Original Author: Julie Chen(@0xJuliechen)

a16z raised $1.5 billion. What exactly is the 'new media' they are betting on?

On X, everyone is a KOL, with millions of traffic every month. Traffic is no longer valuable. What is valuable is attention, the power of 'belief,' and the right to scarcity.

This article explains a16z's new media, agency (the power to act), how to make traffic meaningful on Twitter, and ICM.

🌟🌟

@a16z raised $1.5 billion at the beginning of the year, making headlines across major platforms. They raised so much money to tell a story of "all in on America, believing in AI + crypto and technology."

Two months ago, they specifically established a new media team to help a16z itself and its portfolio companies do "new media."

In Silicon Valley's AI/Web3 companies, there have been recent hires, with heavy rewards for finding a "storyteller"—someone who can write threads, shitpost, and tell stories.

a16z's new media partner directly stated: Marketing majors have replaced computer science as the "hot commodity."

What a16z has truly valued in recent years is not the content itself, but the way power is restructured.

New media is just the surface.

The real change is: Who has the qualification to make people act (agency).

1️⃣ Why has 'New Media' been elevated so highly in the past two years?

Because the path of the attention economy has basically run out of tricks.

- Extreme content surplus

- Distribution costs are nearly zero

- Being seen no longer constitutes an advantage

What is truly scarce now is not exposure.

It's two things:

- Is your judgment trustworthy?

- Can you turn "belief" into "action"?

This is also why you can clearly feel a change:

In the past, media was about telling stories and setting narratives;

Now, media is starting to directly influence decisions and trigger actions.

When content is no longer scarce,

What becomes truly valuable is no longer 'what you said,'

but—what happens next.

This is the core meaning behind a16z's repeated discussion of new media.

It's not about the forms like threads, podcasts, or short videos,

but that the distribution structure has changed, and the power structure has changed along with it.

A simplest comparison:

Old Media

- Scarce distribution (TV, newspapers, platforms)

- Value concentrated in institutions

- Creators are essentially employees

New Media

- Decentralized distribution (X / YouTube / Substack / Podcasts)

- Individuals themselves become nodes

- Creators directly accumulate influence and bargaining power

The real change can actually be summed up in one sentence:

Media has changed from an institutional asset to personal capital.

And once media becomes personal capital,

it is no longer just an "exposure tool,"

but begins to become a tool of power.

When media belongs to an institution, it is your exposure tool;

When media belongs to an individual, it becomes your ability to influence others' decisions.

And influencing decisions is power.

2️⃣ Agency (The Power to Act)

The end goal of new media is not page views,

but agency (the power to act).

Agency means others are willing to act with you, trust your judgment, and pay for your concepts.

Packy mentioned in 《The Power Brokers》:

The goal of a Fund is to earn carry with as few people as possible, in as short a time as possible.

A Firm's goal is to continuously compound long-term advantages through scale.

This distinction explains one thing:

Why in traditional VC, media capability has always been "icing on the cake";

While at a16z, this has been directly made into infrastructure.

For a long time, the default order was:

Money → Company → Market

Money came first, deciding everything.

But in a world of extreme media saturation, this order has flipped:

Agency → Community → Market → Capital

Why is it that now "there is a lot of money, but things are hard to do"?

Because capital no longer automatically translates into action.

- Distribution is not scarce

- Attention is extremely noisy

- Trust cannot be bought with budget

We've seen this many times in the crypto world (won't give examples to avoid offending people):

There's a lot of money, but projects still fail to cold start.

Valuations are high, but no one is really willing to participate.

The narrative is complete, but no one follows up with execution.

It's not because of insufficient money.

It's because there is no agency.

The truly scarce resource now is not capital.

It is:

- The ability to make a group of people believe in the same thing simultaneously

- The ability to make them act at the same point in time

Whoever can do this,

holds the real leverage.

So I am not praising, but using a16z to explain a structural change that is happening.

3️⃣ What does New Media solve? What is it still missing?

If media can form consensus, and consensus can drive action, then the market is the settlement layer of consensus.

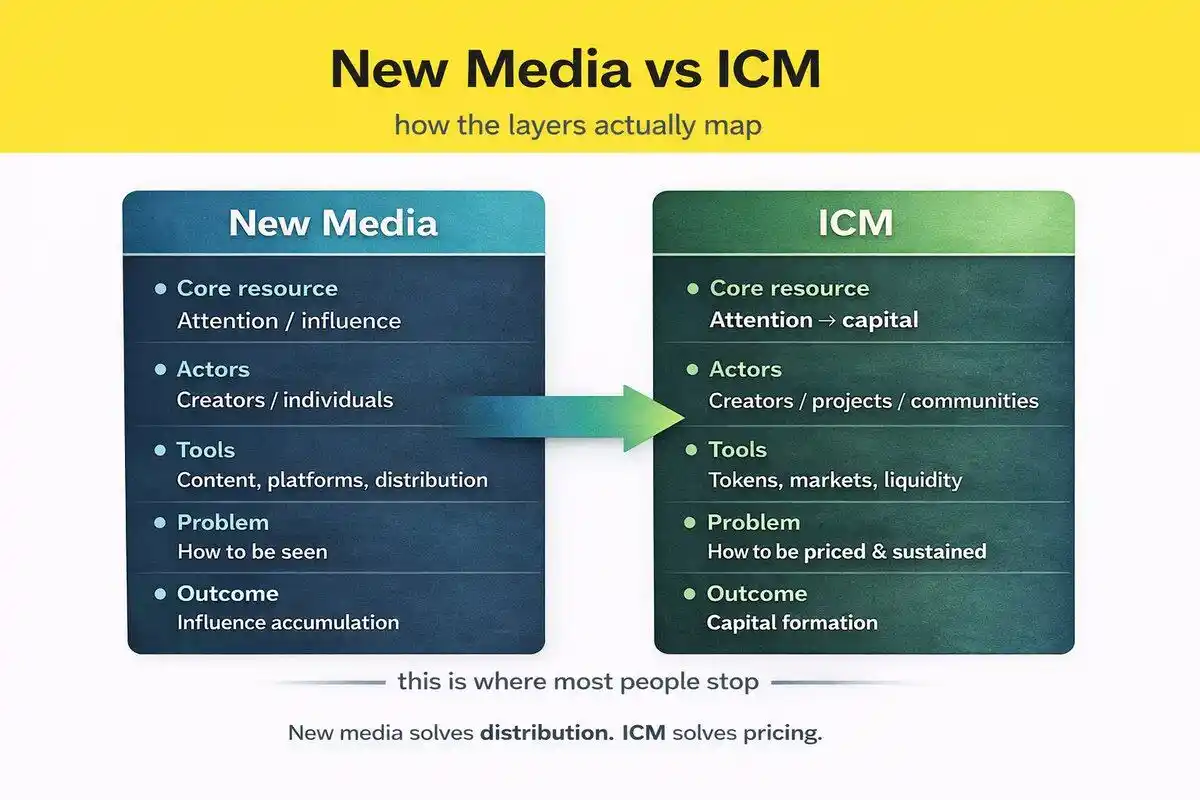

Why ICM (Internet Capital Markets) necessarily appears after new media:

Because new media has a natural structural defect:

- Influence ≠ Ownership

- Traffic can be monetized, but it is not composable, not holdable long-term

- Creators still rely on platform revenue sharing, brand partnerships, advertising cycles

The concept of ICM was first proposed by @solana. It fills in precisely this gap:

- Transforming narrative / consensus / culture

- Into a tradable, holdable, collaborative capital structure

ICM solves the next-step problem for new media:

How is influence priced, traded, and sustained?

To differentiate in one sentence:

- new media:→ Who can gain attention

- ICM:→ How attention becomes a capital structure

Conclusion:

New media solves the "right to disseminate," ICM solves the "right to price."

The essence of ICM:

- Turning attention → agency → pricing → capital formation

- Not a speculative tool, but coordination infrastructure

Closing

Finally, I want to quote my favorite saying from Naval Ravikant to echo this point and conclude the article.

Naval said: Code and media are the leverage behind the new wealthy class.

Indeed, over the past 10 years, Silicon Valley's nouveau riche and big tech companies (internet / software / AI) have essentially relied on "code leverage" to create wealth.

With the proliferation of Cursor and Claude, everyone can vibe code; the ability to code is becoming less scarce. There are even predictions that all entry-level programming jobs will be replaced by AI within the next 10 years.

The truly scarce leverage in the next cycle is new media:

Namely, the scalable dissemination of narrative × judgment × taste. Good leverage can continuously generate compound interest while you sleep, influence others in your absence, and help you build "trust + reputation + opportunity access."

code is law

New media is the law.

Original article link