Pakistan sees Bitcoin and digital assets as the backbone of a new financial rail for its 240 million citizens, a senior official said at the Bitcoin MENA Conference, signaling a shift toward formal regulation of crypto markets.

Bilal Bin Saqib said on Tuesday that Pakistan can no longer rely on traditional economic models, but needs “a new engine,” citing digital assets. The minister said during a roundtable in Abu Dhabi:

“We see Bitcoin, digital assets, and blockchain not just as speculation but as infrastructure. Not as noise, but as a foundation of a new financial rail for the global south.”

Saqib, the chairman of Pakistan’s Virtual Asset Regulatory Authority (PVARA) and former special assistant to the prime minister on blockchain and crypto, said his mandate is to transform one of the world’s largest unregulated crypto markets into a compliant, investment-ready ecosystem.

He argued that Pakistan has a young population — 70% of the country’s population is under the age of 30 — and the scale needed to build a regulated crypto ecosystem, rather than remaining a “late adopter.”

“My message is simple,” he said. “If El Salvador can do it with 6 million people, imagine what Pakistan can do with 40 times the population and one of the fastest growing digital forces in Asia.”

Related: Fiat inflation drives crypto adoption across the globe

The rise of crypto adoption in Pakistan

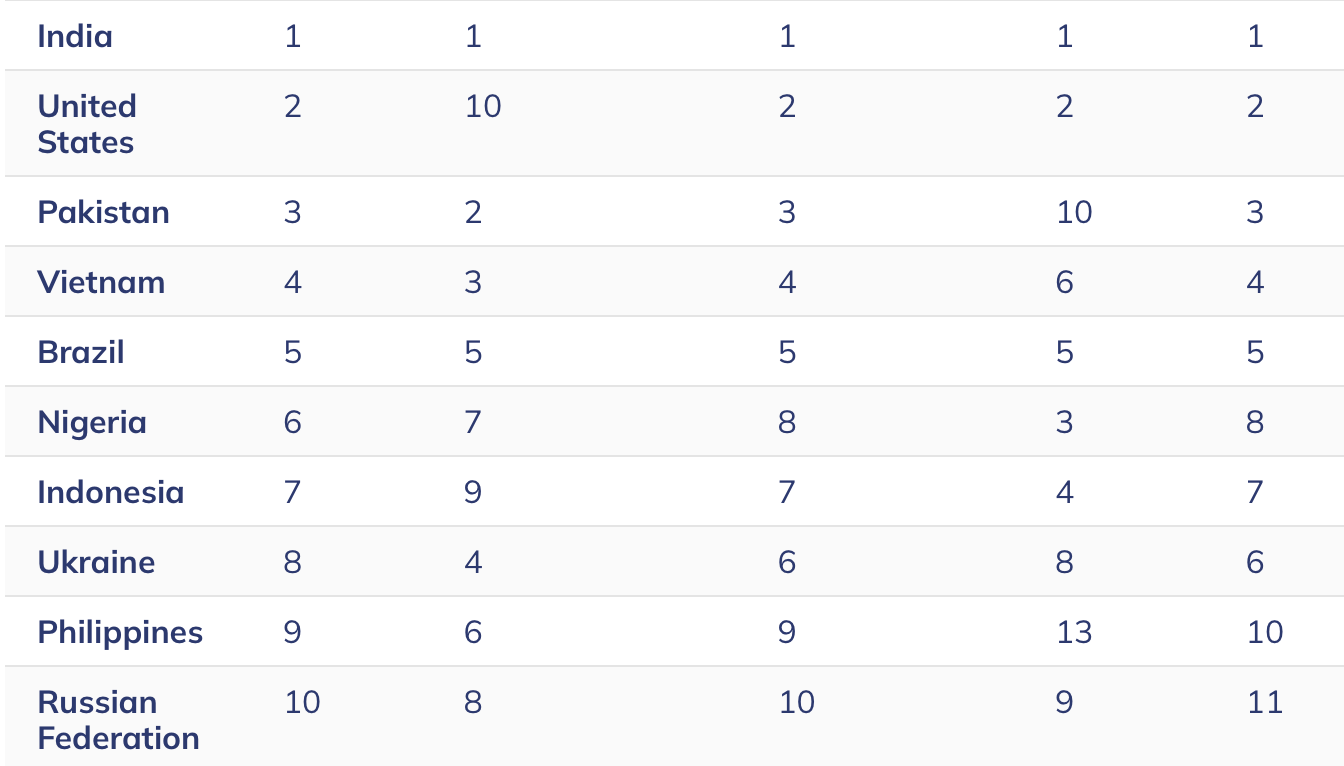

Pakistan has emerged as one of the world’s fastest-growing crypto markets, climbing six places to rank third in Chainalysis’ 2025 Global Crypto Adoption Index.

In May, Saqib announced that the country is preparing to establish a strategic Bitcoin (BTC) reserve and is moving toward more pro-crypto regulatory policies.

That same month, Pakistan allocated 2,000 megawatts of surplus electricity for Bitcoin mining and AI data centers as part of its national digital transformation push. Financial officials say the plan is intended to attract foreign investment and support new high-tech jobs by directing excess power into AI and crypto infrastructure.

In September, Pakistan invited global crypto companies to apply for licenses under its new federal regulatory regime. The PVARA issued a call for expressions of Interest from major exchanges and service providers seeking to enter the market.

Magazine: Quantum attacking Bitcoin would be a waste of time: Kevin O’Leary