Even after reclaiming the $70,000 price level following a relief bounce, Bitcoin short-term investors remain bearish about the cryptocurrency’s trajectory in the near term. With the price of BTC facing downside pressure, these investors are reducing exposure by offloading their holdings.

Short-Term Holders Quietly Shed Bitcoin Holdings

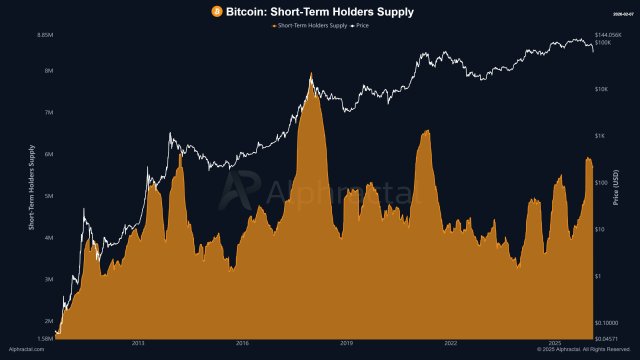

Investors’ activity and sentiment are starting to flip as the Bitcoin price battles with the ongoing volatile market state, bringing it back to downside levels not seen since 2024. Given the persistent downward movement, the supply held by short-term BTC holders is declining, marking a shift in supply and market dynamics.

Related Reading: Bitcoin Short-Term Holders Deep In Loss: MVRV Signals Capitulation Phase

Alphractal, an advanced investment and on-chain data analytics platform, reported that changing sentiment among short-term holders after examining their Net Position Change and Supply. This pattern implies that weaker hands are lowering their exposure by either selling into the recent volatility or allowing longer-term investors to buy their coins.

Historically, a market moving from speculative to more conviction-driven behavior is reflected in a declining short-term holding supply. At the same time, it is evident from the 90-day net position change that new wallet addresses are not interested in building up to these levels.

This reinforces a market scenario where continuation is improbable absent a price or mood reset and suggests weak marginal demand. In the meantime, Alphractal highlighted that the on-chain data remains very clear.

Alphractal noted in another post that the Bitcoin LTH/STH is declining. A drop in this metric implies that BTC transactions from long-term holders are becoming increasingly less profitable in comparison to those from short-term holders. On-chain behavior is repeating, and this pattern has been present in every previous bear market.

BTC Short-Term And Long-Term Holders Are Now Facing Pressure

These investors are still underwater as prices decline. In a recent research, Darkfost, an author at CryptoQuant, revealed that Bitcoin has put all the short-term holders under pressure and is now beginning to test long-term holders since the start of the correction. This change signifies a significant stage in the market structure, where sustained pressure may either confirm long-term holding resistance or compel wider capitulation.

Related Reading: Bitcoin Market Calm As Long-Term Holder Sell-Side Activity Dries Up, Bullish Phase Returning?

With a cost basis of $103,188 and $85,849, the expert stated that the first long-term holder cohorts, particularly holders between 6m and 12m, and 12m and 18m holders, are already under pressure. However, the price of Bitcoin has reacted after hitting the realized price of older holders (those holding between 18m and 2 years), which is currently positioned at $63,654.

According to Darkfost, this level seems to be an area of interest to these holders, but this is not what is displayed exactly on the chart. The fact that their cost basis has been in an upward trend suggests that more holders have been keeping their coins longer. As the correction evolves, the reaction of long-term holders may play a critical role in determining the next possible direction for the flagship cryptocurrency asset.