Quick Facts:

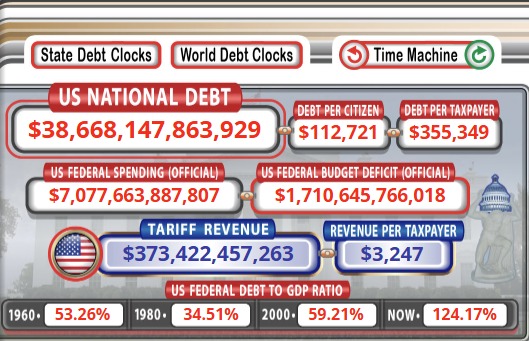

- ➡️ With US national debt projected to hit $3T, the case for Bitcoin as a hedge against currency debasement is stronger than ever.

- ➡️ The market is rotating from pure holding to ‘Bitcoin DeFi,’ seeking Layer 2s that unlock the $2T dormant $BTC economy.

- ➡️ Bitcoin Hyper uses the Solana Virtual Machine (SVM) to bring sub-second transaction speeds and smart contracts to the Bitcoin network.

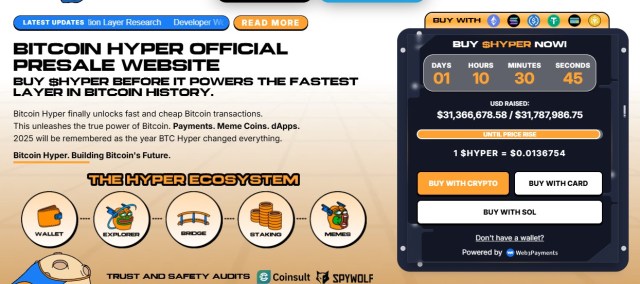

- ➡️ Smart money is active, with over $31M raised in presale and significant whale buys, including a $500K single-transaction entry in mid-January.

The US national debt isn’t just growing. It’s accelerating at a pace that frankly defies logic.

With the ticker currently near the $39T milestone, the macro ground is shifting beneath investors’ feet.

Debt servicing costs are now consuming a terrifying slice of federal revenue, forcing the Federal Reserve into a corner where currency debasement looks like the only exit strategy.

For savvy market participants, the ‘debasement trade’ is no longer just a theory. Bitcoin ($BTC) hovering near $70,000 isn’t speculative frenzy, it’s a structural flight to safety.

But holding Bitcoin is only step one.

Smart money is looking beyond simple store-of-value plays to the infrastructure that unlocks Bitcoin’s dormant capital. If Bitcoin is the digital gold vault, the market is desperately seeking the high-speed rails to actually move that value.

This demand for utility on the world’s most secure blockchain is driving capital into Layer 2 solutions. While established players like Stacks laid the groundwork, a new contender, Bitcoin Hyper ($HYPER), is turning heads (and wallets) by integrating the Solana Virtual Machine (SVM) directly with Bitcoin’s settlement layer.

The premise is punchy: combine Bitcoin’s security with Solana’s speed to create a hedge that works as both a shield against inflation and a sword for yield.

Read more about $HYPER here.

Bitcoin Hyper Brings SVM Velocity to the $1.7t Bitcoin Economy

Here’s the friction in the current crypto ecosystem: usually, you have to choose. You get Bitcoin’s security or Solana’s speed, but rarely both.

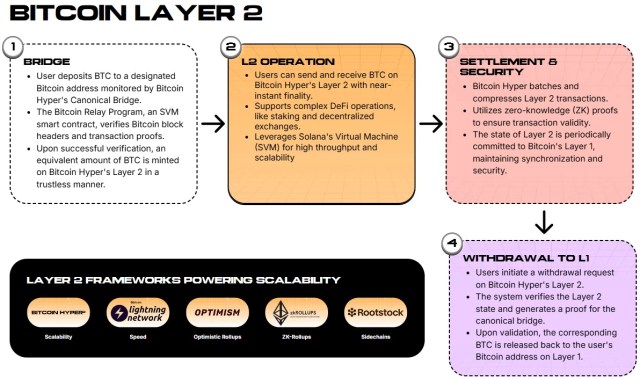

Bitcoin Hyper ($HYPER) attacks this trade-off by operating as the first-ever Bitcoin Layer 2 with SVM integration.

That technical architecture matters. It allows developers to write smart contracts in Rust, the same language powering Solana’s high-performance dApps, while anchoring final settlement on the Bitcoin blockchain.

For the average user, this means transaction finality that feels instant (we’re talking sub-second) rather than the sluggish 10-minute block times of the Bitcoin mainnet. By using a decentralized canonical bridge, Bitcoin Hyper enables users to move $BTC into a high-speed execution environment.

Suddenly, Bitcoin is usable for DeFi, gaming, and payments without the prohibitive fees associated with Ordinals or BRC-20 tokens.

The modular design, separating execution (SVM) from settlement (Bitcoin L1), mirrors the successful roadmap of Ethereum rollups. But there’s a key difference: it applies that logic to a market cap three times larger.

By solving the lack of programmability on Bitcoin, $HYPER positions itself not just as a token, but as essential infrastructure for the next cycle of institutional adoption.

You can buy $HYPER here.

Smart Money Rotation: Whales Target $31M Presale Milestone

Retail investors often chase green candles. Smart money? They front-run infrastructure shifts.

On-chain data surrounding the Bitcoin Hyper presale suggests a decisive move by high-net-worth wallets to secure early positions.

According to the official presale page, the project has already raised an impressive $31.3M. That figure underscores a significant market appetite for Bitcoin-native DeFi solutions.

What stands out is the scale of individual allocations. Etherscan records reveal that three whale wallets have accumulated $1M+ in $HYPER tokens in recent transactions ($500K, $379.9K, $274K).

When sophisticated actors accumulate heavily during a presale phase, where the token is priced at a modest $0.0136754, it often signals a bet on a high multiple repricing once the token lists on major exchanges.

Investors are also drawn to the immediate utility of their capital. Unlike many ICOs that leave funds idle, Bitcoin Hyper offers immediate staking with high APY for presale participants. Coupled with a 7-day vesting period for stakers, the tokenomics reward conviction over speculation.

As the US debt clock ticks louder, the rotation into assets that offer both hard-money properties and high-growth potential is accelerating.

Buy your $HYPER today.

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments, including presales and initial coin offerings, carry inherent risks and are subject to market volatility. Always conduct your own due diligence before investing.