Quick Facts:

- ➡️ Brazil’s Central Bank is drafting rules requiring stablecoins to be 100% backed by reserves, effectively banning algorithmic models.

- ➡️ The regulation signals a global shift away from speculative financial engineering toward compliant, backed assets.

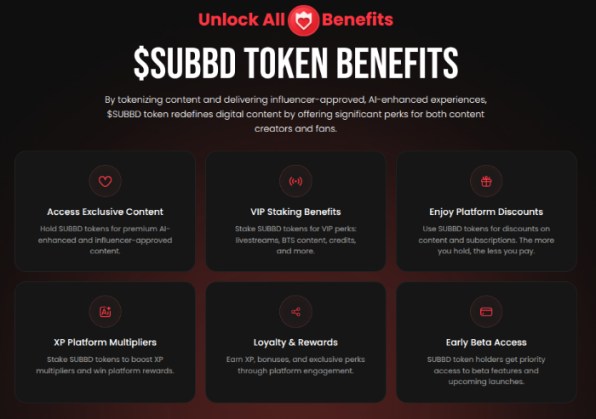

- ➡️ SUBBD Token ($SUBBD) leverages AI and Web3 to reduce creator fees and decentralize the $85B content industry.

- ➡️ Capital is rotating from regulatory-risk sectors into utility projects with tangible revenue models and infrastructure.

Brazil’s Central Bank (BCB) is drafting regulations that could wipe algorithmic stablecoins off the map in Latin America’s largest crypto market. Following Law 14,478 (the ‘Crypto Assets Law’), regulators have taken a rigid stance: asset-referenced tokens must be fully backed. No arbitrage tricks, no complex debt positions—just 1:1 reserves. This pivot threatens the very existence of decentralized stablecoins in the region.

It puts Brazil in lockstep with the EU’s MiCA framework, prioritizing safety over financial experiments. For issuers like Ethena ($USDe), or ghosts of cycles past like Terra’s $UST, the compliance window is shutting fast.

The BCB’s consultation papers suggest that without direct convertibility to the Real or a foreign currency, “stable’ assets face an outright ban. That’s huge for DeFi liquidity, considering Brazil is a global heavyweight in stablecoin adoption.

As regulatory walls close in on financial engineering, smart money is rotating toward sectors with actual cash flow. The speculative premium on ‘money games’ is vanishing. In its place? Infrastructure projects solving real headaches.

This rotation is starkest in the $250B creator economy, where platform risk is a daily reality, not a theory. Amidst this flight to quality, SUBBD Token ($SUBBD) has emerged, merging AI efficiency with blockchain transparency to dismantle the monopolistic fees of Web2.

AI Integration Solves The $85 Billion Creator Monetization Gap

While regulators squeeze complex derivatives, the content sector faces a different crisis: middlemen taking up to 70% of the cut. SUBBD Token ($SUBBD) tackles this by using Ethereum architecture to cut out the intermediary, but it goes beyond simple payments.

The platform aims to integrate proprietary AI tools, like an AI Personal Assistant and voice cloning tech, directly into the workflow. Suddenly, influencers can scale output without bloating their costs.

Here’s the difference. Most ‘creator coins’ are just speculative toys. SUBBD Token ($SUBBD) acts as the fuel for an entire ecosystem. By gating exclusive content and powering AI tools, the project creates deflationary pressure that algorithmic stablecoins often lack.

Creators aren’t just paid in crypto; they use the infrastructure to actually build their product.

The governance model flips the script. $SUBBD holders vote on features and onboarding, shifting power from opaque corporate algorithms back to the community. For investors tired of regulatory headaches in DeFi, this looks like a pivot to ‘revenue-based’ assets. It’s a hedge against the macro volatility rocking purely speculative markets.

FIND OUT MORE ABOUT SUBBD TOKEN ON ITS OFFICIAL PAGE

$SUBBD Presale Momentum Builds Amid Shift To Utility Tokens

The market’s hunger for utility is showing up in the numbers. SUBBD Token has already raised over $1.4M in its presale. With the token currently priced at $0.05749, early entrants see potential upside compared to legacy platforms lacking Web3 integration. However, a price increase is looming, so if you want in do so before the rise.

Not sure how to buy in? Check out our ‘How to Buy SUBBD Token‘ guide.

There’s a clear divergence in the market: DeFi TVL is stagnant, but AI-crypto hybrids are cooking.

It helps that the staking structure discourages ‘mercenary’ capital. $SUBBD offers a fixed 20% APY for the first year. Crucially, this yield comes from ecosystem growth, not the fragile arbitrage loops Brazilian regulators are hunting down.

Plus, stakers get XP multipliers and ‘Daily BTS drops,’ gamifying the experience (and aligning incentives).

Built on Ethereum, $SUBBD taps into deep liquidity while offering a specialized layer for content monetization. As Brazil forces the market to grow up, projects with clear revenue models are positioning themselves to capture capital fleeing regulatory grey zones.

CHECK OUT THE $SUBBD PRESALE ON ITS OFFICIAL PAGE

This article is not financial advice. Cryptocurrency markets are volatile and involve significant risk. Regulations regarding stablecoins and crypto assets vary by jurisdiction. Always conduct your own due diligence before investing.