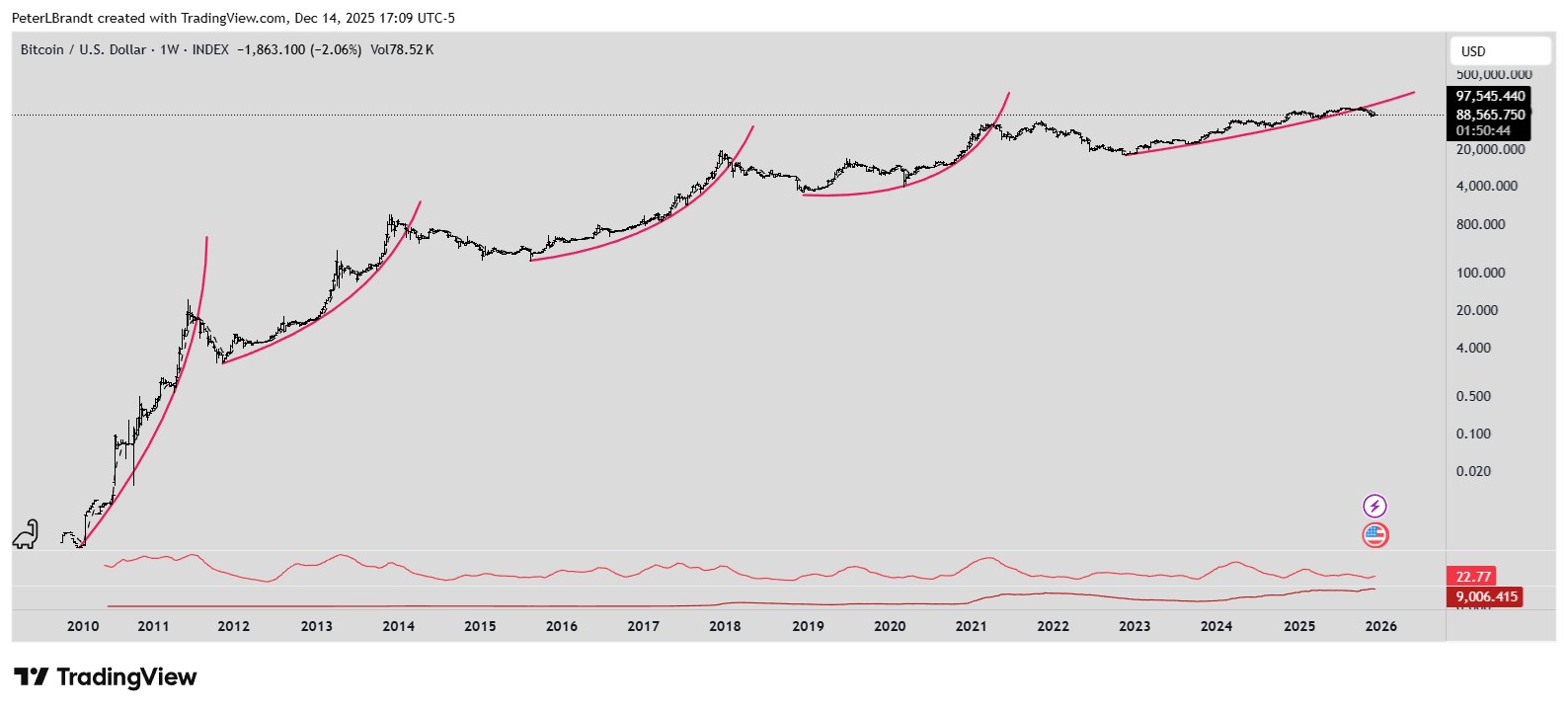

In an X post, Brandt highlighted that Bitcoin bull market cycles have followed parabolic advances with exponential decay over time. In each prior cycle, once a major parabola was violated, the price entered a prolonged corrective phase. Historically, these declines have peaked at less than 80% from the cycle high, but they have nonetheless been severe.

According to Brandt, Bitcoin’s current parabolic structure has already failed, with BTC down roughly 20% from its all-time high.

While this does not imply an immediate collapse, it places the market in a zone where downside volatility has historically expanded, particularly when global financial conditions tighten. If history repeats itself, an 80% decline for BTC would be a revisit to the $25,000 range over the next few months.

Macroeconomic pressure adds to the technical breakdown

The technical warning is unfolding as macroeconomic liquidity risks rise. Polymarket is pricing a Bank of Japan (BOJ) rate hike at a 97% probability, with markets expecting a 0.25% increase on Dec. 19.

In the past, the BOJ tightening has been hostile to global risk assets. When Japan raises interest rates, yen carry trades unwind, global funding conditions tighten, and leveraged positions are forced to deleverage. Bitcoin has reacted negatively to the last three BOJ hikes, falling roughly 27% in March 2024, 30% in July 2024, and another 30% in January 2025, according to a crypto commentator, Quinten.

Bank of Japan is about to hike rates with 0.25% on December 19

— Quinten | 048.eth (@QuintenFrancois) December 15, 2025

Bitcoin dumped the last 3 times the BoJ hiked interest rates:

March 2024 → -27%

July 2024 → -30%

January 2025 → -30% pic.twitter.com/GNjHyUIV3d

Related: Bitcoin to $40K? Macro analyst Luke Gromen turns bearish on Bitcoin

Why this BTC market cycle may be different

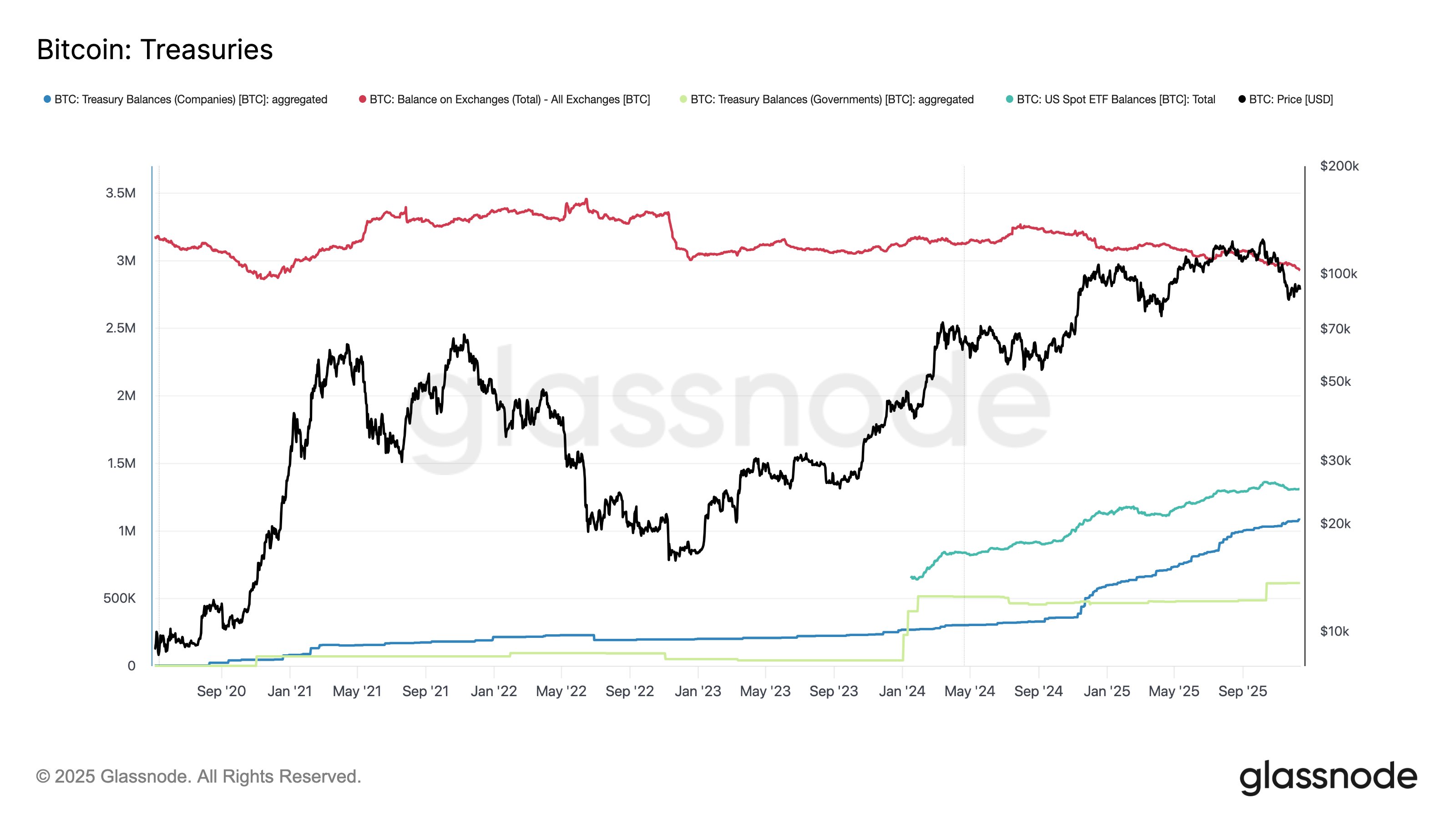

Despite the parallels, Bitcoin’s demand structure has evolved since 2022. Glassnode data shows that corporate Bitcoin treasuries have expanded from about 197,000 BTC in January 2023 to over 1.08 million BTC today — a 448% increase.

This growth reflected Bitcoin’s evolution into a strategic balance-sheet asset rather than a purely speculative trade. In addition, long-term holder supply remains elevated, and spot ETF products have introduced more stable, institutionally driven inflows.

While these shifts do not eliminate downside risk, they suggest that future drawdowns may be smaller and more absorption-driven than in past market cycles.

Related: Bears take over below $90K? 5 things to know in Bitcoin this week

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.