Last week, the market showed a downward trend, and the technical support level of $85,000 we previously emphasized proved effective. After BTC touched a low of $84,500 on Friday, it began a rebound this week. From both daily and weekly perspectives, the support level of $85,000 was validated after the previous continuous decline. Over the weekend, the market maintained its rebound momentum, showing an overall pattern of fluctuating recovery.

2. Mid- to Short-Term Data Changes Affecting the Market This Week

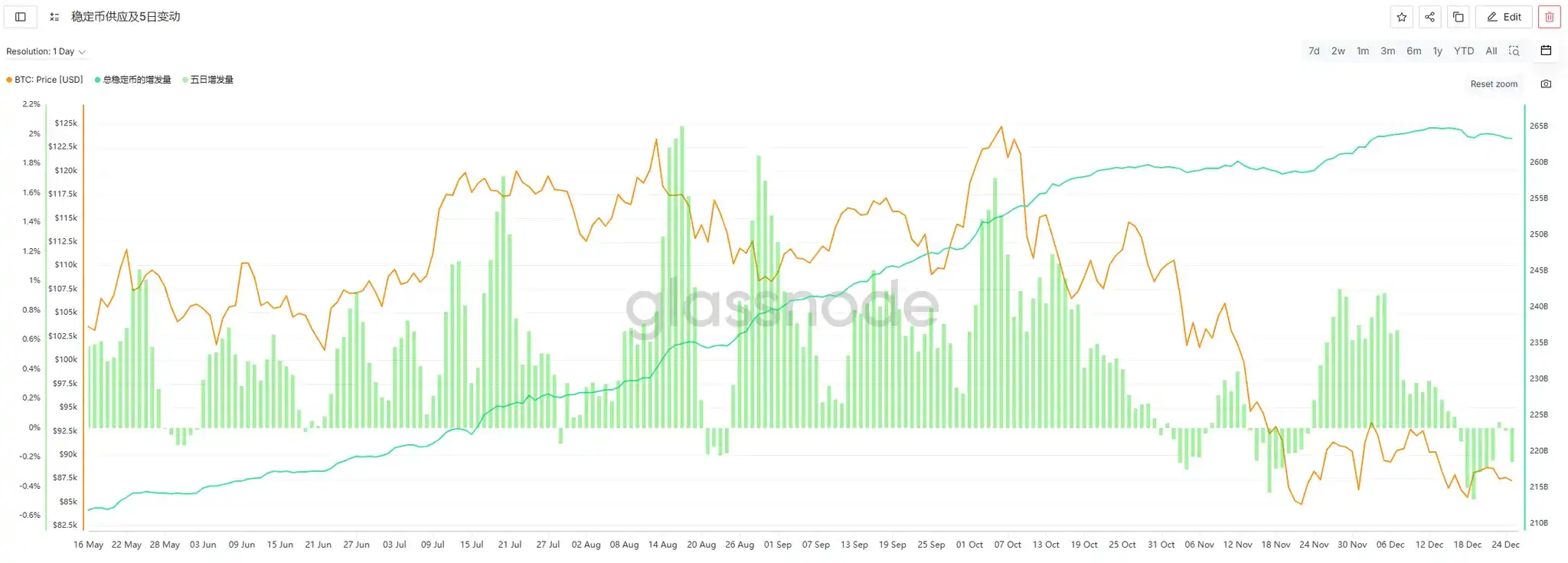

2.1 Stablecoin Fund Flows

This week (12/20-12/26), the weekly issuance of stablecoins was -$326 million, indicating continued outflow of funds, but the scale of outflow has significantly narrowed. Compared to last week's negative issuance of -$824 million, the average daily negative issuance this week decreased from -$117.7 million to -$46.5 million, representing a 60% increase in overall fund flow. The broader market was mainly volatile this week without sustained declines, which aligns with the trend of reduced stablecoin outflows.

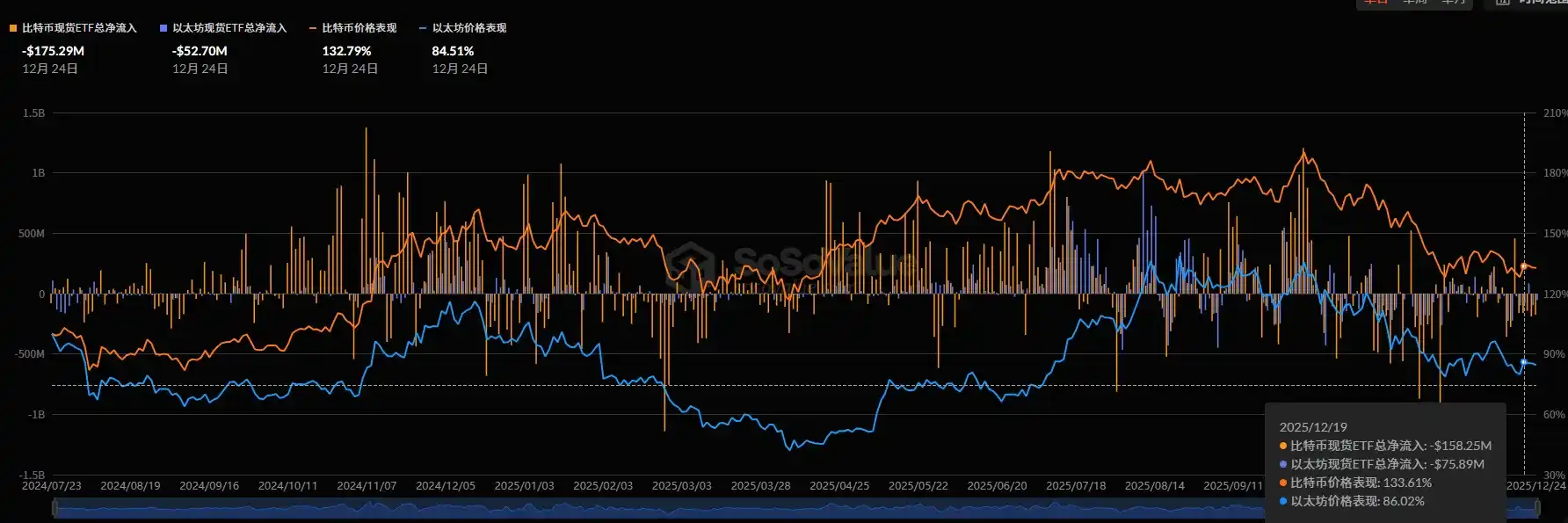

2.2 ETF Fund Flows

This week, the net outflow of Bitcoin ETFs further expanded, reaching $664.37 million, an increase of $374.72 million compared to last week. Based on daily fund flow data, there is no sign of a regular reduction in ETF net outflows yet. Although BTC prices have rebounded, this can only be characterized as a short-term technical rebound. For the market to achieve a trend reversal, the return of Bitcoin ETFs to net inflows is a core prerequisite.

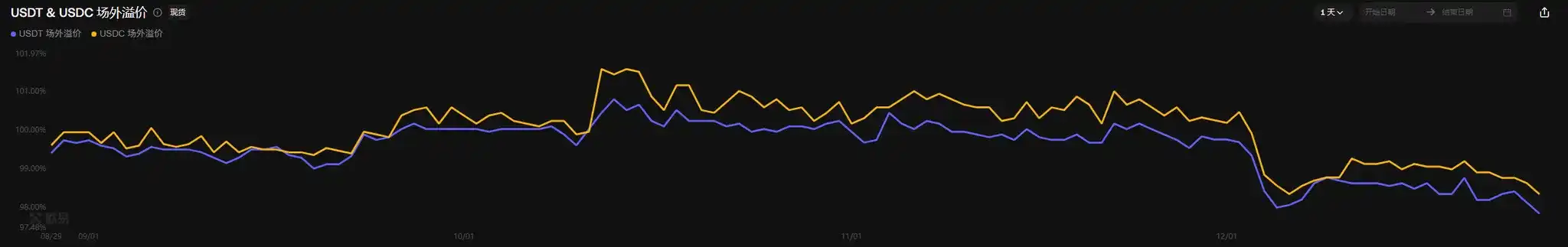

2.3 Off-Market Discount/Premium

This week, the off-market discount/premium rates for USDT and USDC slightly declined. The current USDT discount/premium is 97.86%, and USDC is 98.36%, both at relatively low levels for the year. This phenomenon reflects continued低迷 market sentiment, insufficient off-market funds for bargain hunting, and some signs of capital outflow.

2.4 Ethereum ETF

This week, the net outflow of Ethereum ETFs was -$139.53 million, a significant reduction compared to last week's net outflow of $587.5 million. Ethereum prices showed volatile movements this week without sustained declines, echoing the narrowed ETF outflows. If this trend can be maintained, it will provide strong support for Ethereum's rebound.

2.5 Total Crypto Market Capitalization

This week, the total crypto market capitalization fell to around $3 trillion, precisely touching the weekly EMA100 moving average. The indicator currently shows a weekly oversold signal. Combined with the historical performance of weekly oversold signals since 2021, the market has the potential for a rebound from a technical perspective.

3. Mid-Term Data Changes Affecting the Market This Week

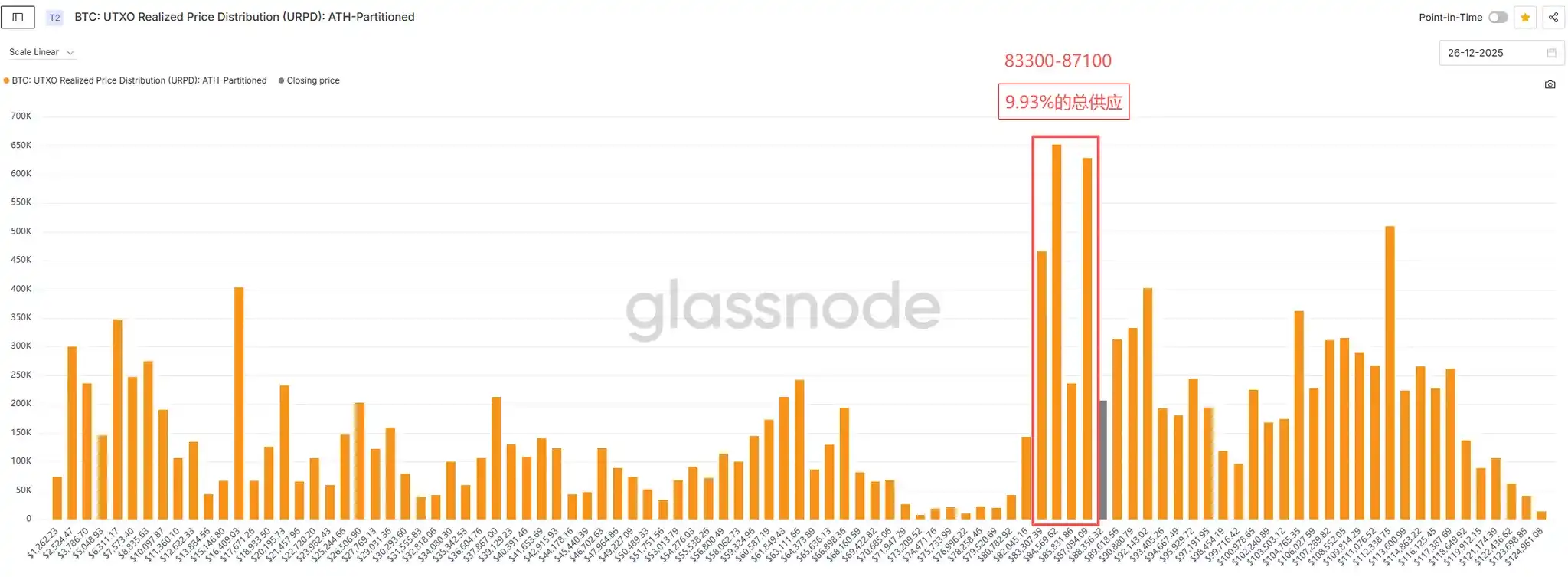

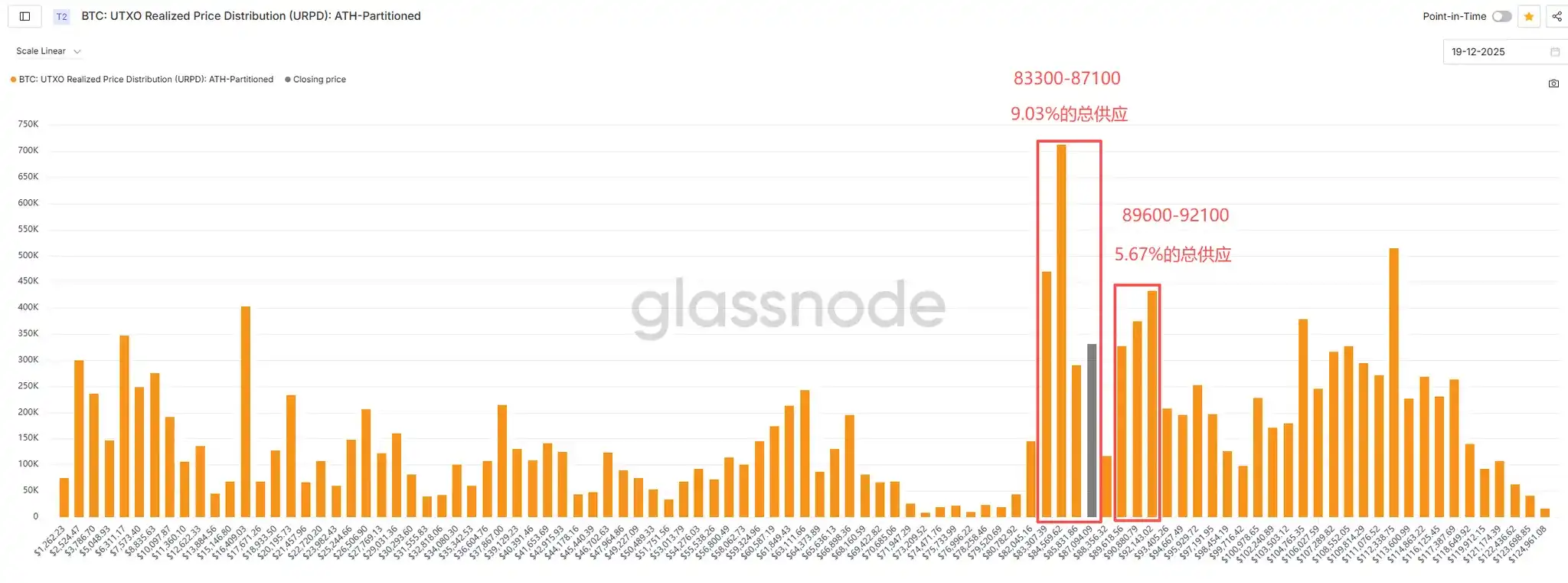

Holding Address Distribution and URPD

In terms of Bitcoin holding address distribution, the proportion of addresses holding 100-1K BTC increased from 25.813% to 25.951%, showing a slight accumulation trend. The proportion of addresses holding 10K-100K BTC decreased from 11.341% to 11.146%, indicating some reduction. The proportion of addresses holding 1K-10K BTC slightly increased from 20.972% to 21.022%, showing overall minor fluctuations.

Regarding BTC筹码结构 (chip structure), the accumulation of筹码 in the $83,300-$87,100 price range increased from 9.03% of total supply to 9.93%, a rise of 0.9 percentage points. Specifically, the accumulation near $87,100 reached 3.15% of total supply, showing significant turnover compared to last week and intense battle between bulls and bears. This price level is expected to form strong support going forward.

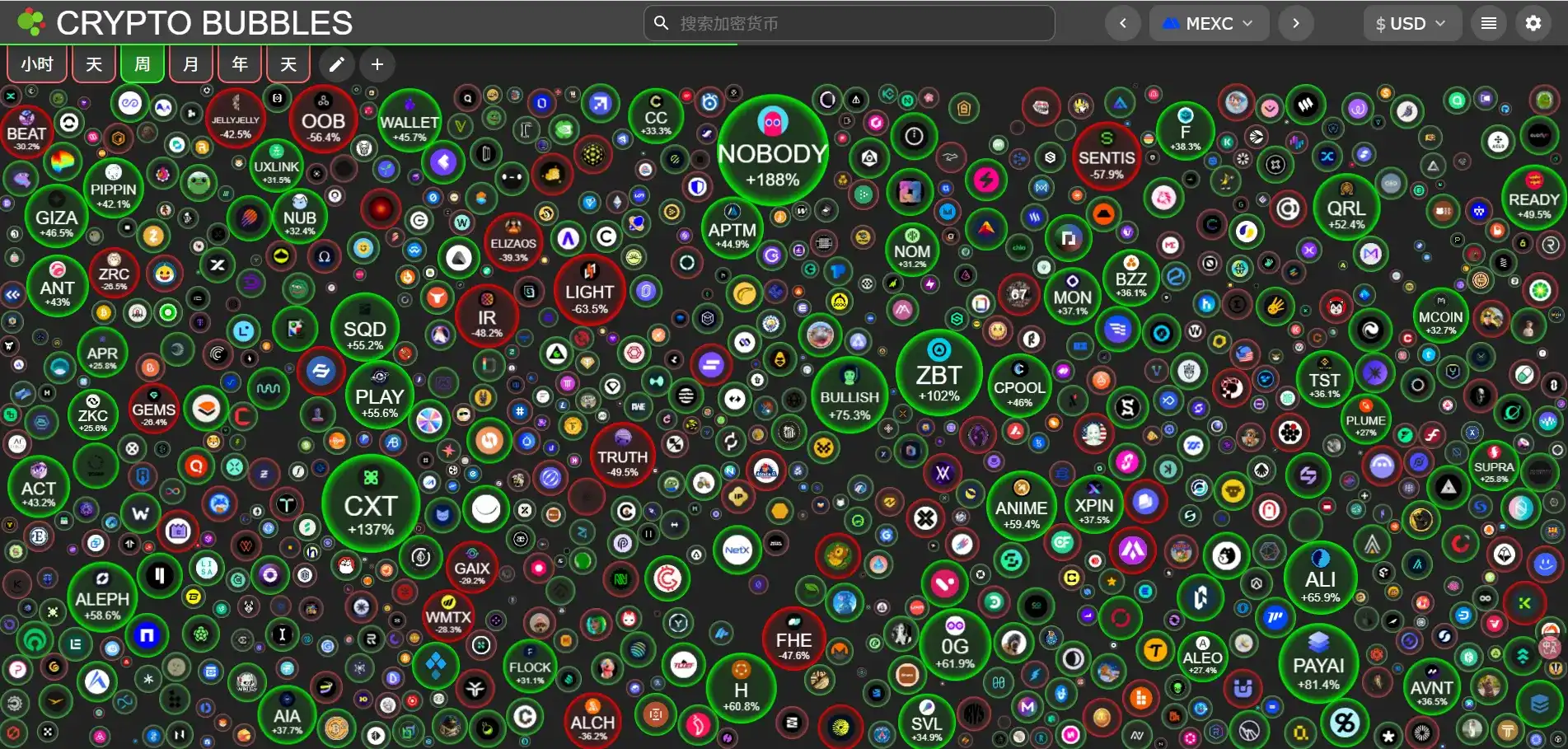

4. Altcoin Market Analysis

This altcoin market analysis will be conducted from three main sections: Market Overview, Secondary Market Performance, and Primary Market Data, providing a comprehensive view of the current altcoin market dynamics.

4.1 Market Overview

Altcoin Market Capitalization

This Friday, TOTAL3 (total market cap excluding BTC and ETH) reached $822.3 billion, a环比 (week-on-week) increase of 1.95%. BTC traded in a narrow range around $88,000 this week, with low volatility. Despite continued rebounds in US stocks and A-shares, BTC did not follow suit, while commodity markets performed strongly. From a fund flow perspective, BTC still ranks lower in traditional financial allocation systems. In the absence of significant incremental funds, it is likely to maintain range-bound fluctuations.

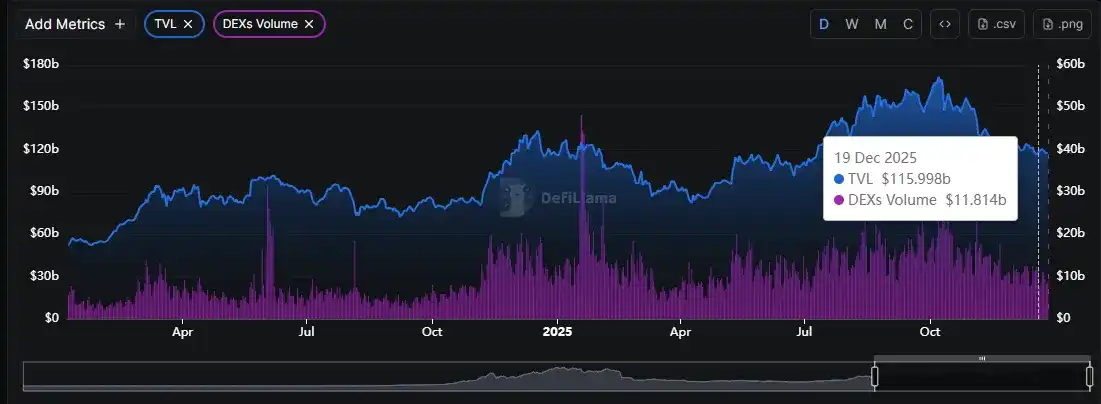

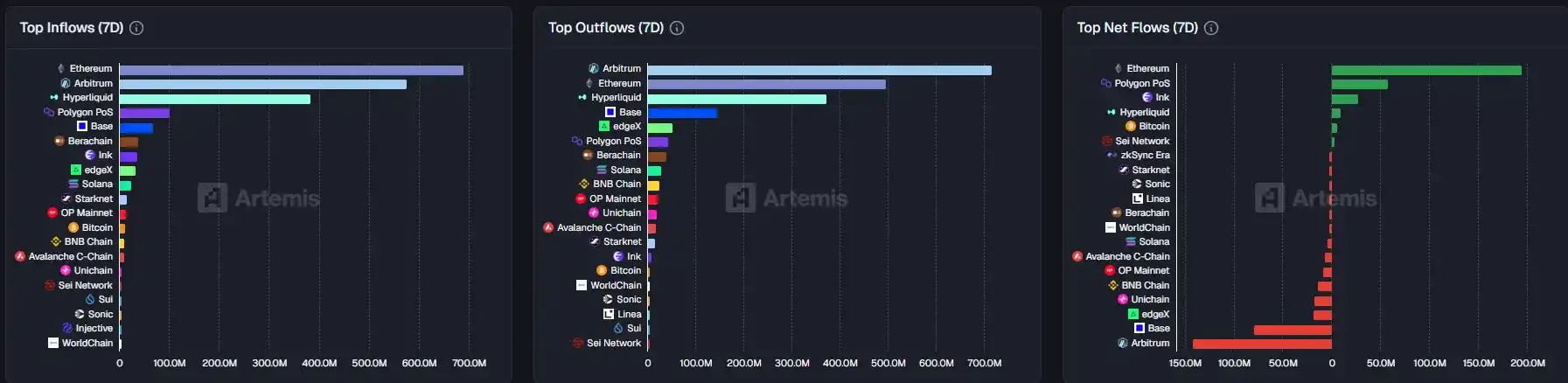

On-Chain TVL Overview

The total on-chain TVL reached $117.5 billion, a环比 increase of 1.29%, showing an overall volatile trend. The amount of ETH staked remained stable, with a trend of fluctuating upward, reflecting relatively solid confidence among long-term holders.

Stablecoin Market Cap and Exchange Reserves

The total stablecoin market cap was $286 billion, a环比 decrease of 0.28%, with fiat-backed stablecoins experiencing a net outflow of $800 million. The current crypto market performance is disconnected from traditional financial markets, showing relative weakness. Market sentiment has not明显恢复 (significantly recovered), with a strong wait-and-see atmosphere. Exchange stablecoin balances slightly decreased this week, and there was no stablecoin inflow during BTC's rebound, indicating the market has not fully stabilized.

<极速div>