Digital Frustration

Last year, a growing number of cryptocurrency commentators believed that China might be approaching a turning point on the issue of digital assets.

After People's Bank of China (PBOC) Governor Pan Gongsheng outlined a vision where the renminbi could challenge the hegemony of the US dollar, the term "warming up" was repeatedly mentioned.

However, on February 7th, the music stopped.

Amid the latest round of cryptocurrency market crash, China tightened restrictions on cryptocurrencies and the tokenization of real-world assets (RWA), prohibiting domestic entities from issuing digital tokens overseas, and banning the issuance of renminbi-pegged stablecoins abroad without approval, citing risks to monetary sovereignty. ()

Angela Ang, Head of APAC Policy and Regulatory Affairs at blockchain intelligence firm TRM Labs, stated: "China's consideration of stablecoins was tentative at best, and in recent months, this attitude has grown increasingly cold."

Ang pointed out that the PBOC's statement "clearly dashes any hope for the issuance of an offshore renminbi stablecoin in the near future—certainly not in Hong Kong, and probably not anywhere else."

This is a significant setback for Hong Kong and its years of efforts to build itself into a digital asset hub. As recently as last June, Christopher Hui, Hong Kong's Secretary for Financial Services and the Treasury, had refused to rule out the possibility of pegging the city's stablecoins to the renminbi under regulatory requirements. But it can be presumed that he would now personally close that door.

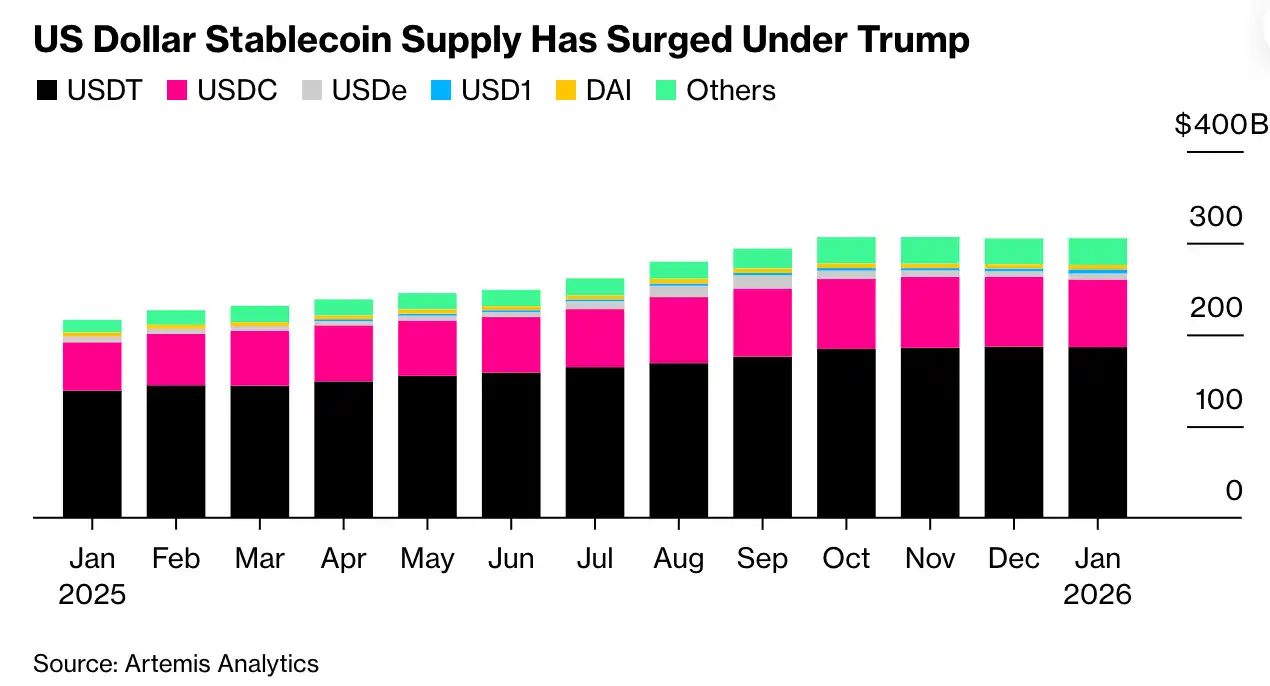

Source: Artemis Analytics

As Ang noted, this was all foreshadowed. As early as last August, China had instructed local brokers and other institutions to stop publishing research reports and hosting seminars promoting stablecoins, in an attempt to curb market enthusiasm.

Patrick Tan, General Counsel at blockchain intelligence firm ChainArgos, said last week's announcement "removes the overhanging uncertainty in the market regarding the private issuance of renminbi-pegged stablecoins." He added: "Issuers now clearly know where the red lines are."

Companies applying for licenses must now compromise and pursue stablecoins pegged to the Hong Kong dollar (HKD) instead.

Bloomberg News previously reported that as many as 50 companies were planning to apply for stablecoin licenses in Hong Kong last year. According to an October report by the Financial Times, this included tech giants Ant Group and JD.com, but they had to halt their stablecoin plans after intervention from Beijing.

Ant Group and JD.com did not respond to requests for comment.

As of Tuesday, Hong Kong had granted licenses to 11 cryptocurrency exchanges and allowed 62 companies to trade digital assets for clients. The list includes institutions with Chinese backgrounds such as CMB International Securities Ltd., Guotai Junan Securities (Hong Kong), and TFI Securities and Futures Ltd.

But there are concerns that all these efforts could ultimately fall flat without access to the renminbi.

Tan stated: "The issue was never about Hong Kong's regulatory framework, but about whether China would tolerate renminbi-denominated instruments circulating outside its control. Capital controls are fundamentally incompatible with the freedom of stablecoins."

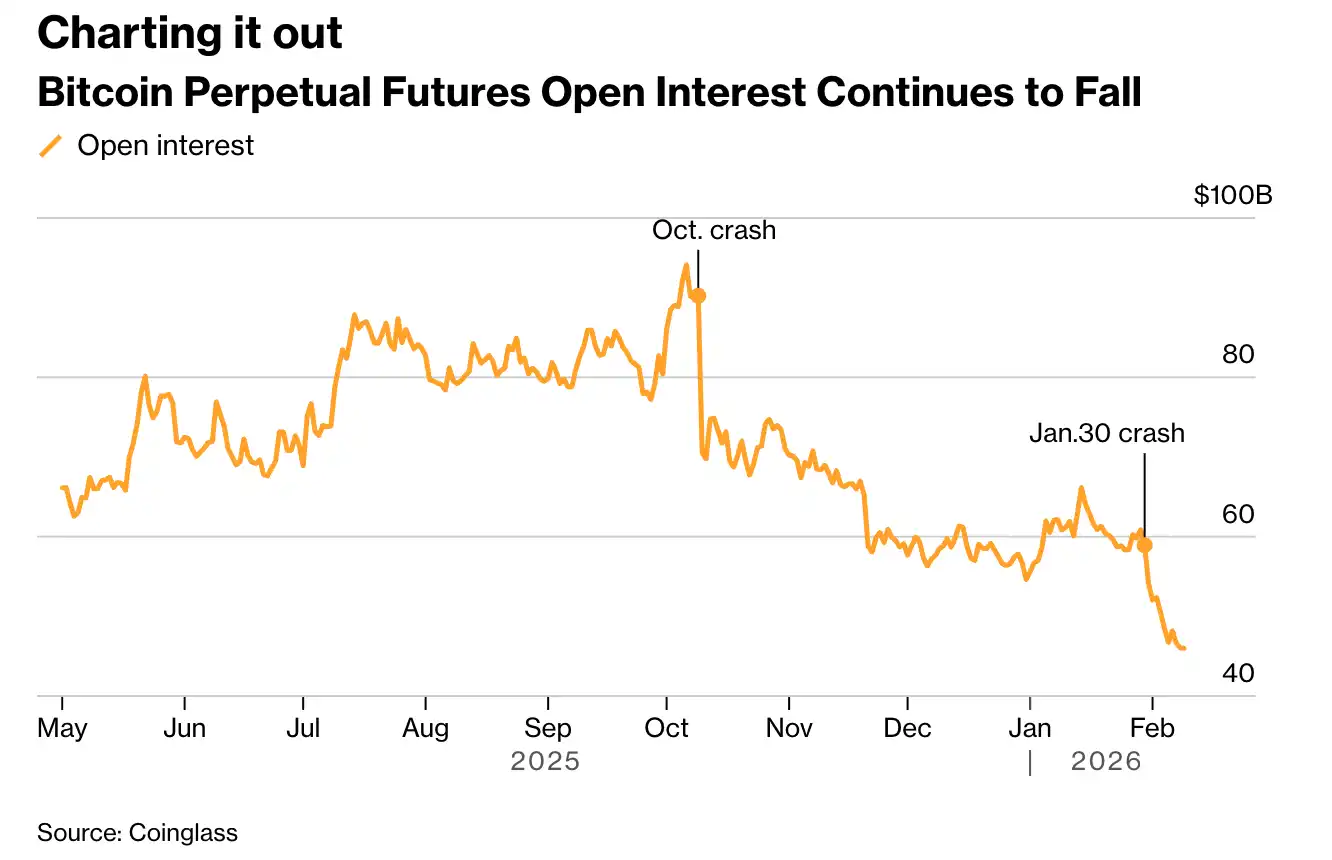

Source: Coinglass

The failure of Open Interest in Bitcoin Perpetual Futures to recover from the decline that began in October highlights the lack of confidence behind the recent recovery. Data from Coinglass shows that current open interest is down about 50% from its peak in October.

Key Figure: $3.3 Billion

According to data compiled by Bloomberg Intelligence, investors have withdrawn approximately $3.3 billion from US spot Ethereum ETFs since the crash in early October, with outflows exceeding $500 million so far this year. The data shows that Ethereum ETF assets are now below $13 billion, the lowest level since last July.

Industry Perspective

"The market is consolidating around what 'actually works.' Even crypto-native VCs sitting on large amounts of dry powder are pivoting heavily into fintech, stablecoin applications, and prediction markets. Everything else is struggling to get attention."

— Santiago Roel Santos, Founder and CEO of crypto private equity firm Inversion.

Crypto-native venture capital firms are shifting their focus to better-performing areas like stablecoin infrastructure and on-chain prediction markets, and expanding into adjacent industries.