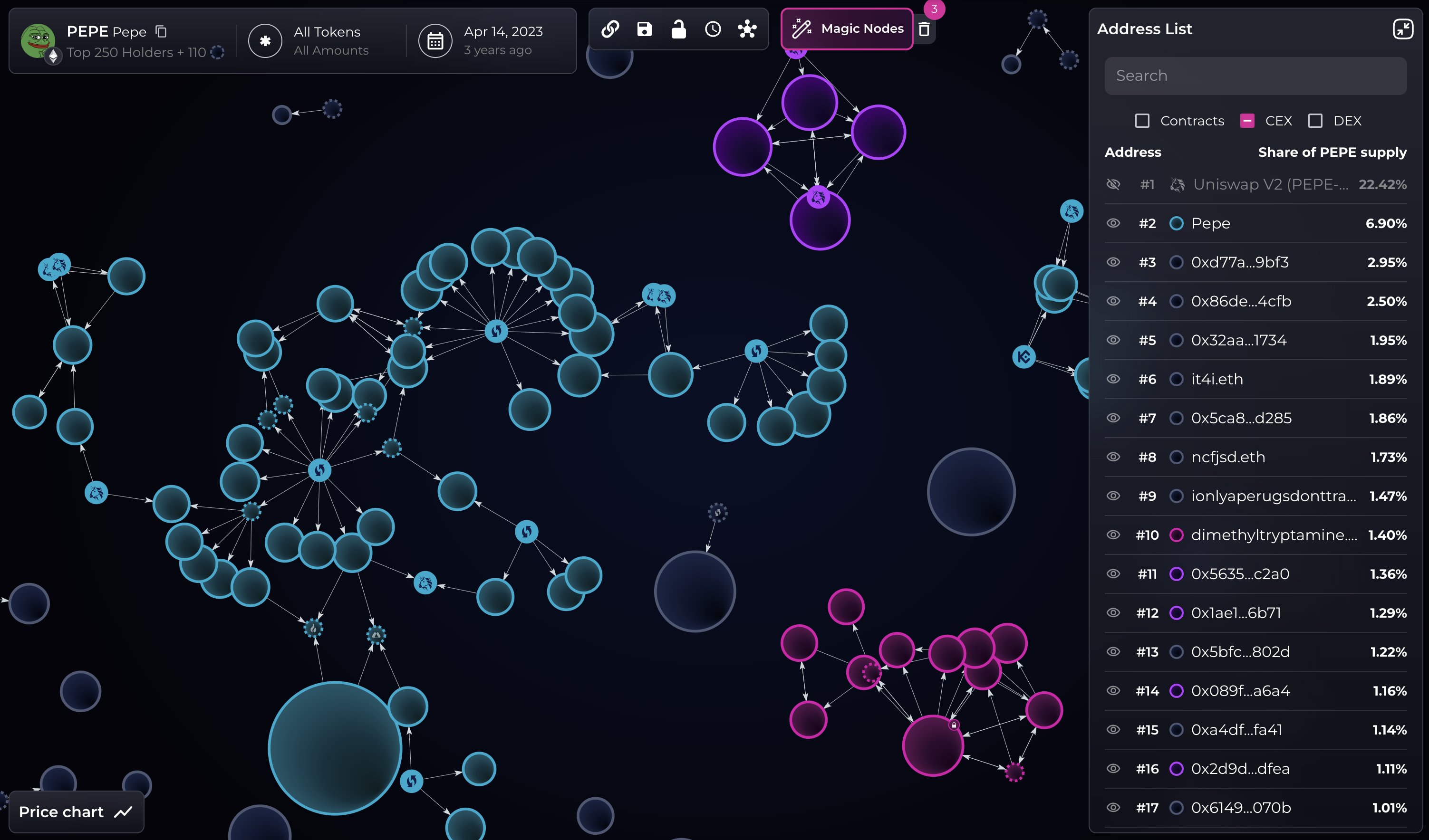

Blockchain data is casting doubt on the “for the people” launch narrative of memecoin Pepe, with new analysis suggesting that nearly a third of the initial supply was held by a single entity and contributed to heavy early selling pressure.

About 30% of the Pepe (PEPE) token supply was bundled at launch in April 2023, blockchain data visualization platform Bubblemaps claimed Wednesday in a post on X, adding that investors were “lied to.”

The same wallet cluster sold $2 million worth of PEPE tokens the day after launch, adding significant sell pressure that stopped the token from surpassing the $12 billion milestone, according to Bubblemaps.

That concentration of the genesis supply contrasts with Pepe’s original branding as a “coin for the people.” The project’s website says the token launched “in stealth” with no presale allocations.

Related: Silk Road-linked Bitcoin wallets move $3M to new address

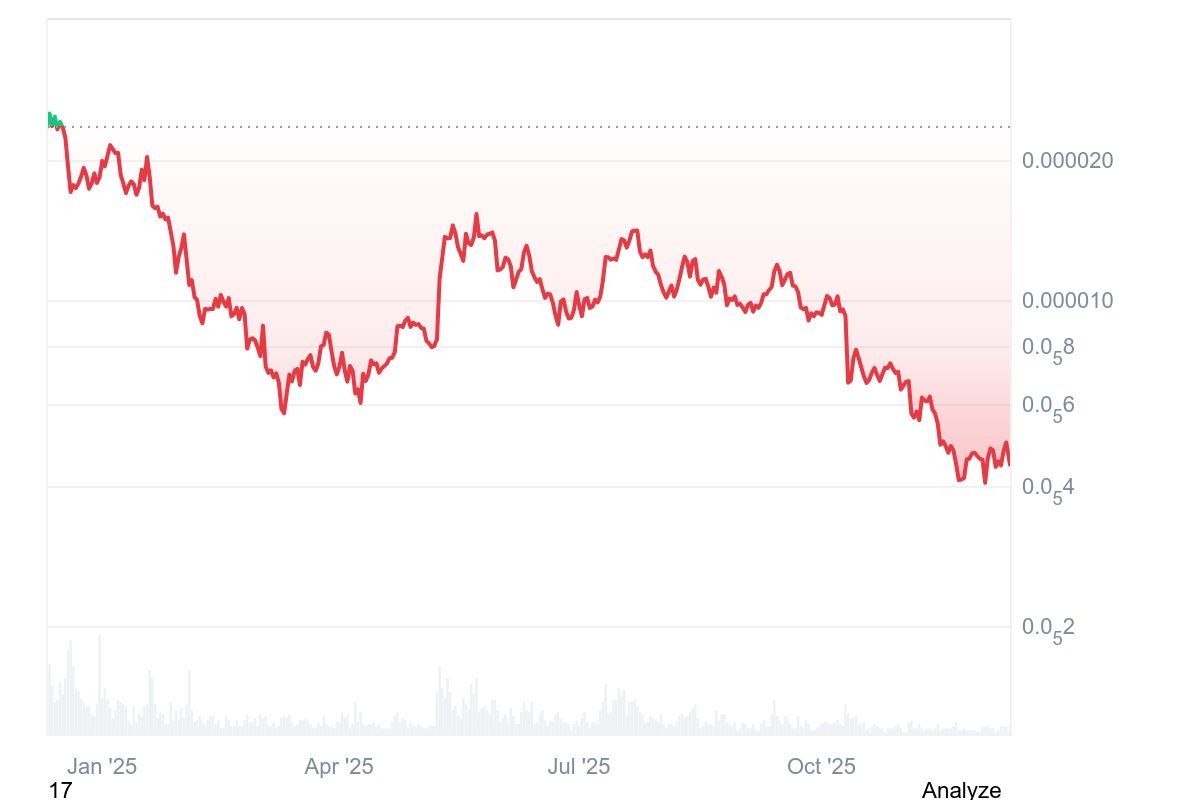

PEPE’s price fell 5.7% in the past 24 hours and is down over 81% in the past year, according to CoinMarketCap data.

Adding to investor concerns, Pepe’s website was exploited earlier in December, temporarily redirecting users to a malicious inferno drainer, a scam tool used for phishing attacks, wallet drainers and social engineering scams.

Despite PEPE’s downside, some crypto traders managed to make millions of dollars on the memecoin.

In March, one trader turned an initial investment of $2,000 into $43 million by holding PEPE. The trader realized a $10 million profit on his position, having held through a 74% decline from PEPE’s all-time high before selling.

Related: Crypto nears its ‘Netscape moment’ as industry approaches inflection point

Forensics tool targets insider-heavy launches

The latest findings were uncovered through Bubblemaps’ Time Travel feature, a forensic-grade analytics tool launched earlier in May, that enables Web3 users to reconstruct the historical distribution of tokens, aiming to detect early insider activity or coordinated accumulation efforts to prevent rug pulls and memecoin scams.

Spotting tokens with a large portion of the supply concentrated across a few wallets can help investors detect scams such as rug pulls, where insiders remove liquidity or stage a mass sell-off, resulting in a steep price collapse that leaves investors with worthless tokens.

Bubblemaps played a key role in uncovering suspicious wallet activity related to multiple memecoins, including the Melania token and an array of fake Eric Trump-themed memecoins.

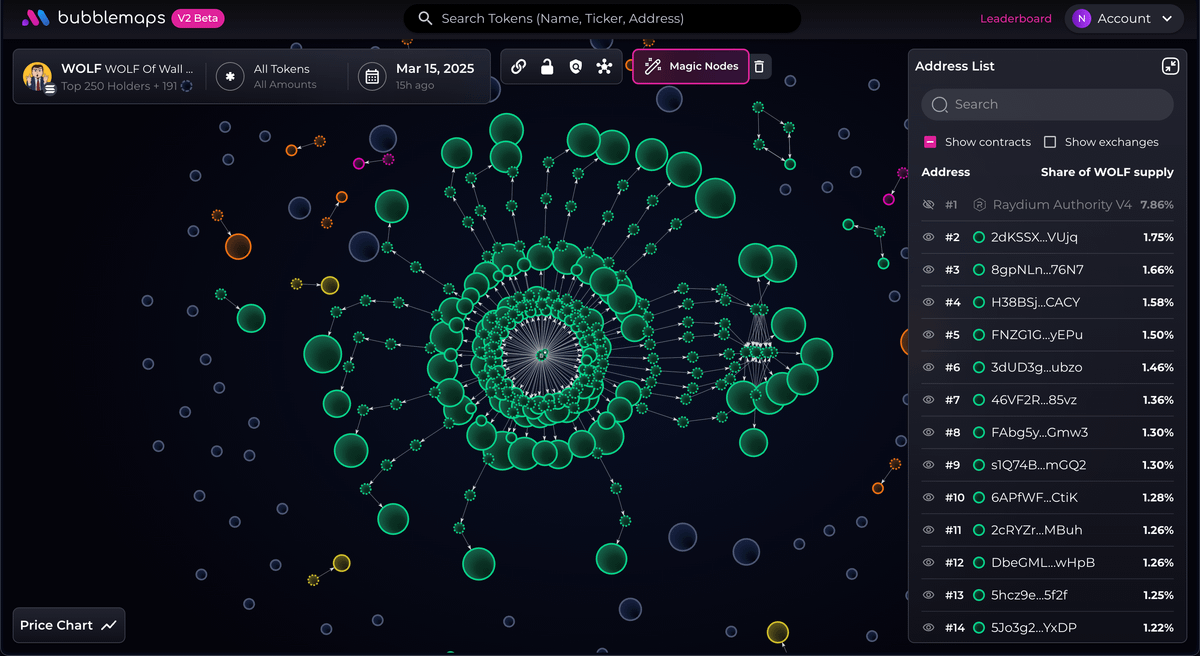

In one of this year’s most damaging rug pulls, the Wolf of Wall Street-inspired WOLF token crashed 99% within a few hours, wiping out nearly $42 million of market capitalization on March 16.

The token was created by Hayden Davis, the co-creator of the Official Melania Meme (MELANIA) and the Libra token.

Magazine: Memecoin degeneracy is funding groundbreaking anti-aging research