Daily key market data review and trend analysis, produced by PANews.

1. Market Overview

The global macro market is in the midst of a severe storm triggered by geopolitical games, fiscal crises, and the resonance of industry cycles, with both safe-haven sentiment and speculative fervor coexisting. Following the U.S. ICE shooting incident that led to the breakdown of Congressional budget negotiations, Polymarket data shows the probability of a U.S. government shutdown before January 31 has surged to 79%. Coupled with the Trump administration's tariff threats and purchase intentions towards Canada and Greenland, and the deployment of the U.S. aircraft carrier "Lincoln" to the Middle East in response to the Iran situation, global "credit devaluation" trading has reached a climax. Spot gold historically broke through the $5,000 mark, rising over 2.3% intraday to a high of $5,106, with Bank of America aggressively predicting it will reach $6,000 by Spring 2026; Spot silver, driven by rigid demand from the AI and solar industries, also broke through $109 to hit a record high, with institutions bullish up to $120.

In the forex market, expectations for a "Plaza Accord 2.0" with U.S.-Japan joint FX intervention have heated up sharply. A rare "inquiry" action by the New York Fed triggered short covering in the yen, with USD/JPY falling over 1% to a low of 153. Meanwhile, the Korean market moved independently, with the KOSDAQ index surging 6%, mainly due to explosive growth in the semiconductor industry. Driven by AI demand, global memory chip supply is extremely tight. Samsung Electronics raised Q1 NAND flash prices by over 100% and plans further increases in Q2. The spot premium rate for DDR4 is as high as 172%. Consequently, Goldman Sachs maintains a "buy" rating on Samsung Electronics and SK Hynix, noting that server ODM revenue has seen 13 consecutive months of high growth, indicating the establishment of a super cycle in the memory industry. In U.S. stocks, earnings reports from tech giants like Microsoft and Apple are due this week, but market sentiment is divided. Bloomberg strategist Mike McGlone and trader Peter Brandt both recommend shorting U.S. stocks and the dollar, believing U.S. assets have peaked. While Goldman Sachs strategists are optimistic about Asia, they also warn that global stocks have gone too long without a correction, and geopolitical risks could be a trigger for a pullback.

Bitcoin ended last week with a bearish candle, down over 7% weekly, finding support near $86,000. Matrixport pointed out that BTC has lost the key bull-bear dividing line of the 21-week moving average, with no reversal signal appearing in the market; Technical views are generally pessimistic. Peter Brandt confirmed the formation of a bearish channel and issued a sell signal. EliZ believes that if it breaks below $86,000/$85,800, the price will seek liquidity near $84,500 to $85,000. Daan Crypto Trades pointed out that $84,000 to $85,000 will be an important upcoming support level; Tai Bai analyzed that the weekly chart shows a bearish engulfing pattern, and if the trendline is broken, it could fall to $70,000 or even the $60,000s. Roman continues to be bearish towards $76,000. Rekt Capital warned that breaking below the macro triangle bottom at $82,000 would accelerate the decline. Murphy also emphasized that losing the $87,000-$88,000 range would damage long-term holder confidence, with key support below at $82,000. Despite this, bulls are not without hope. A Coinbase survey showed 71% of institutional investors believe BTC is undervalued between $85,000-$95,000. Astronomer insists on a weekly bullish view and has already entered a long position at $86,000. Sykodelic pointed out a CME gap at $89,500 and that liquidity in the $86,000 region has been absorbed. Castillo Trading believes the return of spot buying on Binance is the only signal for a market rebound. Placeholder partner Chris Burniske has formulated a ladder buying plan, focusing on buying opportunities at $80,000, $74,000, and $58,000, stating that he will continue to add positions if there is a major drop.

Ethereum's weekly loss was double that of Bitcoin, falling over 14%, once breaking below $2,800, a retreat of over 40% from its all-time high, severely testing market confidence. Man of Bitcoin issued a warning, noting that ETH has broken below the key level of $2,867, and a further break below $2,773 would宣告 the complete failure of the bullish pattern; BigBullMike believes it can only stabilize by climbing back above $2,900. On-chain data加剧了 the panic. Whale Alert monitored a dormant whale address from 9 years ago suddenly awakening and transferring 50,000 ETH (approx. $145 million) to Gemini exchange. This address still holds 85,000 ETH, and the potential selling pressure weighs on the market. However, Ted pointed out that ETH and the Russell 2000 index have shown a huge divergence not seen in years,暗示 a potential catch-up rally in 2026,保留 a glimmer of hope for long-term investors.

In the altcoin market, Meme coins on Solana finally saw some improvement. Over the weekend, the White House released an AI-generated image of Trump walking towards Greenland with a penguin, captioned "Embrace the penguin." This led to Binance Alpha, after a long absence, listing the Solana Meme coin PENGUIN. The token's market cap surged over 30 times at one point, skyrocketing to a high of $173 million, and has since回落 to around $85 million. Additionally, the automated tool Clawdbot gained attention for its utility. Despite token issuance controversies, its token $clawd recorded a maximum gain of 720x, with its market cap reaching a high of $17 million (currently回落 to around $9 million), and caused a shortage of Mac Minis.

2. Key Data (As of January 26, 13:00 HKT)

(Data sources: CoinAnk, Upbit, SoSoValue, CoinMarketCap, GMGN)

-

Bitcoin: $87,596 (Year-to-date +0.2%), Daily spot trading volume $50.36 billion

-

Ethereum: $2,895 (Year-to-date -2.26%), Daily spot trading volume $30.47 billion

-

Fear & Greed Index: 20 (Extreme Fear)

-

Average GAS: BTC: 1.75 sat/vB, ETH: 0.02 Gwei

-

Market Dominance: BTC 59.2%, ETH 11.8%

-

Upbit 24-hour trading volume leaders: ENSO, NOM, AUCTION, XRP, ZKC

-

24-hour BTC Long/Short Ratio: 47.72% / 52.28%

-

Sector Performance: Crypto market generally down, GameFi sector led declines, down nearly 5%

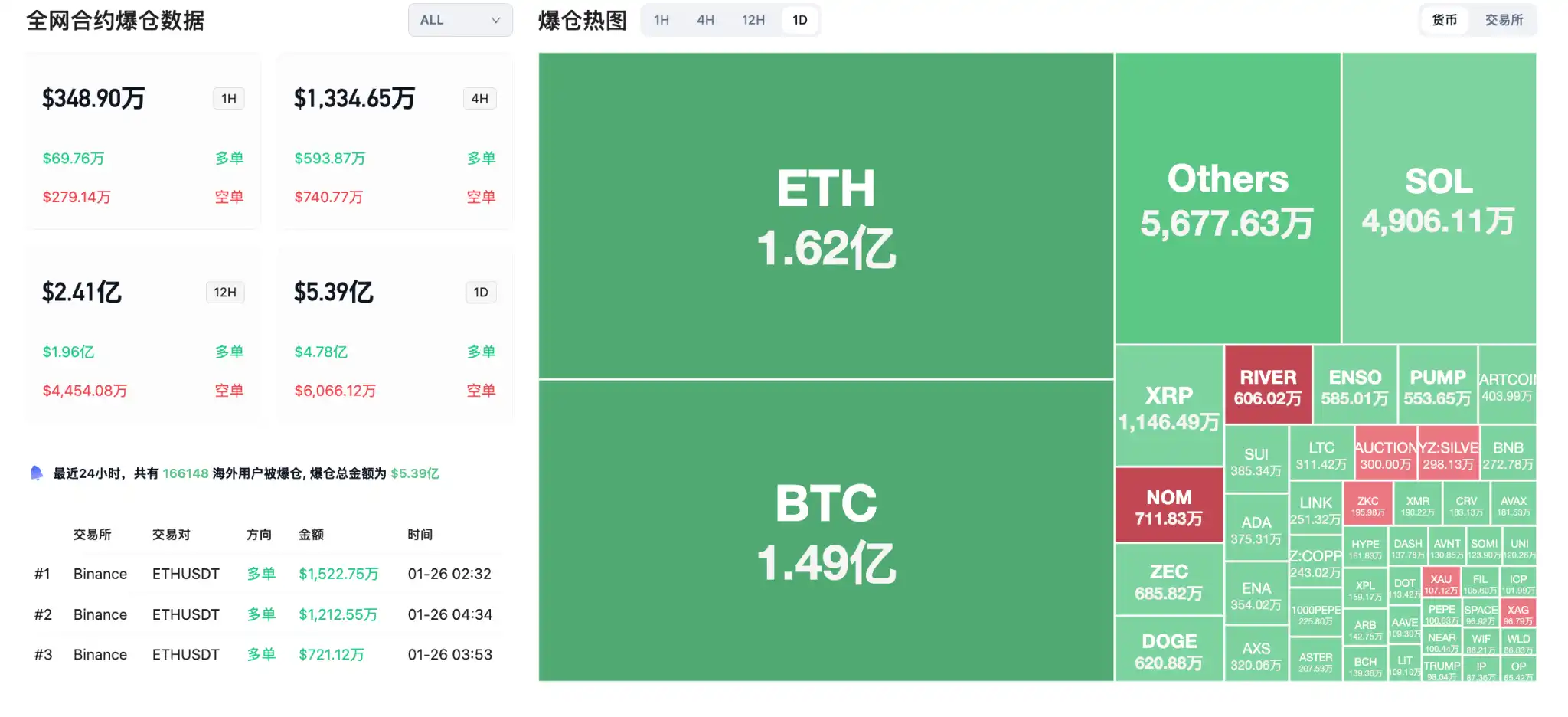

24-hour liquidation data: 166,148 people liquidated globally, total liquidation amount $539 million, including BTC liquidations $162 million, ETH liquidations $149 million, XRP liquidations $11.46 million

3. ETF Flows (As of January 23)

-

Bitcoin ETF: Net outflow this week $1.328 billion

-

Ethereum ETF: Net outflow this week $611 million

-

XRP ETF: Net outflow this week $40.64 million

-

SOL ETF: Net inflow this week $9.5736 million

4. Today's Preview

-

VanEck Avalanche spot ETF will begin trading on Nasdaq on January 26

-

Base network Perp DEX protocol RollX: First batch claim deadline until January 26

-

Fabric plans to launch ROBO token, public sale on Kaito starts January 26

-

Huma Season 2 Airdrop Part 2 opens, claim deadline until January 26

-

SEC and CFTC will host a "Regulatory Coordination" joint crypto-themed event on January 27 at 23:00

-

OKX OKX will delist ULTI, GEAR, VRA and other spot trading pairs

-

Impossible discloses Flying Tulip presale details, public round starts January 27

-

U.S. Treasury Secretary Besant: New Fed Chair appointment to be announced as early as the week of January 26 (Weekly event)

Today's top 100 coins by market cap, biggest gainers: River up 31.4%, Morpho up 1.6%, Algorand up 1.4%, LEO Token up 1%, Tether Gold up 0.8%.

5. Hot News

-

Data: SIGN, JUP and other tokens are about to see large unlocks, with SIGN unlock value approx. $12.2 million

-

Week Preview | SEC and CFTC host "Regulatory Coordination" crypto-themed joint event; Moonbirds to launch BIRB token on Solana blockchain

-

A wallet received 465,000 HYPE from Galaxy Digital OTC, worth $10.32 million

-

Optimism releases Superchain anti-quantum roadmap: ECDSA EOAs to be phased out within 10 years

-

A dormant 9-year ETH whale transferred 50,000 ETH to Gemini, worth approx. $145 million

-

Spot silver breaks through $107 for the first time, up over $35 month-to-date

-

WLFI transferred rewards from the USD1 holding activity treasury to Binance, totaling WLFI tokens worth $40 million

-

Japan may lift ban on crypto ETFs in 2028, SBI and Nomura are advancing related product development

-

Spot gold historically breaks through the $5,000 mark

-

Space public sale refund details: Total $12.3 million, top 5% participants only refunded 11% to 21%

-

Tether Gold market cap breaks $2.5 billion, hitting a new all-time high

-

World Gold Council survey: 95% of central banks will continue buying gold in the future, USD's share of global forex reserves falls below 60%