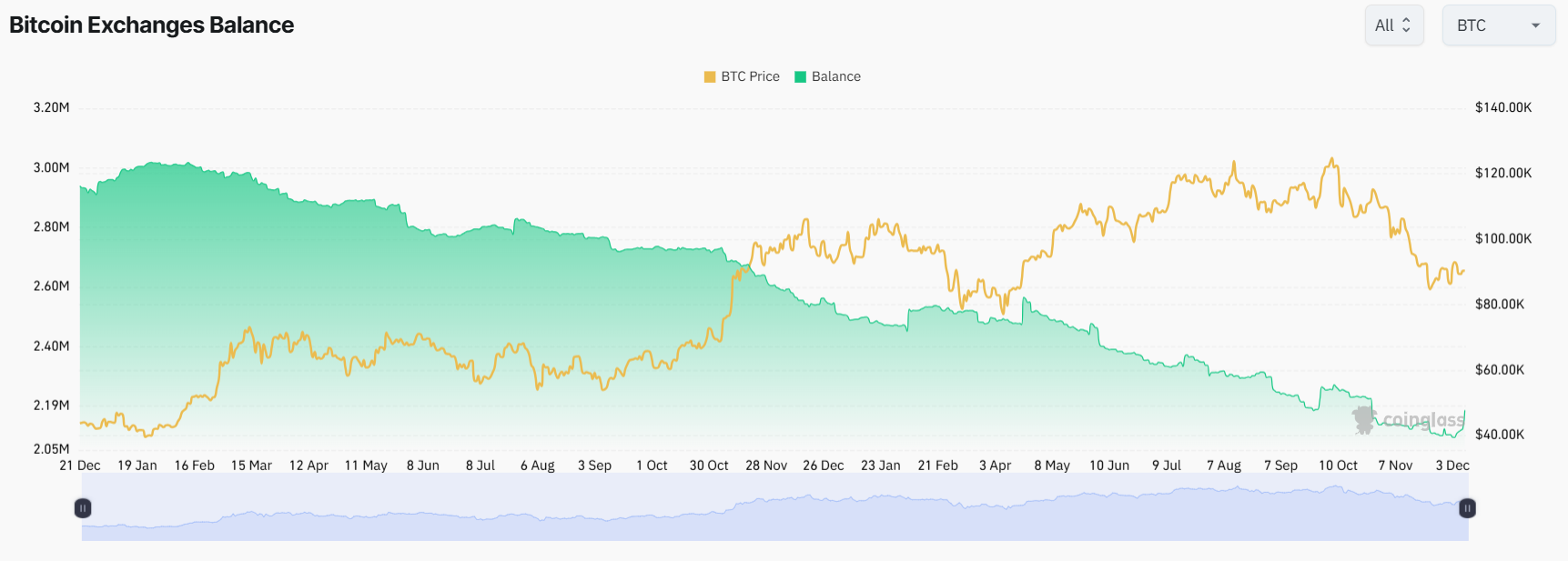

There are at least 400,000 fewer Bitcoin on exchanges compared to the same time last year, in a positive sign for the market, according to the market intelligence platform Santiment.

Over 403,000 Bitcoin (BTC) have moved off exchanges since Dec. 7, 2024, representing roughly 2% of the total supply, Santiment said in an X post on Monday, citing data from its sanbase dashboard.

Users often move their Bitcoin away from exchanges into cold storage wallets, which, in theory, makes it harder to sell and could signal long-term plans to hold.

“In general, this is a positive long-term sign. The less coins exist on exchanges, the less likely we’ve historically seen a major sell-off that causes downside pressure for an asset’s price.”

“As Bitcoin's market value hovers around $90K, crypto’s top market cap continues to see its supply moving away from exchanges,” Santiment added.

Bitcoin is also shifting into ETFs

While much of the Bitcoin on exchanges is likely headed back to hodler wallets, Giannis Andreou, the founder and CEO of crypto miner Bitmern Mining, said that exchange-traded funds (ETF) could also be absorbing these coins.

Citing data from BitcoinTresuries.Net, Andreou said ETFs and public companies now hold more Bitcoin than all exchanges combined, after years of outflows and ETFs quietly accumulating in the background.

Related: Strategy’s Bitcoin treasury swells past 660,000 BTC after fresh $962M buy

“Institutional ownership has quietly crossed into a new phase: less liquid supply, more long-term holders, stronger price reflexivity, a market driven by regulated vehicles, not trading platforms,” Andreou said.

“This shift is bigger than people think. Bitcoin isn’t moving to exchanges anymore. It’s moving off them straight into institutions that don’t sell easily. The supply squeeze is building in real time.”

ETFs and private companies hold more Bitcoin than exchanges

Crypto data analytics platform CoinGlass shows the same trend, with Bitcoin held on exchanges sitting at around 2.11 million as of Nov. 22, when Bitcoin was suffering through a correction and trading hands for around $84,600.

BitBo lists ETFs as holding over 1.5 million Bitcoin and public companies with over one million, representing nearly 11% of the total supply combined.

Magazine: Koreans ‘pump’ alts after Upbit hack, China BTC mining surge: Asia Express