Author: Dave

Have you ever experienced a situation where, after buying some altcoins, the price keeps moving in the opposite direction in a short time, as if the "whales" are targeting you? Why does this happen? Is it really a conspiracy by the whales?

This post will introduce the market maker's quoting system and unveil the mystery behind the "whale conspiracy." The conclusion is: prices often move against us not due to subjective manipulation, but rather due to Inventory-based pricing quote skew under the Avellaneda–Stoikov model and the protective mechanisms for handling toxic flow. How exactly? Once upon a time...

First, let's understand the concept of inventory. Everyone knows that market makers are not directional investors. Under strict hedging, spot price changes should not affect the total P&L. At this point, holding inventory is a "passive" behavior. Changes in inventory lead to an expansion of positions—the more positions you hold, the greater your risk exposure to adverse price movements. At this time, retail buying and selling orders cause changes, and market makers react to the risks brought by these inventory changes.

In a nutshell: you break their balance, and the MM has to protect themselves and try to return to equilibrium. The means of protection is the quoting system.

1. Quote Skew

When the MM is heavily bought by you, it is equivalent to: the MM has sold heavily, and the inventory becomes a short exposure. What does the MM hope to do at this time: (1) Replenish the inventory as soon as possible. (2) Protect the exposed short position.

The MM's reaction is: lower the price to attract selling, prevent further buying, and ensure that their net short position remains temporarily non-loss-making, giving them time to hedge.

2. Spread Widening

When the inventory continues to deteriorate, the MM not only skews the price but also widens the spread to reduce the probability of execution.

Their goal is to reduce the risk of execution per unit time while earning more through spread profits to protect against price losses.

While writing this article, every additional mathematical formula reduces the number of readers by 10%, but in case some小伙伴们 want to see something substantial, I'll briefly introduce the formation of quotes (which is also the mathematical mechanism behind the above quote changes).

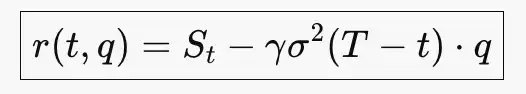

The price at which we trade with the market maker is called the Reservation Price, which comes from the Inventory-based pricing model:

Reservation Price = Mid price − γ⋅q

q: current inventory

gamma γ: risk aversion coefficient

Actually, the Reservation Price looks like the following, but I don't want to gross you out, so just take a glance:

When retail traders buy or sell heavily, q changes significantly, causing the Reservation Price to change significantly. The exact amount of change comes from the Avellaneda–Stoikov model. As you might guess, since buying and selling cause small changes in inventory, this model is a partial differential equation. Guess what? I'm not interested in deriving this equation either, so we only need to know the core conclusion:

The optimal quote is symmetrically spread around the Reservation Price. Inventory must mean-revert to 0. The optimal spread widens with risk.

If you don't understand the above, it's okay. Just know that after retail buying, prices often move against the bullish direction, essentially because our flow changes the market's risk pricing. The reasons retail traders often encounter this situation are:

• Retail traders are almost always takers.

• Concentrated size, non-stealthy timing.

• No hedging.

• No time slicing, no order splitting.

In small altcoins, this situation is even more severe because altcoin liquidity is poor. Often, your order is one of the few aggressive orders in a 5-minute window. In large-cap assets, natural hedging might occur, but in small coins, you are the whale's counterparty.

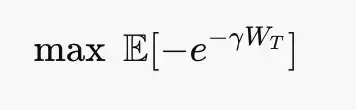

So professional MMs are not trying to crush you; they are maxE[Spread Capture]−Inventory Risk−Adverse Selection. Actually, their objective function looks like this, with inventory risk being exponentially penalized:

Readers who have made it this far must be韭菜 with dreams of becoming whales. So, to激励 the brave, here's a little trick to利用 the quoting mechanism. We said retail traders often have concentrated size and non-stealthy timing—so just do the opposite. Suppose Dave wants to go long 1000U. Instead of going all in at once, using the whale's method, first buy 100U. The quoting system will lower the price, allowing me to build a position at a cheaper level. Then I buy another 100U, and the price will continue to drop, so my average entry cost will be much cheaper than going all in at once.

The story of retail misfortune is only half told here. Besides inventory management and quoting factors, the MM's handling of order flow is another element causing price divergence—the toxic flow mentioned at the beginning. In the next part, I will introduce the market maker's order book and order flow, and I will also speculate on the micro-market reasons behind the 1011惨案.

To find out what happens next, stay tuned for the next episode.

"The Advancing MM 2: Market Maker Order Book and Order Flow"

"The Advancing MM 3: Statistical Edge and Signal Design"