A previously published Bitcoin price crash projection from May 13, 2025, has re-entered market discourse after several prominent crypto traders on X recirculated the chart and commended the foresight behind the analysis from KillaXBT. The model mapped Bitcoin’s full cycle structure — from accumulation to distribution and breakdown — long before the current correction unfolded. Now, the same framework is signaling that Bitcoin has yet to establish a macro bottom.

Chart Signals That Nailed The Bitcoin Price Crash

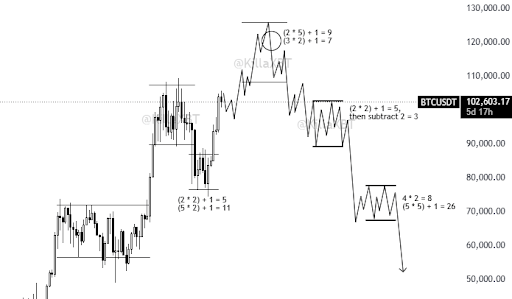

KillaXBT’s framework is built on rotational market mathematics, measuring how many times price cycles are within a range before exhaustion. The analyst segmented Bitcoin’s structure into consolidation blocks and assigned swing counts to identify when liquidity had been fully absorbed.

In the early phase, accumulation rotations labeled “(2×2)+1 = 5” and “(5×2)+1 = 11” defined the base that ultimately fueled Bitcoin’s impulsive rally. These counts indicated that internal liquidity cycling was complete, clearing the path for expansion. Once that move matured, the price transitioned into a high-range consolidation beneath the cycle peak.

Inside the 115,000–120,000 distribution zone, the chart identified overlapping exhaustion clusters marked “(2×5)+1 = 9” and “(3×2)+1 = 7.” For traders, stacked counts at highs typically signal supply absorption. Although Bitcoin printed marginal higher highs, momentum was fading — a textbook late-stage distribution signal.

Market behavior followed that roadmap. Bitcoin formed repeated rejection wicks near the highs, upside momentum slowed, and breakout attempts failed to secure acceptance above resistance. Volume compression reinforced the distribution thesis. Instead of continuation, the price rolled over.

The model then mapped a transition into mid-range consolidation around the 100,000 psychological level, with BTCUSDT referenced near 102,603. Annotated “(2×2)+1 = 5, then subtract 2 = 3,” the structure signaled weakening bounce capacity. Price action mirrored the setup: multiple support tests, lower highs, and eventual breakdown — completing the crash phase outlined in the May 2025 forecast.

Bitcoin Price Could Drop Further Before Hitting Bottom

The resurfaced chart’s larger significance lies in its forward projection. After the six-figure range failed, the model guided Bitcoin into a lower distribution band around 70,000. This zone carried heavier rotational counts — “4×2 = 8” and “(5×5)+1 = 26” — implying extended consolidation within a bearish continuation framework.

Current market behavior continues to align with that structure. Bitcoin has already rotated into lower support territory following the 100K breakdown, while volatility has expanded on selloffs rather than recoveries. Relief rallies remain corrective, lacking the impulsive follow-through required to confirm bottom formation.

The chart’s final stage shows a potential capitulation toward the $50,000 area, marked by a sharp move below the lower range. Structurally, this is an unfinished downside that completes the current distribution phase.

The sequence is straightforward: accumulation pushed prices higher, the rise led to distribution, and now distribution is causing further breakdowns. Because no consolidation has shown the expansion profile typical of a macro base, the model maintains that the true bottom is not yet in.