Binance, the world’s largest cryptocurrency exchange by trading volume, is considering a strategic reshuffling to strengthen its presence in the US market, a move that could see Binance co-founder Changpeng “CZ” Zhao’s majority stake in the company reduced.

Zhao’s controlling stake in Binance has been a “major hurdle” to the company expanding to strategically critical US states, according to Bloomberg, citing people familiar with the matter. Although no concrete plans have been announced, the conversation surrounding any potential action remains reportedly “fluid.”

The company is also considering partnerships with US-based companies, including asset manager BlackRock and decentralized finance (DeFi) platform World Liberty Financial (WLFI), which is linked to US President Donald Trump, to strengthen its footprint in the country.

Rumors of Binance’s return to the US began to circulate in October after Trump pardoned Zhao, fueled by speculation from crypto industry executives and comments that Zhao made on social media.

“Will do everything we can to help make America the capital of crypto and advance Web3 worldwide,” Zhao said in October after the pardon.

In June 2019, Binance announced that it would stop serving US customers, and a separate company, called Binance.US and operated by BAM Trading Services, was formed to provide regulatory-compliant services to US users.

In 2023, the US Securities and Exchange Commission alleged that Binance Holdings Ltd. operated both Binance.com and BAM Trading Services.

Binance.US does not feature crypto derivatives or access to the global Binance exchange’s liquidity and operates as a completely separate crypto exchange.

Cointelegraph reached out to Binance and Binance.US but did not receive a response by the time of publication.

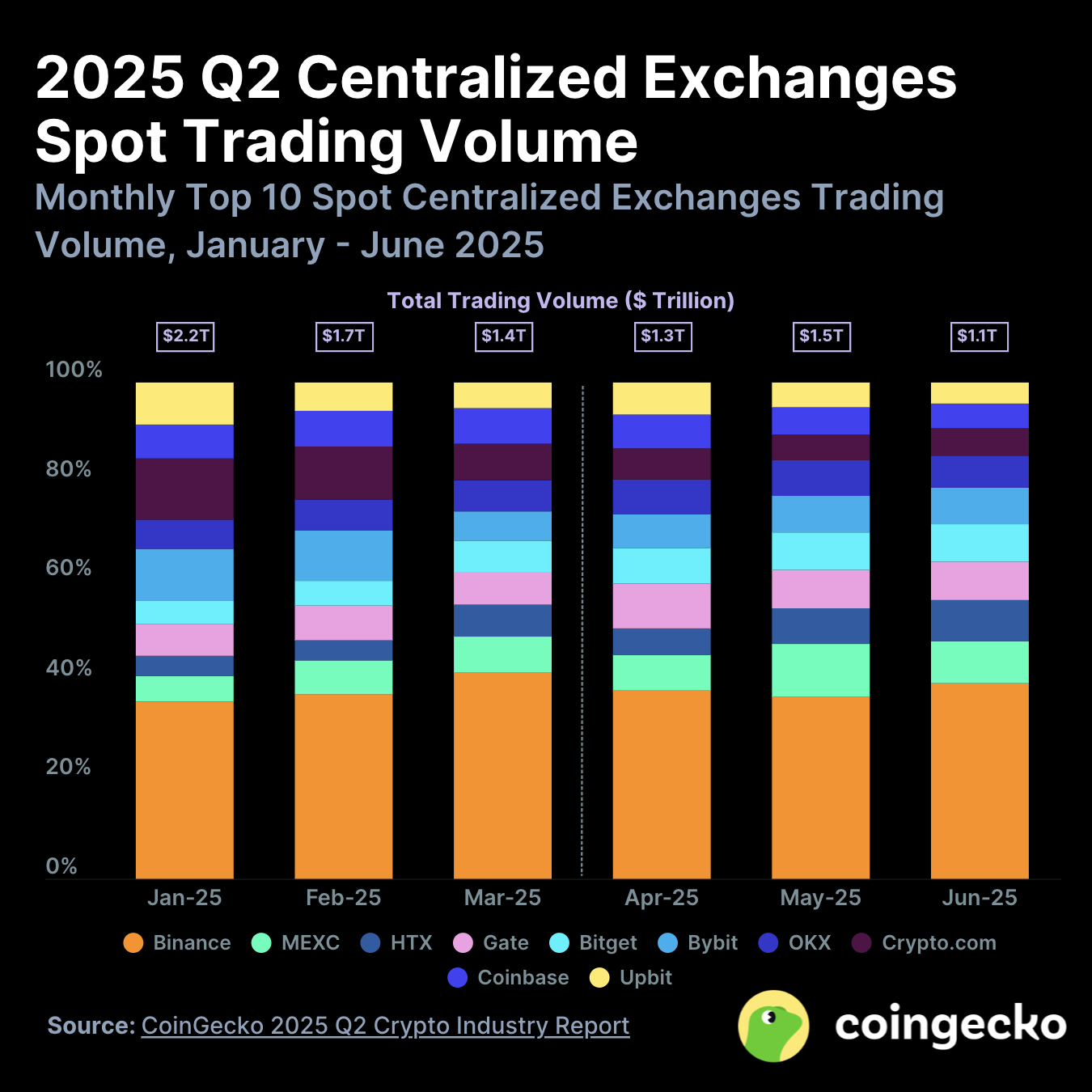

The US is considered a key market for crypto exchanges and is ranked as the number two for global crypto adoption, according to Chainalysis’ 2025 Global Crypto Adoption Index. Expanding to the US would open up US liquidity to the world’s largest crypto exchange.

Related: Binance names co-founder Yi He co-CEO alongside Richard Teng

Several US lawmakers voice opposition to the CZ pardon and the crypto industry

Trump’s pardon of Zhao in October drew backlash from several Democratic Party lawmakers in the US, including Massachusetts Senator Elizabeth Warren and California Congresswoman Maxine Waters.

Waters said the pardon was a form of pay-to-play and accused Trump of doing political favors for the crypto industry that “helped line his pockets.”

Warren, who is one of the most vocal critics of the crypto industry, also criticized the pardon, characterizing it as “corruption.”

The comments reflect pockets of resistance among some Democratic lawmakers to the crypto industry’s continued expansion in the US and could signal potential opposition to Binance returning to the US.

Magazine: Unstablecoins: Depegging, bank runs and other risks loom