A growing rift has emerged in Washington, D.C., between the cryptocurrency industry and labor unions as lawmakers debate whether to ease rules allowing cryptocurrencies in 401(k) retirement accounts.

The dispute centers on proposed market structure legislation that would allow retirement accounts to gain exposure to crypto, a move labor groups say could expose workers to speculative risk. In a letter sent on Wednesday to the US Senate Banking Committee, the American Federation of Teachers argued that cryptocurrencies are too volatile for pension and retirement savings, warning that workers could face significant losses.

The letter drew immediate pushback from crypto investors and industry figures. “The American Federation of Teachers has somehow developed the most logically incoherent, least educated take one could possibly author on the matter of crypto market structure regulation,” a crypto investor said on X.

In response to the letter, Castle Island Ventures partner Sean Judge said the bill would improve oversight and reduce systemic risk, while enabling pension funds to access an asset class that has delivered strong long-term returns.

Consensys attorney Bill Hughes said the AFT’s opposition to the crypto market structure bill was politically motivated, accusing the group of acting as an extension of Democratic lawmakers.

Related: Atkins says SEC has ‘enough authority’ to drive crypto rules forward in 2026

Opposition to crypto in retirement and pension funds mounts

Proponents of allowing crypto in retirement portfolios, on the other hand, argue that it democratizes finance, while trade unions have voiced strong opposition to relaxing current regulations, claiming that crypto is too risky for traditional retirement plans.

“Unregulated, risky currencies and investments are not where we should put pensions and retirement savings. The wild, wild west is not what we need, whether it’s crypto, AI, or social media,” AFT president Randi Weingarten said on Thursday.

The AFT represents 1.8 million teachers and educational professionals in the US and is one of the largest teachers’ unions in the country.

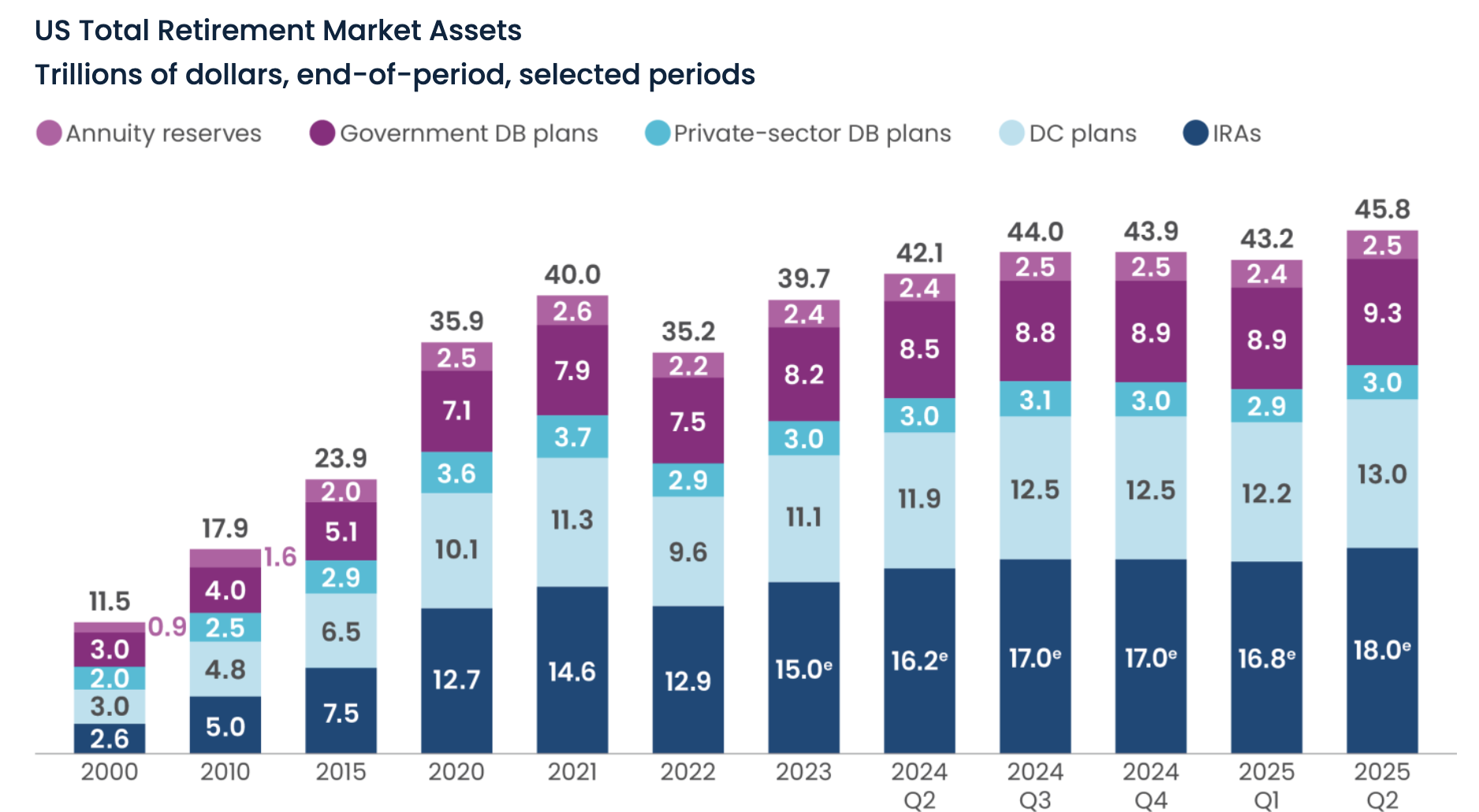

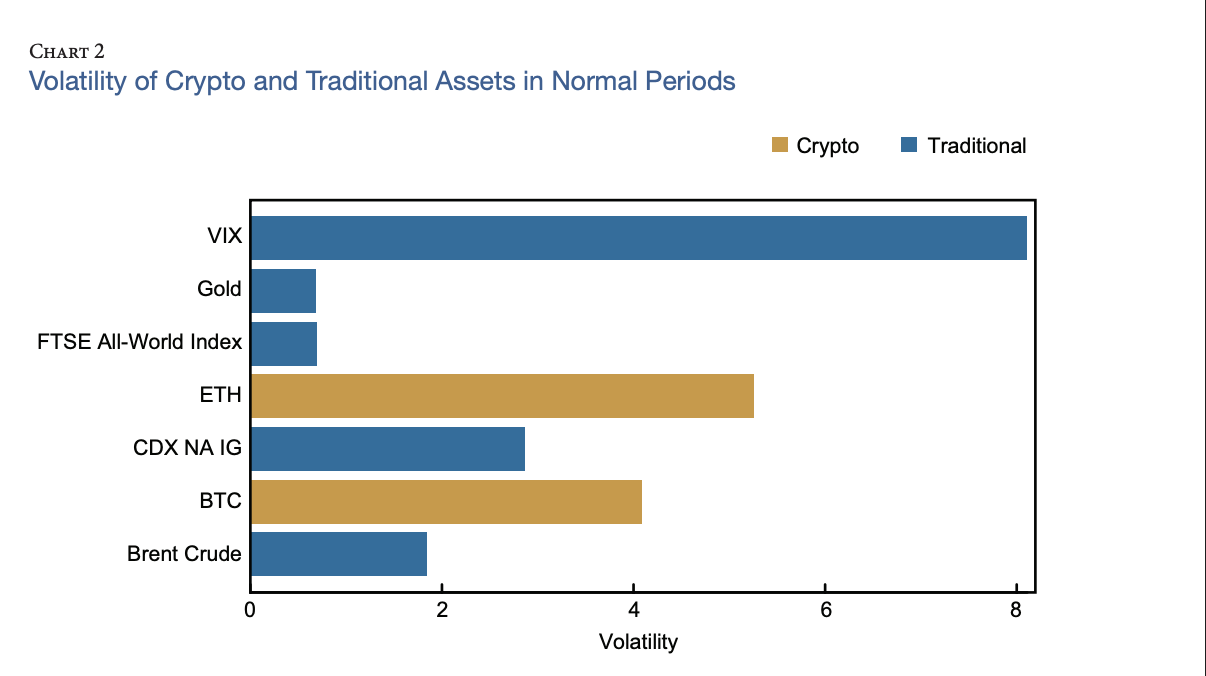

According to Better Markets, a nonprofit and nonpartisan advocacy organization, cryptocurrencies are too volatile for traditional retirement portfolios, and their high volatility can create time-horizon mismatches for pension investors seeking a predictable, low-volatility retirement plan.

In October, the American Federation of Labor and Congress of Industrial Organizations (AFL-CIO) also wrote to Congress opposing provisions within the crypto market structure regulatory bill.

The AFL-CIO, the largest federation of trade unions in the US, wrote that cryptocurrencies are volatile and pose a systemic risk to pension funds and the broader financial system.

Magazine: 13 Christmas gifts that Bitcoin and crypto degens will love