Recently, the Inland Revenue Department ("Hong Kong") of the Hong Kong Special Administrative Region updated its Frequently Asked Questions (FAQs), providing clarification for individuals who may be considered residents in both Mainland China and Hong Kong on how to determine their tax residency status according to the Tie-breaker Rules under the "Comprehensive Arrangement between the Mainland of China and the Hong Kong Special Administrative Region for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on Income" ("Comprehensive Arrangement").

With increasingly close economic ties between the two regions, cross-border work and dual-location living have become commonplace, with many people leading a lifestyle of "working in Hong Kong, living in the Mainland." When an individual meets the respective residency criteria of both jurisdictions simultaneously, the application of the tax regime and the Tie-breaker Rules play a crucial role. Click here to read the original text.

Overview of the Tax Arrangement between Mainland China and Hong Kong

Mainland China:

A Mainland tax resident individual refers to an individual who has a domicile in China, or an individual who has no domicile in China but has resided in China for an aggregate of 183 days or more in a tax year. Here, "domicile" is defined as the habitual abode within China due to household registration, family, or economic interests. In practice, the Mainland uses habitual abode as the core criterion, and retaining a Mainland household registration is likely to be presumed as having the intention for habitual abode, thus leading to classification as a Mainland tax resident.

Hong Kong:

A Hong Kong tax resident individual refers to an individual who ordinarily resides in Hong Kong, or an individual who stays in Hong Kong for more than 180 days during the relevant year of assessment or for more than 300 days in two consecutive years of assessment. Compared to the Mainland, Hong Kong's determination of tax resident individuals focuses more on the factual state of residence and the closeness of economic ties, rather than legal permanent resident status or household registration details.

Given the objective existence of differences in residency determination, calculation of the year of assessment, and other tax system variations, cross-border workers may simultaneously meet the residency standards of both places, facing the tax conflict issues arising from dual resident status. On August 21, 2006, Mainland China and Hong Kong officially signed the "Comprehensive Arrangement" to avoid double taxation and prevent fiscal evasion. Subsequently, both parties have signed several protocols to update the content, adapting to the development of international tax rules and promoting economic and investment exchanges between the two regions.

Logic of Tax Residency Determination: The Tie-breaker Rule

To resolve conflicts of tax jurisdiction, the "Comprehensive Arrangement" incorporates the Tie-breaker Rule. This rule is widely used in the field of international taxation and is an important mechanism for resolving conflicts arising from an individual's dual tax resident status due to differences in the laws of various tax jurisdictions.

According to the Tie-breaker Rule under the "Comprehensive Arrangement," the tax residency of an individual who meets the tax resident criteria of both Mainland China and Hong Kong is determined in the following order:

1. In which party does the individual have a permanent home available;

2. With which party are the individual's personal and economic relations closer (centre of vital interests);

3. In which party does the individual have a habitual abode;

4. The competent authorities of both parties shall settle the question by mutual agreement to determine of which party the individual shall be deemed to be a resident.

It is particularly important to note that these criteria are listed in order of priority. A subsequent criterion is used only if the preceding one fails to resolve the issue.

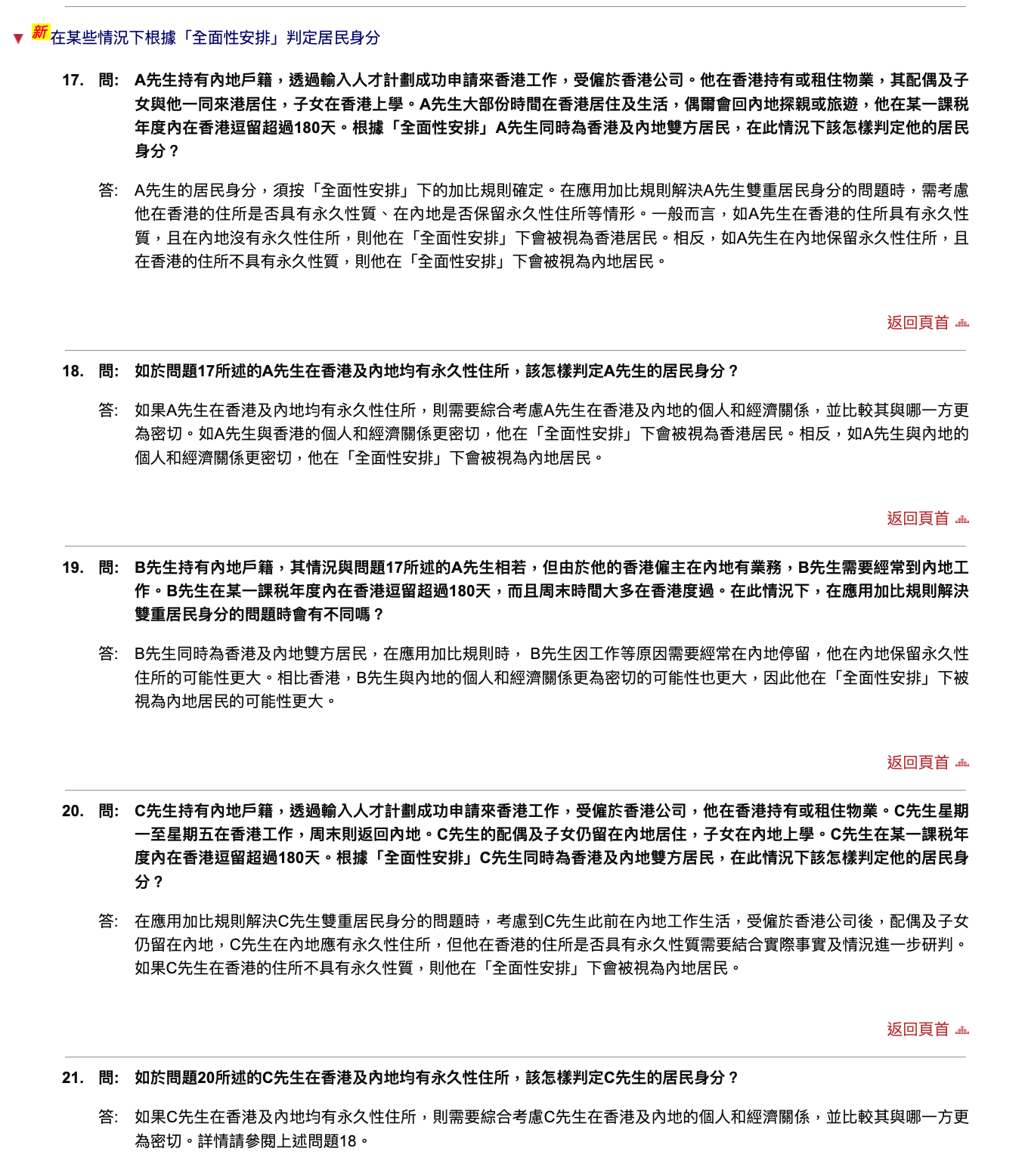

FAQ Update: How the Tie-breaker Rule Applies to Real-World Scenarios

The significant importance of this FAQ update lies in its use of more realistic examples (Q17-Q21) to demonstrate how an individual's tax residency should be determined under the Tie-breaker Rule in common scenarios such as "Talent Schemes" and the "Dual-City Lifestyle."

For various scenarios, the Hong Kong Inland Revenue Department does not provide absolute answers regarding tax residency determination but lists factors that may be considered when determining residency status. These include, specifically: the individual's Mainland household registration; the long-term place of living, work, and study of core family members such as a spouse and children; the location of held corporate shares; and the place of salary payment and social security contributions. These factors constitute strong evidence of "close economic ties."

Therefore, single elements such as an individual possessing a Mainland household registration or whether they stayed in Hong Kong for more than 180 days in a tax year are not decisive factors in determining residency status under the Tie-breaker Rule. Under the "Comprehensive Arrangement," such an individual may still be considered a Hong Kong resident. This does not mean that core standards like "number of days of stay" are unimportant; rather, the determination is made by considering multiple factors comprehensively through the Tie-breaker Rule.

Summary

Overall, this update to the Hong Kong Inland Revenue Department's FAQs does not represent a major systemic adjustment but serves as a practical guide—further clarifying the rules for determining tax residency for high-frequency cross-border individuals. As tax regulatory capabilities improve and the transparency of tax-related information increases, the determination of an individual's center of vital economic interests by the tax authorities of both regions will become more precise, and cross-border tax management is developing in a more refined direction.