The waning cryptocurrency market momentum, coupled with ongoing geopolitical tensions, continues to hamper Bitcoin’s price trajectory, pushing it downward. With BTC’s price and sentiment dropping significantly, the market appears to have entered a phase of heightened uncertainty and caution as investors look for alternative assets to hedge against geopolitical risks.

Bitcoin Weakness Reflects Broader Risk-Off Move

Bitcoin remains on a downward trajectory as its price trades below the $70,000 mark, bolstered by the geopolitical tensions around the world. Following the unfavorable conditions of Bitcoin and the sector, the market is now positioned at a critical moment, where the bearish action could either flip or continue.

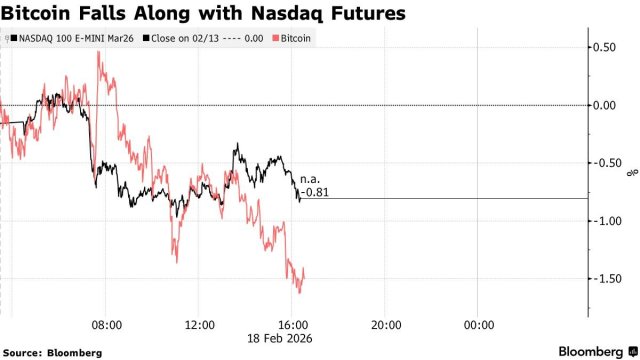

Walter Bloomberg shared that Bitcoin is sliding as geopolitical risks spur risk-off trade after examining the cryptocurrency’s price against Nasdaq Futures. Such synchronous decrease indicates that market behavior across asset classes is once again being driven by macro variables like changing interest-rate expectations and a generalized feeling of risk aversion.

The report shows that Bitcoin fell by 1.7% to about $67,000 ahead of the United States Open, tracking weaker equity futures. Meanwhile, Nasdaq 100 Futures experienced a drop of 0.9% and S&P 500 contracts fell by 0.6%.

This development has impacted investors’ sentiment and focus. Currently, investors are becoming more cautious due to growing tensions over Iran, renewed discussions about AI’s broader economic effects, and uncertainty about a potential Fed rate cut following recent inflation data.

In the midst of the geopolitical tension, flows, especially from Exchange-Traded Funds (ETFs), have stayed negative. US-listed Bitcoin ETFs recorded a fourth consecutive week of outflows, with over $360 million withdrawn just last week. These outflows point to weakening sentiment as indicated by CryptoQuant’s Fear and Greed Index, which is positioned at 10, classified as extreme fear.

While the market has shifted into extreme fear levels, analysts believe that BTC might extend its ongoing consolidation phase, with $60,000 considered as the main support. However, further macro shocks are expected to push BTC’s price back toward the $50,000 threshold.

Which BTC Investors Are Under Stress

During increased bearish phases, investors’ action and activity are crucial to gauging the current market state and its next possible direction. In a recent analysis, Anil, an on-chain researcher and investor, has outlined a key divergence between Bitcoin short-term holders and long-term holders.

With the market’s current state, BTC short-term holders are going through a stress period driven by capitulation. Meanwhile, long-term Bitcoin holders have yet to undergo a true stress or capitulation process.

It is worth noting that long-term holders eventually go through a phase of capitulation in every cycle, and then a fresh uptrend starts after a period of accumulation. However, it is hard to determine whether the group will capitulate again this time. Should this occur, Anil noted that the area below 1 on the LTH Unrealized Profit/Loss Ratio chart would be the decisive point for the market.